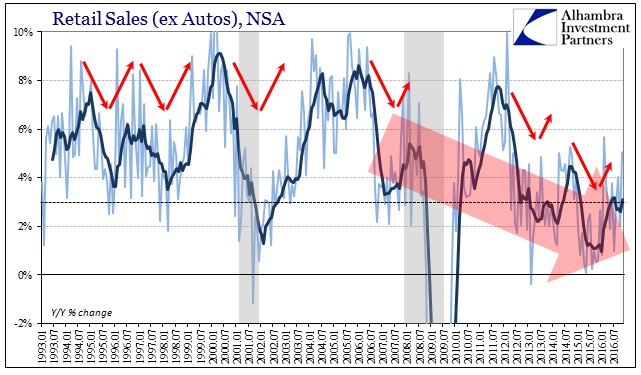

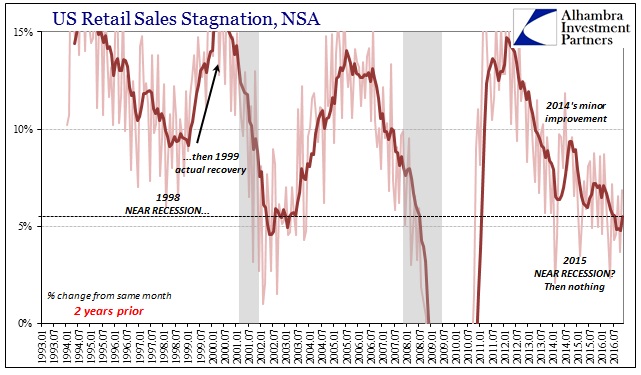

It was a 5% month for retail sales, the second such month this year. Overall retail sales grew by 5.3% year-over-year (NSA) in November 2016, the best growth since February. Ex autos, retail sales were up 5.1%, while retail trade expanded by 5.3%. These results, however, follow one of the weaker months of the entire data series, October, suggesting again that consumer spending remains constrained. The 6-month averages for retail sales, trade, and both without autos all remain stuck right around the 3% level that used to be consistent with recession.

There is a vast difference between retail sales growing occasionally at 5% and what we would find in spending growth during an actual growth period (or even during a period leading up to an actual growth period). The unevenness of these results is what is important. I should point out that the seasonally-adjusted estimates are attributing this wide variation over the past two months to seasonal factors, where October wasn’t as bad as it seemed and therefore November was likewise nothing special to the upside. It’s all stuck in that atrocious 3% range, however you wish to net it all out month to month.

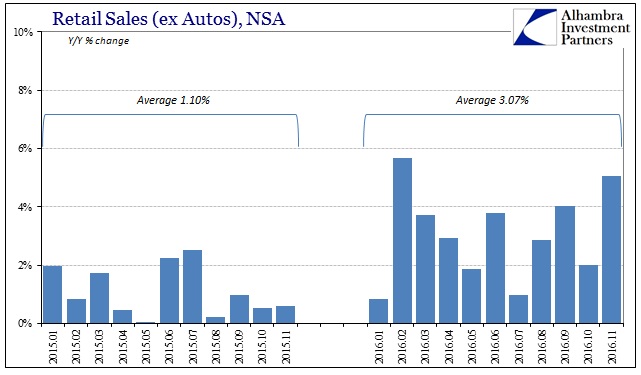

It is the same economy with one difference – oil prices and inflation. If we compare retail sales (ex autos) this year to the growth rates last year it appears as if the economy in 2016 did actually achieve improvement.

