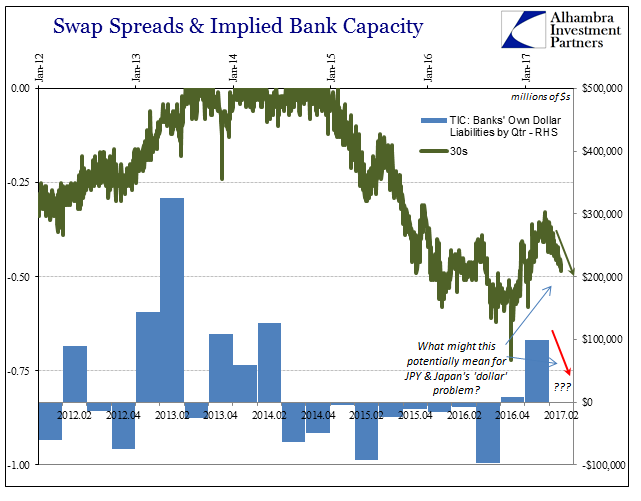

One of the most prominent features of the “rising dollar”, if not the “rising dollar” itself, was an almost out of control shortage in FX basis. Though cross currency basis swaps with Japan received all the attention, with very good reason, the basis was off against the euro, franc, and a host of other majors. These things happen from time to time, but they don’t stay that way and get all out of proportion like that. From that sustained situation we can only infer a lack of banking capacity, a shortage of money dealing that in the pre-crisis era policed these kinds of spreads, retaining predictable hierarchy (or, if you prefer, covered interest parity).

But bank capacity is not the only capacity. There are other monetary channels inside and around the eurodollar system. Corporations, for example, have easily raised funds from bond markets and through other means domestic or offshore where local banks might often run into trouble. Thus, it would be quite the cost savings for a company in, say, Japan to issue dollar-denominated debt and swap that debt back to local yen currency where the negative basis was large enough to offset any interest rate differential. It would have to be considerable because Japanese companies, like their European counterparts, can float bonds at or around 0% in their own denomination.

So it is far from a perfect substitute, an arbitrage boundary, if you will, and therefore is nothing like when money dealers roamed money markets with, they thought, unlimited capacity and potential. That brings us to JPY.

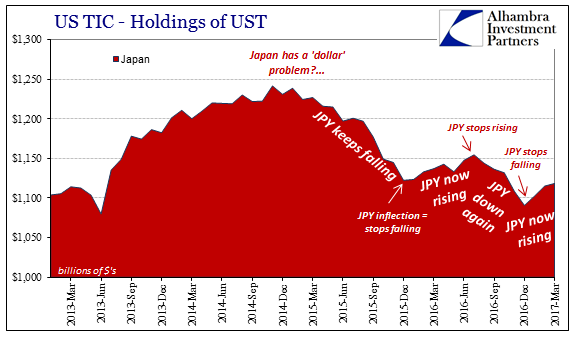

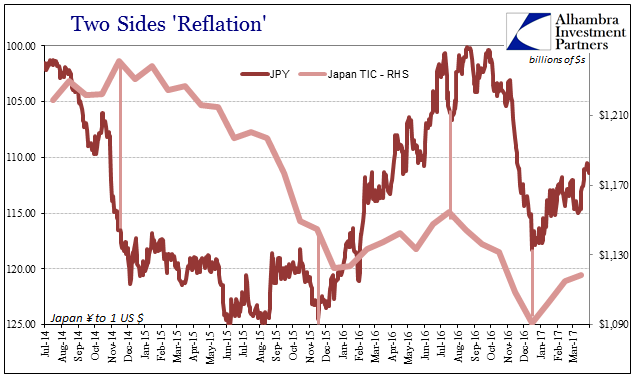

As difficult as it is to perhaps easily and intuitively understand, we can predict the (reported) level of Japanese holdings of UST’s by the direction of the currency. One of the biggest problems in understanding the wholesale dynamics of currency exchange is the belief that the rate of exchange is something like a price or a value. It is merely a number functioning in one of the basic monetary purposes, a unit of account.

