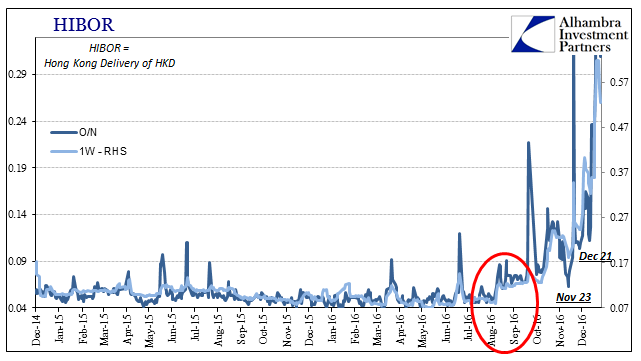

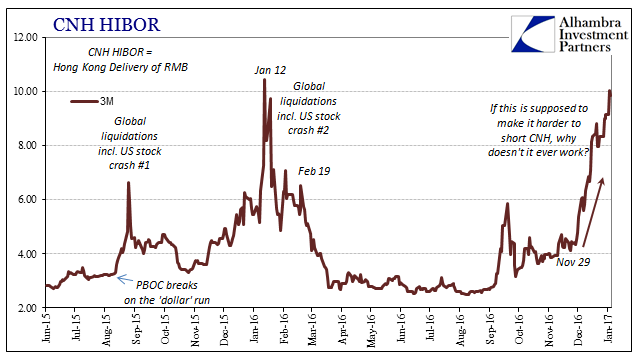

For all the fuss about speculators in Hong Kong, China’s central bank doesn’t seem very capable of handling them. Last week the offshore RMB money rate was driven once more to ridiculous proportions, with conventional “wisdom” attributing it to intentional PBOC policy. That seemed to be the case on Thursday, where the overnight HIBOR rate (CNH) was 38.335%, but not Friday when the same rate registered 61.333%. At 38.335%, the currency exchange rose sharply as would be expected with “speculators” under attack. CNY, however, fell very sharply on Friday though liquidity was even more atrocious (meaning “speculators” supposedly unable to borrow short RMB, though short RMB was what happened).

The exchange rate dropped considerably again today, making the past two trading sessions the worst for China’s currency since August 2015. One might argue that overall the CNY exchange has at least stayed above 7, debated flash crash aside, but if the PBOC’s resolve is for sideways doing it in such volatile fashion is unhelpful and in the long run even more destabilizing. A currency within the throes of so many wild gyrations is indicative of all the wrong attributes.

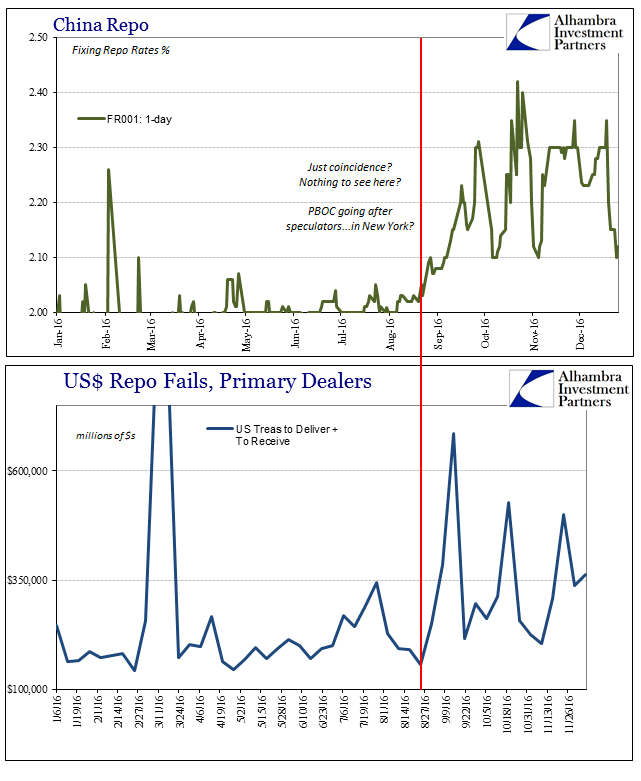

That is because the links between “dollars” and internal RMB, whether onshore or offshore, are poorly understood and more often totally ignored or uncomprehended. If you start with the premise that the Fed’s balance sheet expansion is the relevant setting for dollars, then the PBOC’s actions are just that confusing and mysterious; maybe even nefarious and “unfair.” If, however, you are properly observant of “dollars” unrelated to QE’s in the US or anywhere else, then China’s palpable desperation and clear lack of control actually makes perfect sense. The currency as well as RMB liquidity seems to be related to factors outside of China, which is actually the case.

