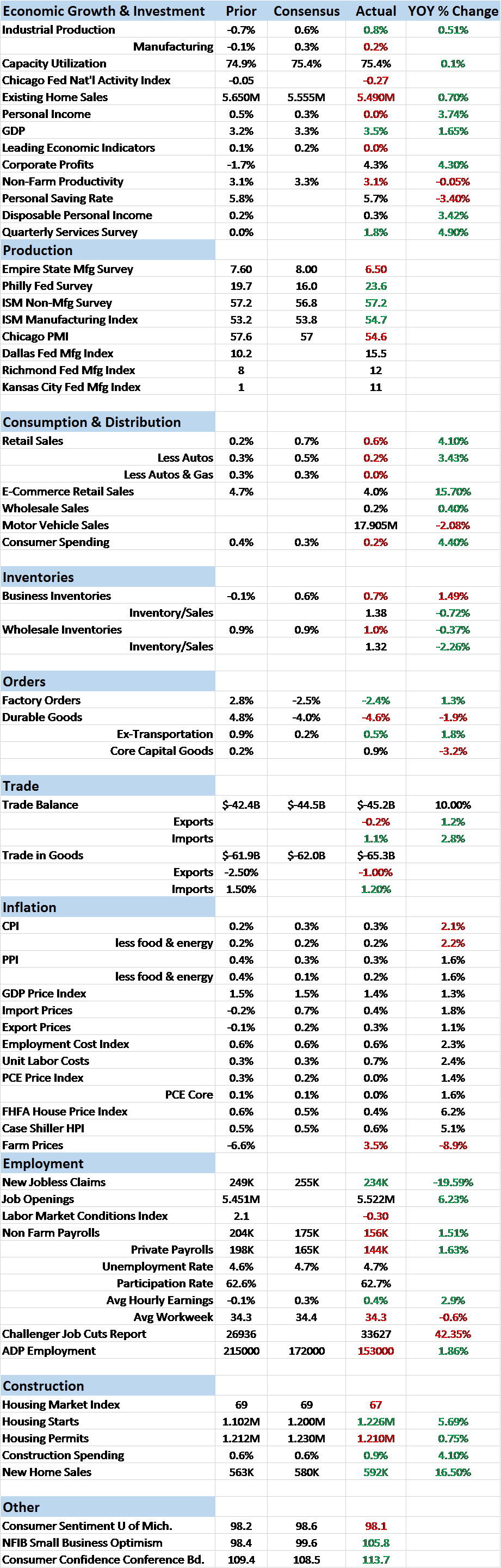

Economic Reports Scorecard

Well it’s time to get back in the habit of doing this every two weeks. The schedule was interrupted over the holidays and then again by my annual outlook piece.

The economic data released over the last two weeks was not particularly inspiring, not that hard data is what has been egging on the old animal spirits. That’s a decidedly political phenomenon not to be found yet in the economic statistics. Whether the political rhetoric will ever translate to actual improved economic growth is something I can’t answer just yet because I have no idea what policy changes will make the cut. Whatever we see out of the data today – with the exception obviously of sentiment measures in all its varieties – is not anything that can be credited or blamed on the new administration.

But back to the data. We’ve been getting what I’ve called mixed data for several years now. Good reports contradicted by bad ones, sometimes within the same press release. That is a product of the long period we’ve had of sub-par growth, running a bit less than 2% currently. The last two weeks continues this dismal trend of two steps forward and two steps back. The Labor Market Conditions index returns to negative territory while jobless claims dip into territory not seen since bell bottoms were in vogue. The JOLTS report shows lots of job openings with apparently no one qualified to fill them. But there doesn’t seem to be a surge in wages – a small recent rise notwithstanding – to support the notion that companies are scrambling to fill positions. There’s no urgency there.

Whatever workers are finding in their pay packets, they don’t seem anxious to spend it; retail sales ex-autos and gas were reported as a big old goose egg, 0.0% month to month and a sub-3% yoy rate. That’s confirmed by rising inventories at the wholesale and retail levels and inventory to sales ratios ticking up a tenth. Inventory to sales numbers had been moderating since the summer but now may be starting to move in the wrong direction again. Q4 GDP may get a boost from that but Q1 will see the payback, same as it ever was, same as it ever was (HT: Talking Heads). Maybe the punk sales are because inflation continues to tick higher with both PPI and CPI up 0.3% on the month. CPI is now above the Fed’s 2% inflation target although they don’t use CPI so as far as they’re concerned we aren’t there yet.

At first glance Industrial Production looked like a positive note but a huge rise in utility output – cold weather – accounted for most of the gain of 0.8%. The improved sentiment we see in all the Regional Fed Surveys – Philly Fed and Empire State the most recent – doesn’t seem to be making it to the factory floor. Housing starts were much better than expected at 1.226M, up 11% from November. But then the details show the entire gain was in multi-family while single family starts were actually down. Housing has been going sideways for months and this report didn’t change it a bit. Again, sentiment, in the form of the Housing Market Index, is outpacing reality. One can’t help but wonder how long that particular bubble can last.

