As we move past all the calendar effects pressed to the front of each year, some trends are starting to come into view. Not only are there trends but a few round numbers, even. The Chinese monetary system is one that is predicated on “dollars”; not all in dollar-denominated assets, but the type of foreign reserves that are consistent with the eurodollar system as it actually exists. Though it may seem just that easy, choosing to reverse that condition is not simply a matter of fiat.

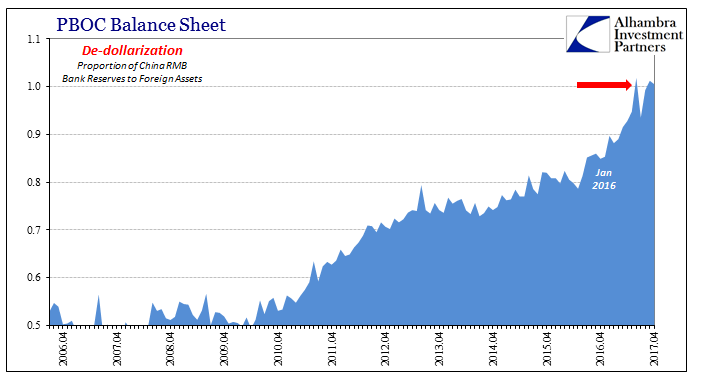

When crisis first struck China in the middle of 2008, there were two RMB of foreign reserves for every one RMB in bank reserves. That was not by accident, as even under the more flexible currency regime following the partial float in July 2005 the PBOC endeavored to maintain such a cushion for legitimacy and therefore stability. The global eurodollar markets, however, stopped cooperating so that in the years of “recovery” since then the Chinese central bank has been essentially diluting RMB.

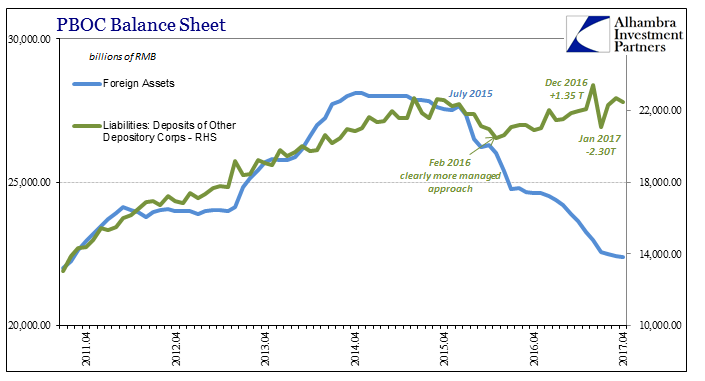

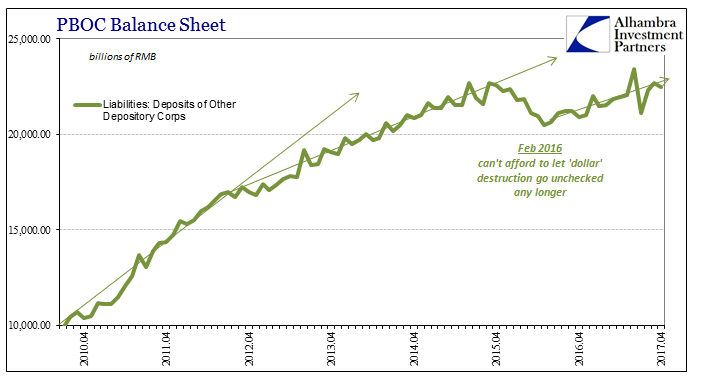

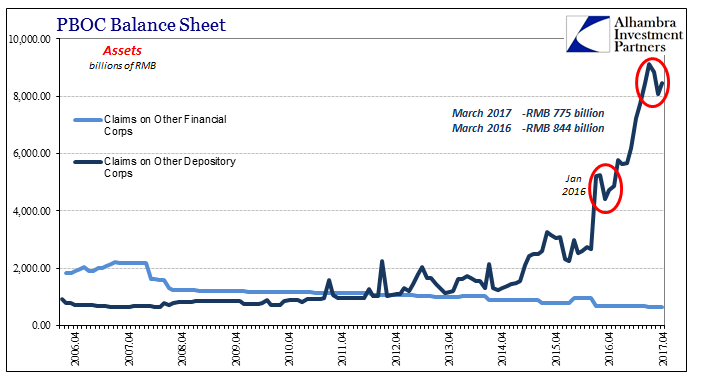

Not wanting to push what was at the time an extreme, the PBOC throughout 2014 and 2015 chose to let the banking system absorb the “dollar” reductions (cutting the RRR and interest rates instead) rather than further thin the RMB “dollar” basis. The result was by March 2015 heretofore unthinkable outright contraction in bank reserves (Liabilities: Deposits of Other Depository Corporations) that by the end of 2015 went way too far. Starting in February 2016, a switch was made but it could not be a complete one.

