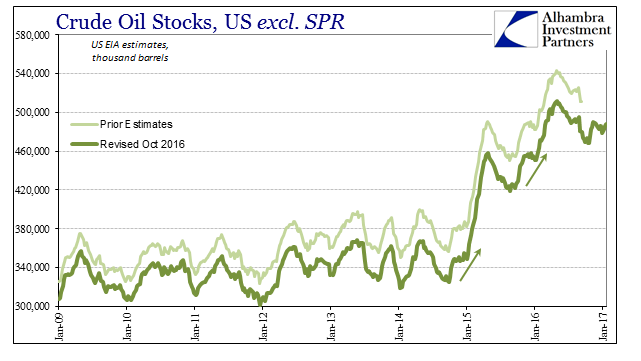

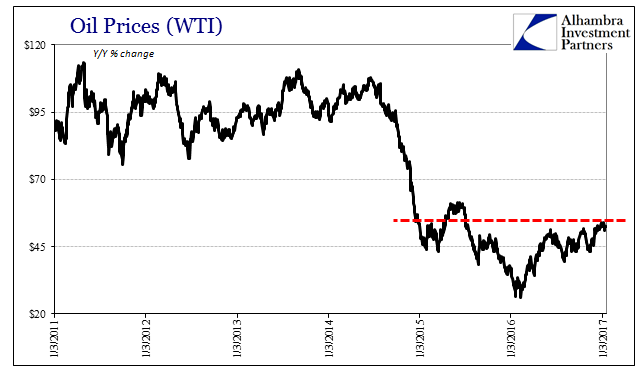

For the first time in three years, oil inventories in the United States are not rising precipitously more than the seasonally expected. At the start of both 2015 and 2016, oil stocks exploded higher as oil prices crashed, all related to the “dollar” flex on the front end of the futures curve creating sufficient contango necessary to strip that oil from upfront usage. With no immediate “dollar” threat in 2017, oil conditions can go back to normal seasonality with one vital exception; the inventory builds of the past two years remain. All that has changed is the new amount added to the still-existing “glut.”

That’s why, as noted yesterday, it will be difficult for oil prices to more fully embrace “reflation” in a way that other asset classes have already. Before things can truly go back to normal, something must be done about what happened over the past few years. “Reflation” is mostly about what could happen tomorrow, but oil, in particular, can’t just ignore yesterday.

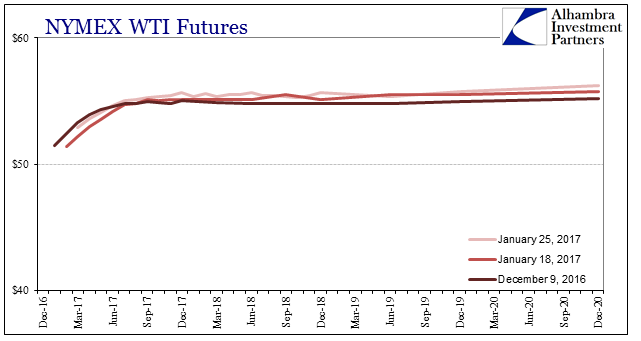

For the most part, it hasn’t. The WTI futures curve, for example, has found an eerie sort of stability pegged at around $55, with mild backwardation in the middle. That suggests, strongly, oil investors don’t expect oil to go much above that level for quite some time. With the familiar “hook” in the front end of the curve, the risks remain still to the downside.

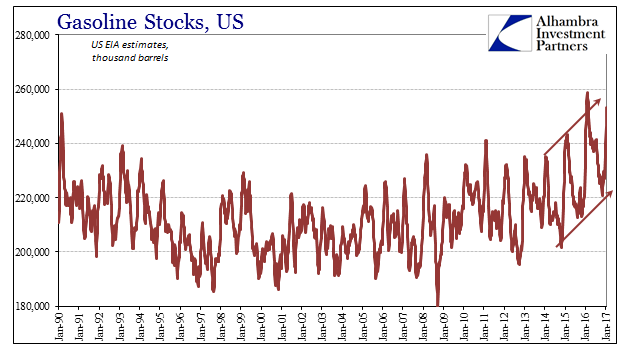

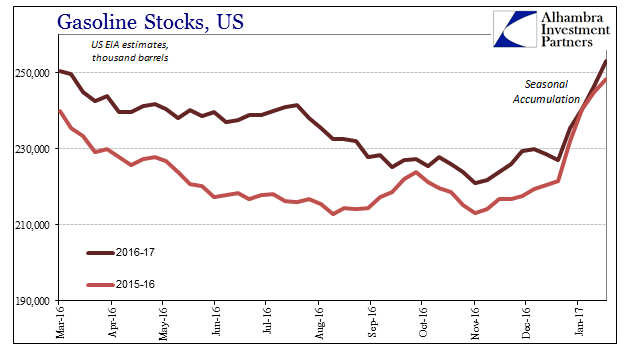

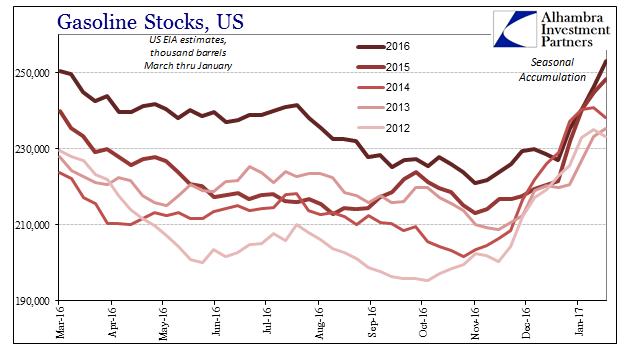

It is in many ways a remarkable state, though not wholly an unexpected one. Downstream of crude is gasoline and a more direct economic relationship. Unlike crude, however, gasoline inventory is sharply higher to start 2017 just as it was to start 2016. That is a serious and somewhat alarming circumstance given that the beginning of last year was bordering on recession. Further, gasoline flow-thru rates have fallen compared to late 2015, meaning that there is less going in to gasoline inventory and still not nearly enough coming out of it. Supply has dwindled somewhat, but still not enough to match demand that remains in the same state of weak.

