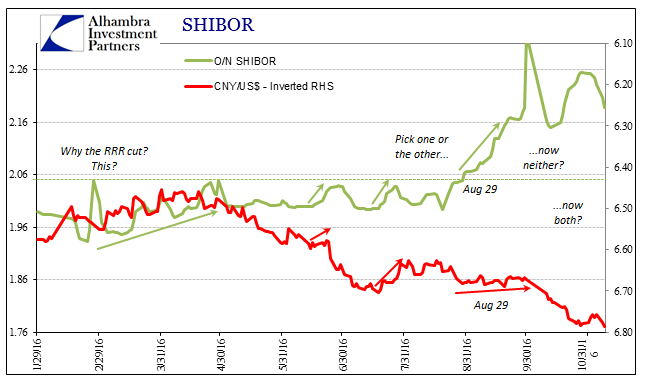

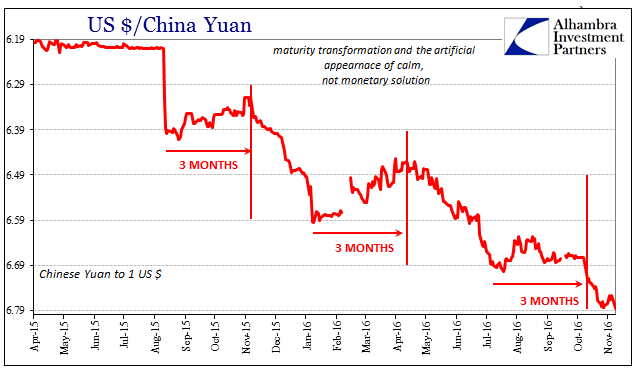

For about the last two weeks, I have been writing about the contours of what I have perceived as a RMB liquidity operation that seems to be far more than the usual management of day-to-day confluences. Since the last week in October, RMB liquidity both onshore and offshore has been more and more plentiful but only in the shortest overnight terms. Interest rate swaps tied to the overnight SHIBOR rate had surged from October 21 to October 26. Spot SHIBOR at first traded with it, as the former anticipates (and is hedging against) the latter. But then the overnight spot rate stopped rising, and the offshore spread between overnight and 1-week CNH remained conspicuously wide.

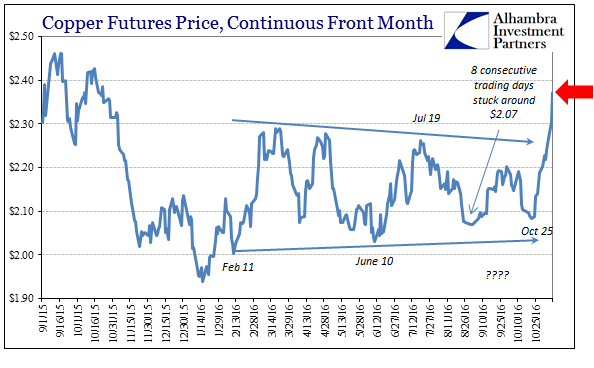

While those are pretty good signals of PBOC operations (either direct or conducted via Chinese banks with or without cover but certainly non-discretionary directives) it is perhaps copper’s recent ascent that truly focuses our attention in that direction. Neither China’s trade figures nor its published statistics on usage and inventory would seem to justify such a sharp, condensed move. If it has broken what was a steady, even narrowing range that had lasted a remarkable almost nine months, then that would suggest as RMB money markets the heavy presence of an RMB source.

This is very different from what transpired starting in mid-August. At that time, “something” surely happened in the “dollar” environment which flipped PBOC priorities against internal RMB, focusing instead its recent fixation with ad hoc “power” on the exchange rate (trying to steady the relative price at which Chinese banks “bid” for “dollars” in all its formats, including FX). The cost of intervening in “dollars” is tighter RMB – absent any large, sustained intervention. As CNY grew steadier on clearly artificial terms, SHIBOR (and HIBOR) skyrocketed beyond prior boundaries.

If the PBOC has flipped again, going back to RMB rather than “dollars”, as surely they have (CNY is down big again today), then that would indicate some degree of internal turmoil. The Chinese central bank has a reputation, with some good reasons, for being robotic and decisive, perhaps even precise to a fault. In September 2008, for example, the US FOMC ridiculed the Chinese for the exactitude with which they seemed to be carrying out their liquidity operations (it stands as total embarrassment on the part of Fed officials who were laughing at the PBOC as it attempted to deal with the fallout from Ben Bernanke’s utter incompetence). That reputation seemed intact even throughout the last year though the results of its “precision” in certain markets were disorder anyway; at least they could manage a stable rate even if that stable rate didn’t amount to anything.

