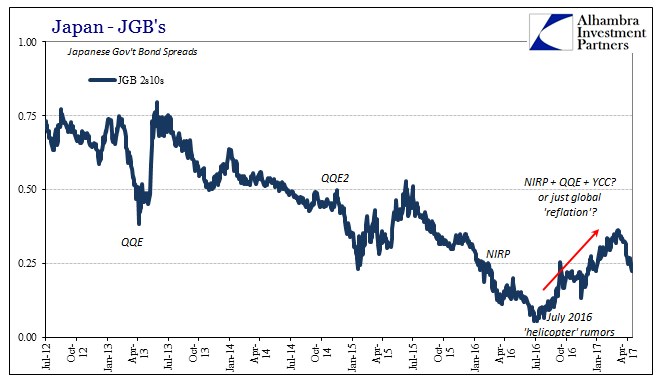

The more I look back the more I am convinced that this version of “reflation” was born Japanese. It all seemed to turn around in early July 2016, the very week that whispers of the, for some, long-sought “big one.” It was all over the financial press all around the world. Having gone as far as negative rates (NIRP) and finding only different ways to screw up, the Bank of Japan was firing up the helicopter at long last. The “deflationary” mindset which economists especially over on that side of the Pacific blame for more than a quarter-century of literally unbelievable stagnation might finally be vanquished.

Even in more measured quarters, it represented a possible regime change. Last summer was that in many ways for monetary policy, as it was the time in which central banks finally saw QE for what it could achieve – nothing. Therefore, even if you weren’t excited by the prospects of a money drop in Japan, more broadly even the serious consideration of the idea meant that for the first time in so many years central banks might stop fooling around with balance sheet expansion and actually try something else.

That something else, whatever other form it might take, at least had a chance of success where QE or NIRP so very clearly did not. It wasn’t huge hope, but it was hope nonetheless after more than a year of (justified) so very little.

For those excited by the “helicopter”, Japan’s policy meeting at the end of July 2016 was disappointing; for those merely looking for different, the Bank of Japan actually delivered if more quietly than the ridiculous noise generated by those other whispers. It wasn’t at all as sexy, but in terms of the genesis of “reflation” possibly far more substantial. Haruhiko Kuroda, BoJ’s governor, had ordered a “comprehensive” review of all its policy efforts to be released at its next meeting along with, it was widely believed, recommendations for new policies that BoJ might at that time act on.

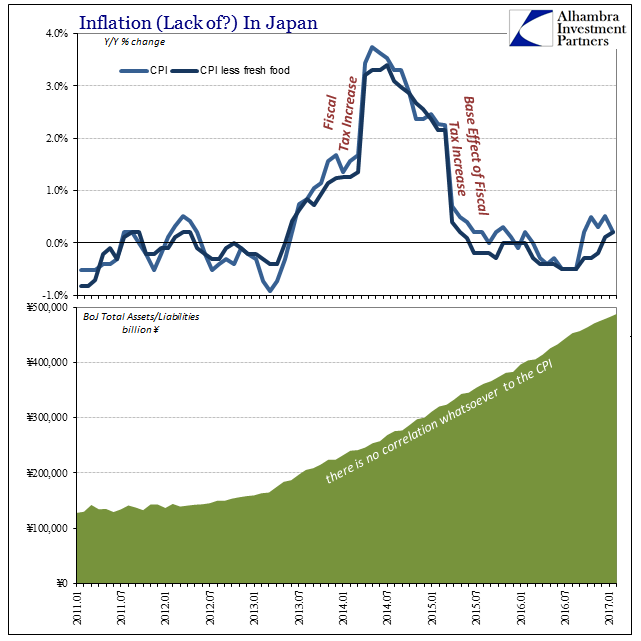

I have to further believe that practically no one has actually taken the time to read the assessment. Rather than performing a much needed reckoning for past failure in order to pinpoint exactly where to start anew, it is still another whitewash of recent history. It is not an honest examination intended to actually achieve the reform of Japanese monetary policy so much as yet again a justification for monetary policy largely as it is.

There are so many examples I could submit demonstrating this more illicit purpose, but the very first page more than suffices. After first in Section A declared that QQE was completely successful in raising inflation expectations, the report in Section B contradicts that very evaluation:

However, the price stability target of 2 percent has not been achieved. In terms of the mechanism described above, this is largely due to developments in inflation expectations. The following two factors have played a role in the development of inflation expectations. First, exogenous developments, including (1) the decline in crude oil prices, (2) the weakness in demand following the consumption tax hike in April 2014, and (3) the slowdown in emerging economies and volatile global financial markets, have lowered the observed inflation rate. And second, amid this decline in the observed inflation rate, inflation expectations — after having been largely flat — weakened, reflecting the fact that expectations formation in Japan is largely adaptive, that is, backward-looking.

Unless the Japanese to English translation is foul, the Bank of Japan’s “comprehensive” review seems to be starting out by saying that QQE was successful by increasing forward looking inflation expectations but that they didn’t actually translate into 2% inflation because the Japanese people formulate their inflation expectations only by looking backward. Huh? BoJ tries to make an affirmative argument for its polices by claiming that regular Japanese believe QQE will work but that it doesn’t because the very same Japanese find no evidence that it did.

And so it goes on from there, largely, as I wrote above, justifying how Japanese monetary policy has been terrifically successful except in every way that matters (none of its goals have ever been achieved).