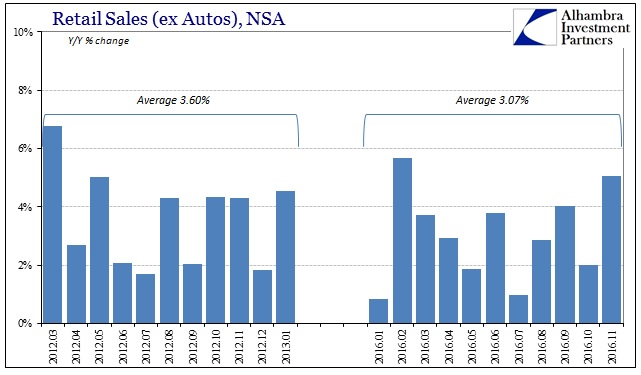

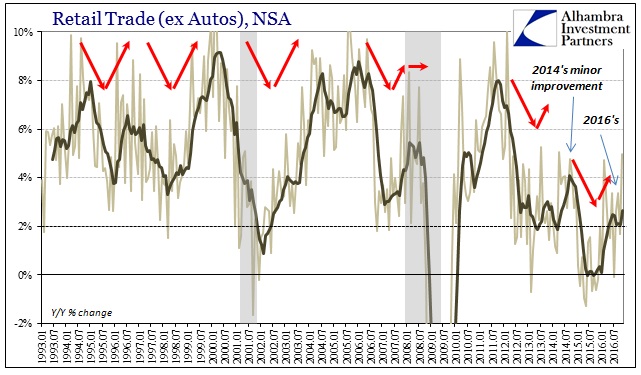

What happened last year was as full-blown recession, only one that didn’t actually lead to recovery as any true business cycle would have. Instead, the economy as it related to consumer spending went from very bad to just plain bad. That would be a continuation of the same economic trend as has plagued the US and the world since 2011. That much is very plain when you compare the data from 2016 in retail sales to other similarly weak periods, starting with the 2012 slowdown itself.

Retail sales in February 2012 (not included above) jumped by 10% year-over-year, clearly not suggesting strength but the last throes of the recovery. What followed was what has become very familiar; a higher degree of variation among the monthly rates, alternating almost regularly between weak (those months above 4%) and alarmingly weak (those months less than 2%).

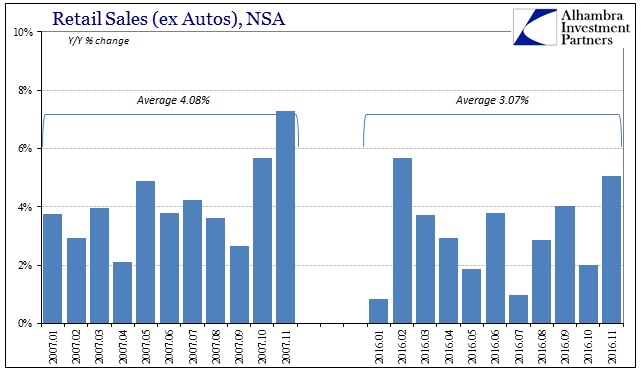

That same variation can be found in 2007, as well. The analogy I would use is from aeronautics. An airplane that is flying with enough velocity is very stable in flight. When it slows down, such as in the landing procedure, it is much less so, requiring additional measures to maintain lift. I think that is what we see in retail sales as one proxy for consumer weakness during low-growth periods.

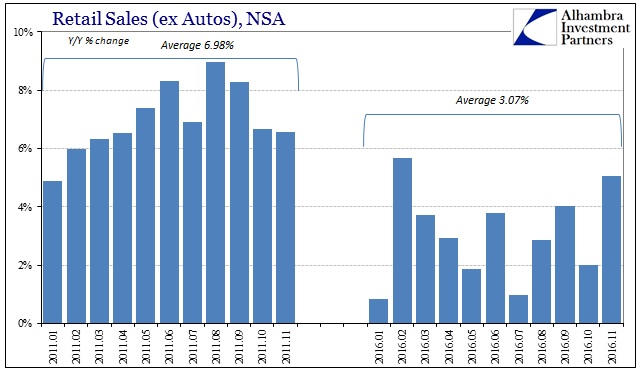

During regular or obvious recovery periods, by contrast, there is much less variation. The weakest month during 2011, for example, was the first overly wintry winter where retail sales (ex autos) grew by “only” 4.88%. That would qualify as one of the best months of 2016 when in 2011 it was clearly the worst (and at the time concerning).