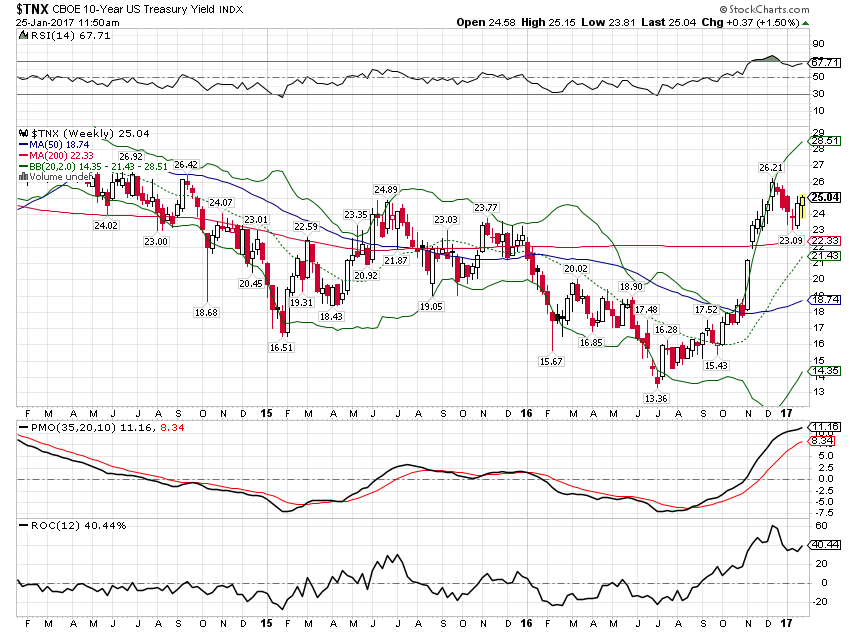

But enough with the confusing and often contradictory economic reports and on to the market based indicators of growth and inflation. First up is a look at the bond markets. The 10 year Treasury rallied from mid-December to around the first of the year. Rates have backed up a bit since then but have not yet made new highs for this move. It appears the market is taking the initial moves of the new administration as positive for nominal growth. The 10 year rate is now around 2.5%.

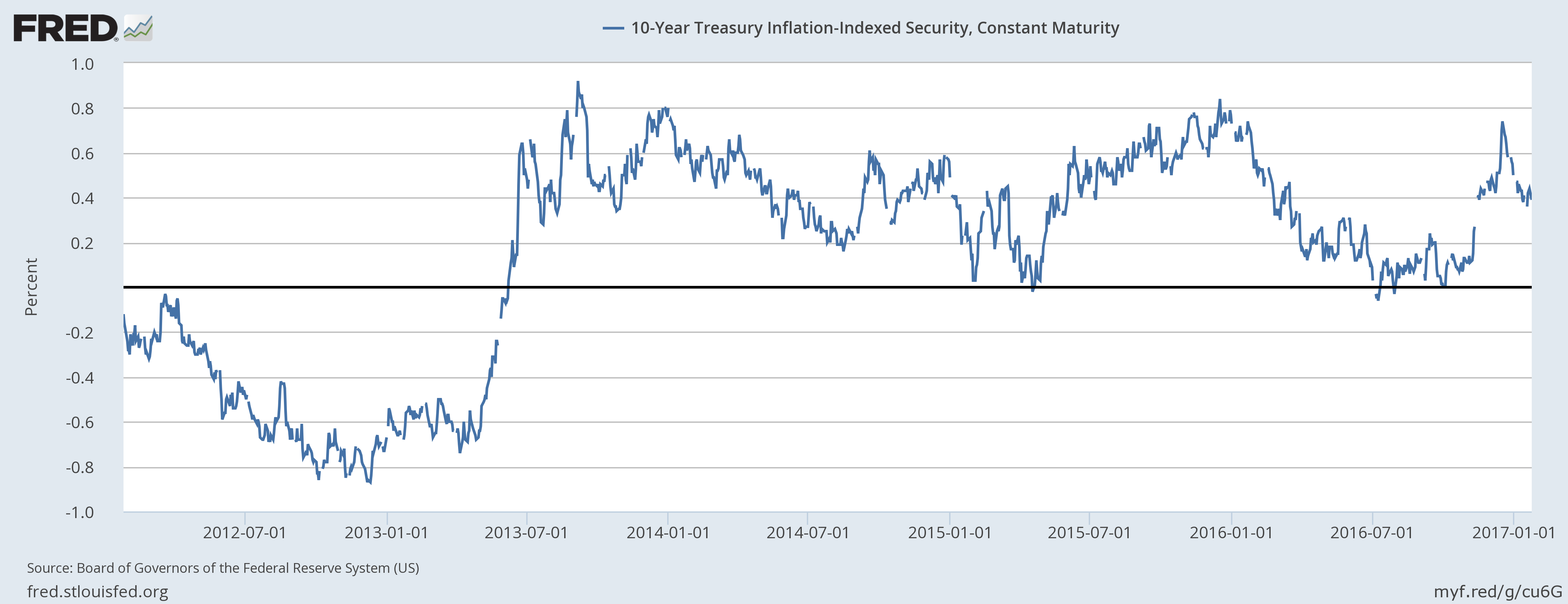

10 year TIPS yields have not, however, followed suit. Real yields peaked the same time as nominal yields in mid-December and rallied together as well. TIPS yields have not moved up in 2017 as nominal yields have.

