A big reason why Chinese banks struggled yesterday in their daily bid for “dollars” (CNY DOWN) was the relatively unchanged economic statistics for November. Many in the media have tried to frame China’s economic situation in 2016 as if stabilizing were a positive outcome. Markets, especially funding markets, aren’t so enthused about the prospects for “weak but not getting weaker.” It does seem as if many were betting on the usual cycle, where avoiding a recession or “hard landing” earlier in the year was supposed to kick off acceleration.

A Chinese economy that after sustaining a downdraft (“dollar”) in 2015 fails to accelerate in 2016 is still a dangerous set of financial circumstances. There is past debt that was written for full recovery, as well as new debt accumulating to help rollover some of that past debt in addition to betting on “rebalancing.” From this perspective, October’s numbers were uniformly disappointing even if they didn’t show further deterioration.

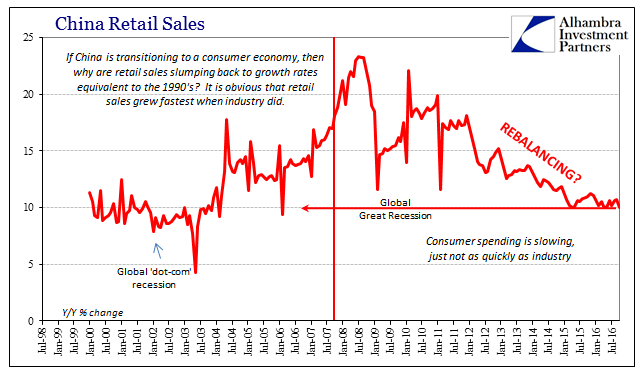

Where industrial production is stuck almost literally at just better than 6% (when 8% used to constitute recession for China), retail sales are likewise pegged mostly between 10% and 10.5%. Last month, September, retail sales jumped outside that range to 10.7% and reignited so much talk of “rebalancing” when in fact it was just another set up for disappointment. After all, Chinese retail sales have been up at various points the past two years, too, the last being 11.2% in November, only to fall back down each time. Retail sales growth first decelerated to 10% last April, and really hasn’t changed much since.

As for industrial production, since March the rate of growth has been between 6.0% and 6.3% in all seven months. That may indicate that IP is becoming like GDP, a government-massaged number to suggest what officials want to project as realistically as they might be able to (which is why they don’t just push it a lot higher). Or it is just this usual depression cycle filling out what we have already seen twice before: the Chinese economy, as a very good proxy for the global depression, absorbs a monetary blow, gets knocked back because of it, and then stabilizes for some many months at that lower level.

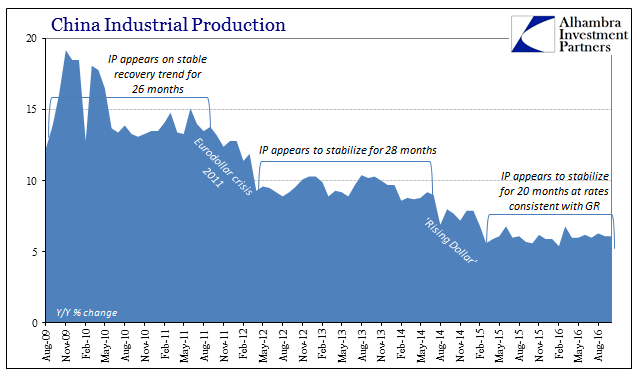

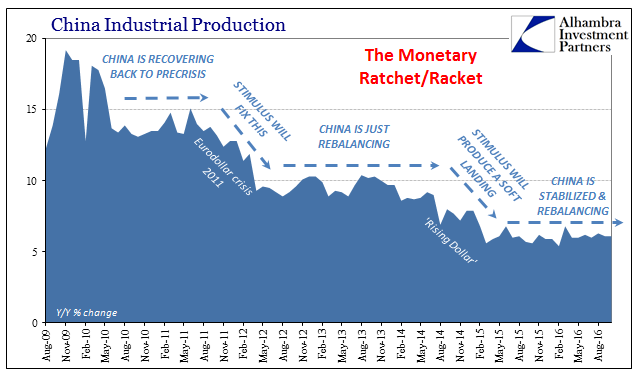

Because this isn’t typical, it’s more unprecedented than anything, everyone is utterly confused by it. It defies traditional classification because it isn’t anything like a traditional environment. Starting in 2009, IP showed what looked like first a stable almost recovery, only to be interrupted exactly when the 2011 crisis flared up. It then dropped below 10% by early 2012 and then mostly stayed there, with a few months above 10% here and there that “proved” to economists and policymakers “stimulus” was working, for a total of 28 months. Then in the summer of 2014 coincident to the “rising dollar”, IP slowed yet again, this time below 8%, dropping to around 6% by March 2015; where it has remained, more or less, for each of the last 20 months and counting.

