The FOMC voted to raise rates yesterday and the dollar is up, therefore the vote caused the dollar to be up? It’s a classic case of ex hoc ergo propter hoc (after this, because of this), the logical fallacy where correlation is confused for causation. In the case of monetary policy, it isn’t surprising that this is repeated constantly no matter how ill-suited the attempted explanation.

So the strong dollar has been resurrected, as if the attempted use of the term in early 2015 wasn’t enough to dissuade its reappearance. For the record, a strong dollar is an anachronistic concept, one that hasn’t applied since at least1971. When money was money, currency was tied to the willingness of currency-holders to hold currency rather than convert it back into money. The dollar was strong only when there was little detectible convertibility. Post 1933, that meant foreigners holding dollars wishing to turn them instead into US gold.

Thus, the dollar was strong only when the US monetary situation was steady and acceptable, typically tied in with perceptions of the US economy. The idea had nothing to do with the price of the dollar against anything including gold because everything was fixed. The proxy of a “strong” dollar was thus a derived view of a strong economy. Conversely, the weak dollar meant weak fundamentals that caused currency-holders to claim US gold, which is what happened throughout the 1960’s, especially the latter half that became the Great Inflation.

For known reasons, commentary about the dollar still in many ways suggests it isn’t yet 1971. That is clearly the problem of the past few years as there has been a great struggle to make sense of what the dollar is doing and more so what that actually means. In late 2014 and early 2015, the “strong dollar” was issued up as if it was the global market reflecting what Janet Yellen was talking about with regard to “overheating” risks at “full employment.” It didn’t work out so well, of course, so the “strong dollar” of that time obviously didn’t mean what everyone thought it did.

In late 2016, the mainstream still labors under those same illusions, this time tied to actual monetary policy actions rather than just the threat of them.

“This move was telegraphed by the Fed and was fully justified given the improving trajectory for the US economy, tighter labour market conditions and rising wage pressures,” said Nick Stamenkovic at Economic Perspectives.

Better economic conditions plus rising borrowing costs equals “strong dollar?” That seems to be the consensus, but it just isn’t true. We need only look back at the last time there were “rate hikes” to see that there is “something” else to all this. Starting in June 2004, Alan Greenspan’s Fed embarked upon a steady series of rate hikes that brought the federal funds target, as well as the money rates that once obeyed it, up from 1% all the way to 5.25% by the June 2006 meeting.

Greenspan’s FOMC did so because, like today, the US economy was being described in exactly the same way that justified such “tightening” measures. After sluggish recovery from the dot-com recession, finally that weakness had been shaken off and better days were surely ahead. With so much appearing to be exactly the same then and now, it must’ve been the same strong dollar, right?