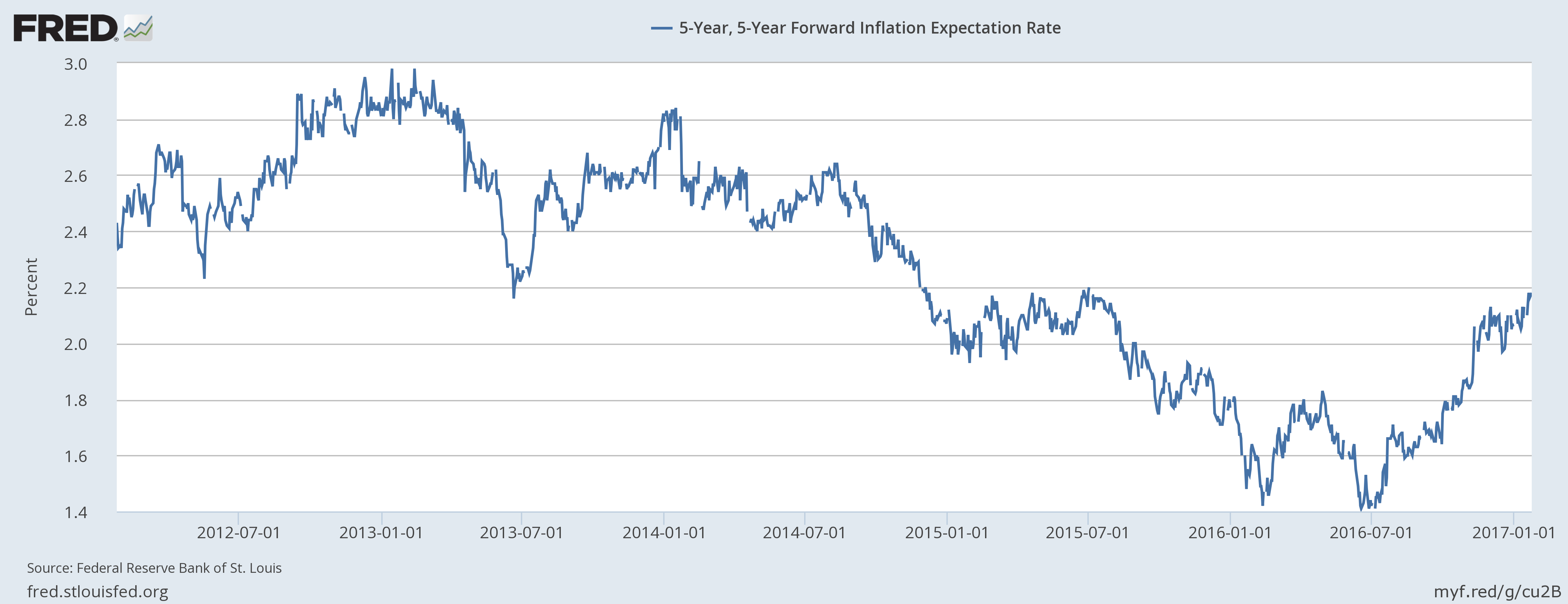

What that means is that the main outcome since the election is a rise in inflation expectations.

