The release of the 2011 FOMC transcripts has provided some useful clarity on the thinking of Federal Reserve officials. Unlike in 2008, policymakers were a little better acquainted with wholesale money and its possible points of failure. They never did solve or even identify all of them, of course, but the repo market in particular seems to have finally been considered as something more than a bank funding option. In many ways, it had become central to all forms, and the FOMC began to contemplate what that might mean overall.

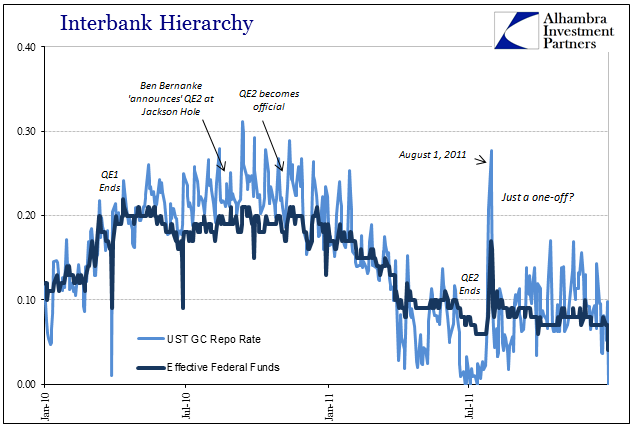

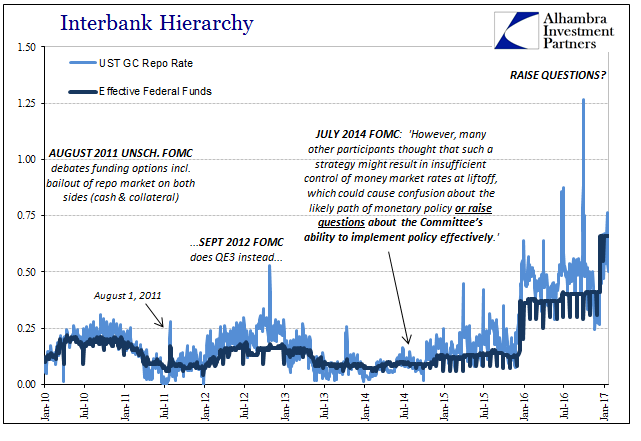

As noted yesterday, on August 1, 2011, the Committee debated and considered what would have amounted to a repo market bailout all over a few days’ trading. The GC UST rate that day had shot up to 27.7 bps, while the MBS GC rate was 39.4 bps on August 1, and above 30 bps in the sessions both before and after. These were rates much higher than federal funds and more importantly above the upper bound. That “ceiling” was set technically for federal funds but it was clear that the FOMC considered it an important signal for when circumstances might be less than ideal (to put it mildly).

Just a year before, in the summer of 2010, the Fed had instituted QE2 after several months of angst and funding irregularity, some of which is pictured in the GC rates as distinct from federal funds. As you can see above, the GC rate decoupled from federal funds and began to behave erratically toward both EFF as well as the “ceiling” (25 bps at at that time). At the November 2010 FOMC meeting, however, the one where QE2 was voted and approved, the repo market wasn’t mentioned except twice, but both of those in reference to the reverse repo in the capacity for the Fed being able to drain reserves.

Though that was the case, I have to believe repo was at least on their minds if at that point unofficially. By August 2011, of course, it was no longer unofficial as the repo rate was again unpredictable and concerning. In the space of just eight months, the Committee went from implicitly figuring the repo market in monetary policy to explicitly recognizing the potential for doing that. As was said in August 2011:

MR. ENGLISH. With the funds rate up only a few basis points over the same period, a natural question is whether the repo rate has idiosyncratically diverged from the overall constellation of money market rates or whether it is a symptom of broad dislocations in money markets that could interfere with the transmission of the Committee’s intended monetary policy stance.

