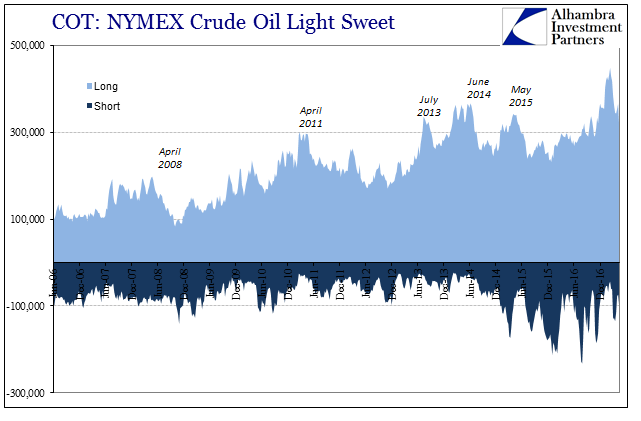

Back when the WTI curve was at its steepest contango, who was it that was buying up all that oil? A sheer vertical curve is an invitation to almost free money, very much like other curves everywhere else during the “rising dollar.” You could simultaneously buy crude at spot and sell it for delivery years ahead using a futures contract, pocketing the enormous spread between those calendar differences. Because the spread was at one point so large, storage and borrowing costs were easily absorbed making it the closest physical equivalent to “free money.”

And yet, contango persisted to such a high degree for a very long time. Like the breakdown in covered interest parity, what it suggested was a shortage of some factor allowing the “market” to very quickly arbitrage this backward situation (oil futures should be in backwardation, not contango). As usual, the suspect list was short, and right at the top sat financing, liquidity, “dollars.”

Those who did obtain the requisite monetary arrangements made out handsomely. Their story, however, is one of history rather than relevance to the current market conditions. What we should ponder now is those on the second leg of the arbitrage journey, those who in 2015 and early 2016 were buying up that crude oil headed into storage on the original buyer’s contango dime. Those contracts are maturing, indeed have matured, so that this second shadowy agent is being forced to make a choice that didn’t seem to be so risky at inception.

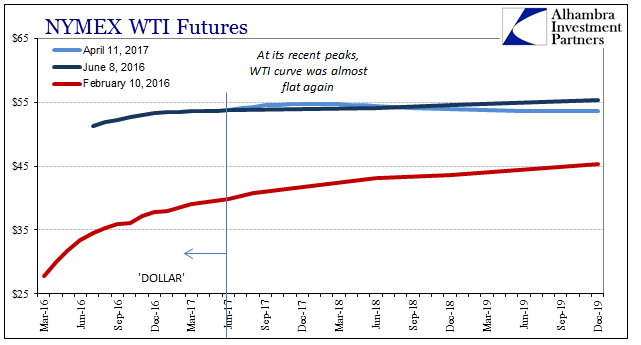

Clearly they were buying into the future over the past few years because they believed Janet Yellen when she said the oil crash was “transitory”, and then when she said there was no economic weakness, and now it is that such weakness is “transitory.” At the lowest point around February 10 last year, the futures price of WTI crude for delivery in June 2017 was around $40. It seemed like a sure thing all its own, an ancillary opportunity for “free money” left after those original speculators had cleaned up on contango. Surely there was no way oil would be anything less than well on its way back toward $100 by then.

Now that oil has stalled out, however, having done so for a very long time now, these second set of speculators are being pushed by time and the same factors to either take delivery of that crude at a much lower price than thought or try to roll it further into the future. While that’s not as dangerous a position for those who bought futures at or near the bottom, those lucky few are, well few. There are far more who are now at risk of substantial loss.

