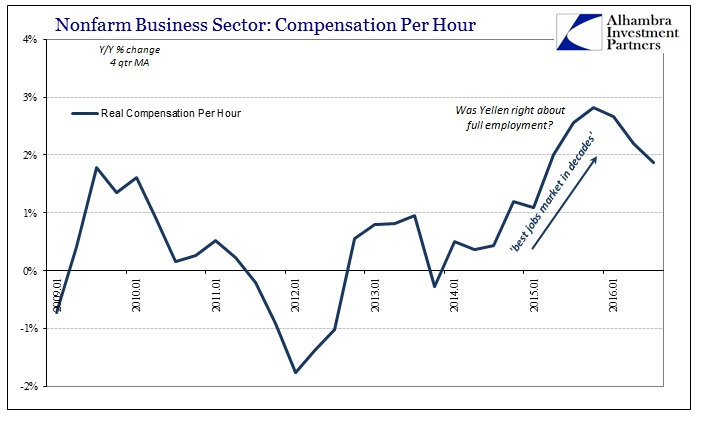

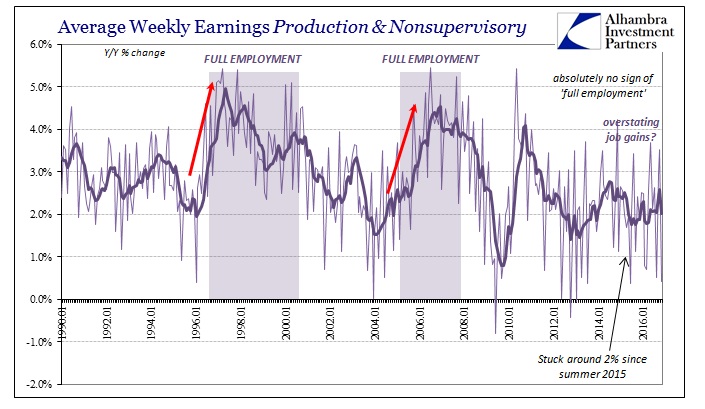

According to the BLS’s latest figures, real hourly compensation increased 2.2% Q/Q (annualized rate) in Q3. Wages and earnings are being closely watched, of course, for signs of acceleration due to the so far ethereal full employment level. That idea is taken from the unemployment rate even though, as in November, it has been as much determined by the lack of enthusiasm for the jobs market as what is supposed to be the “best jobs market in decades.”

