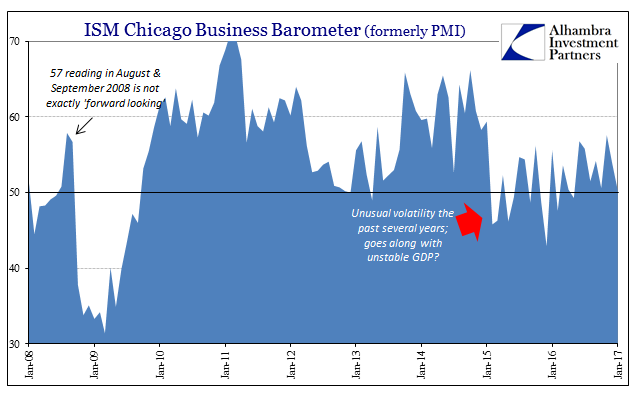

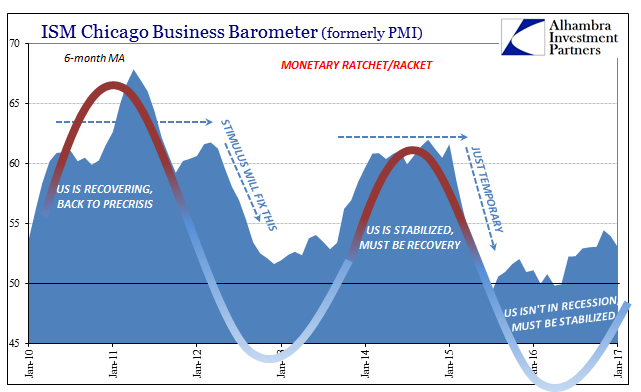

For two years now, the ISM Chicago Business Barometer has not failed to disappoint. Whether you were bullish or bearish on the manufacturing sector, if you were frustrated by the index one month you needed only wait to the next, maybe two, to be turned around. The index value for October 2015 was 56.2, for example, but 48.7 the month after and 42.9 the month after that. Then in January 2016, the index spiked back to 55.6 as if nothing had ever happened.

The behavior of the Chicago BB at the end of last year was the same as it was in the beginning of it; the PMI registered 57.6 for November 2016, dropping to (revised) 53.9 last December and now 50.3 in January 2017, nearing the so-called contraction level all over again. Midwest manufacturers, including a heavy proportion of auto production, seem to be confused.

Small wonder, however, that they might be, given that they are constantly told one thing only to find economic reality often sharply different. At least in the Chicago version, respondents due to this unclear overall picture have been more grounded. In other PMI’s, such as the ISM’s national manufacturing survey, optimism has been less restrained.

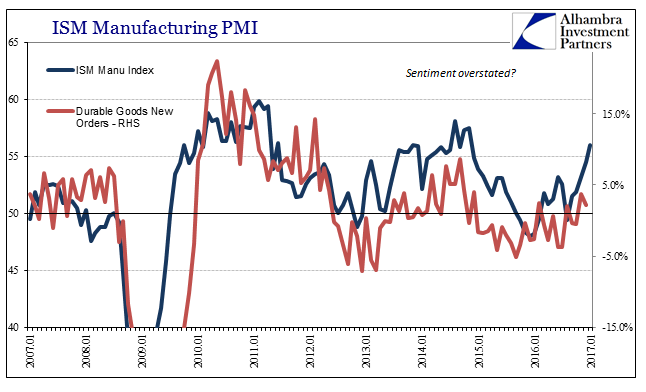

The index value for January 2017 was a robust 57, the highest since late 2014. This is, of course, nothing that we haven’t seen before as related by nothing more than that comparison. With most of the economic world, outside of the Chicago region, apparently, breathing an increasing sigh of relief after last year’s near recession, sentiment was bound to increase no matter what. The introduction of “reflation” possibilities may have pushed that to more extreme levels.

Given that this is nothing new, on the same upswing just three years ago, corroborating sentiment is a necessary task. PMI’s aren’t very useful to begin with as economic indications, but they may be in this manner as a method of checking “reflation” as merely imagined.

Comparing the ISM Manufacturing PMI to Durable Goods New Orders we find a long and very robust relationship in both directions. There are only a couple of historical periods where sentiment noticeably decoupled from the order data. For one, the bond market “soft landing” period in 1995 shows where sentiment was much more pessimistic than perhaps warranted. The other was 2004 when after a languishing “jobless” recovery the full weight of the housing bubble finally kicked into gear.