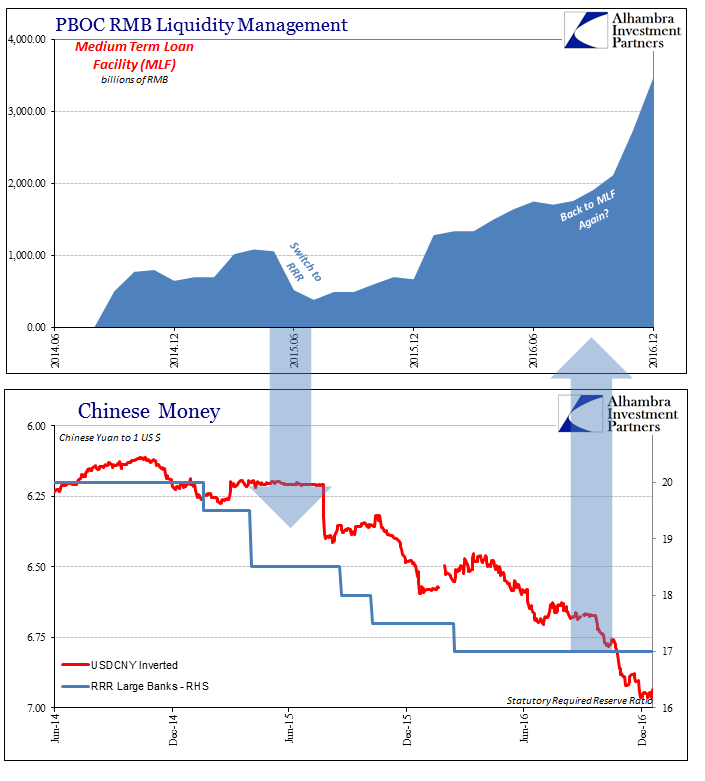

Despite ridiculous offshore rates, money rates in China were far calmer at the end of last month than in the middle. In mid-December, in what was, unsurprisingly, attributed to the FOMC vote, everything from repo to SHIBOR was in a state of liquidity shock. The PBOC responded as it has over the past few months, injecting enormous quantities of funds largely through its “alternate” tools such as the MLF. In December alone, the PBOC added RMB 721.5 billion in additional liquidity, following RMB 624 billion in November.

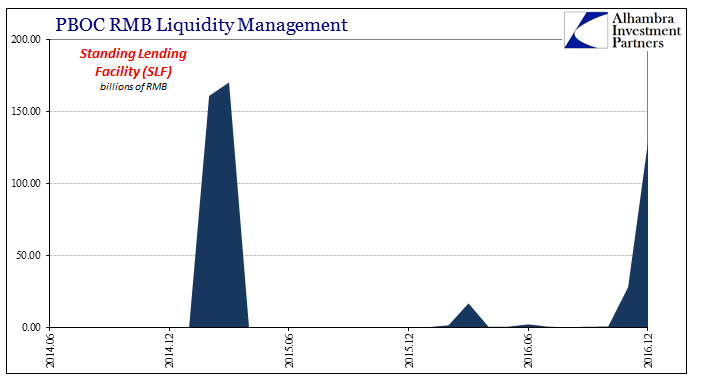

In addition, the PBOC’s Standing Loan Facility (SLF) saw the third highest monthly usage in its short existence; only February and March 2015 were reported in greater volume. The SLF is similar to what people still conceive of the Federal Reserve’s Discount Window, a sort of last resort for institutions that still hold eligible collateral.

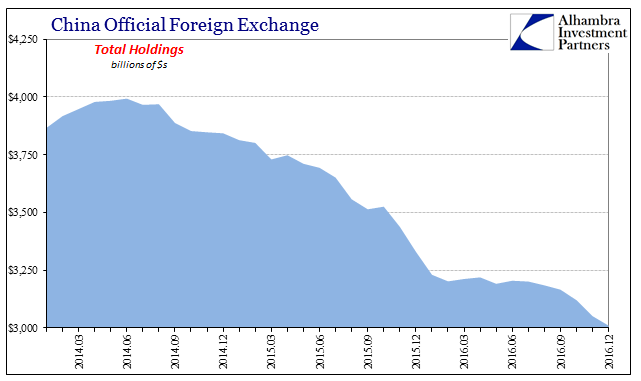

If there is so much liquidity on the side of “needs”, therefore requiring an elevated internal response, there has to be some reason of serious, even alarming deficiency. Given that the asset side of the PBOC’s balance sheet is populated by two-thirds in forex of various qualities, and therefore total money in China related to the PBOC’s balancing act between external “flows” and these various liquidity programs offsetting (or not) them, any desperation is easily traced to that large space.

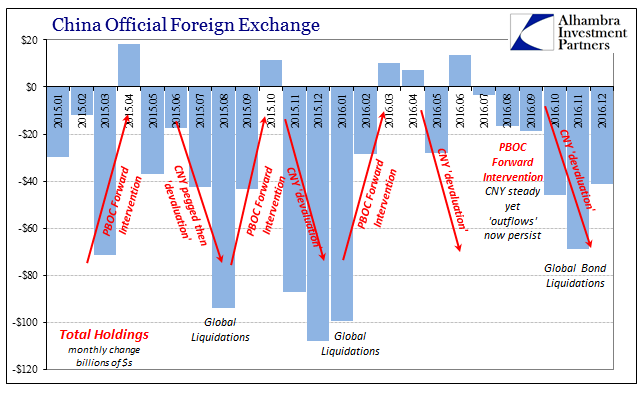

China’s SAFE has reported official “outflows” for every month in the second half of last year, escalating in size to crescendo again in November coincident to the global bond market rout. Such steady drain in reported forex is both emblematic of what we find in Chinese money markets as well as being very likely just the more visible aspects of what is driving them to illiquidity and volatility.

By SAFE figures alone, it had appeared as if China had turned a corner, with official forex stabilizing February thru July 2016. “Something”, however, changed around August and Chinese monetary officials have been holding on for dear life ever since.

With Hong Kong swept up in the trend, too, meaning HKD and a totally separate money regime run by the Hong Kong Monetary Authority, not the PBOC, this “something” is not limited to China or even Asia.

If the Chinese are manipulating their currency, it is only because nobody understands the global currency as it actually is (thus, even in which direction the currency might even be “manipulated”). Far be it for me to sound as if a defense of the Communists, my criticism is far more directed at recognizing the actual problem before either (any) side goes off and makes it even worse. This is the historical danger of prolonged periods of monetary instability that always breeds economic malaise and depression; a search for answers that rarely includes any.

Stay In Touch