It may seem strange that one of the primary forces behind the Bretton Woods arrangement was John Maynard Keynes. That is because what goes on in his name today is often nothing like what he proposed. This is not an endorsement of those ideas, only recognition and deep appreciation that during the worst consequences of the worst kinds of economic disruption there was largely one condition agreed upon – stable money. Many decades later, Keynes’ name is invoked largely to do exactly the opposite, which is why it may appear so odd that he created, along with Harry Dexter White, the last attempted stable monetary system operating on Earth.

It wasn’t wholly Keynes that made Bretton Woods, nor was the gold-exchange standard optimal, or even close to it. Perhaps it was the best that could have been realistically achieved given the circumstances. For Keynes, he preferred a single global currency, one tied to commodity prices rather than American discretion. He even gave it a name, Bancor, though it just never caught on largely because there was and probably could never be an agreement about just how to manage it (most of the debate at Bretton Woods was about exactly who would do what). Stable money requires no management, but that prospect terrified enough representatives at the conference so that Harry Dexter White’s compromise (the dollar, tied to gold, loosely administered in international terms by supranational organizations like the IMF) carried the votes.

At the bottom of the crisis in March 2009, People’s Bank of China Governor Zhou Xiaochuan created a stir by publishing an open essay calling for monetary reform worldwide. His views were summarily dismissed as political posturing, an opportunity, supposedly, to take shots at the US and the dollar while it was at its weakest point. Politics will always intrude, but if there was ever a time to consider a new international monetary order that was it.

Governor Zhou even went so far as to reference Bancor, writing that Keynes may have been right after all. “The collapse of the Bretton Woods system, which was based on the White approach, indicates that the Keynesian approach may have been more farsighted.” It is simply inconsistent where a sovereign currency acting as reserve can be consistent with the theory; the inherent conflicts are simply too great to maintain a stable system.

The global monetary system, however, “solved” that problem while nobody noticed. The floating dollar did not replace the gold exchange standard of at the official end Bretton Woods in 1971, the eurodollar did as it had taken for itself a headstart more than a decade prior. Though it is denominated in dollars, the eurodollar is a completely separate affair, often having very little to do with domestic settings apart from what was, until August 9, 2007, a close relationship of LIBOR to federal funds (an arbitrage that over the years became far less of a primary parameter). Zhou, in his March 2009 missive, even referenced this major difference, correctly for once (for a monetary officials) identifying that the world’s reserve currency was no currency at all, for how could it be being “credit-based.”

There is all the difference in these two words put together with a hyphen. Nowhere is that in 2017 more appreciated than in China. As far as the Chinese complaints about it during the crisis, there was a bit of disingenuousness to them. After all, China was the primary global beneficiary of the eurodollar standard, and so was at great risk of becoming the primary victim of its possible end.

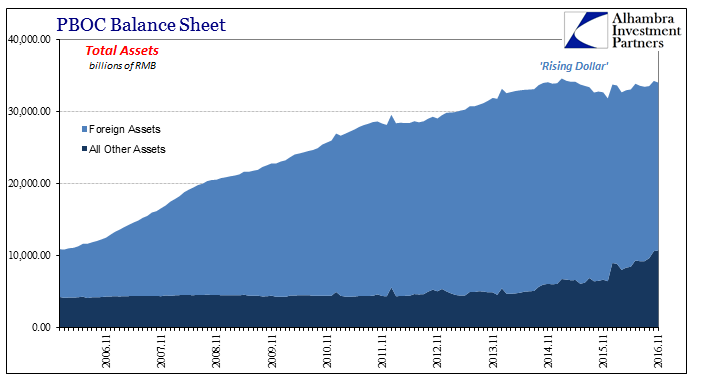

The eurodollar is written all over Chinese money, though even today nobody seems able to recognize it. No great effort is required to demonstrate this fact, as the PBOC’s balance sheet need only be separated, on the asset side, into forex on the one hand and everything else on the other.

Monetary expansion in China had been conducted by forex expansion exclusively (therefore primarily “dollars”). Conversely, as you would expect, “dollar” deflation, so to speak, has become a far more serious prospect starting in 2014 than it ever was in 2008 (or 2011). For China, restructuring was on the agenda in 2009 when it appeared everyone else was weak and China the sole strong hand left; after the Asian “dollar” under the “rising dollar” took the lead to the downside, hitting the Chinese more than almost anywhere else, nary a peep on global monetary reform.