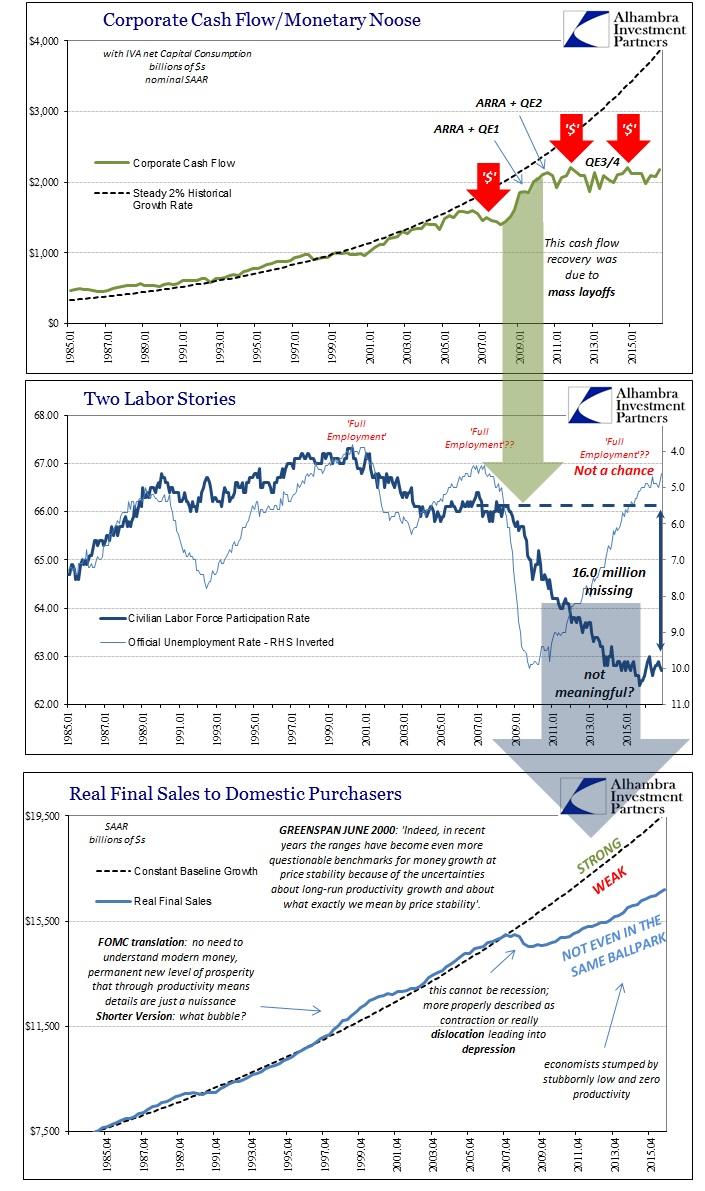

This is a very delicate balance where the longer it lingers the more likely economists will be forced to admit the impossible about the unemployment rate. From there, the whole narrative of the “recovery” unravels, because if there are no wage gains then there must remain enormous “slack” which can only mean that the denominator of the unemployment rate was more important than the numerator and that the Great “Recession” was therefore no recession at all.

For over two and a half years now, economists have been claiming that slack was disappearing and that wages were poised to takeoff and prove it. For Janet Yellen, that would have been the signal to begin tightening before the economy might overheat as wage gains fueled price gains. Without those wage gains, economists are still stuck on Step 1, which is why the Fed is in no hurry whatsoever to actually “tighten” (or what they believe is tightening policy).

