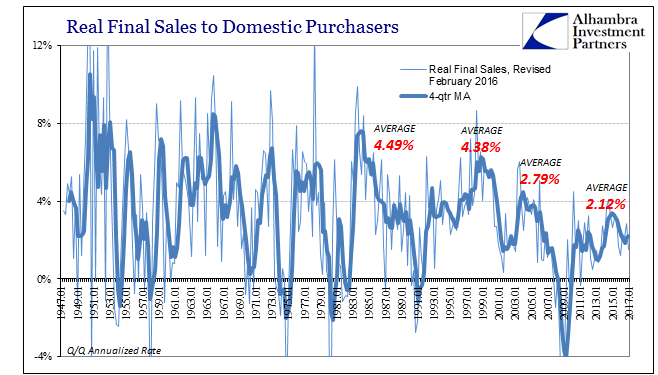

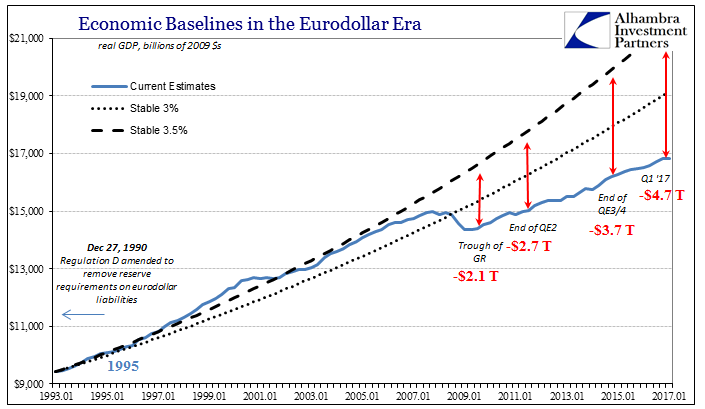

The internals of the GDP report were as ugly as the headline. The major source of weakness was what was supposed to be the sole source of strength – consumers. Real Final Sales to Domestic Purchasers, a measure of all goods and services Americans bought regardless of where they originated, increased by just 1.51% (quarter-over-quarter annual rate) in Q1. That was the lowest result since Q1 2016 and continuing to suggest no recovery at all in US “demand” from the now-unquestioned weakness of the “rising dollar” period.

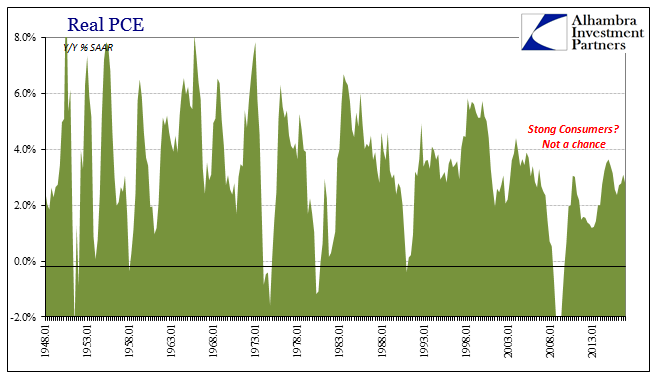

Real Personal Consumption Expenditures were barely more this quarter than last (+$10 billion, or +0.08%), as the PCE Deflator’s oil-inspired rebound subtracted a significant amount. Translating the statistics into the real world economy, the rise in gasoline prices, largely, crowded out spending in other places, leaving consumers without the ability to contribute anything to an expanding economy.

Lingering problems in consumer spending really should not be surprising given labor statistics over the past year and a half. Even the Establishment Survey has registered some level of significant slowing over that time, and despite the unemployment rate fully less than what was supposed to be “full employment” there isn’t even a small suggestion of wage inflation.

