In February 2000, the FOMC quietly switched from the CPI to the PCE Deflator as its standard for inflation measurement. There were various technical reasons for doing so, including the CPI’s employment of a geometric mean basis (which was in 2015 finally altered to a Constant Elasticity of Substitution formula). But it was one phrase that in hindsight did the Fed no favors, as it explicitly cited the expected fruits of the PCE Deflator’s methodology which would “avoid some of the upward bias associated with the fixed-weight nature of the CPI.”

I am not a conspiracist by any means, but there are times when you have to shake your head as these economists lack even a modicum of self-awareness. The central bank has been given a legal mandate for price stability, so the average American might wonder why that central bank is allowed to choose the measure most inherently stable (and low). At the very least, it seems like a conflict of interest, one among so many.

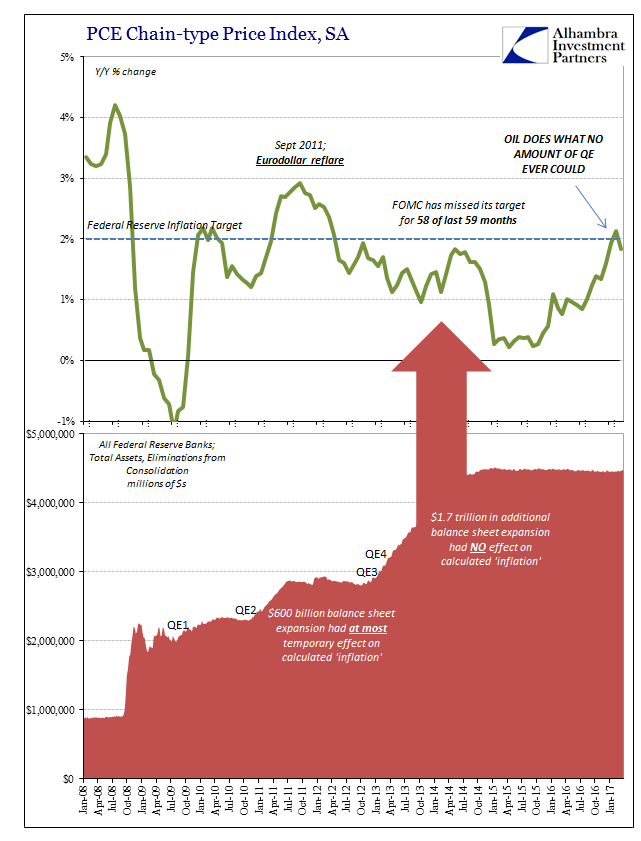

In that regard, the last five years have been almost fitting. The PCE Deflator has, as expected, avoided the higher beta tendencies of the CPI and in both directions. For that, it has remained stable, alright, but stable below target no matter what the Fed does with its own balance sheet. I hope the irony is not lost on them, especially as it was oil prices that “achieved” what they could not despite considerable expenditure on their part.

For the first time in 58 months, the Deflator measured above 2% inflation for February 2017. It was heralded a triumph of burgeoning improvement by the media, but for all the wrong reasons. To start with, the calculated inflation rate was barely above 2% despite what was an average 80% increase in oil prices during that month. That immediately proposed the anchor for the index remained quite a bit less than target still. Thus, without further oil price acceleration there would be nothing keeping the rate even near the mandate.

As expected, the PCE Deflator for March 2017 dropped below target once again. At 1.83%, it is still being held up by oil price base effects which are quickly fading (variable to the WTI price), an average 33% increase in March compared to 77% in February. Expectations for conforming inflation in 2017 were written out based on oil’s anticipated straight-line ascent, for if the economy is getting better then demand for crude would surely continue to increase, leading the price right back up toward $100 or more.

In that way, oil prices are again an almost perfect economic reflection, the junction between “dollars” and the harsh physical reality of them. This year may not be in near-recession conditions like last year, but it isn’t all that different, either. There remains a massive “glut” of oil (and now gasoline) waiting to be discharged by actual economic improvement. Without it, oil won’t be of any more help to monetary policy standards.

The wider economy is not, either, as both demand for energy as well as anything else. The stability of calculated inflation apart from this temporary crude distortion is clearly weighted lower, meaning sluggish. There is consistency of WTI and economy in that way, as the lack of (monetary) momentum continues to be indicated by both.

What was driving inflation expectations and therefore some of the “reflation” narrative was instead the same kind of straight extrapolations that have universally failed since 2007. Cyclical philosophy continues to be employed even though after a decade of nothing but anti-cycle reality (depression) the contraindication has been thoroughly established.

It suggests that, as noted Friday, there is as high a degree of denial in official channels as in the rest of the public. Nobody seems to be able to grasp the obviousness of it because the hugeness of its implications is an assault on all established sensibilities. In that respect, it is no wonder the “experts” are the last to comprehend because they have nothing else other than their carefully construed “rules” that rather than common sense govern all their thinking.

Maybe, then, the PCE Deflator will after some additional time actually achieve its task. By being more stable below the explicit inflation target, it could help policymakers at some point realize they have no idea what they are doing. It is, admittedly, a remote possibility, for after missing for 58 of the last 59 months, what’s a few (dozen) more?

Stay In Touch