Traditional monetary economics assigns a judgment to the direction of a currency, though in more recent days it doesn’t ever reason why. Under a gold standard or fixed exchange system, such would be relevant and even important; devaluation actually meant something in a way it doesn’t today (has any nation that “devalued” in the last ten years experienced the “stimulative” effects they sought? No.). Economists got what they wanted, for currencies float which really means their exchange rates are relative expressions of monetary mechanics rather than economic or financial fundamentals.

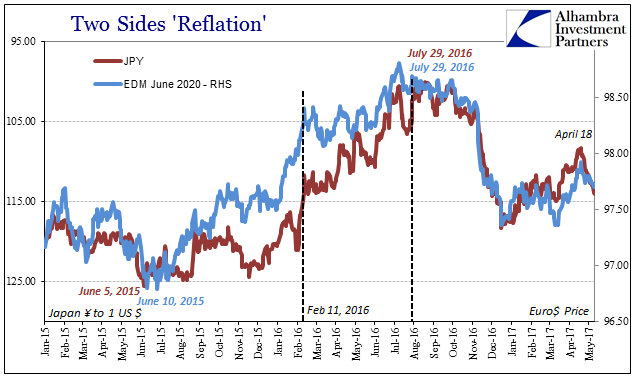

The “rising dollar” in Japan meant instead a yen exchange value that actually rose whereas the dollar exchange against the yen fell. This description by itself tells us nothing about what is going on, it is only through outdated views that we so often attempt to give these results meaning. To be perfectly blunt, the yen was supposed to drop against the dollar, therefore all FX arrangements were set as if that were the irrefutable baseline; basis swaps to naked forwards. If the yen instead rises (sustained), all that says is “something” changed to break with that convention; the direction largely irrelevant since all that matters is contra-convention.

If JPY is at 120 today and you expect it to be 125 next month and 135 next year, then your FX basis is deployed as if that will be the case. If everyone else thinks the same way, their positions largely match and agree with yours. Therefore, it is cheapest to put on positions that follow that pattern. If for whatever reasons enough participants are no longer able to continue to provide capacity to keep the trend intact, then increasingly counterparties are going to bid backward to try to entice other counterparties to re-establish predictability – even if it is non-bank corporate treasuries that can easily borrow dollars from the bond market.

The problem is therefore twofold; meaning how much of a premium it might take for those stuck in the old JPY to keep it all going at the same predictable pace, balanced against whatever it was the caused defections in the first place. This is basic monetary mechanics; if you need FX and was expecting and positioned for 125 JPY next month but there are fewer takers out there than you were prepared for, how much in reverse can you go to maintain a steady funded state before serious problems set in? 123? 120? Less?

The other matter is more fundamental. How low do you have to go to trigger arbitrage? In other words, if those offering FX become suddenly unwilling, at what level do they start being interested again? In either case, if the answer is too far off trend then it begins the cascade of position readjustment that eventually turns into a self-reinforcing trend, or run. In other words, everyone started out expecting JPY to go to 125, as it did in early June 2015, but then “something” changed where clearly “dollar” providers got spooked undoubtedly over exposures in China and related CNY. Where once you were sure there was no way JPY was going anywhere but 135, suddenly you, and they, no longer are. What was supposed to be riskless, or nearly so, can become fraught with it.

The more uncertain the market becomes, the more unsettled its providers. At some point, concerns become action, where you no longer wait to see if 135 is even possible anymore, you just start taking whatever measures to extricate before next year’s 135 becomes 115; or 105. But the less likely 135 is, the less money dealers are going to step up without an enormous return for doing so, if, after their own volatility calculations, they can do so at all.

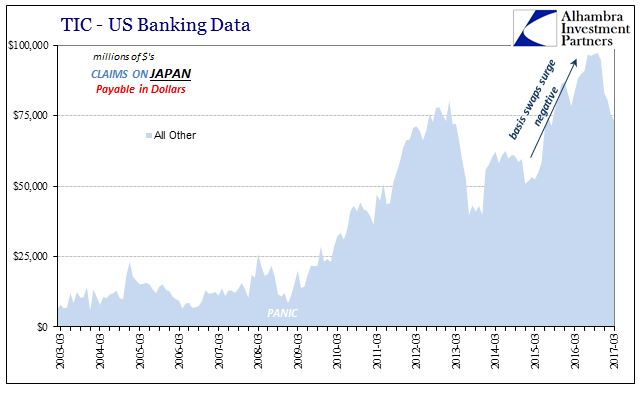

What the TIC data in its various forms describes is (potentially) alternate means of escaping what becomes like a trap. For Japanese banks further redistributing “dollars” it morphed into a situation no unlike JP Morgan and the London Whale, the usual wholesale nightmare scenario; the more you struggle, the more stuck you become. The sharks circle and even those eurodollar banks with spare “dollar” capacity are able to extract huge premiums because they know your desperation; afraid of JPY 95, you will pay anything to get “dollars.” Again, the similarity to a bank run is clear.