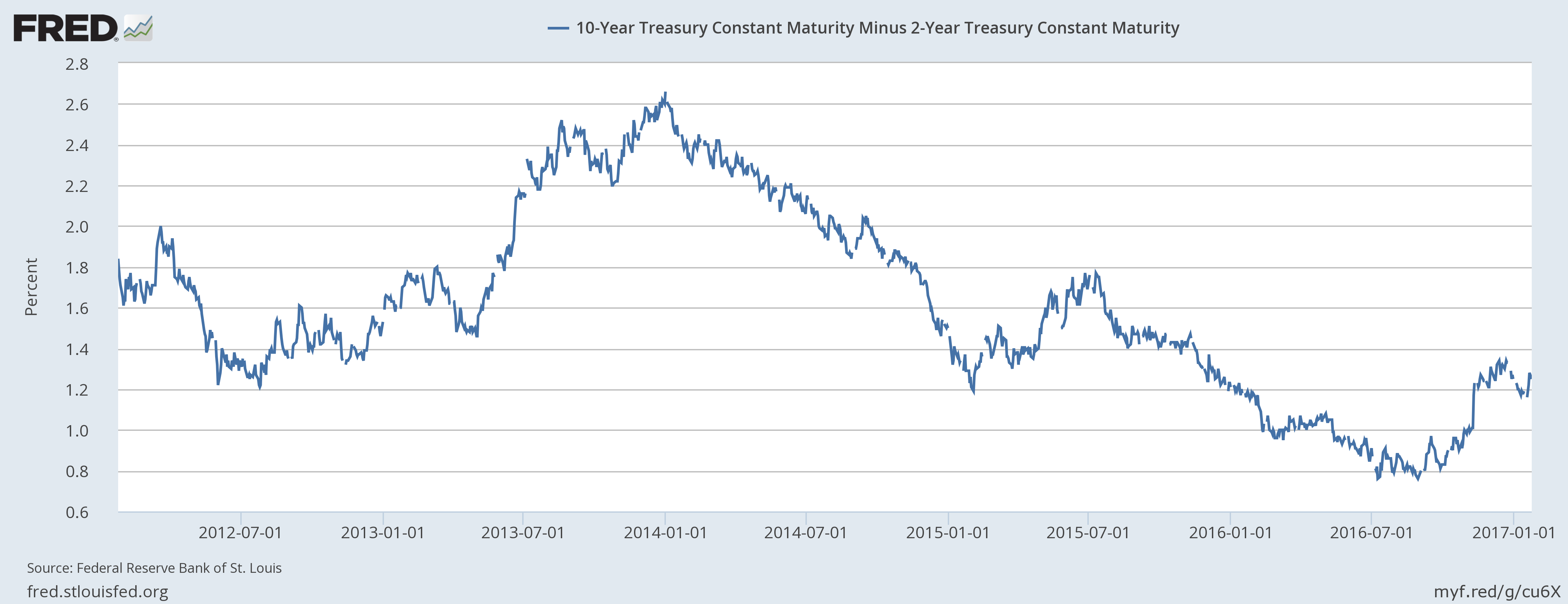

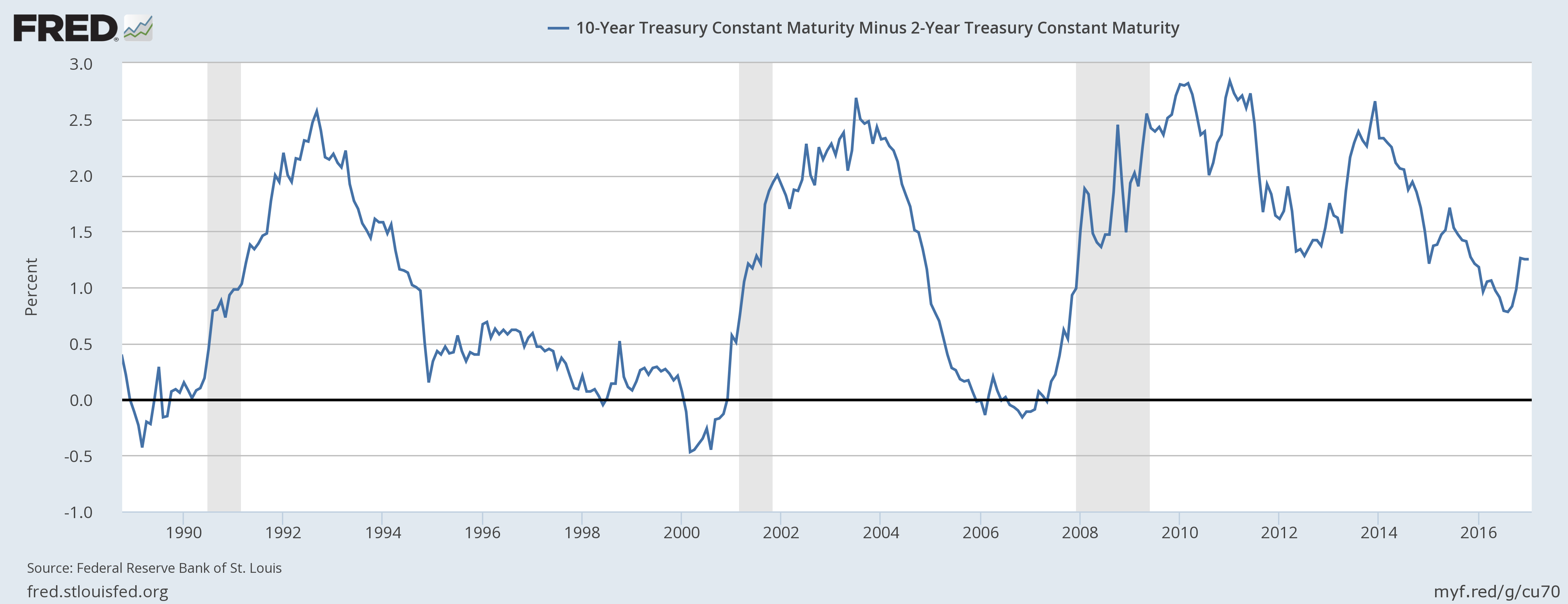

That rise in inflation expectations is reflected in a slightly steeper yield curve:

The yield curve though is still in the middle of its historic range so if we assume the curve will get to flat before recession – not necessarily a good assumption but we have nothing else to go on – then current levels are not worrisome.