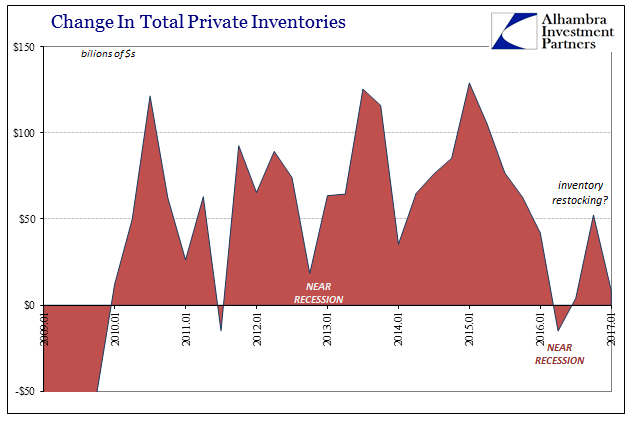

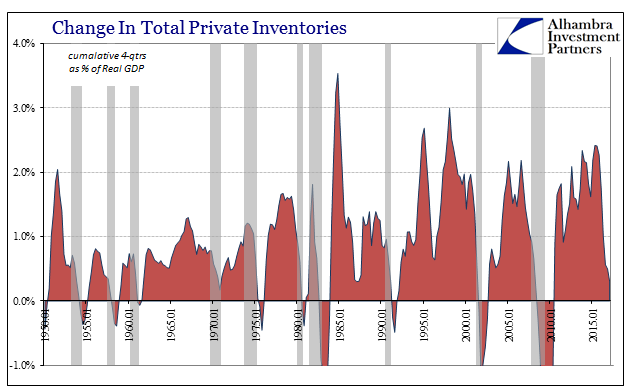

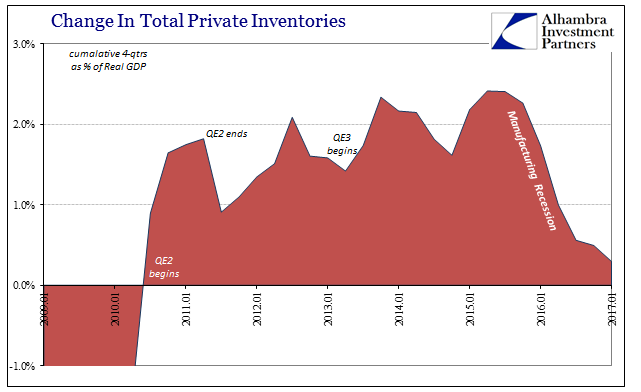

That is, of course, a problem all its own but especially one at this juncture. Perhaps the defining quality of any cyclical recession is the inventory liquidations. Like clockwork, you can nearly define a business cycle by the behavior of inventory. For what were surely all the wrong reasons (listening to Janet Yellen), inventory levels surged in 2014 anticipated the economy that was “supposed to be.” The “rising dollar” turmoil of 2015 pointed out the error, and US businesses finally started reducing their inventory buildup. It wasn’t, however, until Q2 2016 that the GDP estimate for inventory was negative in its outright change (as well as the second derivative that is part of the official calculation).

As “reflation” took hold as an economic as well as financial concept, it did appear as if some restocking was starting to take place even though the destocking during the winter didn’t actually reduce levels by all that much. But with consumers not following the “reflation” expectations, the retrenchment in inventory in Q1 2017 certainly makes sense. More important, though, is what happens next.

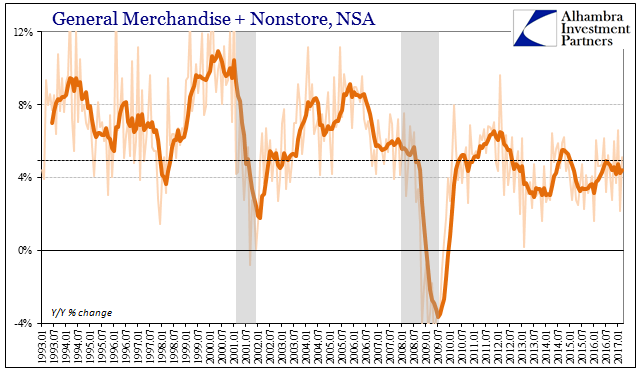

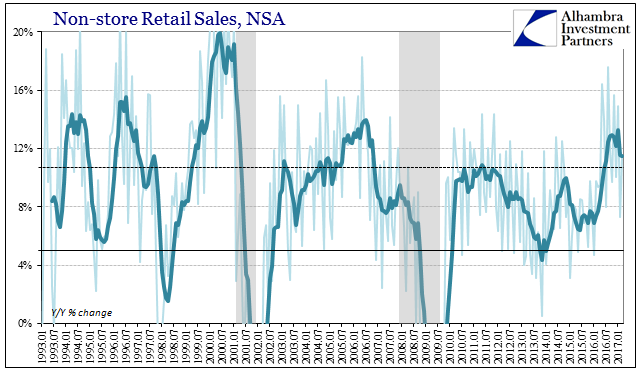

If consumer spending remains as it has throughout, we could very well see further destocking and maybe even liquidations. Not only are there serious concerns in the auto sector, it is that way for retail overall. The retail segment in particular is being radically overhauled at the moment, with store closures and potential bankruptcies at “cycle” highs above even last year’s alarming conditions.

As we find in retail sales, online shopping has beaten “brick and mortar” but having done so because of consumer problems this area of the economy remains exposed.

In other words, as retail chains go under the pressure to liquidate inventory is likely to be intense, and as in all previous recessions that creates negative feedbacks for even the healthier chains and businesses. Not only could the lack of inventory growth be a further drag on GDP, it could also subtract that much more from the real economy that can’t really afford it.

Though the past ten years don’t fall under cyclical categorization, there are still cyclical forces to this economy. The inventory portion has in slow motion contributed to the elongation of these processes, first in 2014 keeping the economy looking better than it really was and now drawing out the rebalancing that in a typical recession gets done in condensed fashion rather than being spread across several years.

The only uncontroversial interpretation from any of the GDP data is that there is a serious need right now for an actual burst of consumer spending. “Reflation” has been based on tomorrow without much regard for today, but the appeal of tomorrow at some point has to be related to legitimate signs from today that something will and even can change.

Why are interest rates so low around the world, including UST’s as the Fed “hikes rates”? Simple. What genuine basis is there to believe that burst of consumer spending is right around the corner? Economists have been predicting it for years now, and are doing so even today, which only helped define this jaded, cynical economic approach. Even if there is some small possibility that could happen, the risks including inventory are all weighted in the other direction. Still.

Stay In Touch