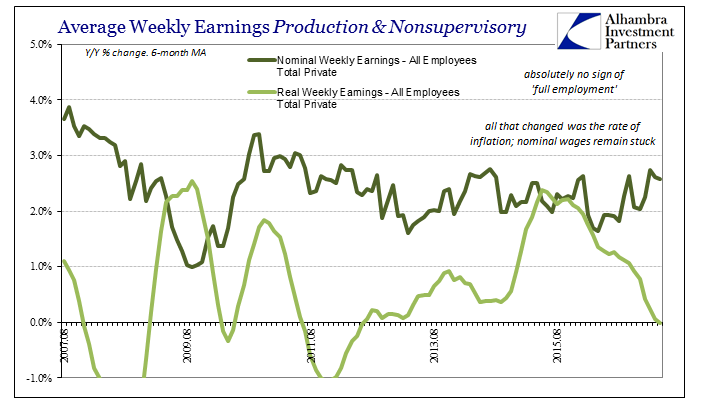

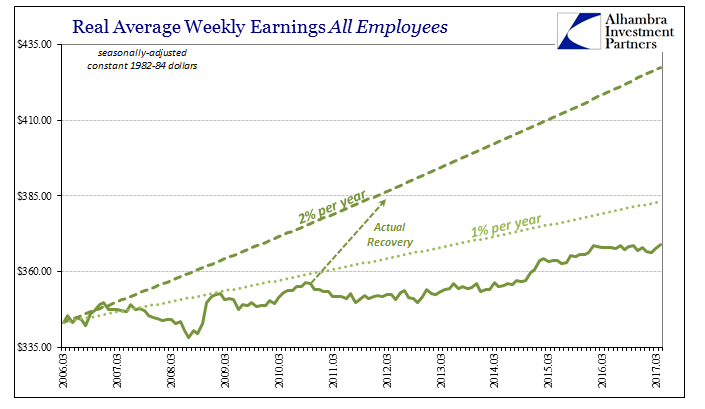

Despite a lower calculated inflation rate for April 2017, Real Average Weekly Earnings were only just positive for the month year-over-year. As the CPI had moved higher on the base effects of oil prices, real earnings were forced negative in each of the three prior months. The reason is, as always, no acceleration in nominal wages or earnings. None.

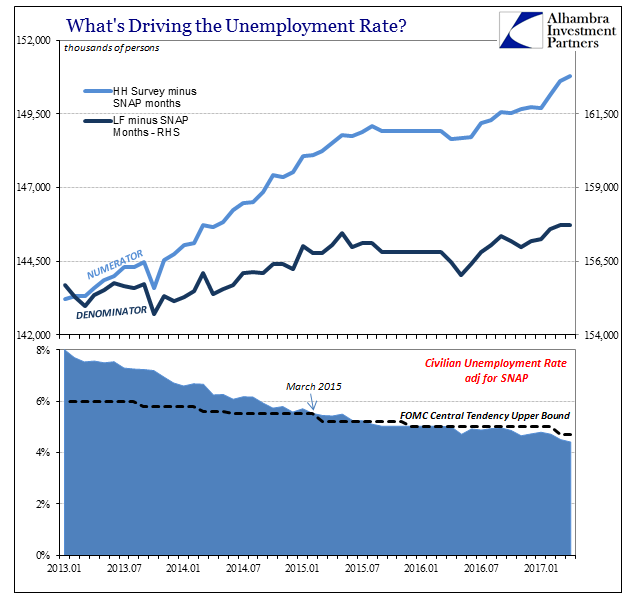

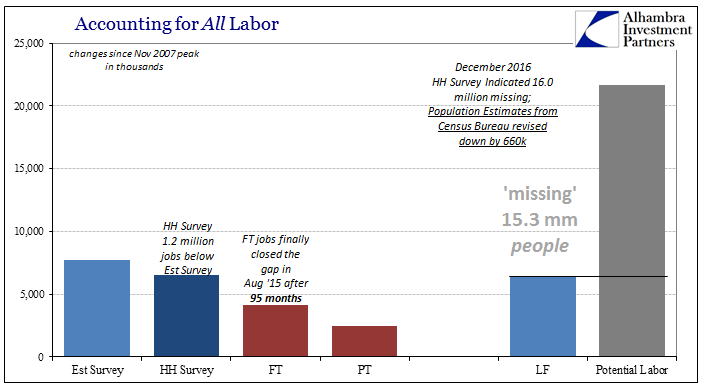

Given where the unemployment rate is, and how it has been this low for several years now, clearly “something” is missing. By that view of the labor market there is no longer any slack, as not only has the unemployment rate dropped to the full employment area it has gone so low so as to force economists to redefine full employment altogether. The reason is, again, because wage growth that should accompany this condition is totally absent.

