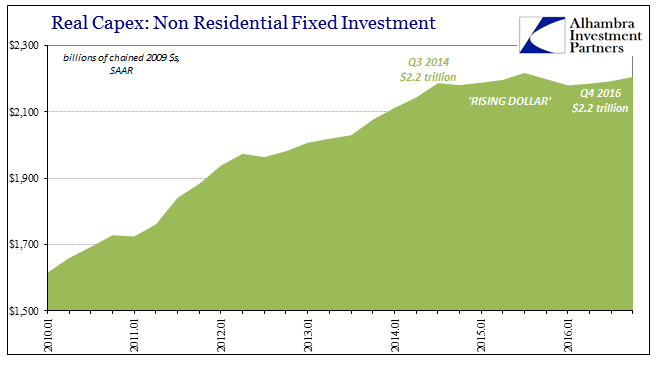

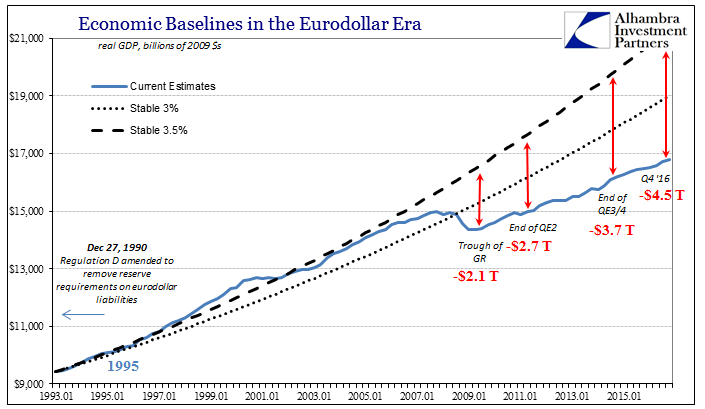

Nonresidential Fixed Investment, the GDP component most alike capital expenditures, broke above $2.2 trillion in Q4 for the first time in over a year. It was up for the third straight quarter, suggesting that perhaps the start of the year and its near recession could be the worst of at least the appearance of negative signs in business investment. As with everything else in this economy, however, that doesn’t mean actual growth has returned, just that it isn’t right at this moment getting worse.

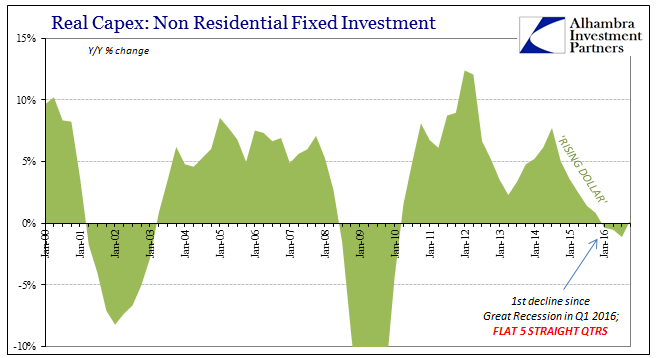

Year-over-year, NRFI was up just 0.3%, but that was the first positive comparison since Q4 2015. More importantly, however, total GDP capex is just barely more than it was in Q3 2014 and in no hurry, again, to resume forward momentum. If anything, business investment appears to be stuck more than cyclically determined.