For the PBOC to flip-flop back and forth in the past few months is a possible indication of two conditions: internal indecision that is surely related to the increased “dollar” pressure that some officials in China, quite unlike here, realize would result in the next leg lower for the Chinese economy. The situation being what it is, not what it was supposed to be, it seems as if that might provoke more extreme measures from the political authorities.

So China’s globally renowned finance minister Lou Jiwei being replaced by the relatively unknown Xiao Jie, has caused quite a stir.

Mr Lou was seen as one of the government’s more outspoken and reformist figures. His replacement, Mr Xiao, is a long time bureaucrat from China’s Ministry of Finance.

The move comes as global concerns grow about China’s economic slowdown.

Just a few weeks ago, the PBOC was allowing RMB conditions to really bite; now they aren’t. As I wrote yesterday (subscription required) in more detail:

If the top-level government shakeup is related to what you see above, and my first guess would be that it is, then it does seem as if Chinese officials are quite concerned about just letting these markets go where they may – financial spillover but really further economic erosion. In other words, if Lou’s ouster is related to whatever changed recently, then it seems the Xi regime has connected the “right” dots so as to expect further RMB turmoil (related to the “dollar” pressures) will lead to the next leg lower in the Chinese (and world) economy. Having suffered two years of it so far, and with FAI contracting despite fiscal “stimulus”, there may have been limits to how much the Chinese will accept from monetary disorder.

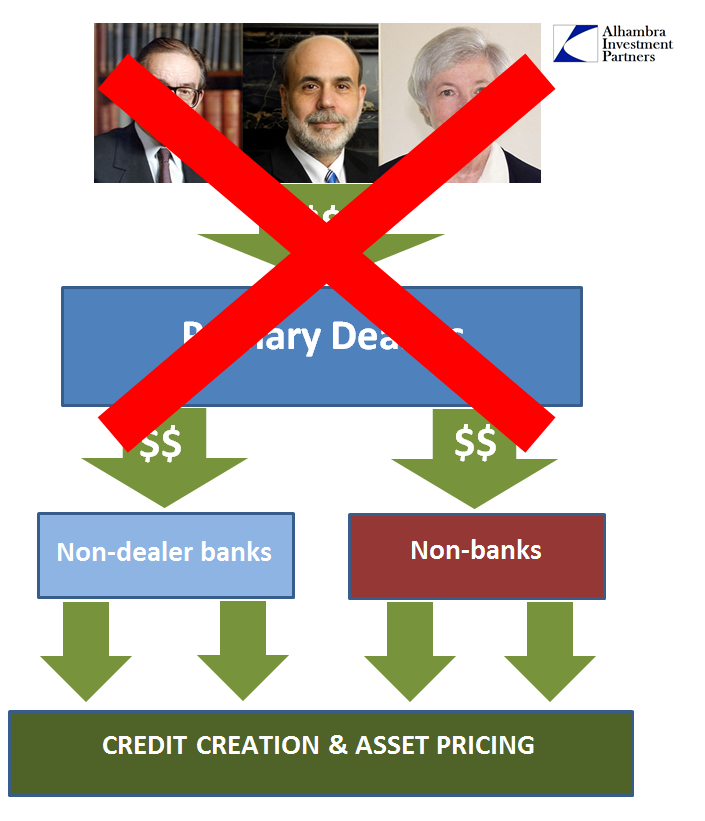

As I write constantly, monetary policy is not “stimulus” but a reaction, and often a panicked one, to what is happening or has already happened in global “dollars.” We will likely never know for sure, but the sudden and unexpected removal of Lou, who was seen by some as a rising star, isn’t a giant intuitive leap. If there is one constant throughout this “rising dollar” period, it is that the eurodollar system has easily made mockery of even the most stoic and attentive of central banks (starting with the SNB). Before they know it, they are left struggling in a sea of contradictions that upsets the very order that was supposed to be the guiding baseline for getting out of all this.