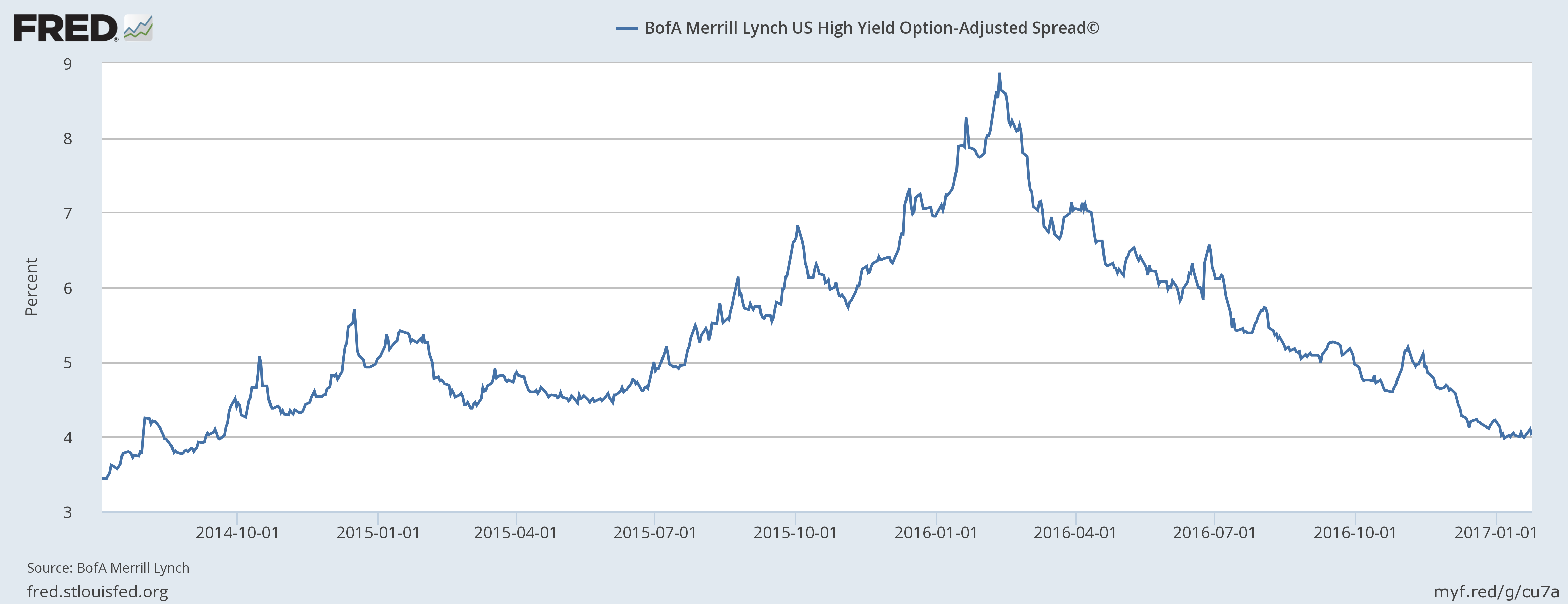

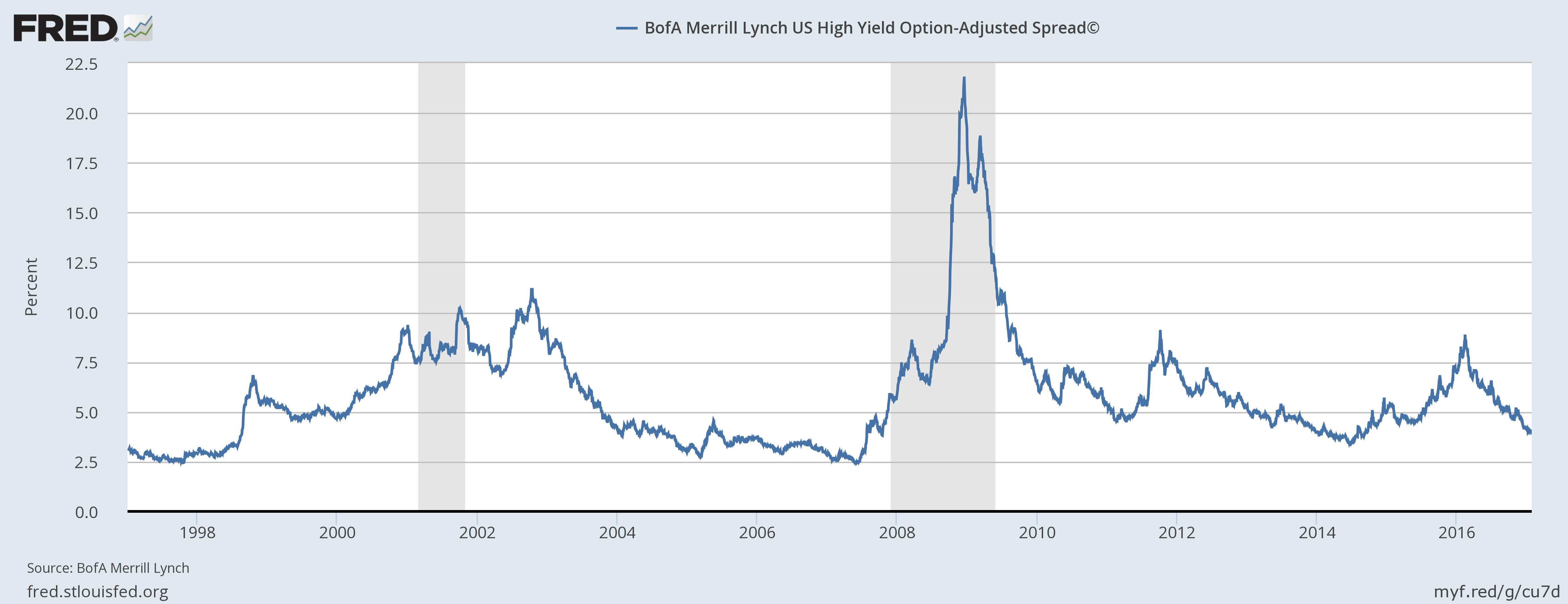

Credit spreads have stopped improving in the new year. They aren’t widening but they have stopped narrowing. Current levels are near the best for this cycle. Not a lot of room for improvement unless they are going to make a run for the lows of last cycle of around 2.5%.

So, contrary to the euphoria of the stock market – don those Dow 20,000 hats! – bonds don’t see Mr. Trump in nearly the same positive light. Inflation and growth expectations have both risen since the election but the vast majority of move in interest rates is about inflation.

