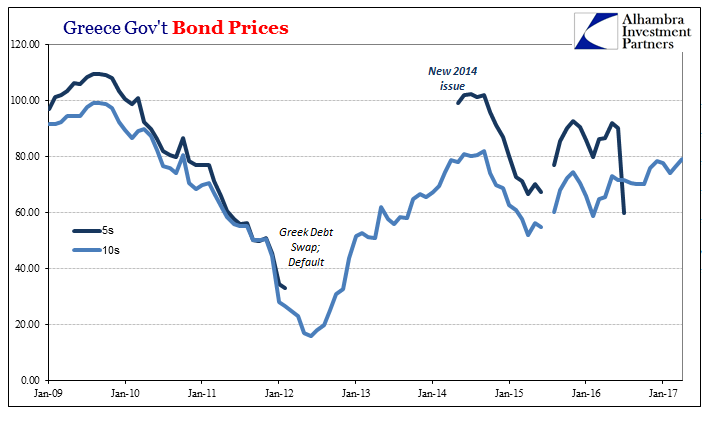

It certainly does feel like 2014 all over again, at least in terms of sentiment and the air of a carefree attitude. There are dramatic differences, of course, but with regard to emotion there truly doesn’t seem to be much daylight between now and three years ago. All that was left to cap the comparison was for Greece to take advantage in the bond market again.

As Greek assets rally on optimism of a deal to restructure the country’s crushing debt, Greek government officials are planning a bond issue—the first by the country in three years—possibly as soon as July or September.

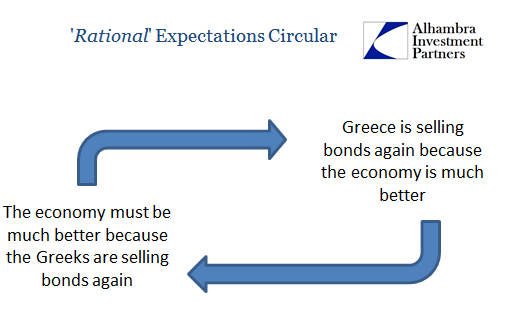

Sometimes it really is hard to keep track of what year this is. The above quote is taken not from a Wall Street Journal article written in April 2014 as you might expect, it was instead published in one today. Déjà vu doesn’t do this justice. It’s almost a rite of passage where no “reflation” idea can be complete(ly foolish) without the Greeks participating by taking advantage of these emotions. No matter how many times that country “restructures”, or remains in dire need of the next one, there is a sense of optimism outside looking in that will prevail.

“2014 feels a long, long time ago … It’s ancient history from our point of view,” said Andrew Wilson, EMEA CEO of Goldman Sachs Asset Management, who said his firm had bought bonds from Greece in 2014, which they have since sold.

“Everything has got to be forward-looking and you have got to say ‘What is the opportunity? What are the risks?’ … But it has got nothing to do with what you did a year ago, two years ago, five years ago,” he said, adding he would not rule out buying a new Greek bond.

Nothing to do with three years ago? Or five? Wall Street’s absurd infatuation with the random walk is one thing.

For me, this is pretty easy; I can just reprint what I wrote back then:

Investors have such short memories whereupon the “reach for yield” is all that matters. Nations that default so spectacularly usually are shut out of bond markets for more than just a calendar turn or two. The difference, of course, is the ECB. With that implicit/explicit guarantee, bond investors have bid any and all debt under that umbrella without much regard to any realistic sense of risk. This is even more basic than arguing over whether recovery exists or not – in other words the Greek economy may well have stopped contracting and found a bottom, but that does not erase the high risk attached to any credit derived therein. The most basic foundation of finance is risk/reward, yet here we have it completely obliterated.

There is a term in finance for when an intermediary openly and actively entices investors to ignore all means of sense in order to purchase the securities of a very risky prospect without inhibition: pump and dump.

In this case it is legal. Emotion is exactly what they are after. One more self-quote, this one from yesterday:

It results in repeated circumstances where every small positive, no matter how slight, is seized upon, amplified, and blown out of any proportion because continued depression just cannot happen. Every small signal of potential optimism is turned into the most convincing piece of happy evidence that has ever been conceived; only to be forgotten often in the space of just a few months, overturned by predictable reality brutally restored once more.

It’s not 2016 anymore, therefore “too risky” can only be just as relative. There is nothing people cannot convince themselves of when nudged toward those preconceptions, no matter how much they don’t actually make sense. Welcome back 2014.

Stay In Touch