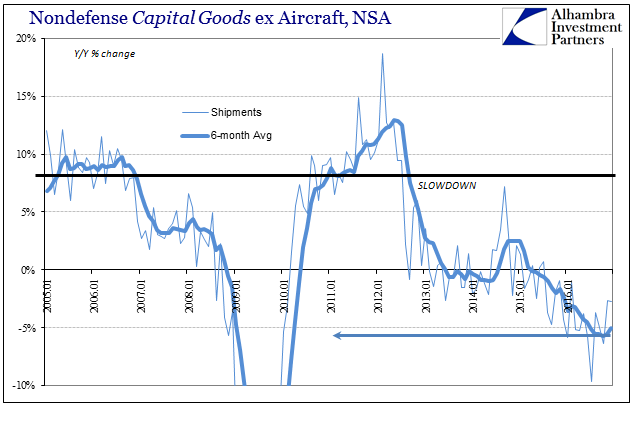

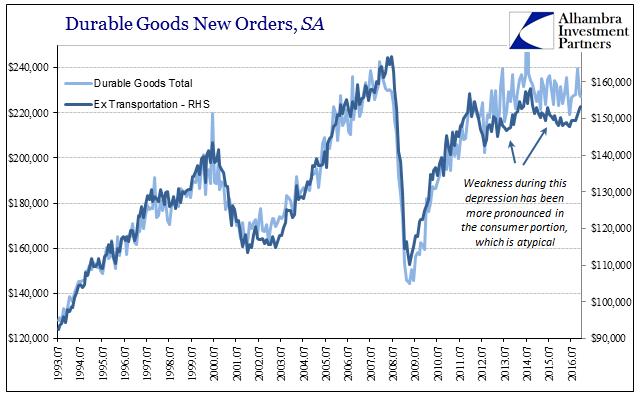

The durable goods figures also released today agree with that assessment. New orders for capital goods (non-defense ex aircraft) increased 1.2% year-over-year (NSA) in December 2016, the first increase since February. Shipments of capital goods, however, continued to decline, not yet catching up to the flattening of orders. Year-over-year, shipments were down 2.7% for the second straight month in December, and have contracted in each of the past seventeen.

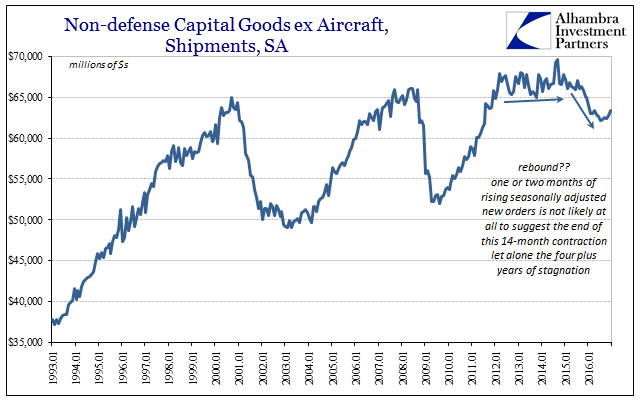

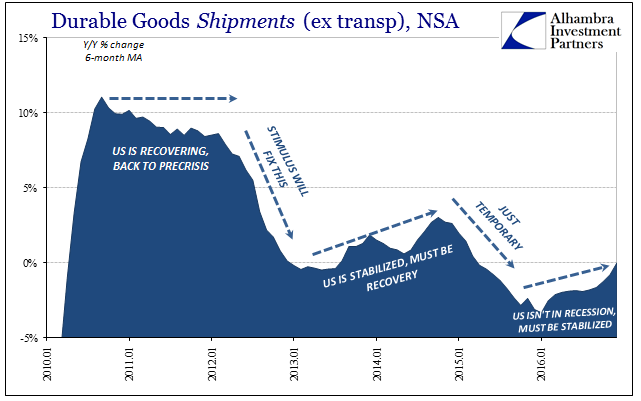

In seasonally-adjusted terms, capital goods shipments have turned up in four of the past five months. While that sounds hopeful, it doesn’t come close to offsetting the past two years of declines, nor the three years before that without any growth. It is, in that way, a perfect representation of this no-growth, intermittently positive numbers paradigm.

That is true for durable goods overall, as well. For the second straight month, durable goods new orders (ex transportation) as well as shipments rose year-over-year (NSA), but in still unimpressive fashion. New orders have been positive in four of the past eight months, but the 6-month average is still basically zero (+0.6%); shipments are up in three of the last five month, and the average is zero.

It offers more confirmation to what is the economic parallel to “reflation”; that the last “dollar” event having been far enough in the past leaves open space for more mistaken interpretations about what that means. Not that long ago, 2013-14 as well as 2007-08, it led to the widespread belief that the worst was behind and that only growth and recovery could be ahead. Those assumptions pulled forward all over again will continue at least until the next “dollar” event, which will restart the cycle all over again, only from a lower starting point (and to finish off, like in 2016, that much worse for having suffered through it).

The big problem with these cyclical upturns (depression cycle, not business cycle) is these positive interpretations. It will likely end up being hugely counterproductive (if it continues for long enough) in the same way as 2013-14 was attributed to QE3 and the belief that recovery was at that time not just possible but even likely (it’s amazing in review how in late 2014 the Federal Reserve was more concerned about “overheating” and how that view pervaded, uncritically, the whole mainstream description of what was going on). With that conventional perspective, there was and will likely be far less urgency to do what is necessary, even to (honestly) examine what it is that might be causing this sustained misery because there are seemingly plausible conditions (positive numbers) that suggest an end to the misery finally at hand. The economy ends up like a dog chasing its tail.

Because of that, “reflation” and the parallel economic trends in the reappearance of positive numbers are the worst case. The biggest cost in all of this is time, and that is what another round or cycle will mean.

Stay In Touch