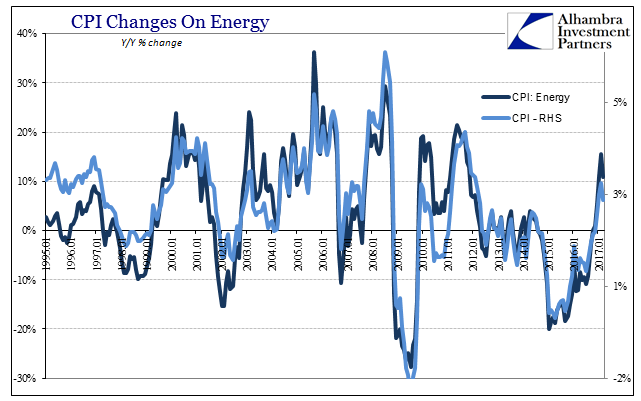

I suspect that Federal Reserve officials would prefer to not speak about inflation, nor ever again be asked about it. When oil prices first crashed at the end of 2014, they said it was a “transitory” phenomenon not worthy of much attention. Or if it was to be given some consideration, it was a benefit to consumers, another positive “tailwind” in an otherwise economy seemingly at the time full of them. Their view of the strengthening economy as indicated by the unemployment rate meant that whatever drag from WTI would promptly be corrected by the end of slack in the labor force.

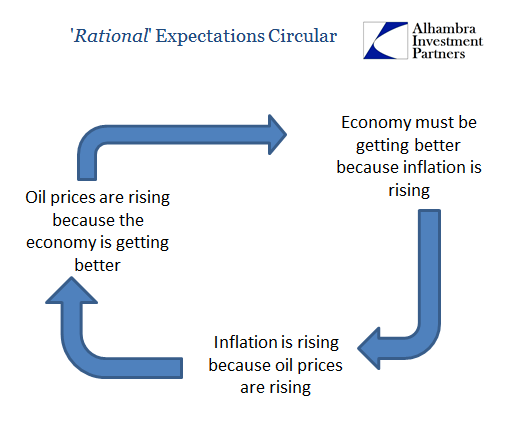

Ironically, it has been oil prices coming off the bottom that has accomplished what no QE could. Still, however, mainstream commentary about inflation fails to recognize that fact, as well as what “rate hikes” actually mean. For most of the media and a great many economists, the view as it existed in 2014 remains somehow operative. When the CPI first rose above 2% for the month of December, those were the terms by which that milestone was described – as if it was actually a meaningful economic achievement.

From CNBC in January:

U.S. consumer prices rose in December as households paid more for gasoline and rental accommodation, leading to the largest year-on-year increase in 2-1/2 years and signaling that inflation pressures could be building…

Price pressures are likely to remain on an upward trend amid expectations of fiscal stimulus from the incoming Trump administration. Republican businessman-turned-politician Donald Trump, who will be sworn in as U.S. president on Friday, has pledged to increase infrastructure spending and cut taxes.

There was really no reason to believe that was ever the case with regard to inflation except through the circular reasoning of the herd mentality that so infects economic commentary.

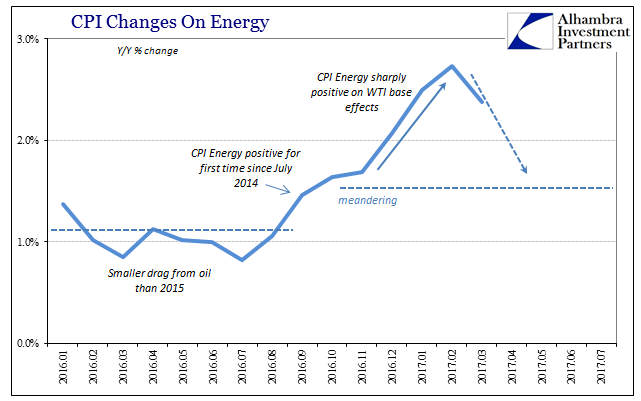

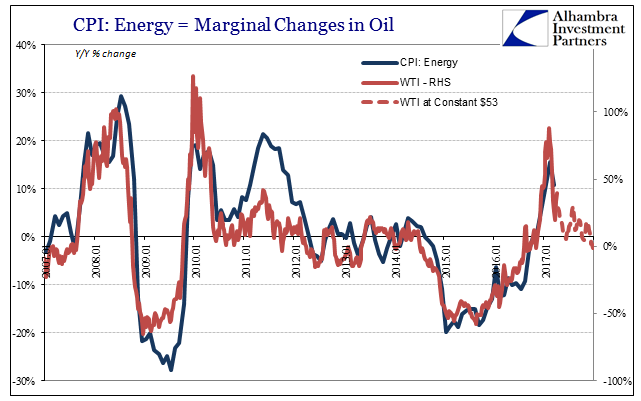

The euphoria peaked with February inflation statistics, the month of comparison to the absolute trough in oil prices. The CPI registered 2.74% while the PCE Deflator finally for the first time in almost five years reached the Fed’s inflation target. But these are only to be very short stays, for this burst of inflation is the only thing that will prove to be “transitory” and therefore another embarrassment for the $4.5 trillion Federal Reserve. It is oil prices not LSAP’s that gave the media this island of reprieve and it is oil prices that are already taking it away.

The CPI for March dropped back to 2.38% as the base effect from WTI scaled back. The average gain last month for the benchmark oil price was 33% compared with 77% in February. The energy component of the CPI rose 10.9% last month but 15.6% the month before.