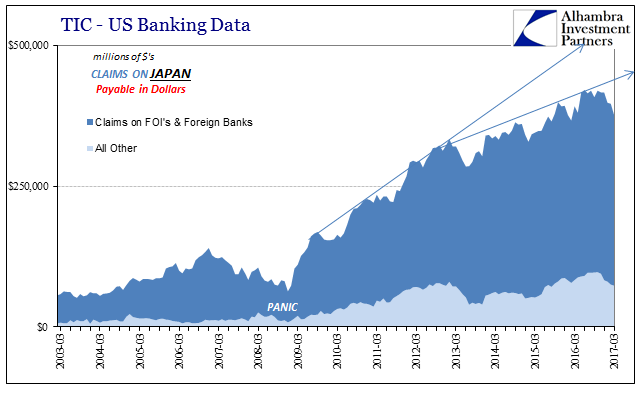

The moment an alternative opens up, you will jump all over it. What other choice is there? On July 29, 2016, the Bank of Japan opened one, misunderstood at the time for all the wrong reasons about “stimulus” and currency. They doubled the dollar swap aid ceiling for a program previously in place, but they also created a JGB/US Treasury swap where Japanese banks could use Japanese government bonds as collateral for some of the more than trillion dollars in UST’s floating around Japan in possession of the BoJ. Doing so meant a capacity for Japanese banks to circumvent the circling FX basis sharks by going right at other means like US$ repo – when the price was right.

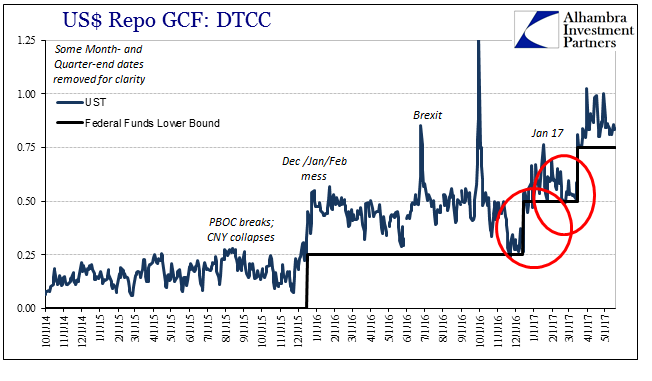

It still isn’t clear why, but around November 10, 2016, during the bond selloff, US$ repo rates suddenly became very cheap both in absolute terms as well as in relation to other methods. By November 22, the UST GC rate was actually slightly underneath the RRP “floor” at 24.4 bps.

Maybe it was a spillover of excess funds as MBS prices adjusted to the bond selloff, where reduced expectations of the future mortgage pipeline further reduced demand for MBS repo (especially TBA) and therefore create an available surplus for UST repo. Whatever ultimately was the cause, what was relatively expensive repo funding became suddenly relatively cheap, perhaps even cheap enough for Japanese banks that had an open channel into UST collateral through the BoJ. They could then, theoretically, circumvent eurodollar banks extending “dollars” at extortive prices in FX.

The more UST’s being deployed in the JGB exchange, the more “dollars” might have been obtained via repo or whatever else, the less demand from Japanese banks in FX, therefore a lower basis (as well as, in general, JPY, for a short while, going back in the “correct” direction again).