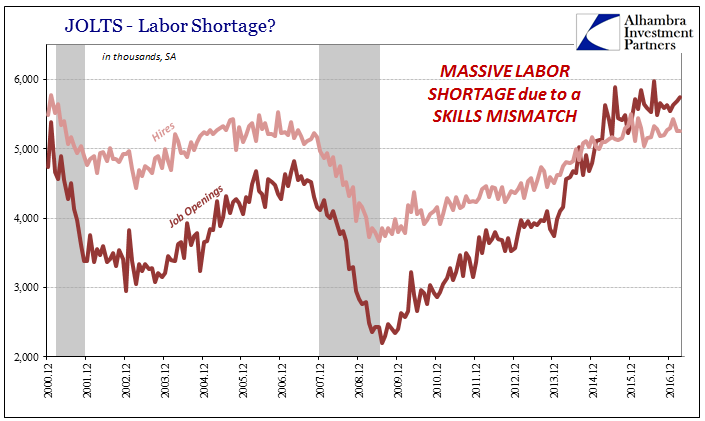

In many ways this is the flipside of the monetary policy argument made three years ago. In 2014, as convention posited a full economic recovery aided in no small part by QE3 (and 4), the rapid decline in the unemployment rate for a time made it appear as if the FOMC was in danger of being too slow toward the monetary policy exit. Quite a few economists and policymakers (“hawks”) started to worry that the economy was starting to grow too quickly, including a rapid increase in the demand for labor represented by JOLTS Job Openings, and that the Federal Reserve that was still purchasing UST’s and MBS at the time was not normalizing policy fast enough to head off what to these people was surefire inflation pressures.

To address this criticism, the “doves” began to describe weaknesses in the labor market statistics that suggested risks of economic “overheating.” Among them was Chicago Fed President Charles Evans, who in a speech given to the National Association of Business Economics in September 2014 suggested that the JOLTS Job Openings data wasn’t a complete enough view of the actual situation. Based in large part on that particular series as it moved very quickly higher throughout 2014 compared to the estimated rate of hiring, economists over the past few years have turned to the “skills mismatch” explanation for why the economy never did recover as expected after 2014 and further why QE then failed in every way.

Other statistics, Evans argued, showed that the Job Openings series was perhaps incomplete if not altogether faulty:

Why might firms report many more openings but be slower to fill them? Posting a vacancy is only part of the hiring process. Jason Faberman of the Chicago Fed, in collaboration with Steve Davis of the University of Chicago and John Haltiwanger of the University of Maryland, estimate that the overall effort that firms actually are putting into filling a job vacancy fell by over 20 percent during the recession. It has been slow to recover since and today still stands 8 percent below its 2006 peak and, for that matter, below where it was anytime during the last expansion.

In May 2013, Davis, Faberman, and Haltiwanger published a paper in the Quarterly Journal of Economics where they attempted to model essentially demand for labor beyond the level of mere Job Openings. Trying to better quantify the “matching function” between employers and prospective employees, they realized there was more to it than simply putting an ad in the paper (or posting one on Craigslist). Using their statistical techniques, Davis, Faberman, and Haltiwanger developed an index suggesting “recruiting intensity.”

DHI Hiring Indicators, a private research firm created by the paper’s authors, has been updating their recruiting intensity data each and every month (through February 2017). The index is described as:

The DHI-DFH Recruiting Intensity Index quantifies the effective intensity of recruiting efforts per vacancy by employers with vacant job positions. It captures the impact of advertising, hiring standards, compensation packages and other employer actions that influence the pace of job filling… The BLS Job Openings Rate captures the availability of job vacancies in the economy, whereas the DHI-DFH Recruiting Intensity Index captures the effective intensity of employer efforts to fill those vacancies.