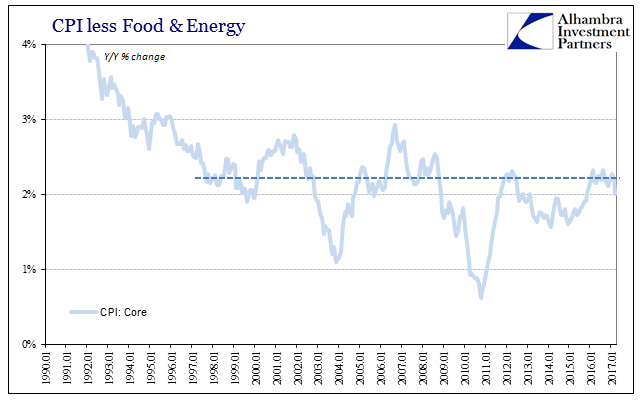

Stripping out food and energy, the so-called core index rose just 2% in March year-over-year, the smallest increase since November 2015. That indicates, like everything from GDP to retail sales, very little momentum in money and therefore economy in the US (or anywhere else) aside from the oil comparison (meaning that even oil prices exhibit no more momentum).

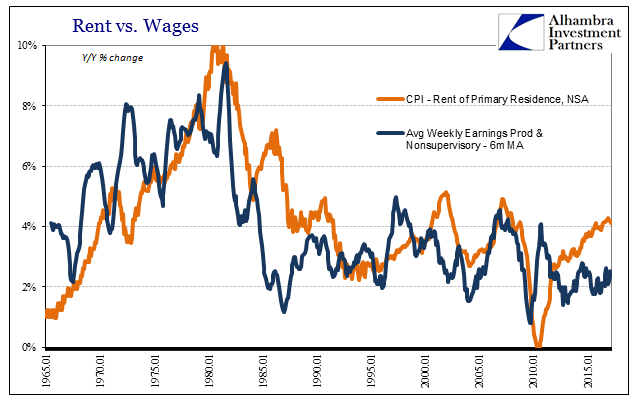

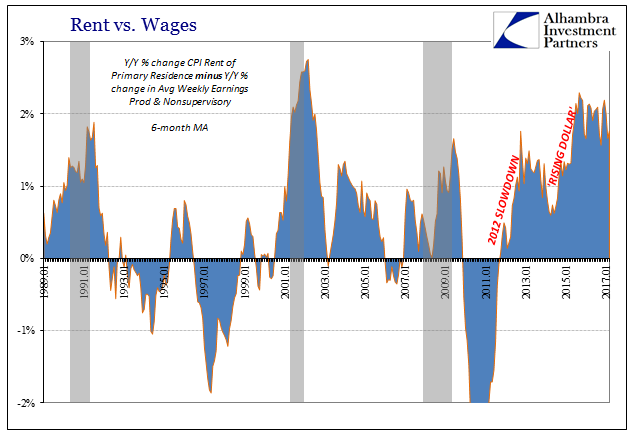

The only part of the CPI report where prices have increased at a robust rate is the very place where price inflation is the most economically damaging. The rental component of the index rose by more than 4% for the eleventh straight month, making seventeen out of the last nineteen (with the other two just barely less than 4%). With wages nominally rising by about 2% on average, this disparity continues to press consumers with conditions that feel very much like unending recession.

It all leaves monetary officials vulnerable to further questions about the inflation target. For a few months, anyway, they could let the media speculate about 2% inflation and what it supposedly meant, particularly combined with the untouched convention about “rate hikes.” In the long run, however, they will likely find it would have been better to more forcefully temper such unhinged conjecture with their economic vision they now share more closely with the bond market or eurodollar futures.

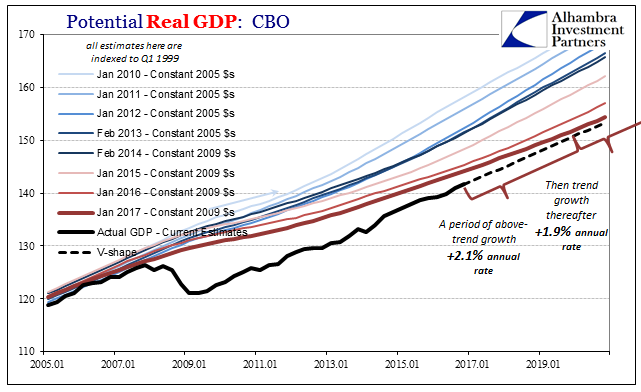

I further suspect that the Fed welcomes the distraction however temporary of it being credited success having nothing to do with its policies (or success, for that matter). The reason for that is the actual state of the economy which is nothing at all like what it was supposed to be as monetary policy “exits” from “stimulus.” It seems quite likely that they are content to have everyone believe the inflation target has been reached so as to distract from what to the mainstream would be a huge contradiction (“rate hikes” without the slightest hint of the end of labor slack and therefore the inflation monetary policy has been after for almost ten years).

Given the March CPI estimate, it is very likely that the PCE Deflator’s stay at 2% will be just the one month. Without that statistic at target, people might start to wonder why the Fed is really “raising rates.” Janet Yellen and her fellow policymakers don’t appear to be ready to admit just what is going on, especially in the humiliation of how oil prices did what they couldn’t and still can’t.

Stay In Touch