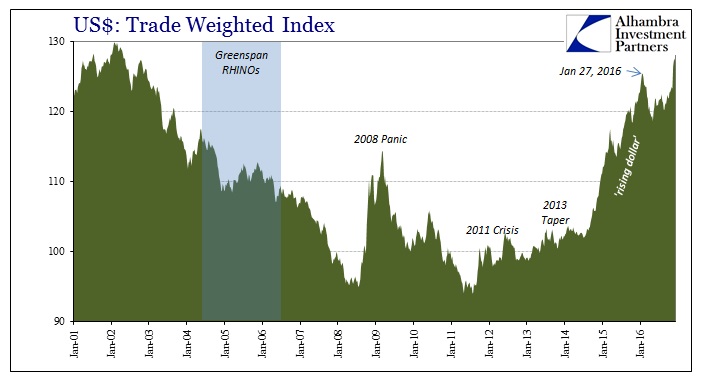

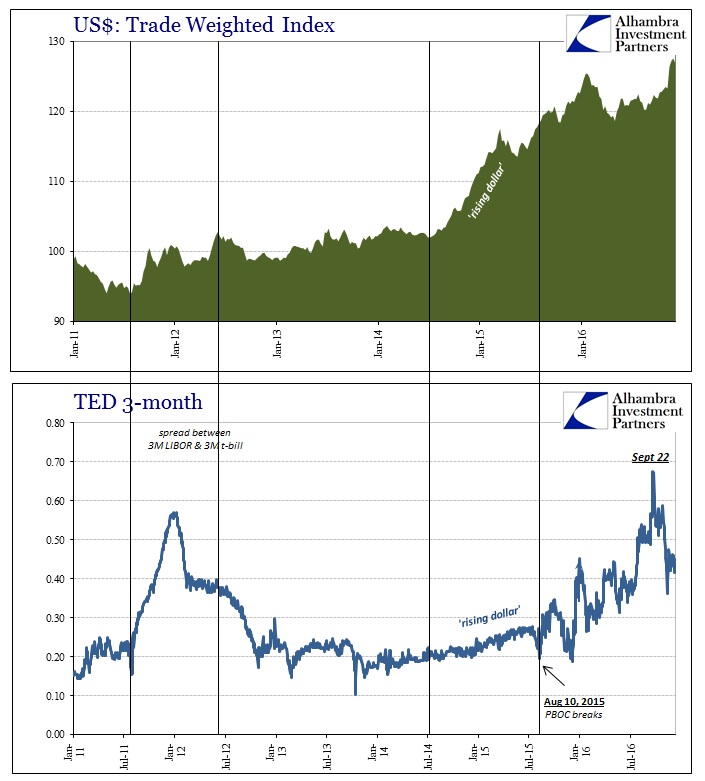

Not remotely. I am not a fan of dollar indices, but for our purposes here the Trade Weighted Dollar Index will suffice. Like everything else with monetary policy during that time, conditions were upside down. The most that can be said of any monetary policy effects on the dollar was that the index rose pretty sharply in anticipation of the June 2004 rate hike series. But then the dollar just continued to “fall” anyway.

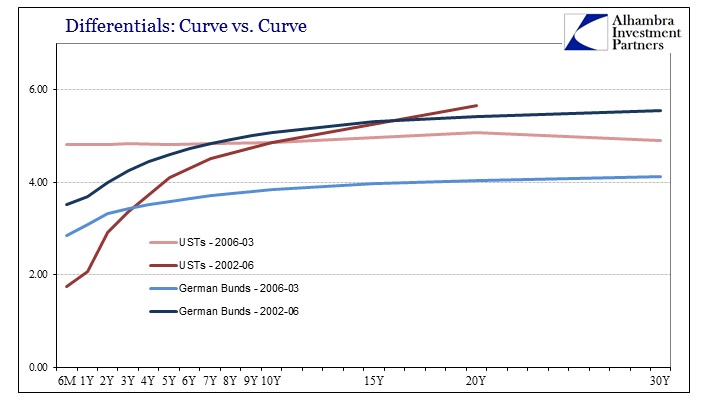

When you look at the history of the dollar index the past fifteen almost sixteen years (I have omitted the late 1990’s since the conditions then were of a somewhat different paradigm), monetary policy stands out exactly nowhere. We can’t even detect interest rates as they relate to possible differentials. For example, the UST curve in March 2002 at just about the top for the dollar index in the early millennium was significantly underneath the German bund curve of the same time (using Germany as a similar risk-free proxy for interest rates in Europe and the euro, a significant portion of that dollar index).

By the time Greenspan was done in June 2006, the UST curve and the bund curve had actually switched places; bunds well under treasuries. That should have meant “strong dollar” by traditional interpretations, but again the opposite occurred.