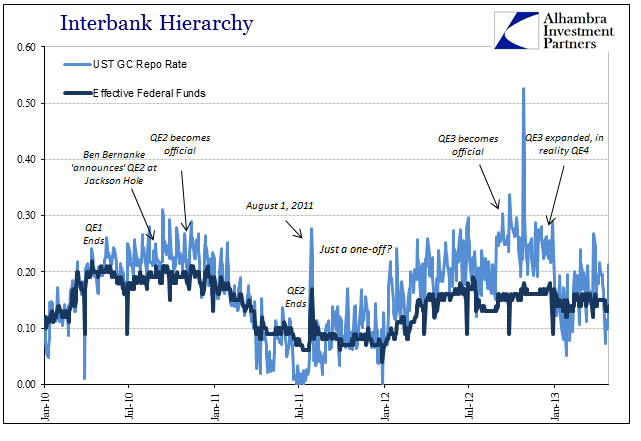

Not only was that a big change for policymakers, finally realizing money markets as they were rather than how the FOMC believed they “should” be, it continued to be a significant factor all the way to QE3. In fact, if you review the trend in repo, you have to wonder if the FOMC regretted not bailing out the repo market in summer 2011 (though we will have to wait until next year for the 2012 transcripts).

Throughout 2012, conditions looked very much like they had throughout 2010. Lo and behold, both times the Fed ended up adding another QE into the mix. From that consistent relationship, as well as, now that we have the transcripts, their considerations in especially August 2011, we can reasonably assume that Fed officials believed the repo rate was not only vital information but that what it suggested about overall financial functions may have been a primary trigger point (complementary to economic analysis of the time that was equally as concerning) for additional QE!

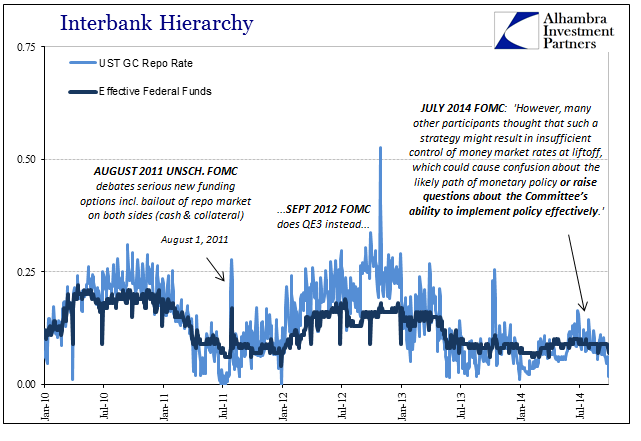

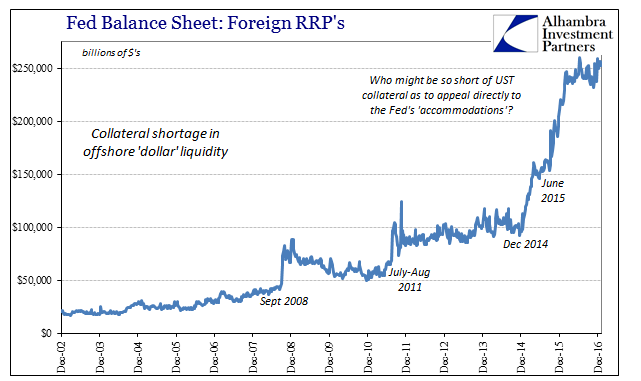

In the summer of 2014, the Fed began to seriously contemplate its “exit” strategies. Again, even without having in hand the full transcripts for that year we can still reasonably assume that the repo market was on their minds. In July 2014, for example, the official minutes of that policy meeting record discussions over how the Fed might conduct monetary policy under an exit program. No longer was there strictly a federal funds target, there would be a corridor which presumably would capture repo within it, being perfectly consistent with what looks to have been prior intent.

At the time the Fed issued these thoughts and concerns (written on the chart above) , repo had for the most part been well-behaved, the debt ceiling drama in October 2013 the only exception (as far as GC rates, I have omitted repo fails from this discussion as more purely a matter of collateral). In that way, the possibility that “insufficient control of money market rates” could “cause confusion” or “raise questions” about the Fed’s ability to do its primary job seemed a small danger, even if one taken seriously. The economy (in their view) was certainly on the upswing and the swelling of the Fed’s balance sheet to $4.5 trillion after QE’s 3 and 4 appeared to have worked and worked well (again, in their view).

