The FOMC voted today to raise the federal funds corridor by another 25 bps. It was the third such change and the second over the past three months. Judging by the reactions to it, you would think this is 2004 again. It is not. It is instead perfectly consistent where on a day when the media describes a “strengthening” economy we find instead the usual opposite.

The rate increase comes amid a broad improvement in the world economic outlook and a sense among Fed policymakers that the U.S. economy is close to the central bank’s employment and inflation goals.

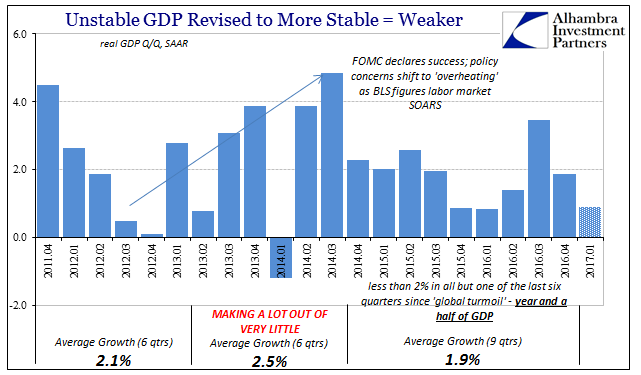

This is no mere short-term divergence, as yet another quarter’s worth of output is poised to amount to much less than 2% (as if 2% is an appropriate standard, which it isn’t). Assuming the latest update from the Atlanta Fed’s GDPNow models are even close (0.9%), that would mean Real GDP in the US is below 2% for the sixth quarter out of the past seven, and below 1.5% for the fourth of the last six. That’s an astounding amount of weakness, not just “transitory” weakness but chronic. The last part from the quote above is the only part that is correct, but clearly without realizing the implications for it. As I wrote earlier today with regard to inflation (CPI):

Though Federal Reserve officials may seem to be in rush to “raise rates”, they might appear so only because they more so wish to avoid uncomfortable questions about why it is they are actually doing so. If the public believes there is economic acceleration being forecast just as there was in 2014 and early 2015, then so much the better (for the FOMC) than having to answer for why none is actually forecast even by models that through the whole of the last ten years were blatantly optimistic at every chance. Janet Yellen is no longer worried at all about “overheating”, but she is aided in her avoidance if the CPI if for only a few months gives off that suggestion.

What the media quote does, and indeed almost all mainstream commentary about this “rate hike”, is become complicit in stoking these irrational and downright misplaced beliefs. There is a world of difference between the Fed’s economic outlook today and what it was three years ago; but it is the one from three years ago that the Fed is allowing, quite purposefully, to be broadcast as if it were any more realistic now than then. That is the part that is missing from all this commentary, and Janet Yellen knows it.

I don’t know what Janet Yellen said today but in all the relevant markets her words (or the statement) sparked a reawakened sense of reality, and frankly I don’t care what she said because whatever it was or will be borders anyway on perfect duplicitousness. Every statement and part of monetary policy must be evaluated according to the output gap. All the “rate hikes” mean is that the Fed has judged the output gap closed, by whatever means, and therefore there is nothing left for them to do.