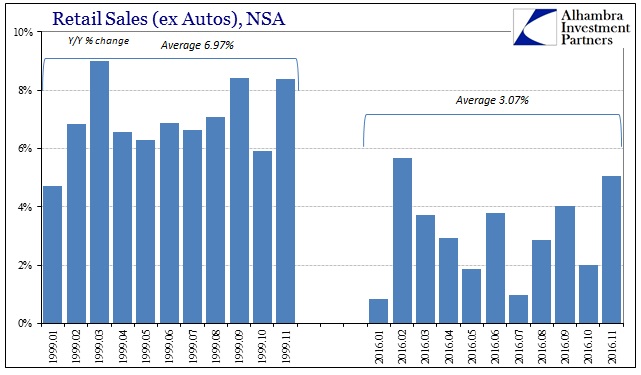

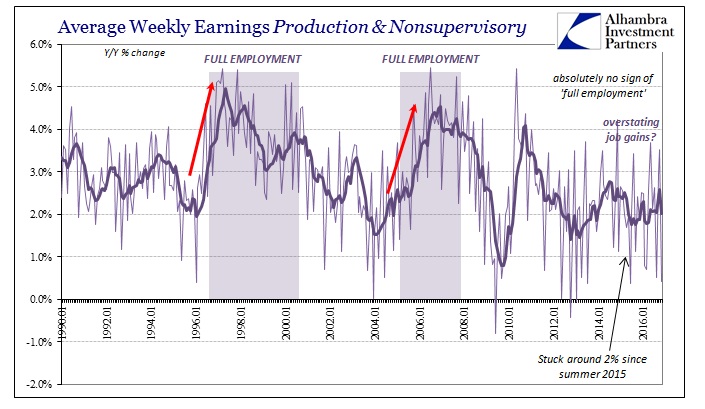

Perhaps the most relevant comparison would be in relation to 1999. The conditional similarities should make these years nearly identical as far as results. The final year of the 1990’s was the last “best jobs market” that the current “best jobs market in decades” refers to. It was also a year where the economy was coming out of an unusually weak period related then to the Asian flu and the slowdown that developed. Oil prices were rising again, and Alan Greenspan, in his crescendo as the “maestro”, began to raise rates that July after lowering them in late 1998 in an attempt to cushion the “overseas turmoil” then devastating much of Asia.

Clearly 2016 is nothing like 1999 in terms of retail sales (or any account that actually matters). About the only statistic that would suggest similarity of results is the unemployment rate. It started the year at 4.3% and ended it at 4.0%. All that does, however, is show once again how unsuitable the unemployment rate is as a meaningful description of the economy in 2016, just as 2015.

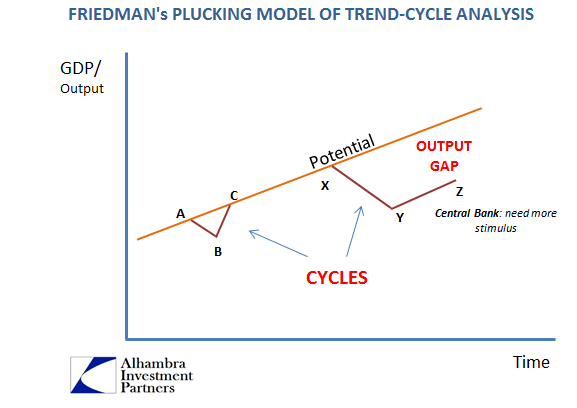

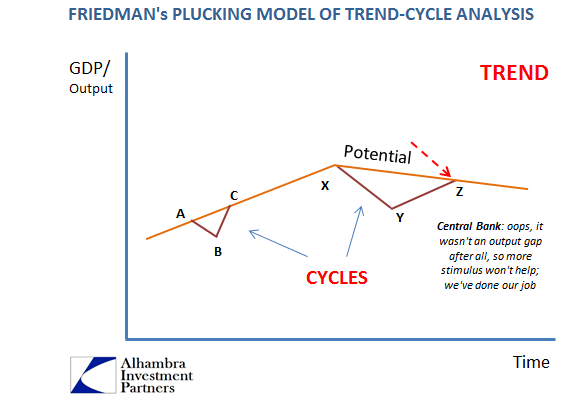

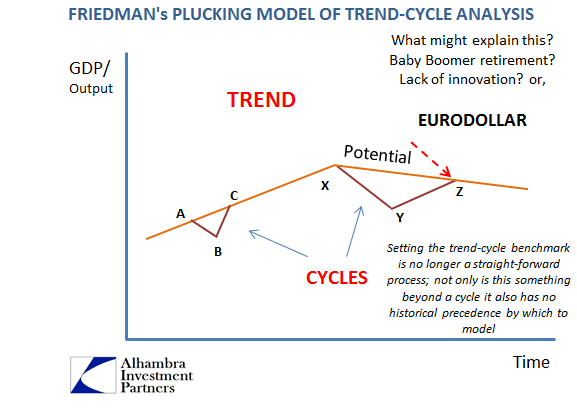

What we find by making these comparisons is the distinct absence of symmetry and cyclicality (as traditionally understood). Even after only a near-recession in 1998, the economy in 1999 improved by almost equal and opposite proportion to that weakness (for more than just retail sales and consumers). By every objective standard, the economy of 2015 was worse than 1998, yet what has followed hasn’t been similar to anything in the historical record. Rather than near-recession to recovery as the late 1990’s, the economy the past two years of the “rising dollar” has moved from near-recession to less but still near recession.

This is a pattern we have seen before, as I wrote in August 2014 amidst the growing euphoria over the unemployment rate and what was just beginning to be described as the “best jobs market in decades.”

The retail sales release for August [2014] was actually quite alarming. The track of sales pretty much confirms the end of the spring “bounce” that showed up in Gallup’s figures, but the real concern is that the “bounce” itself was never more than a minor adjustment; an absence of further erosion as it were. That is nothing like what is being presented widely as the economics profession still clings to the notion that growth is accelerating and the recovery is right around the corner.

Here we are all over again, except 2016’s minor adjustment is from an even lower starting point.

