Part 1 is here.

Part 2 is here.

From the point of the Great Crash forward the interbank market mostly ceased to exist. Having first learned the hard way about money and liquidity, the federal funds market as well as the trend for recirculating borrowed reserves largely died out. Banks overall carried massive reserve balances far in excess of what was required, a response to public sensibilities as well as their own new shyness, even to the point of in 1937 increasing even more that liquidity margin when the Fed disastrously raised the required reserve. For whatever was left of fungible reserve trading was a liquidity system dominated by US government securities, including the widespread use of T-bills for reserve and liquidity management.

It wasn’t until the 1950’s that more robust interbank markets made their reappearance. By the end of the decade, in May 1959, the Federal Reserve, always behind the curve, finally decided to undertake a three-year study of the federal funds market. At the start of its technical description of federal funds, the report re-introduces the same 1920’s concepts:

Directly, the Federal funds market increases the mobility but not the total volume of reserve balances. Through the market’s facilities, banks with deficiencies purchase the excess reserves of other banks. The effect, therefore, is to make the excess reserves of one area or group of banks available to meet the reserve pressures which may converge on others. Indirectly, the operation of the Federal funds market, by increasing the availability of excess reserves, probably results in a somewhat lower level of total reserves than would exist otherwise.

The reason for that was renewed faith from among participants that when needed the “market” could easily provide dollars in learning from the failures of 1929. The growth of the federal funds market throughout the 1950’s was directed by technical changes as well as a US banking system that was further removed from the Great Depression. As such, the market expanded in the same manner in which “borrowed reserves” had throughout the 1920’s:

In recent years, some of the New York City banks have developed an accommodating business—in effect performing a brokerage function among their correspondents. These accommodating banks buy and sell Federal funds as a service for their correspondents, as well as to adjust their own reserve positions. This service has also attracted a number of newcomers to the market, mostly relatively small banks with close correspondent relationships, or banks which for some reason prefer not to deal through the broker. The ability of the accommodating banks to serve their customers was dependent, in part, on the services of the broker in facilitating contacts or furnishing information.

At the same time, of course, the real economy itself was becoming much less dependent upon actual money and even currency; gold was eliminated in 1933 from personal use, while increasingly payment terms were being settled in means other than direct exchange of cash (first widespread checking, as costs for out-of-town settlement were brought down, then the first wire systems that delivered increased ability for what would become electronic settlement). What that meant for interbank markets was a growing tendency to do a great many other things; from federal funds to repos and then eventually eurodollars and derivatives.

Since there was becoming a much smaller proportional need for actual cash, these interbank markets started to serve two purposes – one was still the legal requirement about holding approved balances as “reserves”; the other was to more and more use these markets not for meeting statutory guidelines, but rather for funding bank activities directly in lieu of deposits. Once more from the 1959 report:

The Federal Reserve System considers continuous borrowing an inappropriate use of the discount window and a matter for discount administration by the Reserve Bank. As a result, Federal funds may be particularly attractive to a bank which, for various reasons, may need to borrow frequently.

And what was a telling admission about where all this was going:

Although none of the banks interviewed was an express advocate of continuous borrowing, a few were, in practice, continuous borrowers, including both borrowings in the Federal funds market and from the Federal Reserve. Banks with more or less chronic deficits return to the Federal funds market day after day to meet their needs, whereas banks with more balanced reserve positions and thus needing to borrow infrequently, often prefer discounting to take care of deficits which are expected to last more than a day or so. There are, of course, endless combinations of conditions which affect decisions at any particular time, but they do not alter the basic policies or attitudes of banks.

Over time, however, proved to be a different result. Once the federal funds market became more well-established, or really re-established in a modern, electronic format, as well as introductions via repo and eurodollars throughout the 1960’s, what were once described as “continuous borrowers” with “chronic deficits” became an actual, viable operational model. And why not? In 1959, the practice might have been outwardly discouraged and seen as something only a “problem” bank would engage, but the efficiences and benefits were hard to deny. By 1969, any such boundaries were torn apart, ushering in the age of “missing money” that was only missing to authorities who thought it still 1917.

By the end of the Great Inflation the transformations in banking and money had been so radical and far-reaching that it was wholesale money that played a key destabilizing role in what would be the last gasp of traditional banking as at least an equal force. The Savings and Loan industry by the mid-1980’s had been split between those who would remain faithful to the predominant view of money in the multiplier format and those who enthusiastically embraced “money.” You don’t have to guess which cohort was the one rushing to bailouts and taxing state depository guarantees.