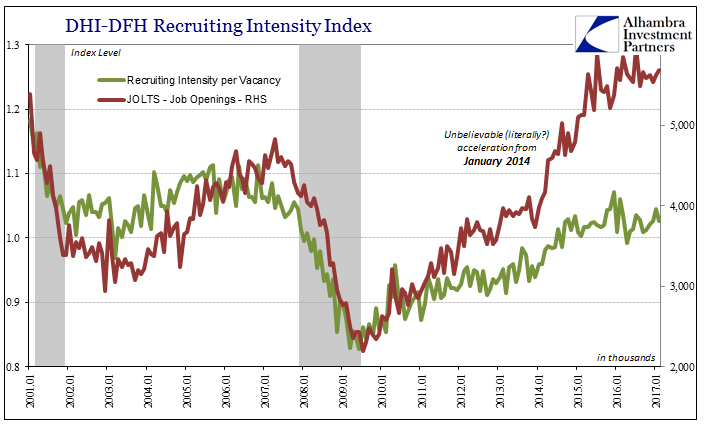

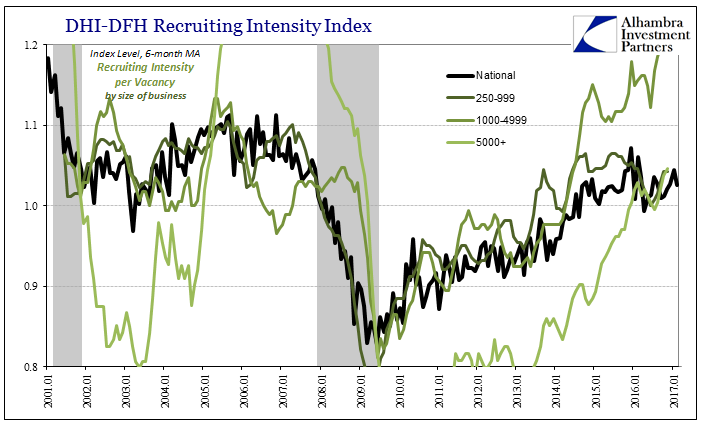

As with so many other labor statistics, the DHI-DFH Recruiting Intensity Index remains short of the prior “cycle” peak, having abruptly stopped its general recovery trend around the start of 2015. The disparity between it and JOLTS Job Openings is truly striking:

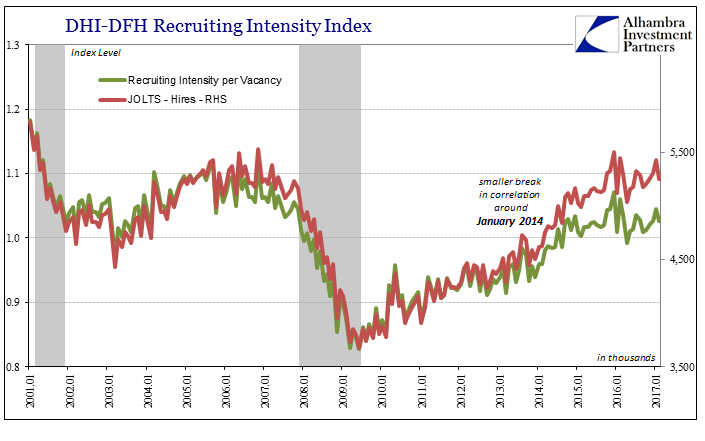

The JOLTS version is clearly more aggressive going back to 2011, but it is around the beginning of 2014 where it truly moves into another paradigm. Thus, the difference here might propose that though employers may be advertising for new jobs they aren’t doing much beside that lowest level of interest. Instead, the recruiting intensity index more closely follows the JOLTS – Hires data in being far more reserved about the labor market “recovery”, especially 2014 forward.

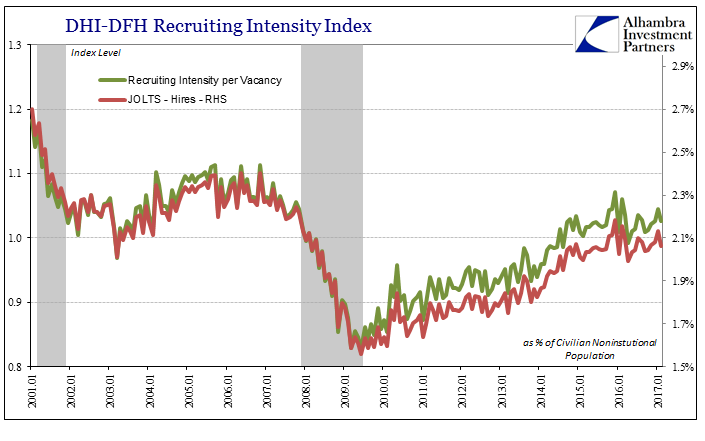

In fact, using instead the population-adjusted rate of Hires, the recruiting intensity index finds its best match at a clearly reduced rate when compared to the pre-crisis era.