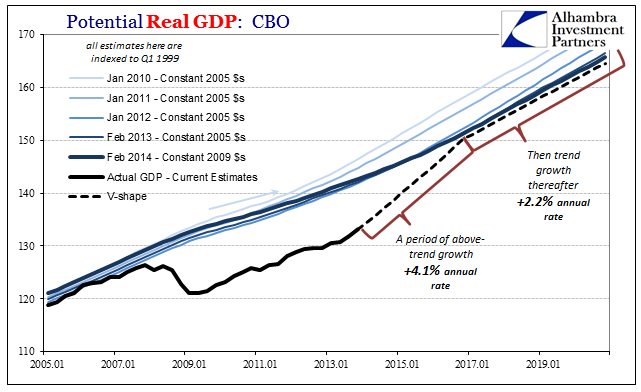

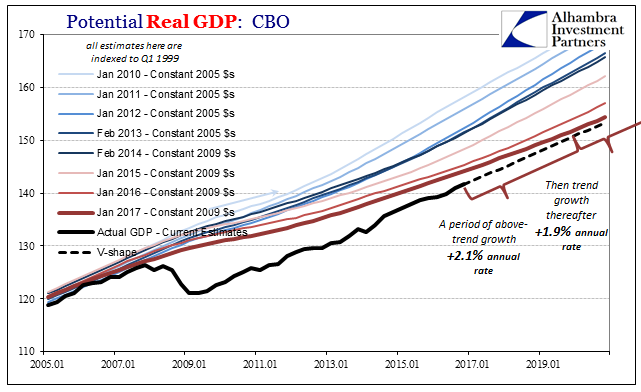

The economy is just the way it is, a result impeccably disappointing and illustrated by the trend in GDP during this transition in outlook; from what three years ago looked like (for all the wrong reasons) potential “overheating”, to what is now more consistent with the mere pitiful economy that is still with us today and going forward.

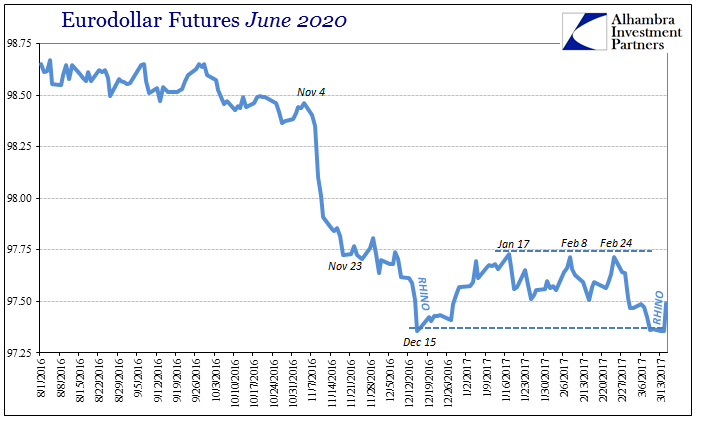

There is no acceleration or “strengthening” or whatever, an outlook that is now for the first time in a decade consistent with every Fed model. So on a day when the Fed supposedly raised rates, in all the relevant markets it was priced the opposite. In eurodollar futures, for example, the entire curve was bid, not sold as you would expect for a rate hike in a continuing string of them, and bid heavily. The June 2020 contract was up about 15 bps at one point, and closed very near that level, almost exactly even in price to where it was at the close on December 14, 2016. In other words, despite two “rate hikes” in between, the June 2020’s (as well as the rest of the curve beyond the shortest maturities) haven’t as of today budged in price!

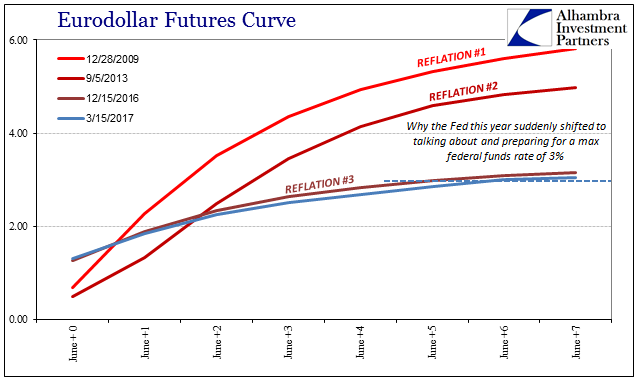

That is truly RHINO. What it says is what I have been arguing this whole time about the economic baseline, meaning that during “reflation” there was a vague sense that economic reality might be changed and that the Fed would have an opportunity if not to fully normalize than at least pull off something closer to it. It was always a vague hope because in truth nothing has changed (and hard economic numbers especially from places like China simply reinforce that interpretation month after month). It is the whole difference not where the RHINO’s cluster at the start but where they might all stop.

The media talks about the first of the charts below, the one that propelled all the dreams of recovery in 2013 and 2014 during that “reflation” flirtation. The Fed “hikes” rates today to acknowledge instead the second. The economy of 2004 is more than a distant memory, it belonged to an entirely different paradigm, a change that took policymakers a decade to figure out (that it happened; why it happened is a whole other story). I didn’t think it possible, but economists are apparently not (this time) the last to know.

Stay In Touch