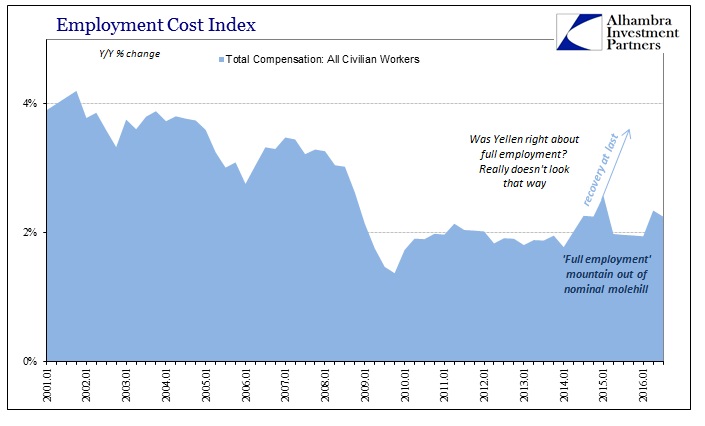

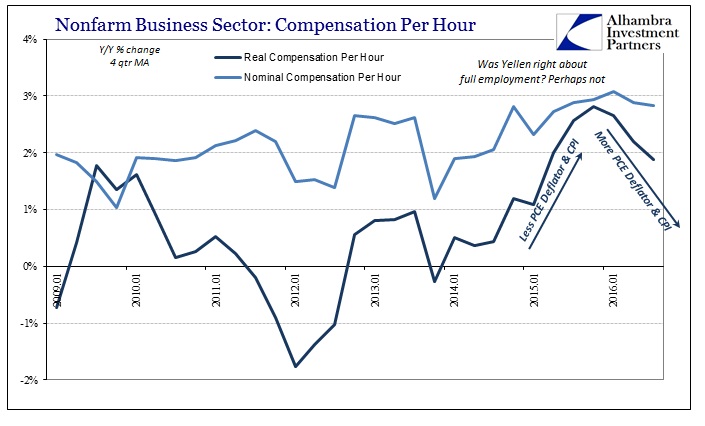

At 2.2%, real hourly compensation is again disappointing, stuck in the same rut as has been the case since 2009. For a few quarters especially to start 2015, it had appeared as if hourly wages were, in this series anyway, looking as if they might break out higher at long last. To end 2014, real pay rose 3% in Q3 that year, 3.9% in Q4, and then 4.8% to start in Q1 2015. To many, that was the signal they had been waiting for. Even the Employment Cost Index, a separate BLS data series, had accelerated to 2.6% in Q1 2015, the highest since 2008.

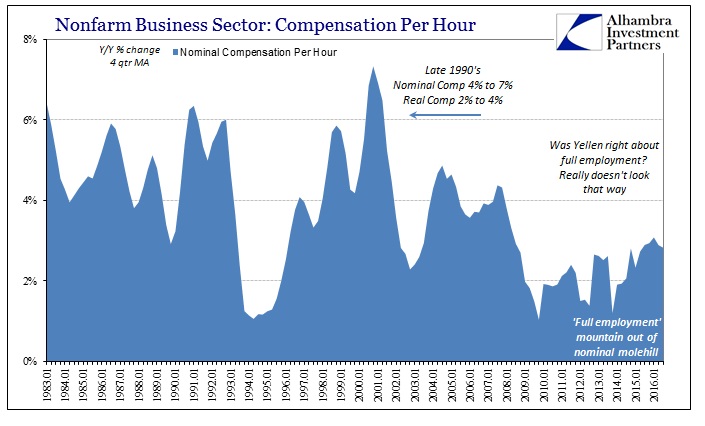

With real wage gains apparently falling back again, we see plainly what was driving them all along. There never was any actual acceleration due to the winding down of slack; instead it was a statistical “boost” due to the crash in oil prices heavily depressing the CPI and other measures of inflation. Nominally, hourly compensation showed very little acceleration and certainly nothing at all like what we would expect at or even near actual full employment.

With oil prices steady to partially retraced this year, the upward meandering CPI means that absent any actual wage gains the “real” calculations will start to fall back again as they have. It is nominal wages where the lower level of slack would be illuminated, and so far there is nothing to suggest either full employment or much even by the way of basic economic progress. By every historical comparison, hourly compensation remains hugely depressed; there isn’t the slightest hint of inflation pressures due to labor market “gains” despite every effort of economists and policymakers (redundant) to see them in the smallest quarterly or even monthly variations.

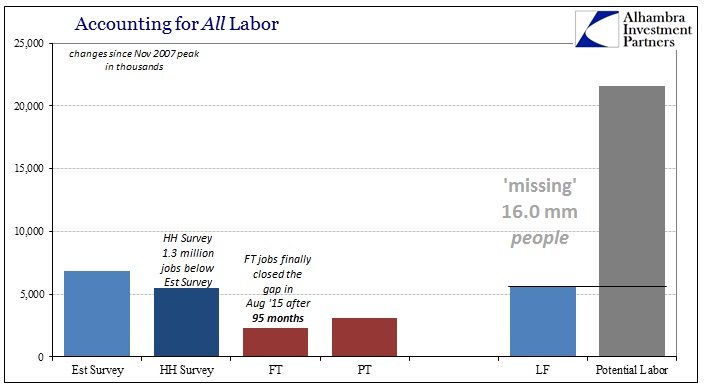

And that forces us back to the denominator of the unemployment rate with the increasingly inarguable conclusion that retirement of Baby Boomers and other demographic changes have not been the reason for the lack of labor participation. We are left with the growing realization that there was no recovery from the Great “Recession” because it wasn’t ever a recession.

The unemployment rate of 4.7% is entirely irrelevant; it only applies to the shrunken economy that followed the clear dislocation that erupted around 2006. And with the denominator clearly the dominant setting for interpreting the unemployment rate, it can only call further into question the numerator. After all, the labor market of that period, late 2014 and early 2015, had been repeatedly, incessantly described as the “best jobs market in decades.” There was really nothing aside from the headline payroll figures to suggest as much, as far more data related to consumers and spending had already turned the other way (weaker).