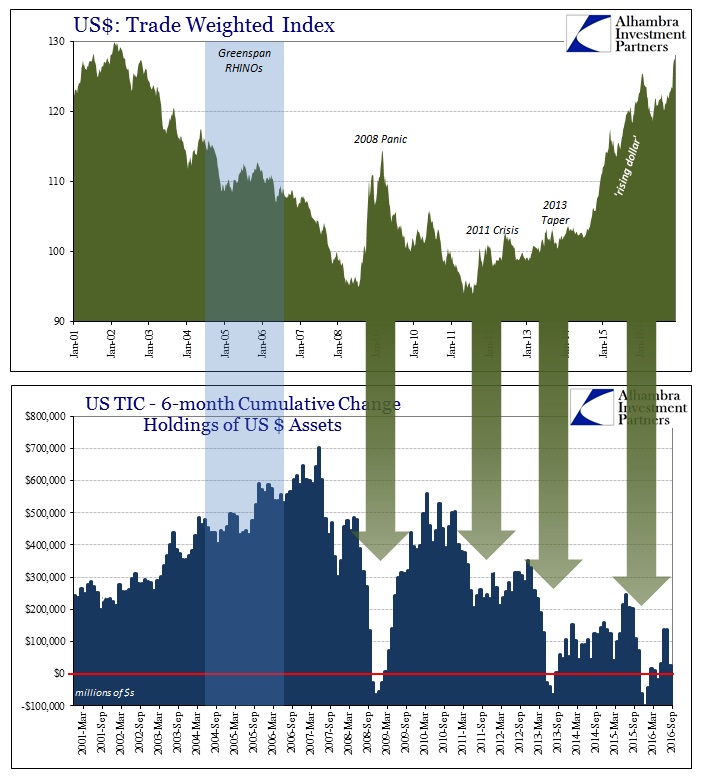

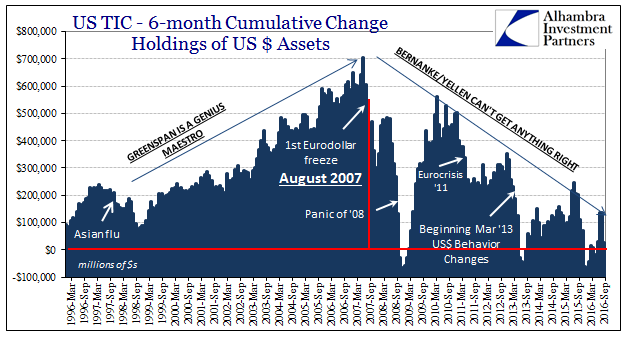

If instead you look at the chart for the dollar index during the timeframe of the 21st century as a funding proxy, like derived money supply, it begins to look very familiar. Even the dollar index I have used here is an almost perfect inverse replica of another data series I often use to depict “dollars” rather than the dollar.

Rather than monetary policy or interest rates, or even US relative economic conditions, what seems to be driving the dollar index is the same thing uncovered in eurodollar format. This view is confirmed by all the ways in which it has led to trouble on this side of August 2007, starting with the summer of 2008. The dollar index spiked enormously that July in final, belated recognition not of the strong dollar as a strong US monetary system representing a strong US economy, rather it was because of the exact opposite of all those things.

In “dollar” terms, that just meant acute global shortage; i.e., panic. The price of the “dollar” rises relative to pretty much everything when “dollars” became harder and harder to source, very much like any classic short squeeze. About the only place monetary policy disturbs the pattern was in mistaken perceptions of it in that window between August 2007 and July 2008; because the Fed was still thought to be a powerful instrument of money printing, it was widely believed (oil prices show this particularly well) that the Fed due to its increasingly unconventional response would eventually be so successful as to overshoot – the first “reflation” rationalization.

Instead, as the dollar index spike upward everything fell apart, including not just the US economy but the US economy first and then the rest of the world. That has, more or less, become the standing template for the index on this side of 2007.