Again, because this defies traditional analysis, it is described mostly in terms of rationalizations that are anchored to beliefs about “stimulus” even though China is one of the few places in the world where the product of these cycles is especially clear – slower, slower, and slower.

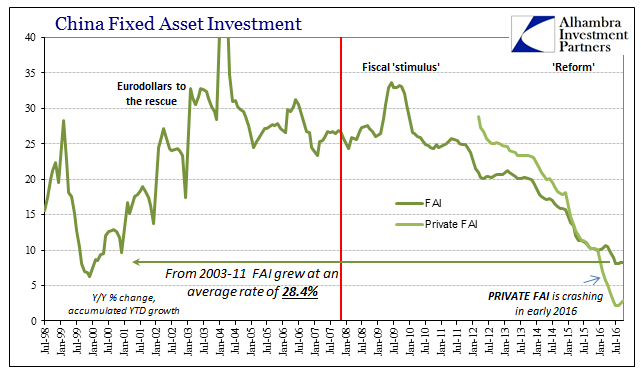

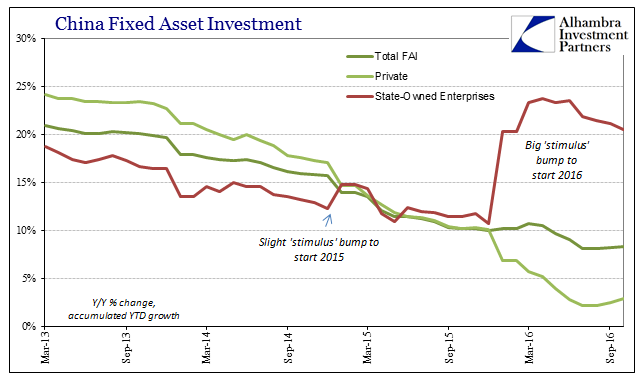

This second post-2008 “dollar” interruption, however, has created much deeper negative effects than in 2011-12 (or, as you can plainly see below, even the Great “Recession”). Fixed asset investment (FAI) had been decelerating since the reform agenda was adopted toward the end of 2013, but in early 2016 as a result of monetary disorder in 2015 fixed asset investment crashed. Private FAI turned negative earlier this year, while at the same time the government in Beijing panicked into another “stimulus” response.

Private FAI in the past few months has stabilized but at an exceedingly low level. Thus, it, too, fits with the overall theme of “weak but not getting weaker”, but also still a huge problem.

What China’s economic statistics more clearly show is that the global economy falls into something like stasis waiting in between “dollar” eruptions. After each one, the global economy, further stripped of monetary vitality, grows only colder, like the slow and uneven approach of an economic ice age. Stasis can mean different things in different places, but by and large it is the same process of positive numbers that don’t ever add up to actual, meaningful growth that is badly needed. Instead, economists take stasis, stabilization, or positive numbers to suggest the global economy just needs a little more time and tinkering, largely because they think it positive that after each “dollar” problem (that they don’t recognize) the economy seems to avoid what they think is the worst case (a traditional recession or “hard landing”). They don’t realize this is the worst of the worst case.

If the FOMC in the US votes to raise rates again in December, it is because of their misreading of these non-traditional depression cycles. To EM currencies, however, clearly nothing has changed, and that is a big problem, the same big problem that has been at work eroding or freezing out economic growth for years now. We are stuck in this reductive processing until one of two things happens: either economists realize (I didn’t say it was a high probability outcome) that this isn’t a normal economy with normal problems that might be solved with the “right” amount and now type of “stimulus”, where they finally begin to work on fixing the global monetary (banking) system; or these cycles continue to reduce until the social and political strain of them forces more radical and unpredictable changes (and not always for the better), something like a trapped animal fighting for its survival.

Stay In Touch