Part of that latter process is certainly to cheapen as much as possible the liability side, which is what opened the door to the undeveloped repo market. According to the FDIC, by 1984, “thrifts with annual growth rates of less than 15 percent had more than 80 percent of their liabilities in traditional retail deposits (generally in accounts of less than $100,000), the comparable figure for thrifts growing at rates in excess of 50 percent per year was only 59 percent.” As the FDIC makes plain, that latter category taking on all these risks were funding them via large-denomination deposits (a notoriously unstable category of funding) and repos.

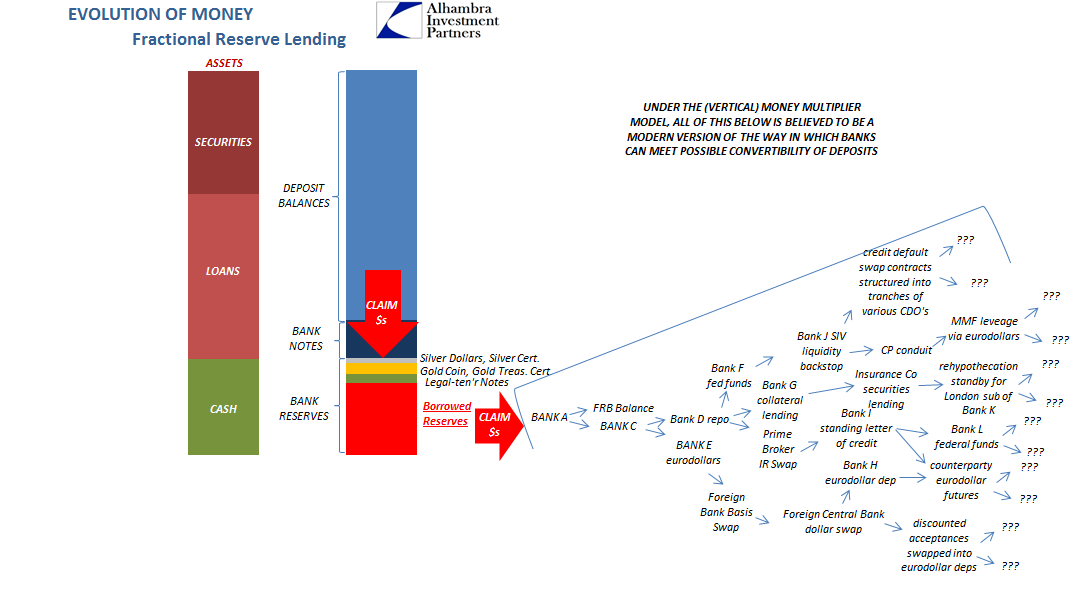

The S&L’s that grew the fastest were those that embraced the non-traditional aspects of money; and they were those who ended up contracting even faster. Though it was more than thirty years ago, what was taking place demanded a rethinking of the monetary function and how it was to be accounted for. Convertibility was no longer the guiding principle for banking, nor the threat of it the limiting factor for bank expansion. If we are to be specific about what interbank markets are, it is that they are more remote claims upon institutions that are believed competent so as to be able to supply dollars if ever called upon to do so. None of these institutions actually have the currency in their vaults, of course, but the counterparties who transact with them on the basis of interbank funding do so in the belief that they could should the conditions ever warrant.

Even the S&L crisis was itself a bad marriage of wholesale funding upon what was still the traditional vertical format of the money multiplier. It was the investment bank model, the shadow banks, who took the next step of actually completing the horizontal expansion or multiplier. In the traditional format, interbank markets were solely a means to a specific end; to be a fluid and broad-based method of allowing banks to better meet the public’s demand for currency. In its post-modern form, this wholesale first arrangement, interbank markets aren’t tied to the public at all; instead, they are an impenetrable string of chained liabilities whose purpose is to transact in fake IOU’s of various banks who claim to be able to deliver dollars should anyone desire them but with an overriding understanding from everyone that nobody ever will.

