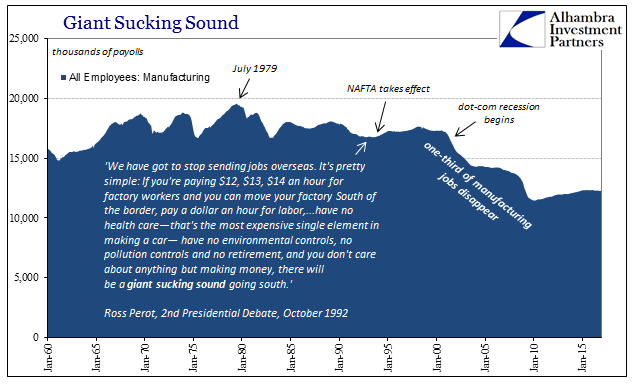

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot.

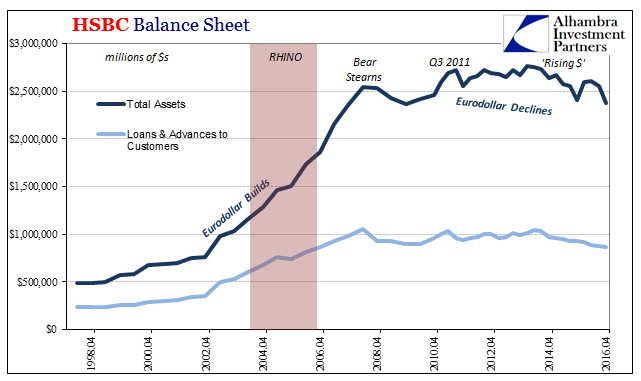

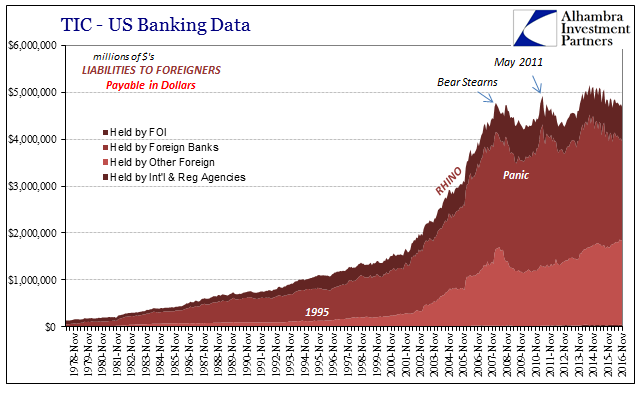

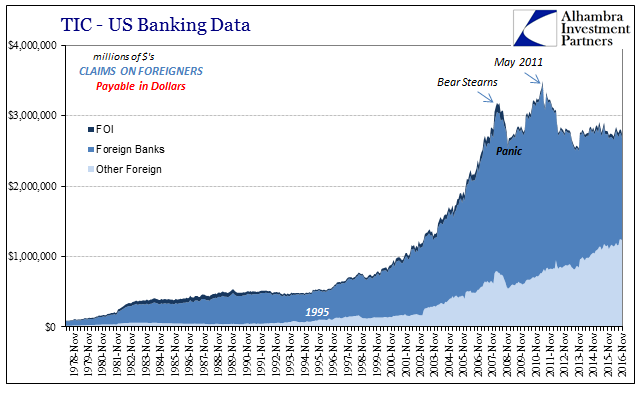

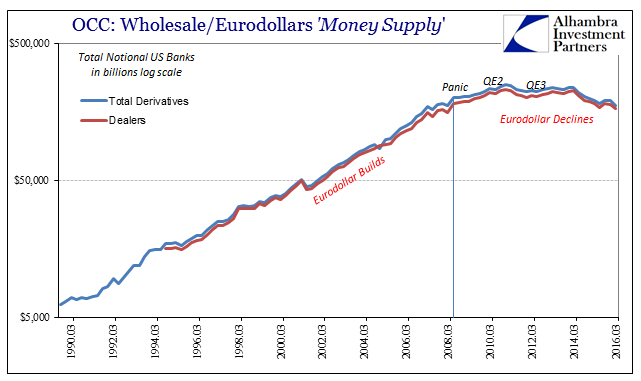

That bubble, however we might center our monetary axis on the US, was not exclusively an American affair. In truth, the eurodollar’s ascent was a global phenomenon that was very poorly understood, though not unnoticed. Alan Greenspan had his “conundrum” while Ben Bernanke stood agape trying desperately and foolishly to explain it all with his “global savings glut.” There was nothing particularly interesting in US money supply figures, but there was in a whole lot of other places.

Among them was emerging markets who for “some” reason caught fire at the dawn of the 21st century. We are not supposed to notice the bright flashing correlation that when these EM’s rose fastest, their so-called miracles, the US manufacturing sector fled with equal vigor. The dot-com recession was a mild one, historically the mildest on record, yet of US industry it was as if an economic plague had been unleashed by it. The incongruity stands as a one key component in the current debate all these years later (why 2000?).

The issue has remained limited to the realm of “free trade”, meaning that NAFTA was it and opposition to it unreasonable to the point of ridiculousness. On November 9, 1993, a year after the 1992 election but eight days before Congress would vote on NAFTA, Vice President Al Gore and former (and future) Presidential candidate Ross Perot sat with Larry King on CNN and debated so-called free trade. At one point, the VP resorted to a childish stunt, presenting Perot with a smiling picture of Senator Reed Smoot and Representative Willis Hawley, the Congressional co-sponsors of what became known as the Smoot-Hawley tariff (officially the Tariff Act of 1930). In bestowing Perot with the symbol, Gore said:

Congress passed the Smoot-Hawley protection bill and it was one of the principal causes, many economists say the principal cause, of the Great Depression in this country and around the world.

As if that wasn’t enough theatrics and melodrama, the Vice President amplified them further:

If we give in to the politics of fear and make the wrong choice, the consequences would be catastrophic.

Oh the irony, that if anyone should listen to Perot it was the “politics of fear” that would surely, signed in agreement by all economists, lead to consequences as grave as the Great Collapse. It has been the sole standard for any debate on the subject, whenever objections are raised proponents of modern free trade will, as monetarists have done with regard to monetary policy in the post-2008 era, invoke the Great Depression. This is a pure logical fallacy, and several lumped together, and needs not be taken seriously. It instead betrays the weakness of the argument.

The debate surrounding Smoot-Hawley was entirely different. As Irving Fisher wrote at the time, with near unanimity from an economics profession that would be deeply divided just a few years later on everything from fiscal policy to monetary policy to even the meaning of money (gold or something else), the context for evaluating the tariff was not necessarily protecting US industry (and agriculture, which was the starting point for the bill) but as a means of a creditor nation reducing the capacity for its indebted vendors to pay back that outstanding credit.

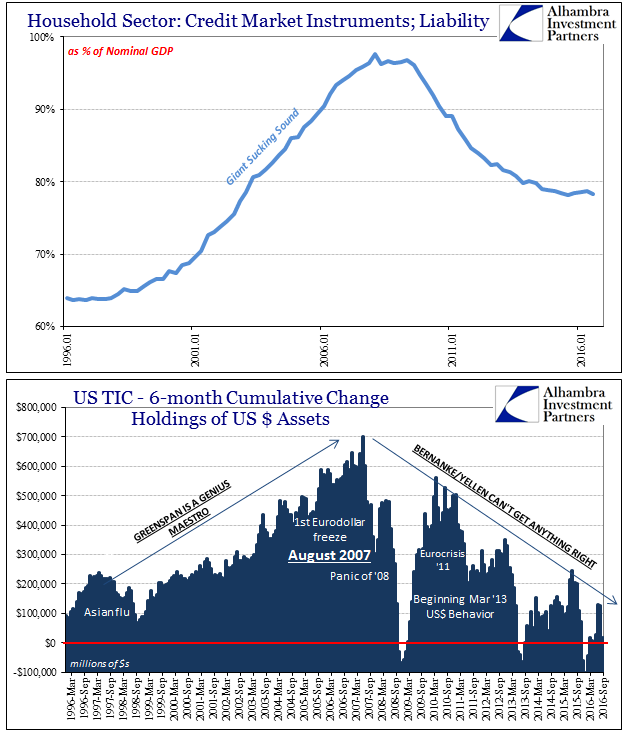

The 21st century results of agreements like NAFTA depended upon circumstances wholly unlike those of the early 1930’s. The roles have been notoriously reversed, more so as the 2000’s wore on. For one, the center point of the argument has not been about the trade of goods between nations but rather the trade of jobs for goods; we send them jobs, they send us goods we used to make, and pay for it all with eurodollars manufactured by bank balance sheets that would always, it was assumed, grow with equal energy to either of those trends.

That is what is so often missing from any point in the current argument. No pool of labor no matter how cheap and deep is a sufficient allure on its own. The miracle of capitalism, including that which Ricardo used to theorize as to comparative advantages, is the productivity that is achieved by the marriage of labor and capital. There may have been so many tens of thousands Mexicans willing to work at $1 per hour as Ross Perot once argued, but without a massive infusion of equally cheap and available “cash” those Mexicans would simply have to wait for the true capital (capex) for it to actually matter. That is why the “giant sucking sound” did not appear until 2000-01; the eurodollar system was simply not ready for the volume, too immature right away even in its final form developed fully after 1995.

Thus, it was the combination of NAFTA with eurodollar expansion that drove this version of “free trade.” Opposition to it is nothing at all like arguing in favor of Smoot-Hawley, and anyone claiming that it is should not be taken seriously.

At the same time, all arguments against “free trade” are likewise unequal, including those that appear to have been advanced by the Trump administration.

We’re one of the only countries in the world that people can sell their product into us and have no tax, no nothing, and they get rich. And yet if you want to do business with them, you’ll have taxes, I’ve seen, as high as 100 percent. So they sell into us, no problem; we sell into them — because we don’t sell them because the tax is so high that they don’t want us to sell into them.

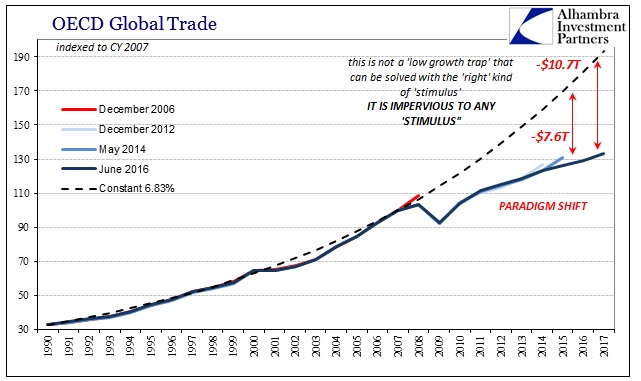

If the grounds for opposing what is called free trade today, represented by NAFTA or TPP, is the substitution of jobs for credit/debt/eurodollar money, then protectionism even if intended to bring about a reverse of the “giant sucking sound” is illogical. In other words, if the eurodollar expansion financed both the capacity for offshoring as well as at the same time the ability of US consumers to pay for those now-foreign made goods, the incapacity of the eurodollar system to continue all of it does not propose protecting US industry from foreign competition. The issue is not too many cheap foreign goods inundating US markets, as it is instead too little global economy for the prior imbalance to work anywhere.

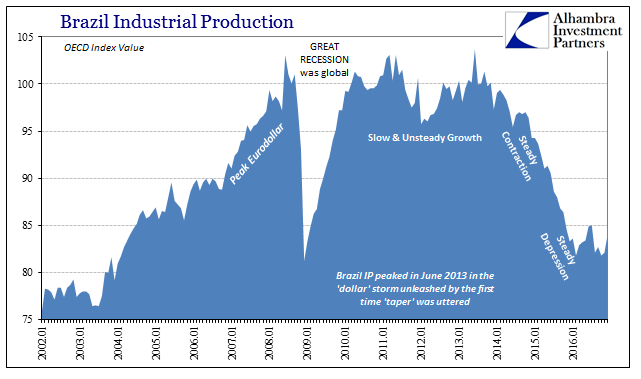

A quick survey of the global economy shows deep depression in many of the places that supposedly benefited from “free trade” at least in the format of modern globalization. Foreign manufacturers are not still winning at the expense of American manufacturers; nobody is winning anywhere right now. The debate about proper balance is superseded, by a lot, by the necessity of an actual rather than imagined global recovery.

In truth, a real global economic recovery will require a replacement for the eurodollar system, which further would mean the debate about so-called free trade is in all likelihood rendered moot. A truly stable currency regime is not one where massive credit-driven imbalances can or would be maintained, meaning that Ricardian equivalence might actually come into play in a way that has been so clearly missing since Al Gore embarrassed himself in 1993 (and it should be pointed out that Ross Perot did his view no favors that night, becoming a national punchline with his “can I finish” cantankerousness).

In a contemporary account of the contest, UK’s Independent newspaper claimed Gore had “trounced” Perot by virtue of performance and set the literal stage for NAFTA’s uncertain passage:

The televised public conversion to the pact by one Florida Democrat immediately afterwards had far too obviously been stage-managed in advance to be convincing. Mr Perot may not have advanced his cause. But waverers must still reckon with union hostility to Nafta as they consider their prospects in the mid-term congressional elections, less than a year off.

Nafta, in short, could yet come to grief.

It truly did, but it wasn’t ever unions the global economy would have to reckon with. It was eurodollars all along. It still is.

Stay In Touch