The Federal Reserve’s Labor Market Conditions Index (LMCI) wasn’t put together until the May 2014, but it was back-tested extensively to ensure that its various assumptions fit with observed conditions in the US economy – no matter what those conditions might have been or be in the future. Even still, given its nature as an amalgamation of 19 separate labor market data points it can be noisy and easily misconstrued.

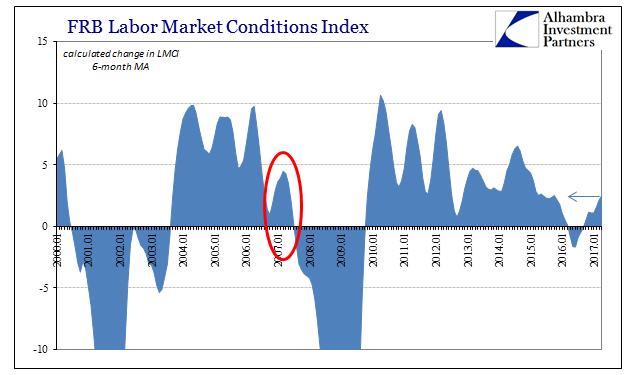

In 2006, for example, the LMCI picks up on the uncertain and dampening end of the housing bubble. It started out that year as everything else very strongly at +14.4, but turned slightly negative just four months later. The metric then suggested a labor market rebound heading into 2007, which had it existed at the time would no doubt have fit with the whole “subprime is contained” early crisis narrative. The LMCI, as mainstream opinion, seemed to suggest that the housing bust was concerning but ultimately not much more than a drag in those initial stages.

The index increased from +1.1 in September 2006 all the way to +6.2 by January 2007. It was, obviously, a meaningless rise as during the same months the eurodollar futures curve inverted at the front, as a whole range of other “dollar” indications suggested there was much, much worse to come in finance and therefore economy.

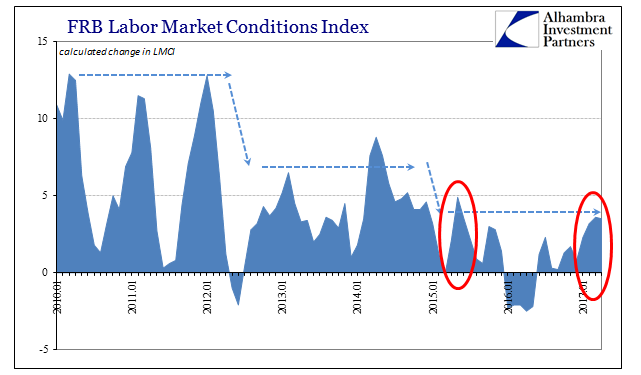

More recently, the LMCI indicated possible trouble at the end of 2014, right around the time it was introduced (ironically spoiling the very reason it was produced in the first place). The index by itself suggested relatively good labor conditions in early 2014 despite the “Polar Vortex”, registering +8.8 that April. It began to drag, however, though by December that year amidst almost euphoria over the economy was still +4.6. But as oil prices crashed, the index dropped to -0.1 for March 2015 in corroboration with a whole range of data. From that low and concerning level it sprang upward again, hitting +4.9 just two months later.

Like 2007, that, too, matched the narrative which was the oil crash and “rising dollar” would be little more than a temporary concern, maybe a “transitory” drag at most.

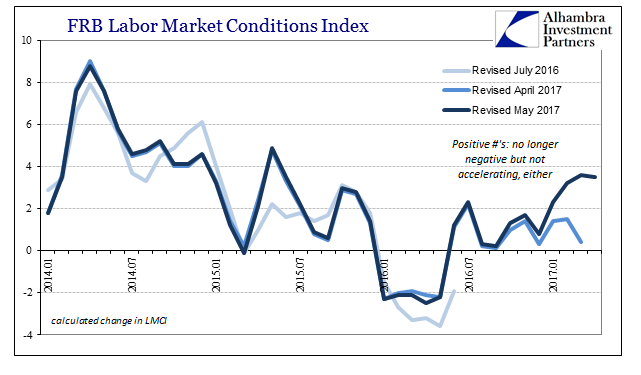

On this other side of the “rising dollar” economy, the index has turned positive again but up until the latest revisions the LMCI had remained lackluster at close to zero. The revisions made this month, however, show that especially in 2017 there might have been some acceleration where none had been indicated before. The question, therefore, is whether a revision from +0.4 as for March 2017 to +3.6 as revised is a meaningful change suggesting actual as opposed to imagined economic improvement.

The answer is an easy one, for as the examples above should have easily established there isn’t any daylight between +0.4 and +3.6. At best, the LMCI suggests a return to conditions like 2014, as if that was a surprising possible result (until the next set of revisions?).

In truth, though, the more apt comparison is not with 2014 conditions, rather according to just this one index more like early 2015 than anything else. At least in 2014 there were, as noted above, spikes closer to +10.0 as opposed to so far less than +4.0. It also isn’t clear what might have driven these latest revisions particularly for February and March 2017. The delayed data is mostly related to JOLTS (2 of the 19), but there are also private sentiment surveys included in the mix (Conference Board “jobs plentiful vs. hard to get”; NFIB “hiring plans” as well as “jobs hard to fill”).

In the end, it is the mere splitting of hairs. Realistic momentum and meaningful difference would be more like late 2001 – from -26.9 in October to +1.1 in March 2002 just five months later. Or the echo “recession” due to the “jobless recovery” that according to the LMCI was as bad as -8.5 in March 2003, only to yield to an upside of +10.0 by October of the same year. The Fed doesn’t publish a “margin of error” like political polls, but given the noisiness of the series they need to seriously consider it.

If they did, I have no doubt the latest revisions would be well within them, meaning we are left where we always are – 2017 is not 2016, but that doesn’t mean nearly as much as it really should.

Stay In Touch