The phrase Charles Dickens used to describe insurance companies can be refashioned to quite well characterize this monetary arrangement; a bank that holds no dollars gets another bank that holds no dollars to guarantee that everyone has dollars. It’s all a lie, but it works because nobody ever demands to be presented with dollars. Transactions are simply settled and worked out in the format consistent with that; Bank B used to have a number that said Bank B was owed a certain amount of dollars but then Bank B lent that number to Bank C so that Bank C could claim an ability to get dollars when neither bank has any interest in obtaining dollars just the whatever transformation that results from that transaction. Dollars are purely theoretical; thus “dollars.”

What governs monetary expansion in the absence of dollars globally is not the relation of money to deposits or even the full complement of bank reserves to deposits but rather this horizontal “fractioning” where interbank markets of chained liabilities all express variable levels of confidence about the prospect of holding claims for dollars from those who have none but claim to.

This is a far more efficient method for banks as well as the public. In the latter half of the 1990’s when banks agitated for an end to Depression-era legislation, Gramm-Leach-Bliley was the result of wholesale intentions rather than how it was sold to the public. From what the industry said, and what was debated publicly in Congress, banks simply wanted to be able to offer their customers a one-stop shop for all financial products; to sell mutual funds and life insurance inside bank branches because people wanted to be able to get all their services in one place. It was the happy talk of synergy and lower costs to the public.

As usual, the real motivation was nothing like that. Citigroup in 1998 practically dared Congress to act on repealing Glass-Steagall by purchasing Traveler’s Insurance on a two-year compliance waiver from the Federal Reserve. Though I don’t want to completely set aside Citi’s profit motive of selling Traveler’s insurance products directly to Citi’s depositor base, in truth what Citi really sought was a greater blend in the whole bank’s overall funding portfolio; to be more and more free from the vertical money multiplier to be able to purse avenues of horizontal balance sheet expansion. Every other major bank followed suit because they all wanted the shadow bank model as the marginal avenue for expansion and all the far greater (eurodollar) profit opportunities that would open up as a result.