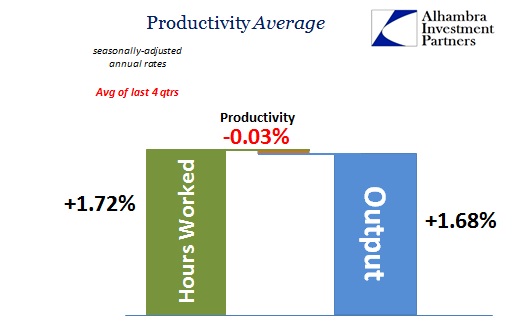

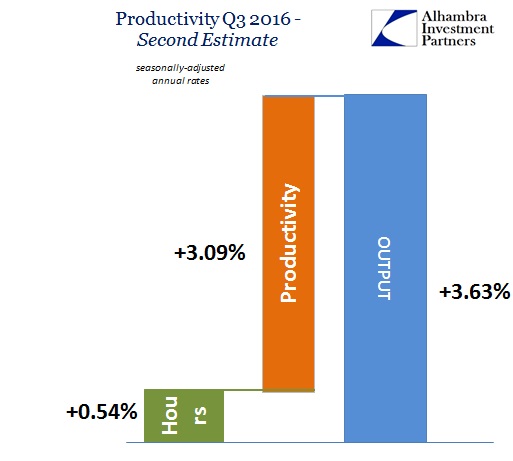

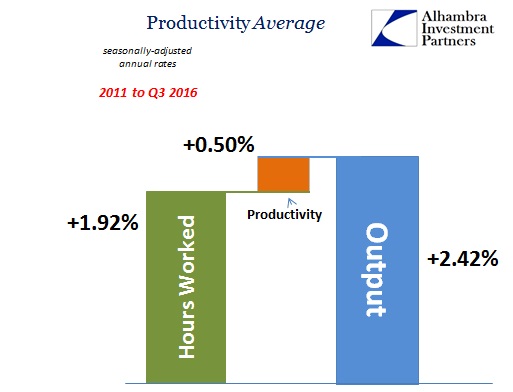

As GDP “unexpectedly” (to the economic view of the unemployment rate) decelerated, this disparity was further elevated by low and even negative productivity. The past four quarters have been, on average, just slightly negative in terms of the BLS’s productivity framework, which is nothing more than the remainder between the BEA’s version of private output (a majority subset of GDP) and the BLS’s estimate for total hours worked.

The estimates and averages of the past year, which include much more “normal” relationships for Q3 2016, are simple a more extreme version of this discrepancy that dates back to the start of the BLS’s jobs “recovery.” Overall, negative productivity, or even just near zero, makes very little sense and questions, as I have suggested for years, whether the BLS has been overstating labor figures and payrolls. That last accusation would be more consistent with what we actually have seen in wages, spending, etc.

What should have been calculated instead was what we find for Q3. Though it is only one quarter, higher output combined with sharply lower total hours indicates more consistent (with common sense) productivity for the quarter. It was only by figuring sharply slowing labor usage in the economy that productivity stops being so absurdly out of proportion.

At lower output levels, as the past six quarters before Q3 2016, it would have made more sense had the balance of labor to output been much more like the current quarter. Instead, because the BLS was presuming relatively robust job gains (compared to 2012/13; in historical terms, total hours were still growing suspiciously slow) it forced the productivity numbers to display repeated nonsense.

We are again left with labor estimates that continue to show no actual economic growth. There are, as usual, positive numbers throughout but that isn’t nearly enough to suggest meaningful economic progress. As proposed yesterday, if the Fed later this month “raises rates” a second time it will have nothing to do with recovery and actual growth. It surely isn’t about actual full employment, as continued indicated slack is pretty close to dispositive refutation of every piece of official and mainstream rhetoric.

Stay In Touch