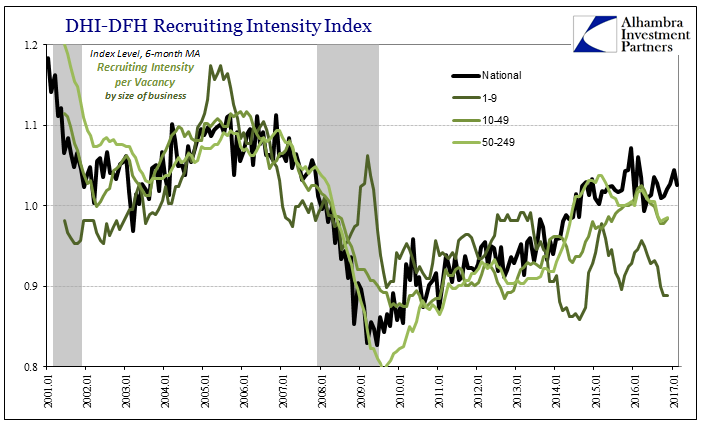

We can contemplate all the possible reasons why this might be the case, where businesses could be advertising new positions but not really trying hard to fill them, but Davis, Faberman, and Haltiwanger have already provided some crucial insight. Their index is further dissected by region as well as business size, and according to the latter breakdown there is a huge and lingering problem particularly among smaller sized firms; results that are perfectly consistent with other data as well as anecdotes that have suggested all along the “recovery” period was heavily skewed only to the larger businesses.

The ultimate irony is, of course, that when Charles Evans in particular referred to these statistics favorably in 2014 he was doing so from the position of a “dove”, a policymaker who felt that the unemployment rate wasn’t a good enough description of “slack” that by these other figures and estimates appeared to be considerable even after four QE’s and to that point seven years of little recovery. Therefore, his position in 2014 was that it was very much appropriate to more carefully reduce QE and then keep rates low despite what many were claiming about inflation pressures building up.

Now, as noted yesterday, despite little change in this labor market contradiction, it is Evans who argues that FOMC policymakers using primarily the unemployment rate as well as Job Openings (and the “skills mismatch” proposed by it) to properly justify their “hawkish” intentions have it completely right now and markets that are predicting low levels of money rates a long, long way into the future must be wrong. What changed between 2014 and 2017? The better question might be what didn’t change.

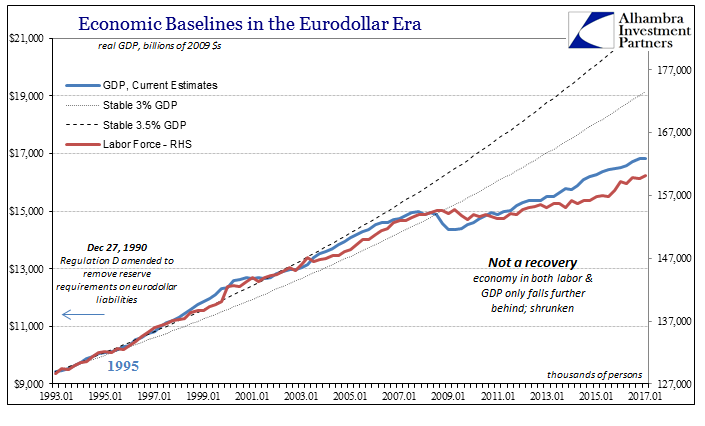

In truth, there likely is no contradiction at all, merely a matter of bad interpretation due to ideological bias. In other words, the JOLTS Job Openings series is completely isolated in its robust view of labor demand, not just in what we find here provided by DHI-DFH, but also in competing versions of Help Wanted indices like that created of online listings by the Conference Board (HWOL). All of these disparities are further tied together by what is the origin to all economic problems, namely the participation problem which mainstream policymakers before 2016 described as “cyclical” in nature, as Evans argued at that time. But being unable to solve the economic deficiency despite years of ZIRP and four QE’s now take in some places the opposite position so as to try to reconcile how they might have failed without being blamed for the failure.

The answer is truly very simple, meaning that the unemployment rate by its very construction is unable to comprehend the situation where the economy just shrunk. It applies itself equally and without prejudice to all situations, including where the economy is operating at full or nearly so capacity, and, like the last decade, operating at a much lower (and dangerous) state. Thus, it does not distinguish one from the other, leaving interpretation open to serious misidentification. Other statistics like those presented above aren’t necessarily created to capture all such conditions, but do a much better job in at least presenting the possibility the participation problem is and has been meaningful to the US as well as global economy (which is just common sense).

The idea of a “skills mismatch” is pure politics not economics (capital “E”, not small “e”). It is an attempt to point the finger of blame in every direction except the monetary one. As such, it is of no surprise that it is contradicted in so many different ways by so many other accounts, especially the lack of wage growth, and often by the people very trying to consider it for their own dubious ends, resting instead as it does on the flimsiest of data like Job Openings and the unemployment rate. To paraphrase yesterday’s conclusion, if the unemployment rate and JO is all you got, you really got less than nothing.

Stay In Touch