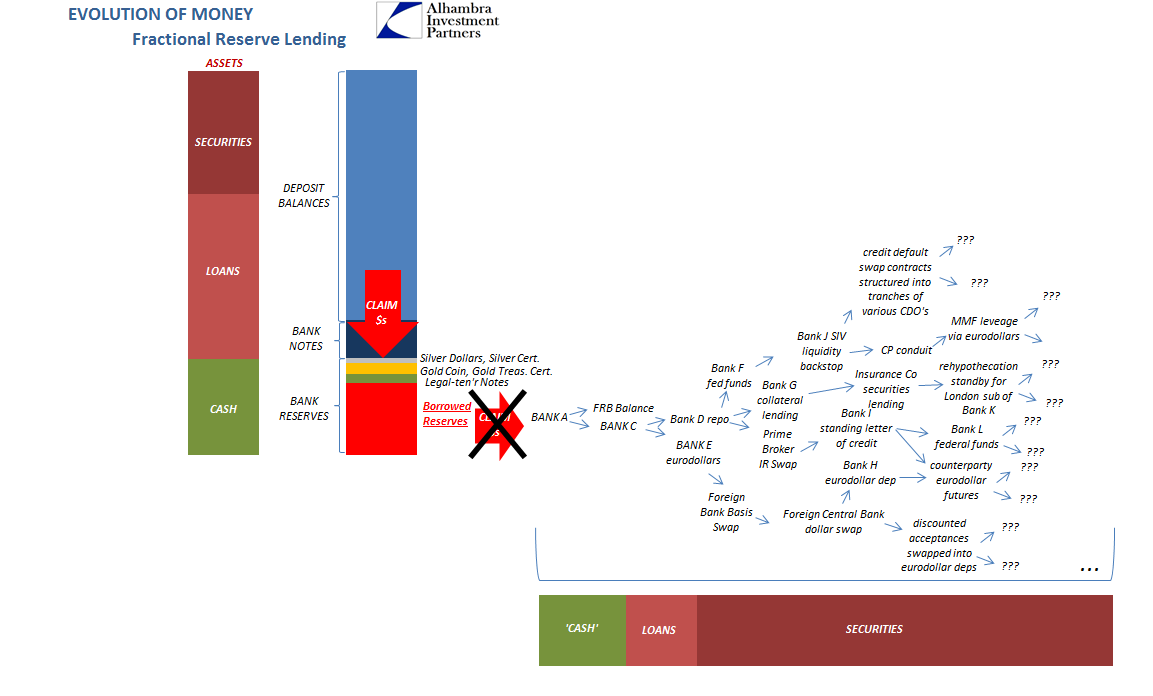

Thus, the wholesale system that is dominated in the dollar denomination (eurodollar) is not a means to deliver actual dollars to depositors eventually, rather it is a system of standards loosely associated with the dollar (by convention) by which banks can transact with each other with regard to global financial objectives. From this view you can (hopefully) far better appreciate what happened in 2008; the vertical “multiplier” section was almost completely untouched with the exception of a few jurisdictions where depositor insurance was less than 100%. There were minor queues at ATM’s in the UK after Northern Rock, for example, with people seeking convertibility of deposit accounts into pounds cash, but apart from that the panic was entirely contained within just the horizontal.

And even then it was never going to be settled with actual dollars demanded from among the interbank counterparties. What happened more closely resembled simple doubt; whereas before August 2007, most participants had few misgivings about claiming to be able to obtain dollars, afterward more participants became shy about it – not that anyone ever actually forced convertibility from their interbank counterparties. Banks within the global wholesale system still claimed to be able to produce dollars, they just did so with much less enthusiasm and at much greater costs as a result.

Less enthusiasm in the interbank market did not translate into public/depositor doubts about being able to access deposit account holdings (vertical multiplier) as it did in 1929 because the horizontal had almost entirely delinked from the vertical; they were to a very high degree separate and distinct monetary and credit systems. With fewer intense and fluid dollar promises, it was the non-money wholesale system that was forced to contract (the horizontal “multiplier” alone in reverse).

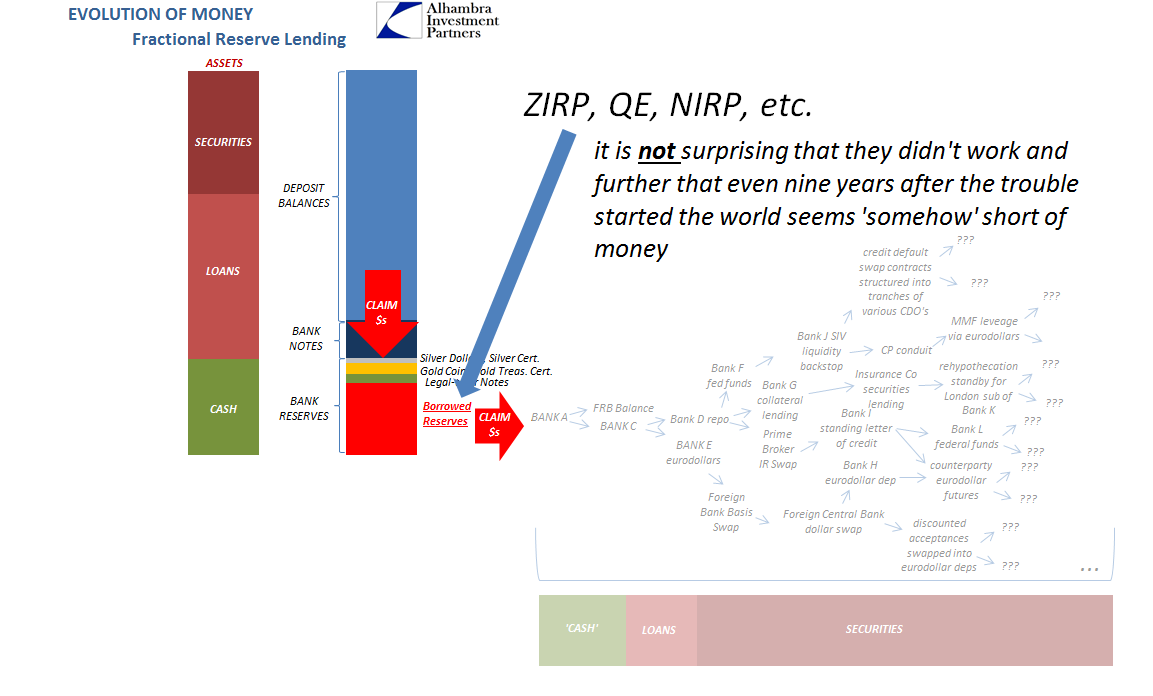

We can further appreciate why QE had so little effect apart from sentiment. As discussed about WWI and 1917, QE was made for a monetary world of the vertical alone; yet, the issue of 2007 forward, including, as we well know, the Great “Recession’s” aftermath, was strictly with regard to the horizontal. Bank reserves are still believed to be a way for banks to meet the public’s demand for currency instead of holding deposits; the interbank market has not been a means to achieve that end in half a century. It is instead a means to its own ends that grew out of technological evolution as well as changing preferences and behaviors.