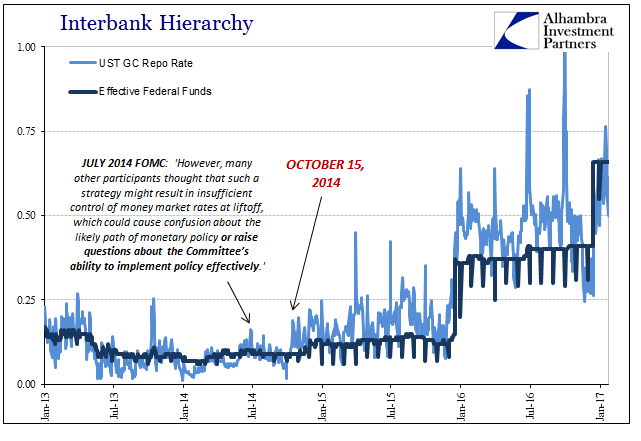

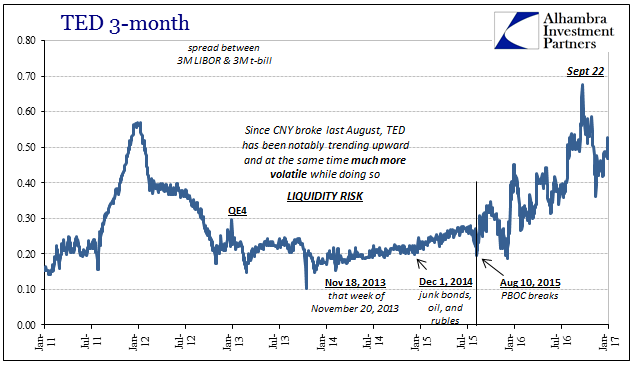

Almost immediately, however, the repo market, as other markets, indicated the opposite. The repo rate actually dropped at the end of Q3 2014 just as it had at the end of Q2 2011, and then jumped higher on a date that is entirely familiar to anyone actually paying close attention the past few years – October 15, 2014. Since that date, repo rates have acted just as they had in the leadup to both QE2 and QE3, only this time there was no forthcoming monetary “accommodations.”

How could there be? The Fed had locked itself into an “exit” and they risked sparking a much worse crisis by totally reversing course and possibly repeating what they had done previously (three times). Further, by the time conditions really started to turn bad in the summer of 2015, there were already serious questions (as there should have been) about what QE had actually achieved and therefore could achieve (though we will have to wait until 2021 to see those transcripts).

This is not actually about “accommodation”, however, as the QE’s in my view, with a great deal of evidence on my side, had little direct effect on these money markets especially repo (and especially collateral). Therefore my point is not that a QE5 would have been warranted in 2015 and could have been effective, it is instead that by even official standards connecting these dots from 2010 to 2011 to 2014 we see that they would have had to agree money markets were and are completely messed up, and that they did, in fact, “raise questions about the Committee’s ability to implement policy effectively.”

Fed officials had discussed replacing the federal funds rate with a repo target or target band throughout 2013 and 2014, so is suspect that when the 2015 transcripts are released they will confirm what the 2011 transcripts have so far. They knew that money markets under the “rising dollar” were not “resilient” and conforming, so that raises the further question about not just lack of control but what the Fed might have done about it. With QE in such empirically established disfavor, were there other things going on? I know of only one officially on the balance sheet (collateral rather than cash), so we will have to wait four more years to find out if there were others (perhaps beyond the Fed’s balance sheet).

In other words, by the standards, loosely speaking, established under what was surely policy evolution toward the centrality of the repo market, its behavior dating back not coincidentally to October 15, 2014 (rates) and June 2014 (fails = collateral shortage) was perfectly consistent with turmoil, disruption, and, most importantly, illiquidity, as surely the FOMC had to have agreed (in private). Either they radically altered their evolved views in October 2014 (to go back to a federal funds focus?), or they were flat out lying about it throughout 2015 until their final “epiphany” in 2016. I have to believe that, like GDP on the economic side, the increasingly indiscriminate behavior of the repo market despite LSAP’s and Balance Sheet Expansion played a decisive role in policymakers abandoning QE last year.

Stay In Touch