The whole point of any “stimulus” is to buy time. The idea is to keep the economy busy or, in the case of more purely monetary policy, happy during that time so that the economy on the demand side can on its own heal. In the parlance of orthodox economics, “stimulus” reduces the output gap, the difference between current output (aggregate demand) and potential output (supply), so that recovery is that much smoother, easier, and, most importantly, quicker. Time is the biggest factor, though it is hardly ever explicitly considered.

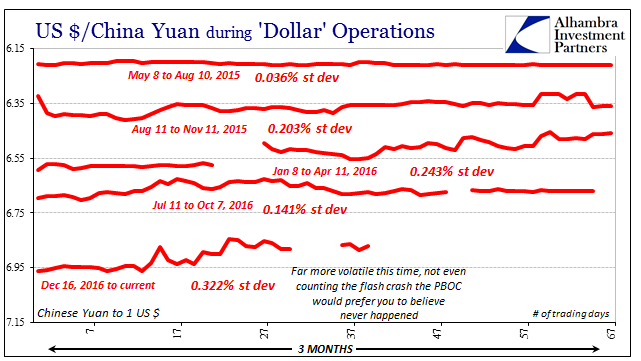

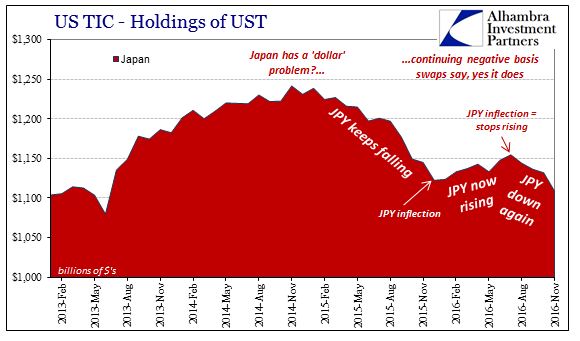

I have written quite often during this “reflation” period that the biggest difference between 2015 and 2016 was the willingness of central banks to further engage “dollar” markets. To be clear, they did not sit it out two years ago while conditions deteriorated, they merely acted with palpable caution and even reticence. Last year, by contrast, there was clearly much less remaining of their reluctance. On February 12, 2016, I wrote (subscription required):

The mess of imbalance survives in Hong Kong, meaning that it will likely continue to afflict the mainland only further eroding sentiment all the way around. It will be interesting how the PBOC reacts, as surely they will and must.

And they did. What followed in the months immediately after was as I described at the outset – to buy time. The Chinese followed it up with fiscal spending in enormous quantity, stuffing rushed “investment” into state-owned enterprises to have done who knows what. By summer, it appeared to have worked, especially in China as a sort of calm fell over the whole country and more. That didn’t mean there was nothing left to the prior disturbance, merely that though there was still visible disorder it just didn’t seem so urgent and immediate anymore.

In early July, for example, Bloomberg published a story suggesting that, “Global investors are growing more comfortable with a weaker yuan after China’s central bank improved its communication with markets.”

“This time, it’s different,” said Song Yu, the Beijing-based chief China economist at Gao Hua, the mainland joint-venture partner of Goldman Sachs Group Inc. He has been the top-ranked forecaster of China’s economy since Bloomberg began its ranking in 2013. “The recent depreciation in the yuan didn’t result in large volatility in financial markets around the world, and there weren’t heavy speculative positions shorting the currency or individuals trying to convert their yuan holdings into the dollar in a panic.”

Even the official statistics where China’s (and others) “dollar” regime was showing up if nowhere else had by mid-year started to suggest that the storm had passed. I wrote in the middle of last August:

From SAFE and TIC estimates for China, it would appear as if the Chinese are intervening much less than they were. We know that is likely false from CNY behavior alone, therefore we are pushed to conclude that they are either doing something else, or that someone else is doing these things too (or some of both). In other words, the stability in Chinese forex holdings is misleading, as it counterintuitively submits greater involvement, not less. [emphasis added]

Considering CNY, though it had “devalued” again right on schedule the unofficial official intervention following it was relatively easy and fit; certainly in comparison to those before and after July/August. In other words, they had a much easier time, relatively, managing CNY in the middle of last year than either the beginning of it or its end. That difference is reflected in the Bloomberg story as well as what I wrote.

It must not be lost in our analysis that it was this very period where “reflation” was born (again). While the Bank of Japan and even Brexit played huge roles in stirring up the expectation, how far would it have gotten had this relatively more calm “dollar” environment, at least on the outward surface, not been achieved? I write “achieved” because it bears all the hallmarks of artificiality in contrast to organic recovery.

This is true for more than just whatever it was the Chinese were doing. I thought then and still believe today that “someone” else was intervening in the eurodollar markets, if more cash than FX. Immediately my attention was drawn to South America, and for very good reason. The Brazilians, apart from the Chinese, have taken the worst of the “rising dollar” but suddenly at the start of March 2016 it all began to melt away. Not only did the real reverse, so, too, did the massive short position accumulated in Banco do Brasil’s swap program that had (as always) achieved none of its goals.

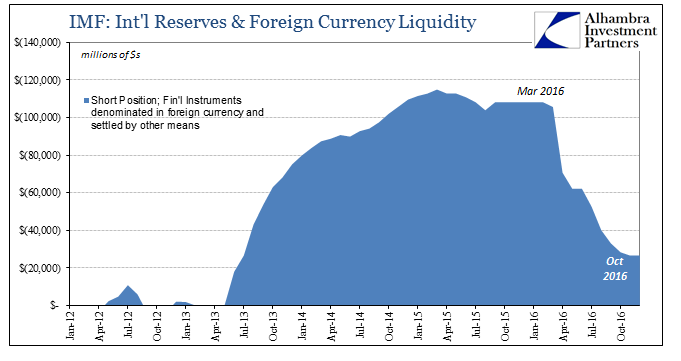

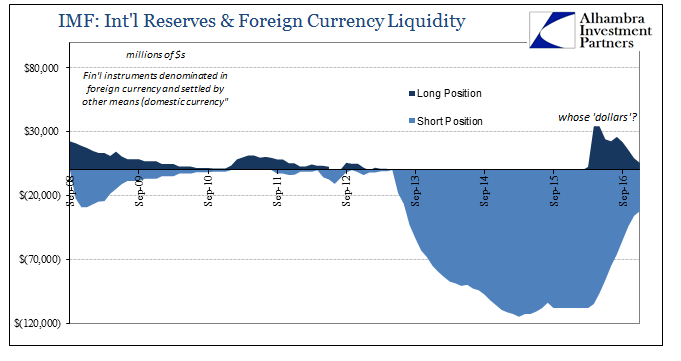

It raises even more interesting questions and prospects, too. Starting in March 2016, Banco do Brasil’s prepared call sheet for IMF reserve accounting shows the sudden appearance of a net long position in “financial instruments denominated in foreign currency and settled by other means (domestic currency).” The initial amount was small but provocative, particularly the timing with both Petrobras’ infusion and the real’s reversal. That part of the IMF call sheet had been notable before since that was where all Banco’s prior “swaps” had been assigned, only on the short side.

It was as if “someone” had given Brazil a large and very timely infusion of “dollars”, which just so happened to be at the same time everything started to become less immediately distressing and dangerous.

Between March and October, Brazil managed to cut almost $80 billion off that short position without any disruption to the real exchange rate. And as suddenly as it appeared, the long side dollar position has disappeared.

Brazil is not the only place where everything seemed to reverse, as its South American neighbor Argentina was also given infusions. But for that country, the “dollars” they obtained were more visible and identifiable.

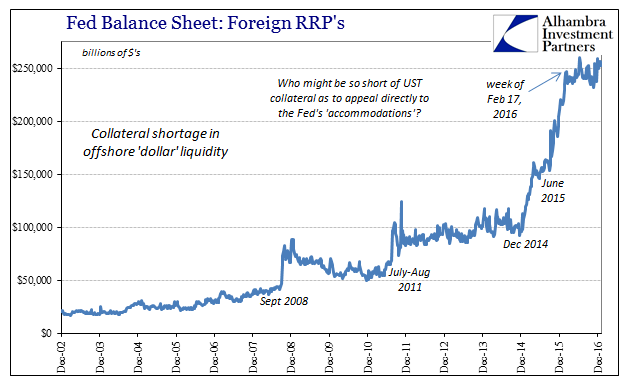

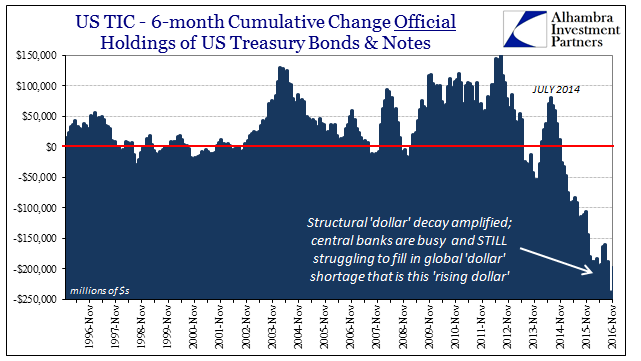

If we examine the Fed’s balance sheet, the absorbing side, its foreign reverse repo “accommodation” had seen tremendous interest all throughout 2015 and early 2016, only to see that interest tail off the week after February 17, 2016. For over a year, foreign counterparties could not get enough UST collateral (maybe MBS, too) from out of SOMA; then, nothing.

It is certainly possible that the private “dollar” market stepped back in to fill the gap it left behind when it stepped out as the “rising dollar.” However, if that had been the case then why would we still find so much of the ongoing “dollar” shortage in so many other places (particularly FX)? Further, why have global central banks been forced to intervene, through places we know, in greater quantities still?

I can’t help but wonder just how Japan has managed to be in the middle of all this, though I can’t present any evidence for that in this specific case. What I do think is that “someone” in some official perhaps dark capacity interceded last year for the specific purpose of buying time. I’ve heard rumors of the Bank of England, and that it was reverse repos, but that cannot be confirmed, nor do I expect it ever will be. It was apparently enough to help birth “reflation”, but I further suspect that it was a one-time deal.

There are any number of indications of “something” that changed starting around August and September, and we can see that in the Brazilian IMF call sheet. The pace of their short position reduction went from $12.5 billion in August, to $7 billion in September, $4.7 billion October, and $1.8 billion November. In December, Brazil reported a small reversal, a slight increase again on its short side.

Their currency appears to have noticed, as in August BRL abruptly stopped its almost 45 degree ascent and has been mostly sideways since.

This is in many ways reminiscent again to 2013, particularly the surface effects of QE3 and QE4. Those made what looked like a credible difference in the economic landscape, seemingly ending the spillovers from 2011 (though I won’t concede that it was QE, LTRO’s, or Draghi’s promise that were responsible for what looked like looming global recession to fall short of that condition) to where that version of “reflation” could likewise ignite. It didn’t last very long, of course, in “dollar” conditions because “dollar” conditions didn’t actually change. What changed was mostly rhetoric about the economy, unsubstantiated assertions that continued and even intensified into 2014.

Maybe we will find five years from now that it was the Federal Reserve behind all this, or at least it was at their behest if not their balance sheet. After all, the US central bank was not immune from the fallout over 2015, and acted quite differently last year, too. Though it appears to have been more of an academic reassessment of what they had achieved, or ever could or can achieve, perhaps their epiphany extended boundaries beyond what they showed in public (which was considerable).

I still have no answers as to this question and the implications for it. But even if won’t ever know “who”, we can at least consider “what.” From the information we have available and given our ability to interpret it (properly, meaning unconventionally), it appears as if this was a one-time intervention (at least limited in capacity) that through the course of last year has been wound down – just as you would expect of this kind of possible “stimulus”-like intervention that purchased some time and distance, and because of it maybe even helped greatly to stir “reflation.” Therefore, if the great difference between 2015 and 2016 was this possible willingness to go that much further in “dollars” via unofficial official channels, might the difference between 2016 and 2017 be again the opposite?

Stay In Touch