It has been out of hand for some time, but the longer it goes the further from sense it can get. Today’s news is apparently about a bipartisan effort for $1 trillion in “stimulus”, as if the last $1 trillion in “stimulus” had never happened. Apparently eight years is enough for memories to have been expunged, or as if IRS rules about keeping documents only seven years applies here. “Reflation” has always contained in the majority the form of dreams, ideas, and fanciful imagination, each always with an expiration date because at some point reality has to be factored if it hasn’t already rudely interrupted.

As I have written before, however, “reflation” has been this time around more squarely a media creation. The rhetoric is simply unmatched by markets, especially those that are more grounded in what counts (economically speaking). First, the media:

I’ve been told by numerous Wall Street traders recently that hundreds of billions of dollars are now on the move. And that’s just the stock market. If you include bond trading, you can take that figure up to a trillion dollars.

Donald Trump has become the single biggest market influencer of our time.

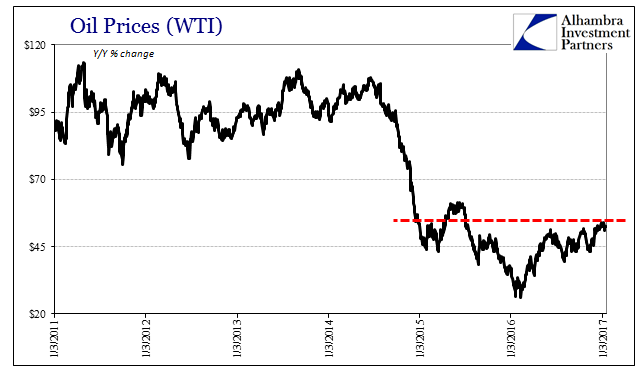

That was from ABCNews, not the US media company but the Australian one. If Trump is what the article claims, it is a very poor reflection upon those “market influencers” of the past. Oil prices as represented by WTI, for example, reached $54 at the end of last year. That was the highest price in a year and a half, and surely had moved up that far in as much “reflation” Trumpism as lingering expectations about OPEC credibility. That price was almost 50% more than the WTI spot from the year before, and up 106% from the ultimate low of February 11, 2016. Yet, despite those comparisons that sound impressive, they really aren’t. In context, you find that markets aren’t really all that much moved, in most cases only partially retracing the massive declines of the years before.

Time and again, this latest burst of optimism takes as its base not a realistic answer to those massive declines but rather as if they had never happened or aren’t important. In terms of oil prices, that makes perhaps the least sense given that oil, unlike shares, are grounded by a reality that can’t be so far bent by imagination. There are overflowing containers and holding tanks all across the world absorbed of an enormous quantity of crude sitting idle that nobody seems too much in a hurry to use. It’s not just oil, however, as this less than half-hearted embrace of “reflation” is endemic (and consistent):

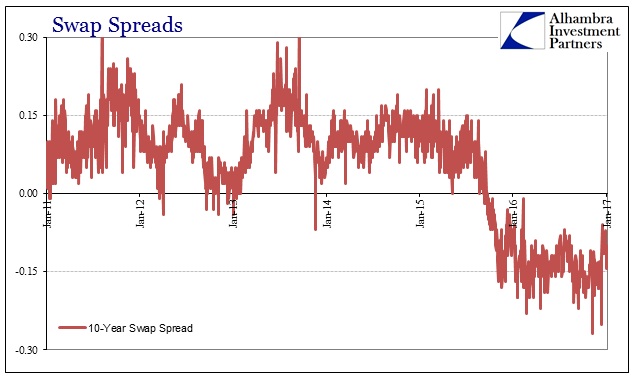

None of these markets have come close to trading back to where they were in the middle of 2014 when all this “rising dollar” disruption began. That would suggest, quite strongly, that despite the media attention to it there isn’t a whole lot other than attention driving “reflation.” More importantly, unlike the last one in 2013, this time there are consequences to factor as to those declines. For example, when the Fed tapered QE in late 2013 to begin that iteration it did so with near-uniform acceptance that it knew what it was talking about. The market (meaning “dollar”) behavior from that point forward, however, showed that it really didn’t.

That is a huge difference very much reflected in these “reflation” market prices in a way that is conspicuously absent from the commentary about them. In words, it’s as if we have gone back to relive 2013, this time with the right ending. In markets, there is no ignoring that absurdity. And it applies to more than just Janet Yellen’s incompetence, it actually speaks to the primary reasons Trump was elected in the first place. Talk is cheap.

Stay In Touch