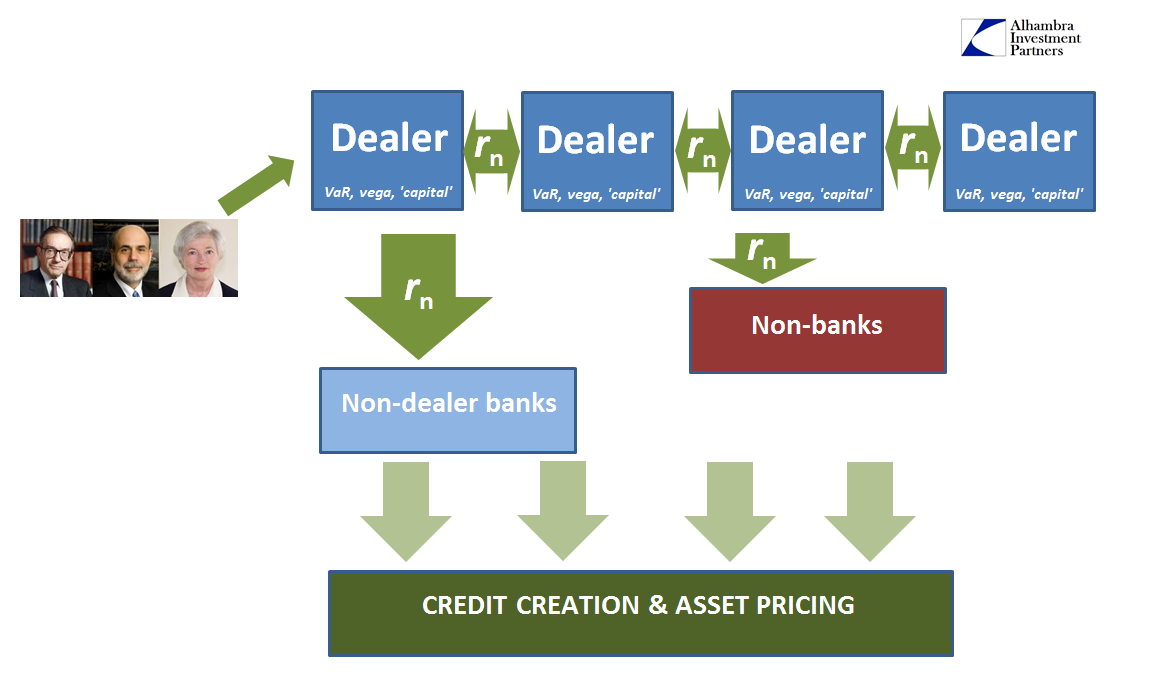

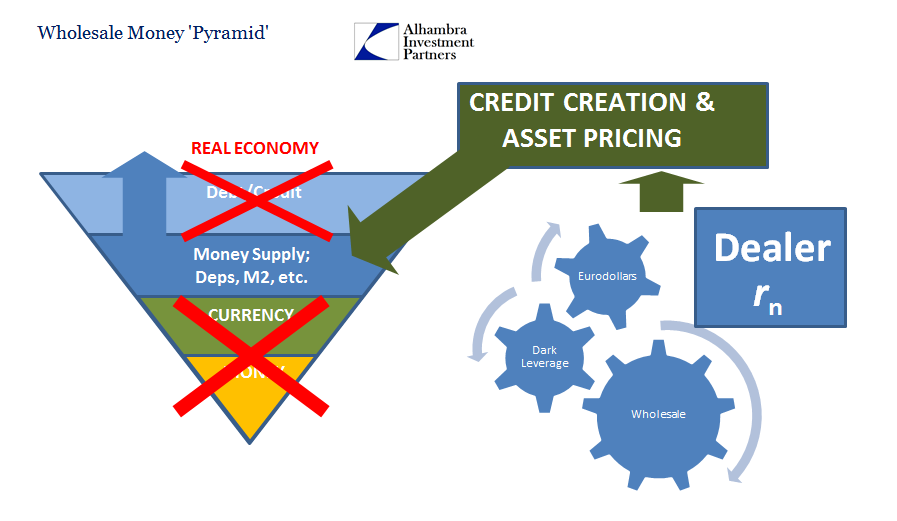

Economists, policymakers, and even many observers who should know better keep making the same mistake. They place the central bank at the center of their economic model by virtue of its assumed monetary power. This is wrong, and has proven wrong time and time again. The central bank is just one input among many for the credit-based currency system that is the true monetary base. Because this is how it actually is, the “dollar” always “wins”, which simply means on this side of August 2007 we always lose. But, as pointed out yesterday, there isn’t anything that anybody can really do about it until mainstream economics is thrown out. Every day we waste until that point expands exponentially the potential for the worst sorts of outcomes – including political instability that comes from increasingly desperate actors in the places where it can be least afforded.

Stay In Touch