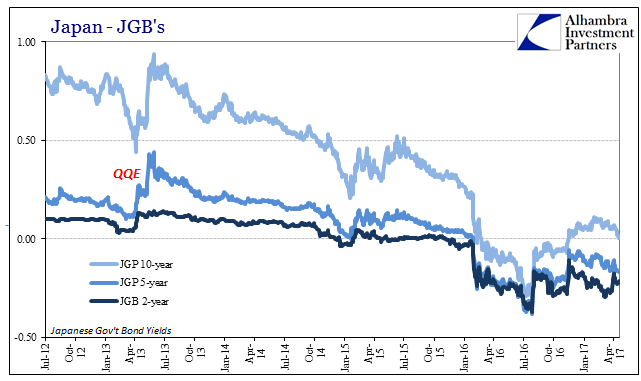

From such a foundation we can better understand both the quarter-century of stagnation as well as the monetary policy “changes” that came from this latest account. As the assessment was released in September 2016 the Bank of Japan switched from a monetary base basis for monetary policy to one more attuned, supposedly, to the shape of the JGB curve. Yield Curve Control was implemented because:

The experience so far with the negative interest rate policy, which was introduced in January 2016, shows that a combination of the negative interest rate on current account balances at the Bank and purchases of Japanese government bonds (JGBs) is effective for yield curve control. In addition, the Bank has decided to introduce new tools of market operations, such as fixed-rate purchase operations, to facilitate smooth implementation of yield curve control.

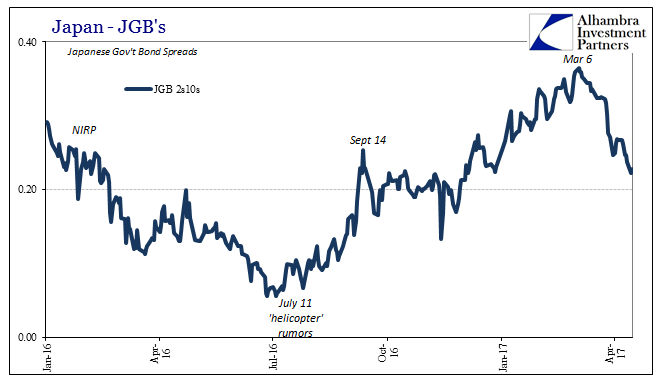

The yield curve did, in fact, steepen but not in any way that would lead one to rationally conclude the Bank of Japan had control over it. To the contrary, it appears as if the JGB curve rather than respond to NIRP plus QQE or even NIRP plus QQE plus YCC has simply followed global “reflation.” That includes, of course, the past six weeks or so where if the Bank of Japan is in control over the yield curve they are now doing it backward.

It puts quite a damper on those hopes from back last July, which reordered actually meant some chance that one of these central banks might actually get its act together. And like those who at the time wanted so badly to believe in the helicopter, these others, too, are now faced with such downright clownish disappointment. The Bank of Japan issued its assessment directive to make it seem like something could change so that nothing would change, and in truth nine months later nothing has changed. Somehow, that might be a shock to some (like all those record eurodollar or bond shorts).

What really happened is BoJ felt pressure after the very public fiasco with NIRP to make it seem like it was doing something positive, when in fact these particular central bankers like all the rest around the world are simply out of ideas. I wrote back in December:

I call that a depression, but doing so often leads to very emotional responses. After all, when envisioning depression, most people go right to the crash part and think little or nothing of what follows it. A depression after the crash might still see growth, but it is not growth in the same way it was before the event. A recession is a temporary deviation in the economy, but one that remains true to the prior trend, meaning potential. Output falls sharply, rebounds just as sharply (symmetry), and then slows when output meets potential all over again (the 2% inflation, 5% unemployment goal). A depression is where all that goes away and what is left are only questions of the sort Alvin Hansen once asked. Again, that doesn’t mean there won’t be growth, it’s just “growth” rather than growth that leaves a rising tide of populism in the wake of a lost decade full of positive GDP and lower unemployment rates.

The surrender of central banks on this point, though they will never, ever call it what it is, is very significant. I believe that one of the interpretations of all this from the “market” perspective is that there has been a belief going back to July and the Bank of Japan “helicopter” rumors that finally this official admission that QE didn’t work would lead to the next set of “stimulus” which would then produce the full recovery and normalization that the last set based on balance sheet expansion did not. This expectation or just hope, in my view, is what has been underwriting this “reflation” dream that has swept the world of late (it should be noted, however, that though reflation has been intense, it is, importantly, to this point still far less intense than the last time in the middle of 2013).

The primary danger to it is not that central banks might disappoint in that next round of “stimulus”, but rather that there won’t be a next round at all.

“Reflation”, I think, it starting to see just that. In the Japanese end of it, it is a real time example of how Japanification happens; it’s not zombie banks or some off-center mindset, it is through “comprehensive assessments” whose whole purpose is to preserve the status quo, to, again, make it seem like something might change so that nothing will change. In that brief excitement of market-driven reprieve, for some markets are spectacularly Pavlovian, all is forgiven and all is somehow forgotten. It’s gone on so long over there that the BoJ even passes off a blatantly laughable report as the basis for the latest one and nobody even notices or seems to care.

To think this is all uniquely Japanese is absolutely a dangerous assumption; read highlights from Boston Fed President Eric Rosengren’s speech from today about R*, balance sheet expansion, and the “next” time. Japan is just a glimpse of our future, ahead of us by maybe only ten years, though the rubbish has in its own American way already arrived. Nazism was once described as the banality of evil; central banks and the lost decades that follow them around like ghosts should be described as the banality of ineptitude. At some point, I guess we all just become comfortably numb.

Stay In Touch