It should be very concerning that those in charge of central banks who claim the heavy crown of monetary supremacy instead operate on terms last verified ninety-nine and almost one half years ago. I often write that monetary policy of the 2010’s is derived from a 1960’s understanding of the 1930’s. That isn’t fully accurate or comprehensive; it is instead 2010’s policy derived from a 1960’s understanding of 1930’s conditions as seen only through the filter of the 1910’s. The world does not stand still, yet monetary policy today assumes money today is still as it was in 1917.

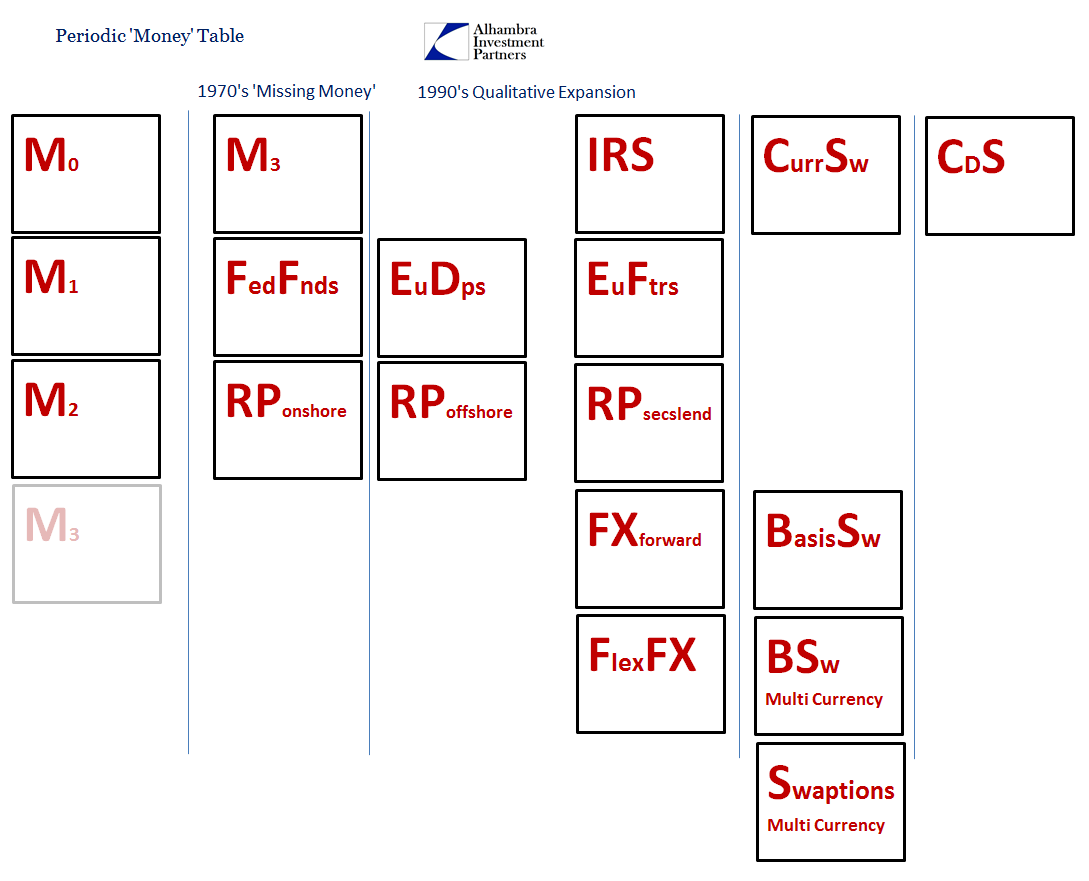

As incredible and even crazy as that sounds, the reason for this self-inflicted blindness is just as incredible in its simple stupidity. I wrote at the beginning that for Positive Economics none of this mattered, and so a great deal of detail that once filled libraries for its scholarship was simply reduced down to the lowest common denominator of aggregate blocks. Economists assumed, in the 1960’s and 1970’s no less, as if that wasn’t a flashing warning for all of this, that no matter what form money took it could always just be expressed as “M” and therefore no study or deep appreciation of it was necessary to achieve economic goals and mandates. If the monetary system had progressed linearly and exclusively under the vertical paradigm of the money multiplier, that might have been a safe assumption. But, again, the world does not stand so still, so it was ridiculous to believe that something like the horizontal expansion of money into “money”, dollars into “dollars”, was not possible. Everything is possible, especially over huge expanses of time. There are no “tail risks”, just progress.