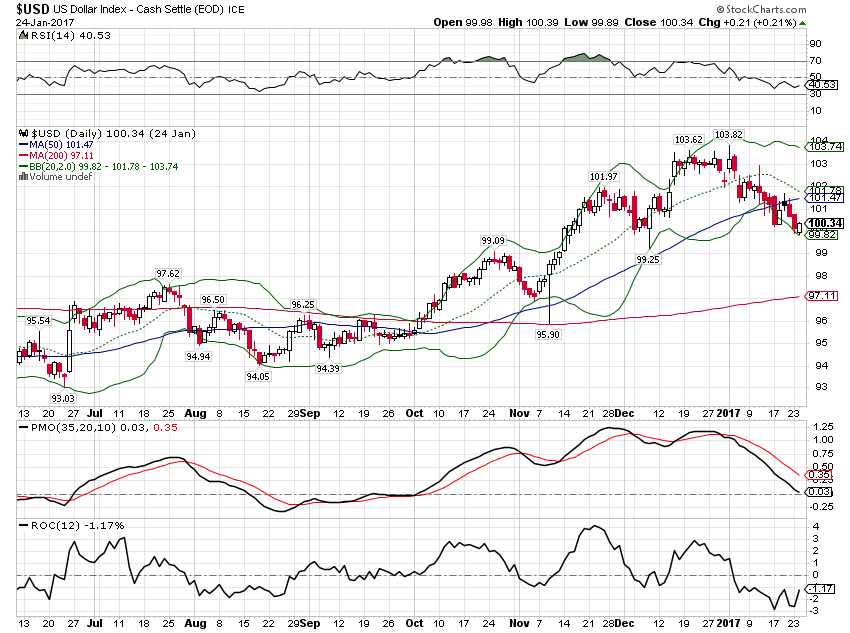

Next, a look at the currency markets. The action in the dollar index supports the inflationary outcome as well, at least if recent trends continue. The dollar rallied 7% in the immediate aftermath of the election but has given back about half that gain since the beginning of the year and briefly traded below 100 this morning.

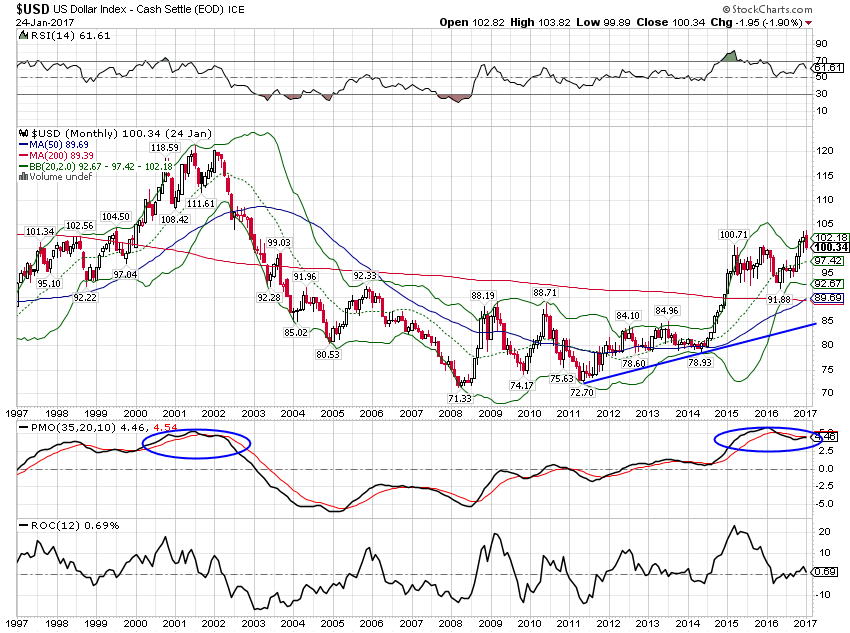

From a longer term perspective the dollar is in an obvious uptrend since 2011. Notice though that momentum is now at almost the same level as the last peak in 2001/2. Also the recent rally to new highs was not confirmed by a higher momentum reading – just as the return to the highs at the beginning of 2002 were not. If this really is a peak I would expect the first leg down to land on that uptrend line.

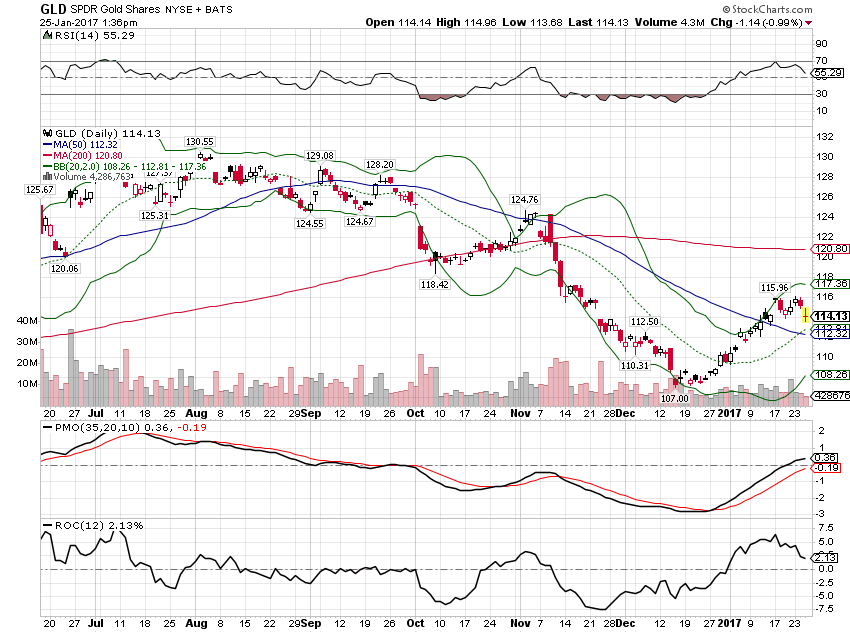

The gold market also shows a reassessment of growth prospects since the beginning of the year although the rally has stalled the last couple of days.