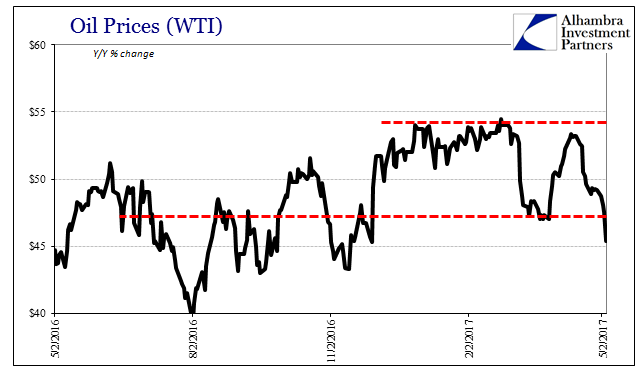

If you bought a June 2017 contract last April instead of February, given the current spot rate you are already at a loss. Worse, the futures curve since the middle of last year flattened out tremendously, and up until the past few weeks has largely remained that way. That has meant there isn’t much if any profit to rolling into the future, either. Thus, if financing conditions maybe start to turn sour, angst on the other end of the phone with your margin provider, there isn’t really any choice at all – you have to liquidate perhaps alongside everyone else herded into the same crowded trade under recovery pretenses.

The day after the ceremonial FOMC pageant, the markets aren’t capture by “hawkishness” but the prospect of more oil liquidations. As always, the behavior of crude is instructive as an intersection between money and physical economy. On both counts there are reasons to be very concerned if you are either the second leg speculator or the outlet who is financing that position.

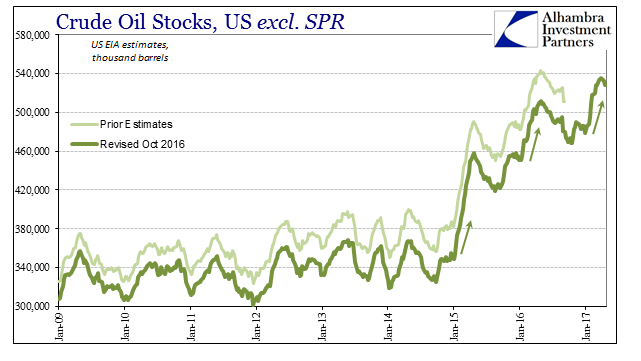

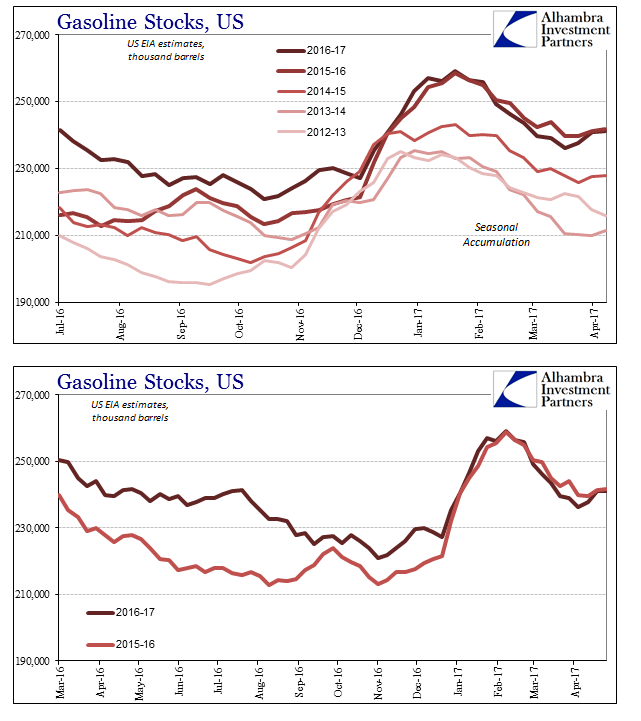

The fundamentals remain atrocious. Though the system is starting toward its seasonal drawdown of inventory ahead of the summer, inventories start from ridiculous levels. They aren’t just at a record high; that label applied to something like May 2013 when inventories rose a few percent above the prior year’s seasonal peak. In April 2017, oil stocks are more than 40% above that “record”, and overall the direction is still upward.

