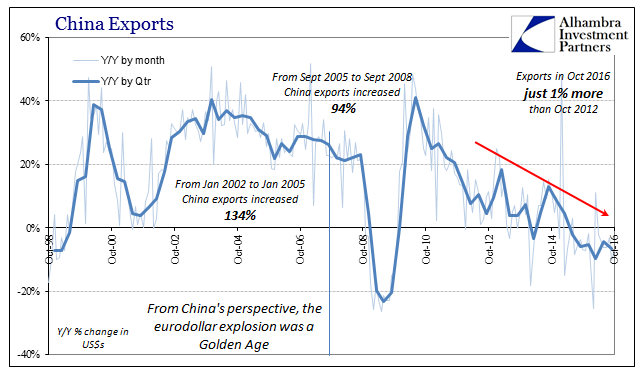

In early November 2012, China’s National Bureau of Statistics reported that China’s exports were figured by the Customs Bureau to have been about $175.57 billion for October that year. It represented a year-over-year increase of 11.5% which only sounds good as compared to the economy that followed. The rate was down sharply from recovery-like growth that everyone had expected would continue from the year before, if after a short delay.

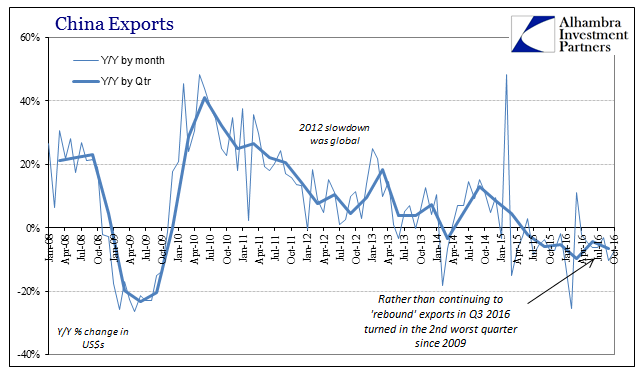

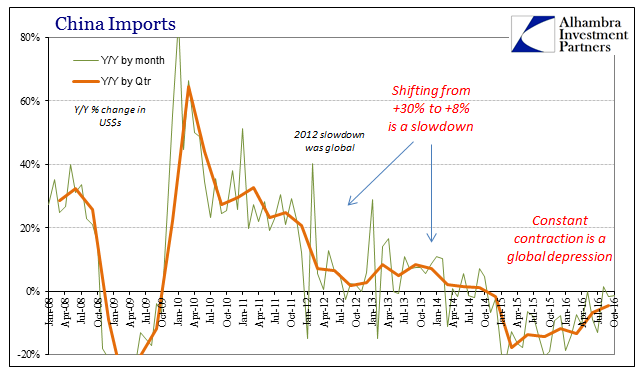

The global economy had weakened appreciably in 2012, no less in China than elsewhere, but by later that year “everyone” saw what they wanted: global central banks coordinating “stimulus” that was leading to signs of “stabilization” throughout.

“Clearly, concerns over continued [China] slowdown can now be put to rest,” said Dariusz Kowalczyk, senior economist as Credit Agricole-CIB.

“The last month of the quarter brought acceleration of industrial output, retail sales and fixed asset investment in year-on-year terms, highlighting the fact that improvement of momentum of the economy was particularly strong in September [2012].”

It was a pervasive view, almost uniformly so, based on all the wrong assumptions; that China, as the global economy, was going to recover from the Great “Recession” because first it was a recession and second that central banks could and would assure nothing less. The passing of four years in between has only revealed those expectations as false as the beliefs upon which they rested.

That was not just a problem for those intervening years, of course, as mainly economists are doing it all over again. They refuse to learn because understanding what is actually going on is to understand Economics (capital “E”) as invalid. They are repeating all the same mistakes, and we are stuck having to live through them because politically there are no alternatives; credentials over science, knowledge, and basic humanity.

Nowhere is that more plain than again China. Last year even economists joined, eventually, in the concern over what was feared a “hard landing”; as 2012, finally being forced to concede that “something” wasn’t right. The term itself is misleading as should have been apparent by the 2012 experience – there is no “landing” in this (global) economy, rather a slow and uneven suffocation that goes on and on if intermittently. Thus, when the more determined downward slope of last year seemed to have shallowed this year, economists were quick to declare all over again that China’s economy had stabilized.

But stabilization means something very different than simply failing to get worse; implicit in the assumption is that once the economy stops getting worse it starts getting better. The experience of 2012 showed just how wrong that assumption was then, and already implies how it is and has been wrong in 2016.

China’s exports in October 2016 fell sharply once more, down 7.3% after falling more than 10% in September (while the NBS revised sharply lower some prior months, an unusual update to the data set). The global economy upon which China depends and for which China is taken as a representative sample is not stabilized, getting better, or acting in the expected cyclical manner. It is being still strangled by “something” larger than what every central bank on this planet has offered, many into the trillions, and several into multiples far greater than those.

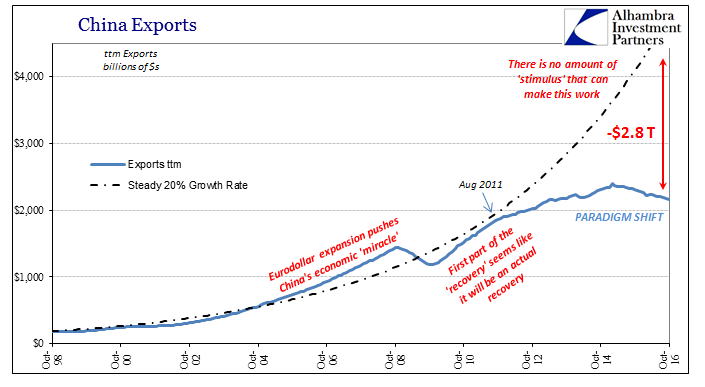

The numbers simply don’t make sense to the traditional, business cycle perspective. In China, this disparity is even more bizarre, which is clearly a problem for those commenting from that perspective. Total exports in October 2016 were just $178.35 billion, barely 1% more than the economic demand for Chinese capacity four years earlier.

Worse, had the global economy actually gone back just part way to acting as it had prior to the Great “Recession” (meaning that it actually was a recession) China should have exported nearly $5 trillion in goods over the last 12 months (through October) at a 20% baseline rather than the near 30% of the Chinese “miracle” years. Instead, they only created and shipped $2.2 trillion. That difference is incomprehensible, and thus doesn’t so easily compute in a straightforward way. So it is simply ignored or reduced into an inappropriately narrowed focus that lives only in the month to month changes as if the second derivatives of those were actually meaningful at this point.

It is no less astonishing on the import side where hopes for “stimulus” this year were truly laid. If China could do nothing about external demand, it could at least push up its own internal levels, to amplify what economists still fantasize about rebalancing. Instead, imports contracted in October by 1.4%. That is clearly better than the 15-20% declines of 2015, but not meaningfully so, as that is, again, just their weak economy not (at the moment) getting weaker. It is far more relevant that another prospective Chinese property bubble can’t even get imports to zero, let alone consistently and significantly positive.

What is most infuriating is that we know what the problem is, as China’s exports better than anything else points in the right direction. In both timing as well as form, the deficit starts with “dollars”; trade more than anything else requires fluid financing and monetary support (the real kind, not what central banks offer). It’s all right there in the numbers as they actually are and have been, not in what they were supposed to be.

Stay In Touch