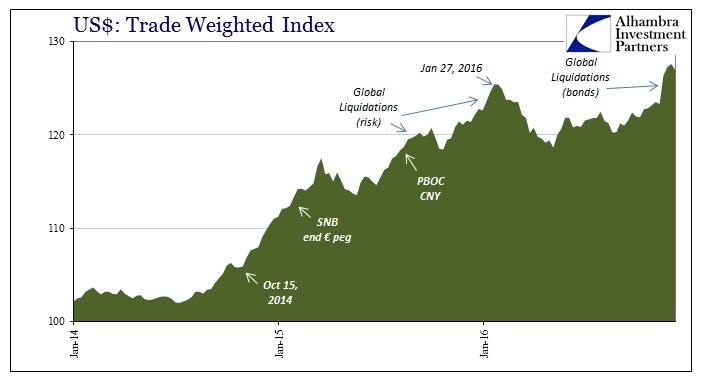

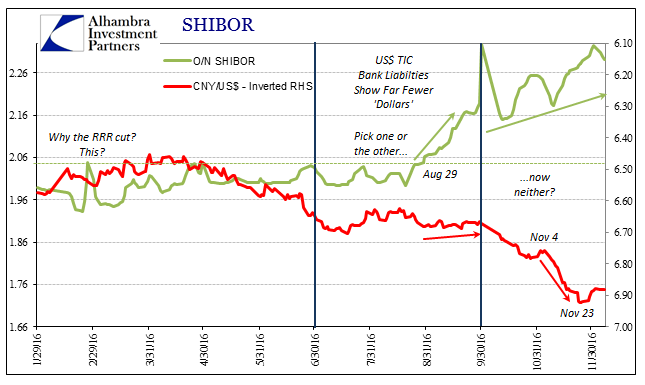

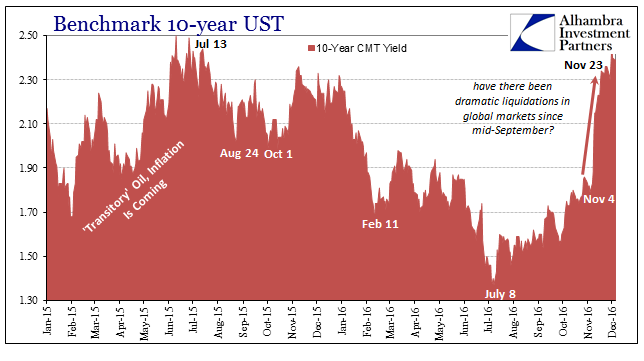

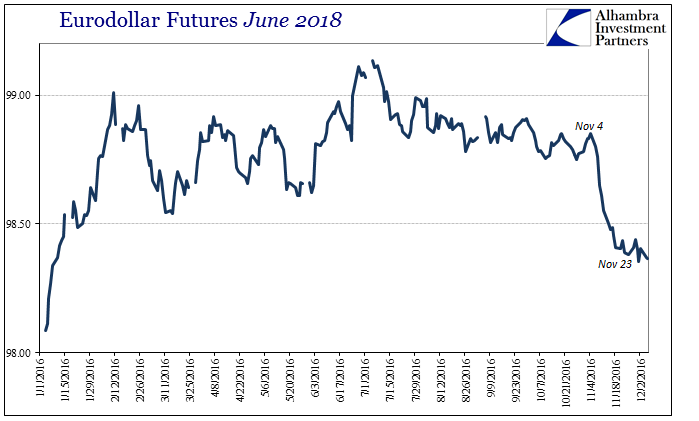

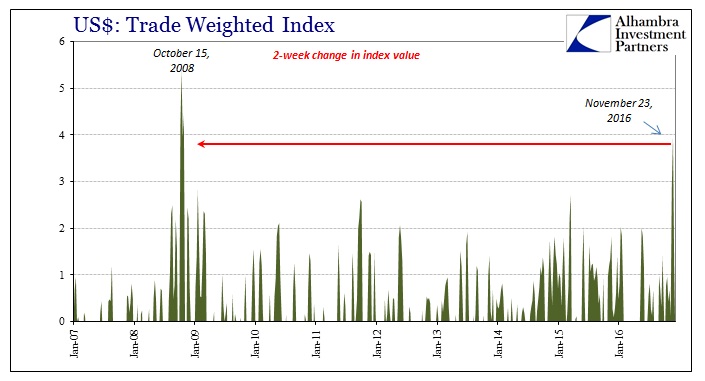

Before the most recent spike, the dollar index had peaked the week of January 27 this year. I am not sure how much clearer an indication this could be given that January and early February (up to the 11th) was full-blown global risk liquidations, from Asia to Europe and into the US. In November, the bond market blew up such that the mainstream attributed the rise of the dollar index to sharply higher interest rates that accompanied that global selloff, when in fact that was backward. The bond market liquidations from November 4 to November 23 were because of “dollars” and the shortage all over again, leading this time to rising interest rates.

Sure enough, the dollar index was 123.54 the week of November 4, but was 127.29 the week of November 23. Those last two weeks were the fastest, largest two-week rise in the dollar index since October 2008. That’s a much different spin on what happened in November, and puts the economy and financial system of December in a far different category than would be suggested by an actual strong dollar.

There is any number of ways to corroborate this funding view, including the TED spread which continues to be dismissed. What is notable about TED is not its absolute value at any given moment, but instead the direction it is going and the clear volatility it has undergone to move that way. It is reminiscent, again, of the dollar index.

Circling back to monetary policy and “rate hikes”, there is obviously “something” very different to them now as compared to them a decade ago. No matter how high Alan Greenspan pushed the federal funds rate, and that was at a time when there was actual volume in that market, he got the “weak dollar.” This time, no matter what the Fed does, add QE, take away QE, increase rates, Janet Yellen seems to be in for the “strong dollar.” Maybe monetary policy and interest rates have absolutely nothing to do with it?

Stay In Touch