There were numerous warning signs all throughout the decades that more than suggested monetary theory was outdated and invalid. Rather than attempt to verify or deny the prospect, Economics (capital “E”) only retreated further into dogma (canceling M3, for example) where it remains to this day. Admitting money is no monolithic, aggregate concept undermines all of Economics, especially econometrics, because it was built on quantity theory. Quantity theory presumes, has to presume else it is subject to singularities in the math, only the vertical money multiplier that delivers a false sense of precision and accuracy. To acknowledge more than that cancels out Economic theory, something that Economists just can’t bring themselves to do (since central bankers aren’t subject to the survivability constraint, at least not yet).

Even now, authorities only seek different methods from which they might be able to affect the vertical money model now that QE has proven ineffective. Only a very few are just now starting to explore the horizontal, to become more fully aware that money isn’t a singular concept and has been developing in all kinds of weird and exotic formations for a very long time already.

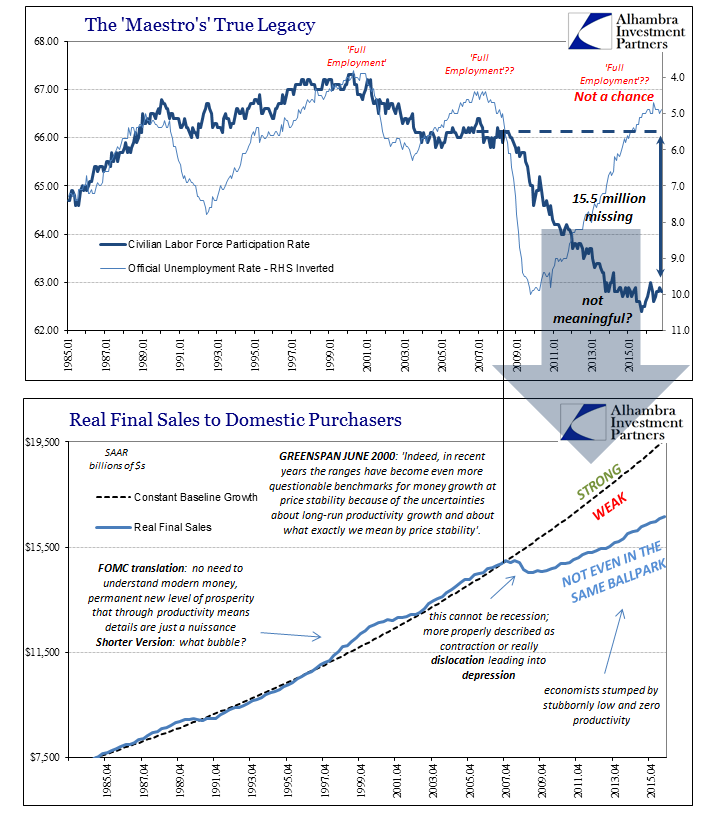

The evolution of money, unfortunately, is not just some scholarly argument to be hashed out exclusively inside the halls of the Academy (capital “A”). It is the biggest issue of our time; everything else flows from it, given the lateness of the argument. The global depression that has developed is fully a matter of the horizontal. Escaping that depression before the worst forms of social rebellion take hold is a matter purely of appreciating that horizontal and then doing something about it; that is why so much lost time figuring only within the vertical has been so harmful. Continuing to be limited about money, really “money”, will only increase the costs of time, already incalculable, and raise the probability of the worst of the worst case deconstructing further into forced transition (of far worse conditions if then at a steadier state).

The ancient understandings remain valid today, if applied now in a different and unexpected direction: monetary shortage, bank panic, deflation, and then the usual depression. It truly is textbook money, just deserving quotation marks to show that though the more things change the more they stay the same.

Stay In Touch