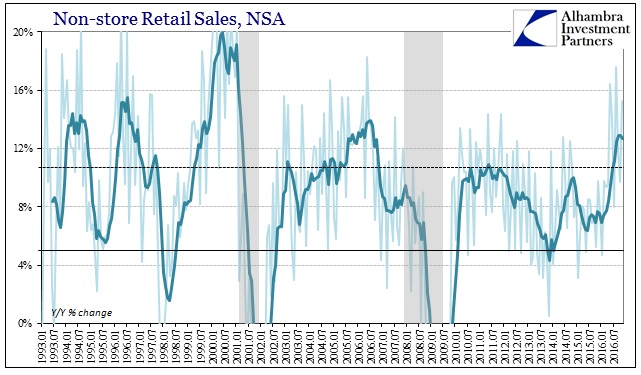

So far, the only segment experiencing meaningful improvement is online sales included in Non-store retail sales. Growth for this category was 15.3% year-over-year in November, continuing the (mostly) double digit expansion that started in February. The average growth rate since that month has been 12.1%; the average growth rate for Non-store retail sales during the period February 2015 through November 2015 was 7.3%.

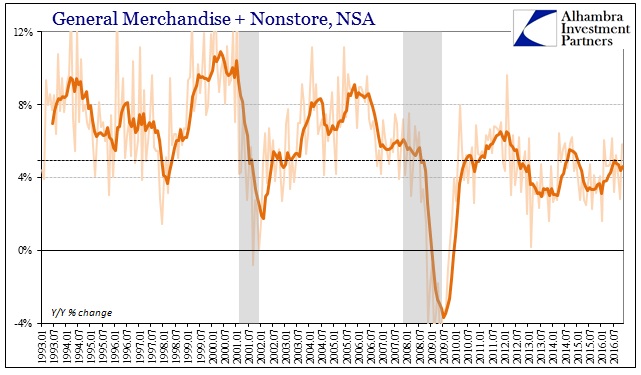

It’s still not nearly enough growth to make up for the losses piling up for the traditional retail environment. General Merchandise sales contracted yet again in November, down 1.4% year-over-year, negative for the fifth straight month and six out of the last seven. Since General Merchandise sales are still (for now) the larger segment, the net transition from bricks and mortar to the virtual setting leaves overall noticeably weak growth.

In my view, the dramatic increase in Non-store sales is of necessity especially in a year where following dramatic weakness there has been no meaningful improvement.

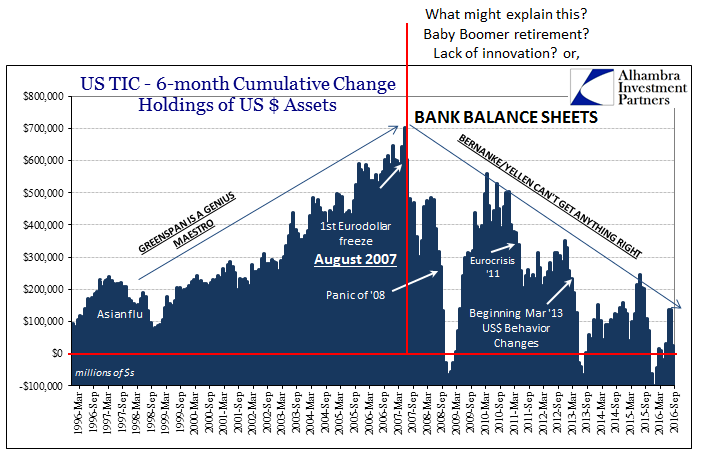

In 2014 I called it absence of further erosion; in 2016 I have suggested weak but not getting weaker. It’s exactly the same because the underlying trend for the economy remains (depression). Rather than alternate between recession and recovery as would be the case in a traditional cycle (or even near cycles like 1998/99), there is never actual improvement after these intermittent down periods like 2015, 2012, and 2008. Yet, reflation has been thrust, inappropriately, into these regular intervals, like it was in 2010-11, 2013-14, and once again 2016.

Anyone who believes in reflation even as just a possibility will rightly point out that it is not about the economy that we see today, rather the economy that is expected to finally result when authorities finally get it right. To which I will counter with all that you see above, especially since “get it right” was also thought of QE2 in 2010, then QE3 in 2012, and now more nebulous policies that are just general associations with fuzzy concepts. The reason each of these periods of reflation drawn from the “right” policies “this time” never achieved more than the “minor adjustments” in 2014 is that the mix of policies isn’t the problem, and therefore cannot be the solution.

Cutting taxes, ripping up tens of thousands of pages in regulations, repealing Obamacare, etc., will all be very helpful, but won’t actually achieve reflation. To use one final analogy, it would be like giving a terminal cancer patient better pain meds. They don’t cure the disease, they just make life temporarily, even intermittently, more comfortable.

Stay In Touch