It is that second example that may be most illustrative as we are seeing something like it all over again – going back to 2012, and this time a more constant optimism “premium.” The ISM PMI rose far more robustly throughout 2013 and 2014 than did durable goods orders (or shipments), just as the decline in durable goods was before then (2012) sharper than in sentiment. The PMI and hard(er) manufacturing data like durable goods estimates have not re-established their prior correlations since that slowdown.

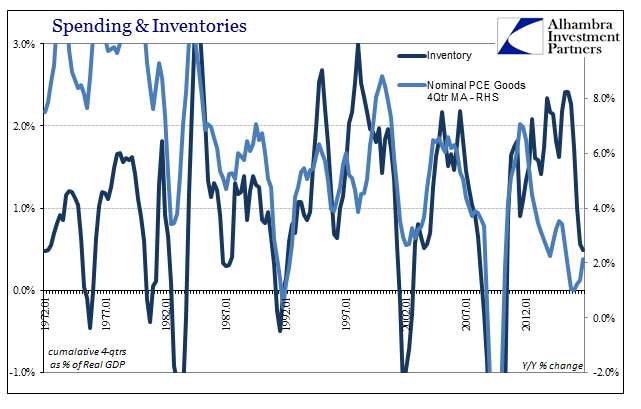

Why would manufacturing respondents, at least in the national survey, be more optimistic than underlying national activity? This question was already asked and answered last week with the release of the latest GDP estimates, particularly inventories. In what cannot be mere coincidence, inventory levels in the economy diverged from what had likewise been a very robust relationship with sales (PCE Goods) also right around 2012.

I think the difference was Alan Greenspan, or, more precisely, the myths built up around his tenure. In the form of Ben Bernanke, monetary policy was given an aura it never truly deserved. The Great “Moderation” looms over everything in the recent economic past, and by and large it has been attributed to the near omniscient abilities of the Federal Reserve. Nevermind the absurdities of the idea (starting with “moderation” itself), in conventional thinking that was how it was and that was what could be done especially if monetary authorities were ever pushed to do whatever it might take (pace Draghi).

There is almost disbelief captured in both inventory and sentiment, declared by these divergences, that the economy just couldn’t possibly be as bad as the hard(er) numbers suggest because monetary policy has been “all in” the entire time (not to mention the emphatically emphasized unemployment rate, particularly late 2014 forward). From the mainstream perspective, a higher degree of optimism in terms of sentiment actually makes sense, especially this far into an economy with no recovery since businesses are going to be longing for one (recession fatigue) every time one seems the slightest bit possible. Every small turnaround can be embraced as the turnaround, even if there is little or no contemporary basis to think that way.

And so it could also be with the latest sharp move up for the ISM as well as other PMI’s, with new forms of “stimulus” possible in the perhaps near future combined with the firmer nature of the sigh of relief as last year’s near-recession is put further into the past. It is, almost exactly, 2013-14 all over again.

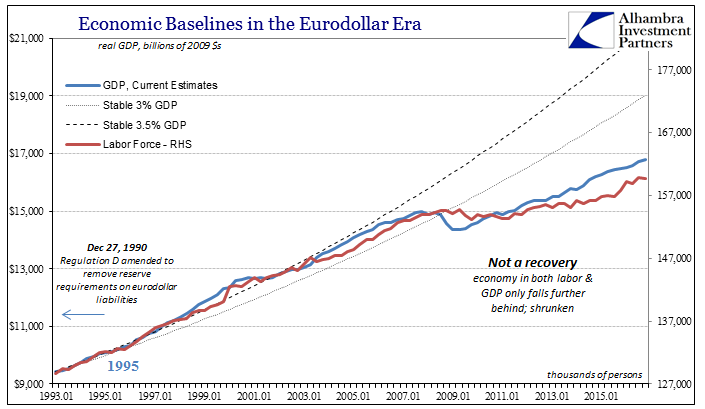

Remarkably, then, it is the ISM Chicago and its volatility that appears to be closer to the facts on the ground – confusion and uncertainty rather than unbridled joy at the maybe future possible prospects for “stimulus” that can’t yet be specified. The economy itself is little to no different from last year, in more than just durable goods, just as it was 2013-14 as compared to an also near-recession in 2012. I cannot be completely unsympathetic to the divergence in positivity of the PMI’s, as it is often hard to believe at times that the economy could actually be so bad for so long. It would seem by nothing more than mere random chance that growth might return, but as we see in these repetitions it never does defying all odds (and confirming depression rather than business cycle).

The economy remains stuck, but there are now regular intervals when we feel better about it.

Stay In Touch