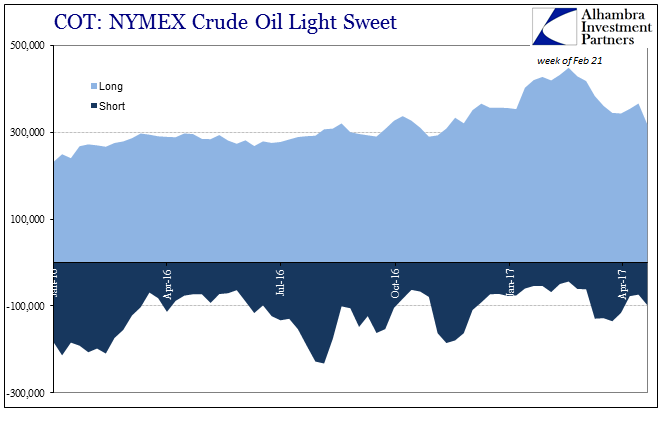

Despite the action, or really inaction in terms of demand, the overall marketplace remains very long crude. The crowded trade is insanely crowded. The farthest long position was reached by February this year, but even as enthusiasm has been forced to diminish due to all these accumulating negative factors it is still by historical comparison ambitious.

There isn’t even a small chance that crack spreads can save oil investors this year like last year. Gasoline inventories are as high into the seasonal pattern in 2017 as in 2016, which is major negative association for (economic) demand. That means additional excess crude is in all likelihood to continue on as excess crude rather than getting siphoned off even temporarily as a downstream distillate.

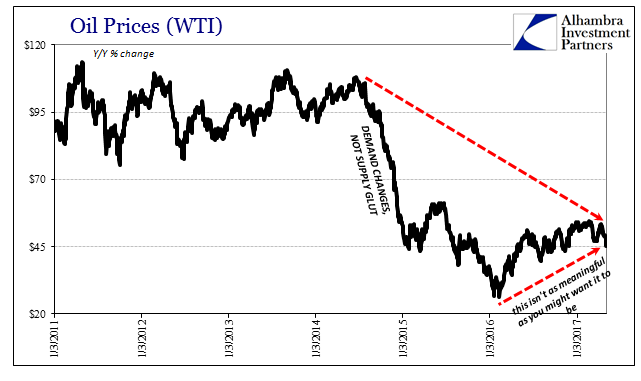

As always, all of this really gets back to the economy, and it has been consistently this way ever since the start of the oil crash once blamed on a “supply glut.” Economic predictions have run so many investors afoul of common sense, where undue over-optimism prevails for no other reason than disbelief. As I wrote back in January:

That’s why…it will be difficult for oil prices to more fully embrace “reflation” in a way that other asset classes have already. Before things can truly go back to normal, something must be done about what happened over the past few years. “Reflation” is mostly about what could happen tomorrow, but oil, in particular, can’t just ignore yesterday.

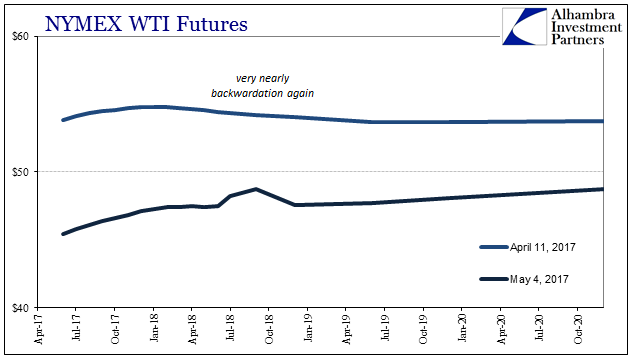

For the most part, it hasn’t. The WTI futures curve, for example, has found an eerie sort of stability pegged at around $55, with mild backwardation in the middle. That suggests, strongly, oil investors don’t expect oil to go much above that level for quite some time. With the familiar “hook” in the front end of the curve, the risks remain still to the downside.

The “hook” very nearly disappeared, but in this latest selloff it is back once again. Oil truly is the intersection of a chronically deficient economy and the “dollar” noose (or ratchet) that is squeezing the life from it.

Stay In Touch