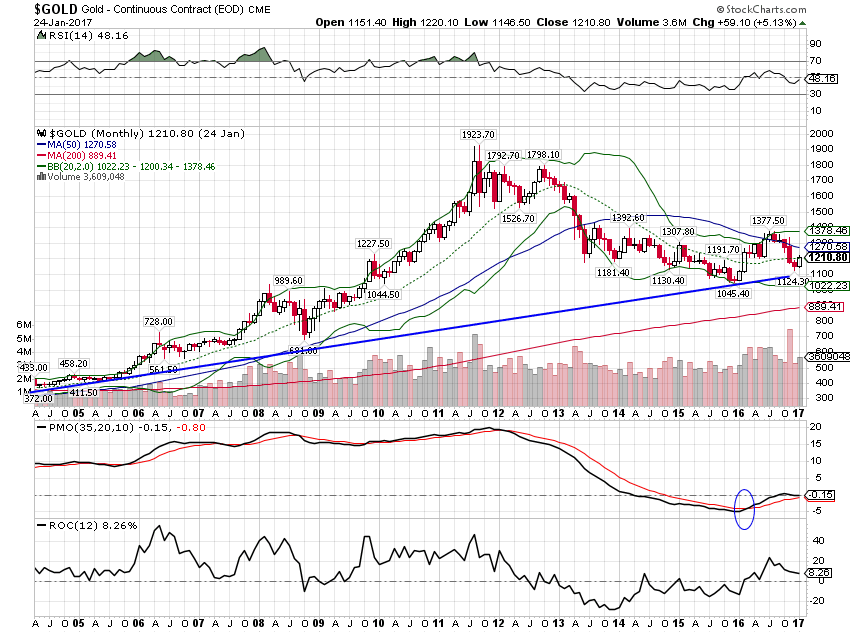

Again taking a longer term perspective, gold has held at the uptrend line and long term momentum remains positive:

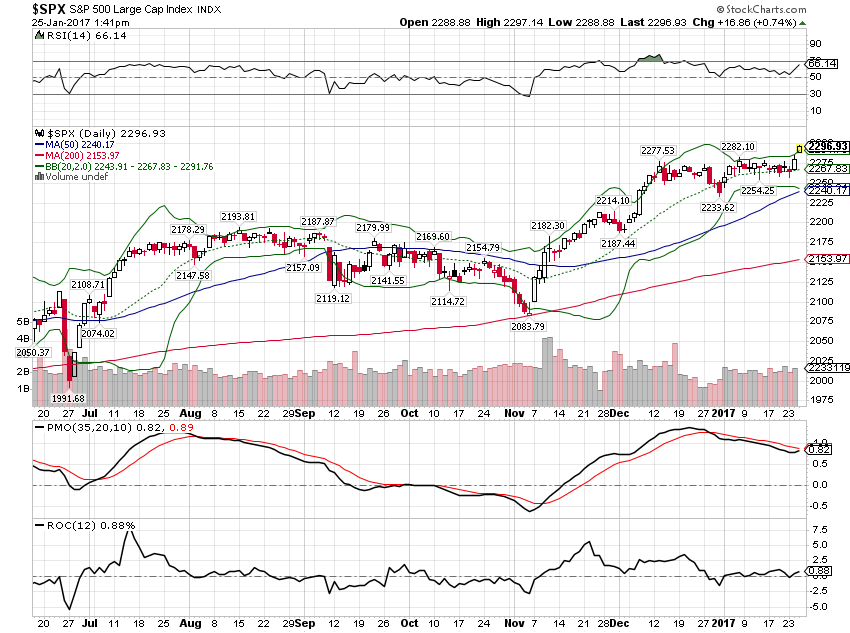

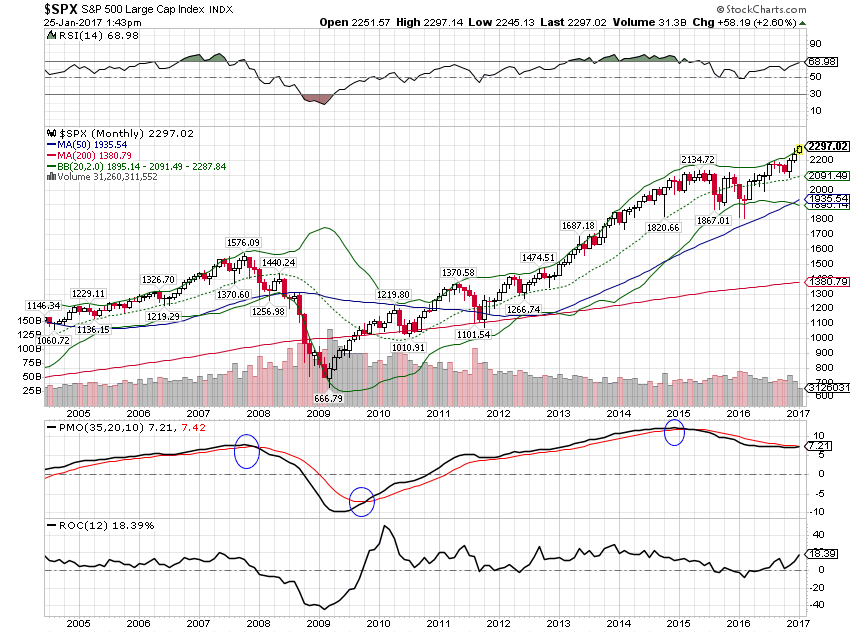

Stocks are offering a more optimistic outlook with the S&P 500 breaking out to a new high today:

Despite the new highs though long term momentum has not given a buy signal:

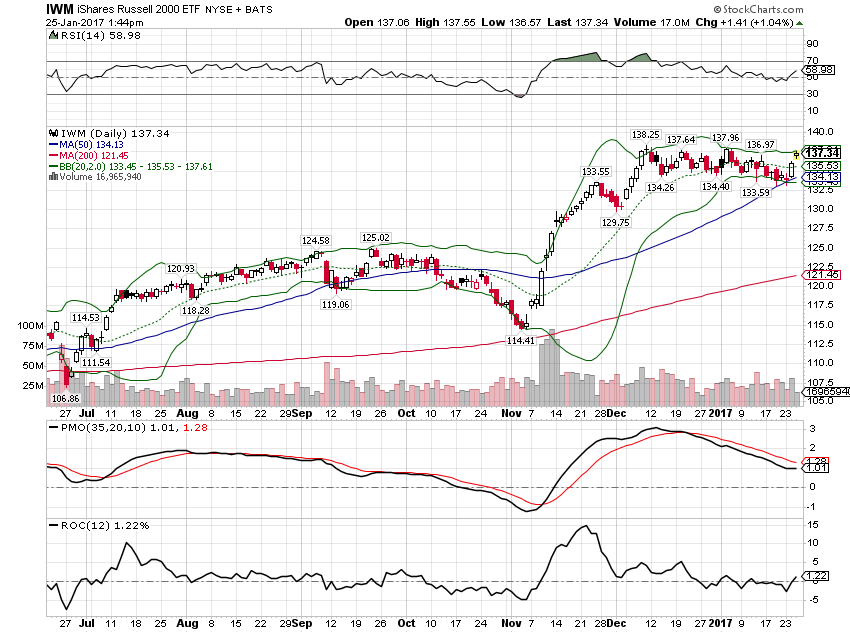

And small caps have not been able to break out yet:

The game now has changed from the immediate post election period. Until last week, the market could assume anything it wanted with regard to future economic policy – the Trump administration was a blank slate. Not so now that the transition of power is complete. Now the hard work begins and we’ll find out what parts of the campaign rhetoric were just that and what parts were real. Does Trump really intend to pursue the protectionist policies that were the main thrust of his inauguration speech? Or will the saner parts of the administration prevail and stop a trade war before it starts? I hope it is the latter but based on what we’ve heard so far, the Peter Navarro faction seems to be winning the internal battle. That may account for some of the market moves since the beginning of the year. There are a lot of unknowns when it comes to trade but I am absolutely certain that tariffs will mean higher prices, i.e. inflation. Growth, if measured by GDP, may be harder to predict but I’m fairly confident that the overall effect will not be positive. Disastrous is another characterization that seems apt. Someone ought to talk to Mr. Trump about what the phrase “at the margin” means.

It is also not encouraging to see both the President and his Treasury Secretary talking down the dollar. Mnuchin tried to soften the blow by talking about the “long term strength” of the dollar being important but that implies that the administration would be okay with a weak dollar in the short term. The market has obliged in an orderly fashion so far but this is a dangerous game. It is largely forgotten now but it was comments from the Treasury Secretary about the dollar that played a large role in the crash of ’87. In other words, careful what you wish for, the market might give it to you good and hard.

There are plenty of other unknowns as well and I expect markets to be volatile until a clearer picture emerges. The debate has already started and I’m just thinking about Republicans. Tax reform, especially the corporate variety, is not going to be quick or easy I don’t think. And neither are the administration’s spending plans which will be scrutinized closely by House Republicans looking to shrink government. All I’ve seen so far are promises to cut some minor items from the discretionary budget; the hard stuff is still to come and my guess is that the easy small stuff won’t be that easy either. Just wait until Hollywood and Democrats start wailing about cutting arts funding. I doubt the administration will want to waste political capital on items that really don’t move the needle on the budget.

So far the changes in the markets are pointing to a small rise in growth expectations and a larger rise in inflation expectations. With so much uncertainty regarding future economic policy it is impossible to say whether either impulse will turn out to be correct. The most important part of the debate will be on trade, the dollar and tariffs. Also important – and more than most appreciate I think – will be the debate on government spending, deficits and debt. The good things I’ve heard from the administration so far – tax cuts, deregulation – are not sufficient to overcome the bad. Stay tuned….

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch