We are at the stage ten years later where it is still necessary to define terms. In every finance and economics textbook, the chapter on monetary policy defines “tight” money as when the Federal Reserve (or whatever central bank) raises its policy rate(s). Conversely, “accommodative” money is where it lowers the rate(s). In the US system, the technical reason given is open market operations, where the FOMC acting through the Open Market Desk of its New York Branch (FRBNY) will buy and sell securities as necessary to achieve the target rate.

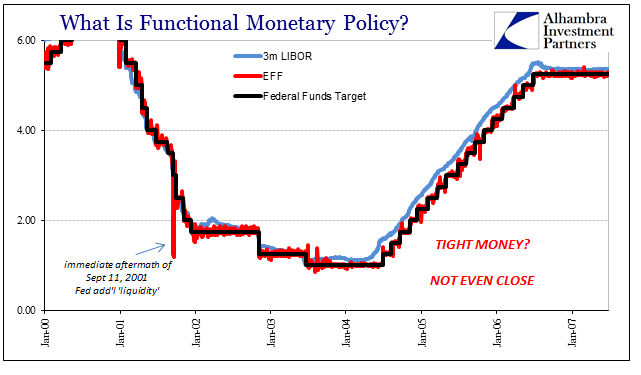

From the perspective of the banking system, that means the Fed will, if pushed, provide whatever level of bank reserves necessary to keep the Effective Federal Funds rate sufficiently near the policy rate. When the policy rate is being raised, as it was in the middle 2000’s, it was in theory moving upward because money market participants fully believed that the Fed would sell bonds into the market (if needed) to reduce the level of available reserves – “tightening.”

That policy was instituted at that time because the FOMC felt the change in stance was warranted given an economy that finally appeared to be recovering from the unusually durable after-effects of the unusually mild dot-com recession. The Fed raised the federal funds rate to achieve that “tightening” so as to reduce economic momentum before it became overly inflationary. It is this assumed set of conditions which are used today to characterize the current action of monetary policy.

But on the most basic level, is that what happens? Is raising the federal funds rate truly equivalent to tightening? The answer is emphatically, unequivocally no.

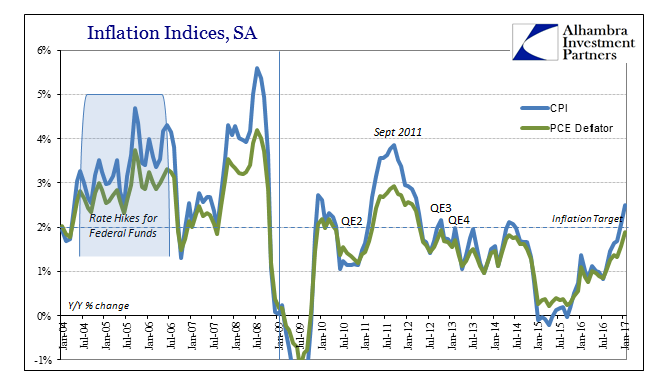

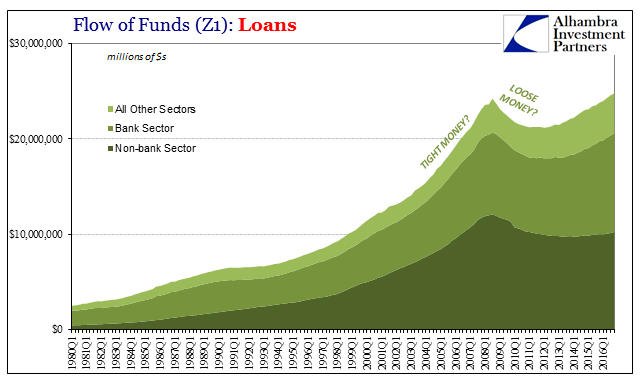

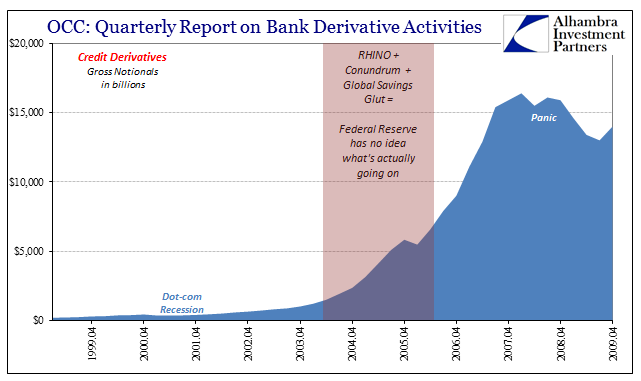

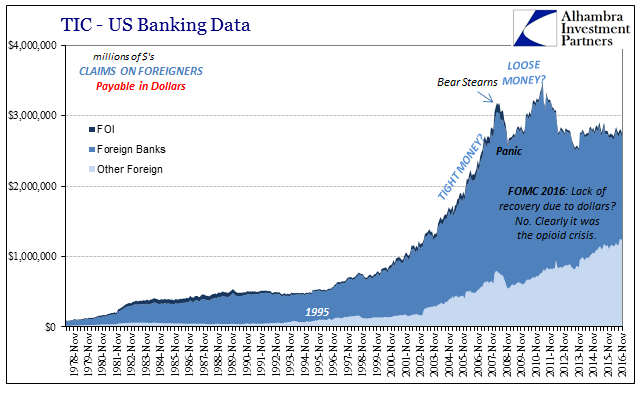

Starting in the middle of 2004, Alan Greenspan’s Fed began a series of “rate hikes” meant to accomplish a “tighter” monetary stance for the reasons stated above. Between June 2004 and June 2006, the FOMC voted 17 times to increase the federal funds target, bringing it up from 1.00% to 5.25%. During that time, inflation continued to accelerate, as did all manner of other monetary indications outside of the traditional money supply statistics (the M’s, including the drastically incomplete M3). There is no way to characterize that period or the year immediately thereafter as “tight.”

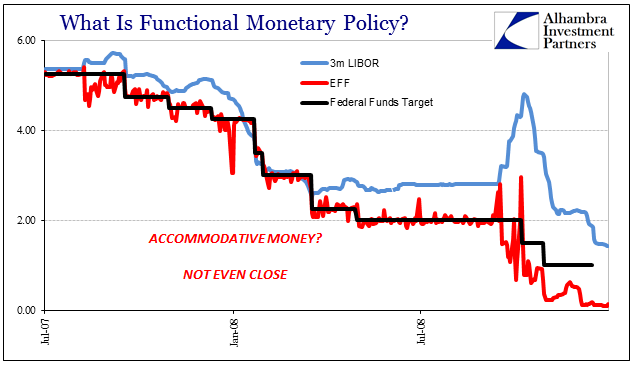

From September 2007, however, through October 2008, the FOMC did just the opposite. In much more condensed fashion, the FOMC voted to reduce the federal funds target from 5.25% back to 1.00%. There is absolutely no way to characterize that period as anything even approaching “accommodative”, especially as it encompasses two of the three liquidation events associated with what was truly a bank panic (and the third one followed the introduction of ZIRP).

So here we have two very clear periods almost mirror images of each other that resulted in exactly backwards circumstances. The Fed raised rates and the system exploded higher anyway; the Fed lowered rates and the system imploded. The most charitable interpretation of what the FOMC did was that they moved the fed funds target in response to extraneous conditions; they did not set them as is still widely believed. That fact is actually established on each of the EFF/LIBOR charts, though in blue rather than red.

As the Alan Greenspan raised the target rate 17 times LIBOR rates dutifully obeyed, but they also remained very close to both EFF and target. That low spread indicated hierarchy, or covered interest parity, if you prefer. There was a seamless operative condition to where money dealing banks would arbitrage any small differences between LIBOR and federal funds (respective of time premiums), meaning that in functional terms there was more than sufficient money dealing capacity no matter how high the Fed “raised rates.”

Conversely, from August 2007 all throughout what was an interbank, eurodollar panic, there was instead only fractured hierarchy – the absence of money dealing banks to arbitrage what became an enormous spread (not the only one) LIBOR to federal funds (especially when the effective rate was so often significantly less than target). Why were there no banks willing to borrow in unlimited amounts in federal funds or even the Primary Credit Window (formerly Discount Window) to lend those dollars in London? There was either no willingness to take the risks of doing so (liquidity preferences) or no capacity with which to maintain it (the real shortage).

So it is extremely easy to establish that monetary policy is not what is taught in every school and written about in every media article. The introduction of the QE’s simply eliminated any remaining doubts (all that “money printing” and no sign of it anywhere other than expectations). Changing the federal funds rate simply moves the nominal frame of reference for the real monetary action, nothing more, denoted here by the spreads of LIBOR to federal funds. That is the real money condition, or was.

The system has evolved and in many places quite drastically. Even the manner of raising the federal funds rate is no longer what it was. In place now is a corridor of sorts where the IOER rate (top) and RRP (bottom) are supposed to define and defend the money market range (but often don’t). Again, all that does is change the nominal frame of reference to where the real monetary action takes place, once again in spreads (FX) throughout the monetary landscape (including only somewhat LIBOR).

The Fed is given powers again that it doesn’t actually possess, as any monetary tightening over the past few years has had nothing to do with monetary policy just as it had nothing to do with it in 2007 and 2008.

This all takes place in addition to grave misunderstanding about the reasons the Fed is “raising rates” in the first place; not because the economy is about to recover and the risks of “overheating” are high, as Alan Greenspan once thought in the middle 2000’s, but because Janet Yellen’s models show the economy won’t ever recover and therefore there is nothing left for the FOMC to do (according to their definitions). There is a world of difference between reality and the public view of monetary policy still today, just as there was throughout the middle 2000’s. This is not mere trivia.

Stay In Touch