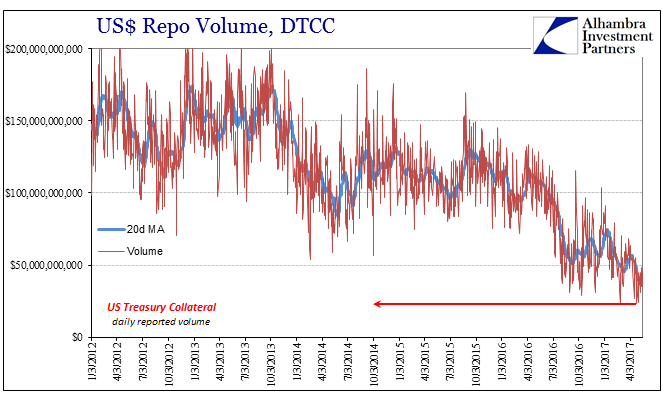

One of the primary problems with this theory is that reported repo volume, at least, has only continued to disappear on exchange. If Japanese banks were suddenly moved to US$ repo en masse in late 2016, it did not show up at DTCC. There have been anecdotes, however, including several I have heard directly that the lower exchange volumes are nothing more than a product of 2a7 reform, meaning that it was money market funds and the like who preferred cleared repo transactions rather than the more traditional bespoke, bilateral. If that is correct, and I have seen no evidence that either confirms or contradicts, then Japanese banks might have been present off-exchange back in the shadows where wholesale first began.

The other problem, as far as the TIC estimates go, is that dollar liabilities due to domestic US banks from Japanese banks have not pulled back; they have done so in a big way instead within the non-bank sector. The timing there perfectly matches repo, TIC, and basis.

Rather than invalidate the theory, however, I think it just means there are more pieces and more complexity to it (non-bank Japanese firms, maybe corporates, obtaining dollars from US banks and then further redistributing them to Japanese banks while the basis was very negative, then not so much when Japanese banks borrow repo and basis becomes less so?) than the rough sketch I traced out above. In general, however, I find it remains plausible that what I wrote earlier this year about the basis swap retracement fits the circumstances:

It is very likely that Japanese banks are simply getting out of the “dollar” business, lightening their “dollar” footprint as much as possible because they simply aren’t going to remain on the wrong end of it forever. Banks and financial firms will take losses in especially monetary arrangements if there is some light at the end of the tunnel – meaning that you will be rewarded for your losses by the (assumed) tremendous opportunity the loss-leading monetary intentions create for you.

If we narrow it down to just Japan “dollars” and China, this position becomes quite reasonable. The Japanese might have been willing to continue supplying “dollars” to Chinese banks at an ever greater and more painful cost if only to be best situated for when China gets to recovering again. If you start to believe, however, that China may never actually do that, a total reassessment just might be required.

A fortuitous (from Japan’s point of view) confluence of events toward the end of last year might just have conspired to let Japan’s banks off the “dollar” hook, at least temporarily. Did that reduction in FX pressure come about because of reduced pressure elsewhere, as described yesterday, or did it contribute in the first place to parallel “easing” of funding difficulties like observed in interest rate swaps? Or, like a reverse run, was it a self-reinforcing trend of “reflation”; lower FX “dollar” demand contributing to JPY “devaluation” furthering “reflation” sentiment and so on and so on.

Whatever it was, repo rates are back up again and since March 15 swap spreads back down – the very same day JPY lurched upward. If Japanese banks got out, it seems like they didn’t get all the way out or only did so for a short while.

The short version of all this is that Japanese banks seem to have been able to do something else about their “dollar” problem (if for a brief time) that they had a large hand in creating in the first place, both by picking up the eurodollar after 2011 when banks elsewhere in the world were getting out, making it more the Asian “dollar”, and further by making an ever downward JPY the baseline for it. That last part was a mistaken assumption almost certainly made by overestimating the effect of QE3 (and 4) as well as locally QQE, meaning restored global “dollar” liquidity that would have made it possible for JPY to keep moving down against the dollar forever.

If after all that it still seems an unsatisfying answer that is because it is. We really have no way to confirm what has actually taken place. The best we can do is make reasonable (we hope) inferences given the various data we do have and the prices of markets related to it. It’s like putting together a hugely complex puzzle while missing so many of the pieces. Even those who are inside of it struggle to comprehend what is going on.

What we do know is that the global system just doesn’t work like all the textbooks say it does (hell, the textbook says all these are almost completely separate systems with at most tangential relationships with each other). It adds another dimension of difficulty to the endeavor, trying to make sense of the (real) world almost starting from scratch. Given where we are, however, it is worth the effort even if, admittedly, big parts of the picture remain obscured and in the shadows. It’s not your father’s yen carry trade; then again, it never was that simple.

Stay In Touch