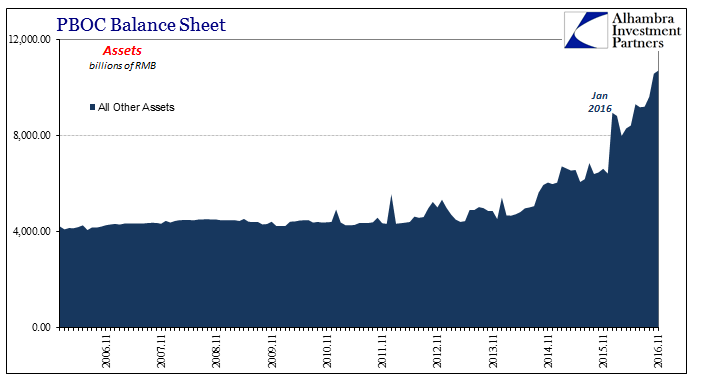

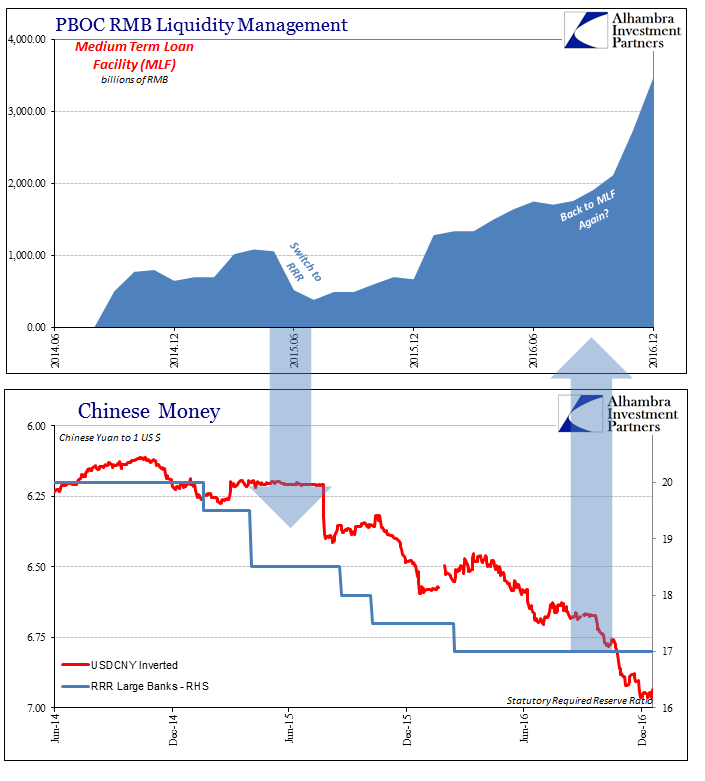

We know without fail just how serious an issue this has become based on the chart above. It is perfectly clear that the one part of the Chinese balance sheet to which Chinese authorities have actual discretion has only been in continuous use since 2014. In all the years the currency regime has been semi-floating, before that time the PBOC actually did very little in terms of implementing RMB policy alone.

That is because the PBOC operates very mechanically, using other tools (such as the RRR) in order to hit its marks in factors like monetary targets. The PBOC balance sheet is, apart from forex, meaning “dollars”, a true last resort. As you can see immediately above, focusing on just the non-forex portion of the balance sheet, up until 2011 this part was almost perfectly stable, and up until mid-2014 it was mostly centered (maybe even targeted) at around RMB 4.3 or 4.4 trillion.

Starting in 2012, however, when conditions in Chinese money markets first began to show up in global risk assessments, the PBOC began to act in these discretionary segments. By March 2014, a very important month in this historical recounting as the first few months of CNY “devaluation” instability, discretionary assets were RMB 4.64 trillion, down slightly from February 2014 and down further from higher balances at the end of 2013. From that point forward, as CNY exchange fell only further, though not in a straight line, the Chinese have been undertaking what looks very much like QE, or balance sheet expansion. As of November 2016, the total of all non-forex assets was nearly RMB 10.7 trillion, up RMB 4.3 trillion in just those eleven months of 2016.

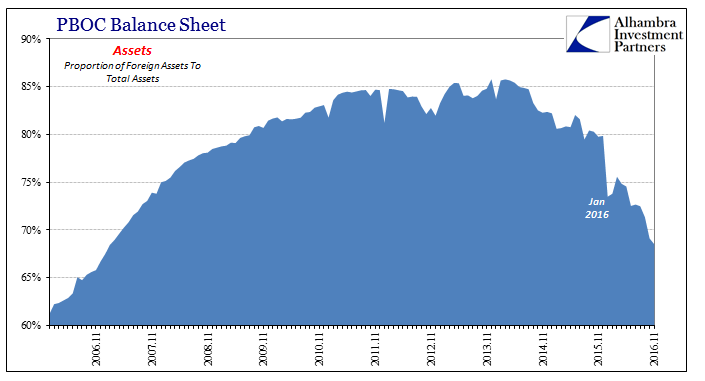

But while it may look like QE or balance sheet expansion in isolation, unfortunately the PBOC cannot ignore the vast majority of the rest of its balance sheet. This “money printing” action is not accretive but rather trying desperately to catch up to the larger contraction and at best partially offset it. In other words, the PBOC has undertaken massive discretionary liquidity measures just to attempt a neutral monetary policy. The “dollar”, despite all this, remains far more than Zhou’s central bank has been able to handle.

As a result, the PBOC’s balance sheet is being stripped of its “dollar” character and base. While given the current contractionary conditions that may sound like a good thing, it isn’t so simple. The shifting composition will only lead to further instability, especially for a mechanically-inclined central bank whose rules and primary correlations no longer apply. I believe that is why especially in 2016 the PBOC has become ever more erratic and less predictable itself. They don’t know what to do anymore and are just experimenting however they can when they can – even denying what was recorded everywhere as a flash crash, a sure sign of great instability.

All of which lead us back to the unanswered and perhaps unanswerable eurodollar. The Chinese are, of course, not alone in their impotence; it is condition widely shared across all the major central banks as a fact of those two hyphenated words – “credit-based.” Though the Chinese may have altered their willingness to submit to international reform, and maybe it was just geopolitics in 2009, none of it means that it wasn’t the right thing to do and that wasting the opportunity then was a huge, incalculably costly mistake.

Stay In Touch