There was some of the optimism provided by the equalization potential that you can see in the chart immediately above; where in 2016 the cutback in the supply of distillates like gasoline after August appeared to be working in addressing the demand shortfall after the huge disparity to start the year (again, under conditions near recessionary). To repeat the outsized inventory accumulation again to begin 2017 shows that, like crude oil, nothing has changed in macro terms apart from diminished supply (negative economy).

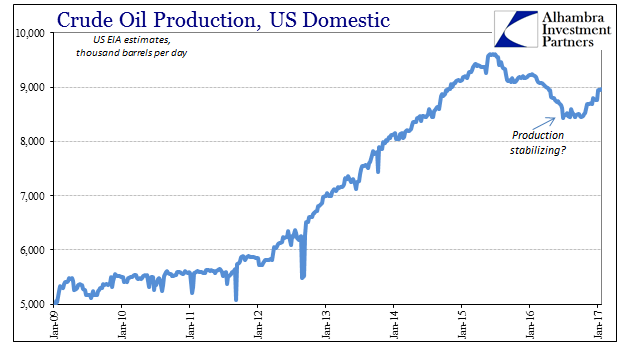

Upstream, however, we have to start to wonder how much longer that might be the case. Production of crude has come back somewhat since October.

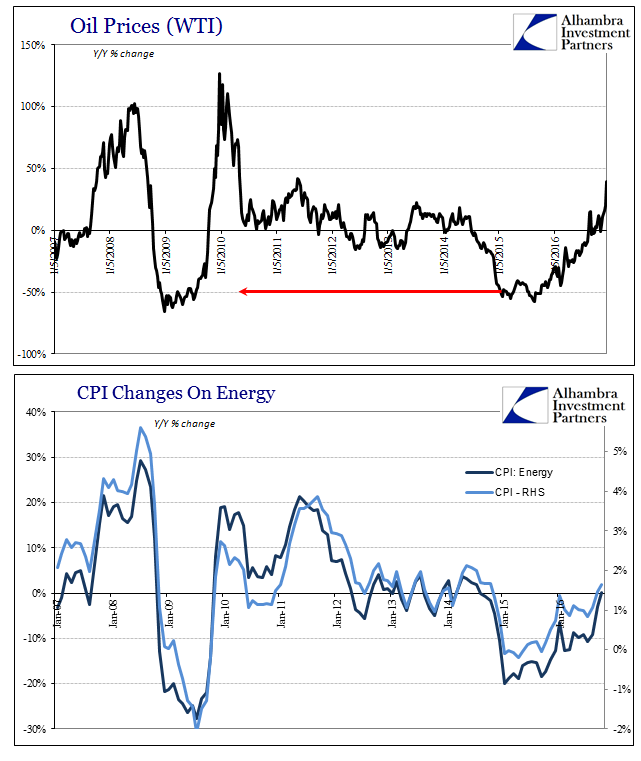

Without any meaningful reduction of inventory whether crude (shipped overseas?) or gasoline (demand), oil prices are going to find “reflation” a difficult if not impossible process to join. Without further rising oil prices, of course, the CPI will in short order become stuck and then recede (toward the end of this year) all over again.

“Reflation” enthusiasts, however, just don’t care about any of this because all that matters to them is what they are sure will happen. Reality, however, just doesn’t get to start from such a blank slate. It’s not a neutral process, either. Every time we go through one of these “reflation” hysterias we end up worse off than before it (2016 was worse than 2013, which was worse than 2011, which was worse than 2007). That means it’s that much harder to actually and meaningfully pick back up each time in reality; in terms of oil and gasoline, that is literally the truth to the tune of hundreds of millions of barrels.

Unfortunately, the real economy is rather more like oil than the dreamlike state of future “stimulus”, where in 2017 it starts with enormous inventory in all sorts of things to work through before ever getting so far as organic forward growth. In orthodox Economic terms, this is a higher degree of what it calls hysteresis. The more hysteresis, the greater the potential for failure (the possibility of success not great to begin with).

As I wrote earlier, there just isn’t much if any evidence that “stimulus” will work. In reality, however, the burden of proof should not be on the side of the skeptics. We have all the evidence of failure we need right here in the stockpile and its continuing imbalance of energy products. The burden belongs instead on those who now claim their genius ideas are more genius than the last genius ideas that obviously weren’t. It’s this reason why so many markets just aren’t as enamored with “reflation” as it may seem in some parts of other markets, as well as commentary often written about it. I wrote this morning (subscription required) about the money end of things as to what actually needs to happen for realistic chances of success:

Reflation, actual reflation, would be predicated on stability, but more than that on global officials’ ability to create a stable environment upon which the private economy would receptively work off in positive and sustainable fashion. That is what we are actually talking about here, not an organic recovery but one that is, as orthodox, “created” for us. Therefore, volatility in money, globally, is more than a little inconvenient to that expectation.

As is so much oil.

Stay In Touch