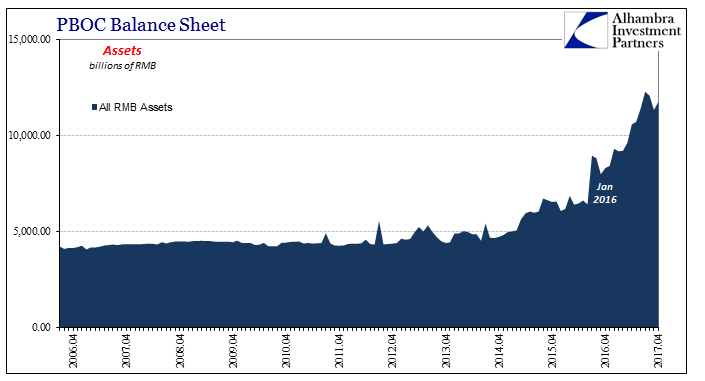

They would have to balance their “dollar” problem against RMB growth of however much. Bank reserves were put back on an upward trajectory last February, but it wasn’t the same as in the prior period. Constrained by again overall dilution potential, China’s internal monetary policy has clearly sought to balance the two conditions, the result of which has been a large injection of RMB but not so large as to totally de-dollarize.

As you can see in the first chart at the outset, the RMB injections were held low right at 1.0, meaning 1 RMB, roughly, in forex reserves for 1 RMB of internal bank reserves. That level was met in December, meaning that for January 2017 forward the central bank has apparently been trying to keep CNY and therefore the outward “dollar” conditions as steady as possible while at the same time limiting the amount of RMB growth so as to keep at this level of its “dollar” basis. Again, round numbers are usually no accident for that central bank.

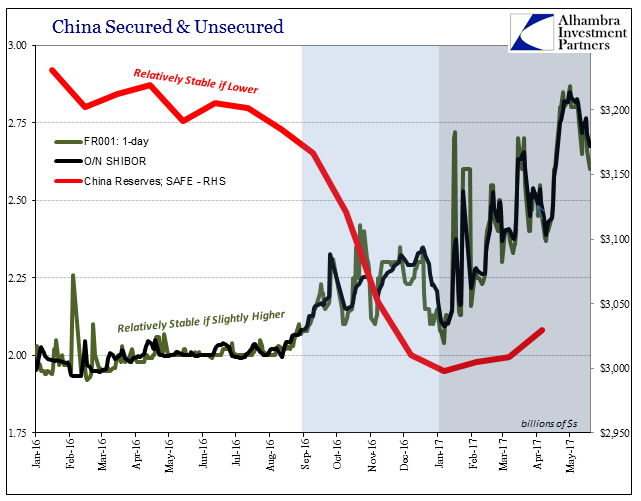

These are, however, far from cost-free tradeoffs and transactions. By maintaining a ceiling on RMB reserve growth the result is as you see above; increasing messiness as nominal money rates rise but do so in hugely volatile fashion. The mainstream confuses this condition for intentional policy, which it is but of a very different kind. This is not, as it is widely proclaimed, intended tightening as a matter of direct monetary policy but instead the (still rising) costs of trying to give “reflation” whatever best chance it may ever have.

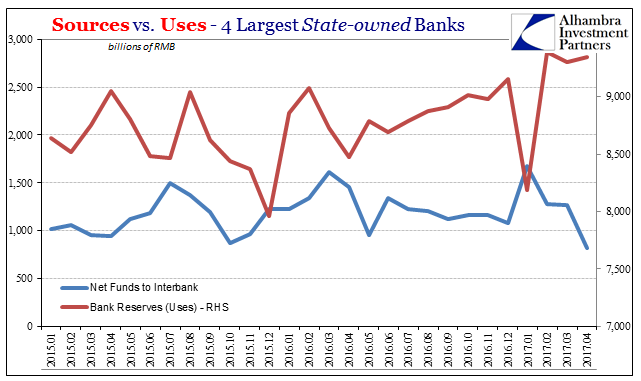

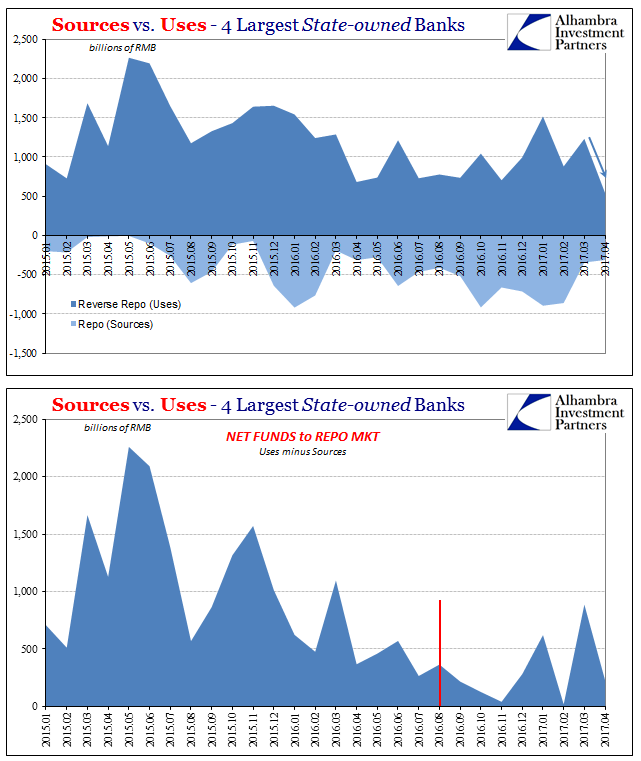

The lack of reserve growth has left China’s Big 4 banks without excess liquidity for which they might maintain loan targets but also a sufficient surplus to be forwarded into Chinese money markets; especially China repo. Despite four years of contraction, the monetary system on that side of the Pacific remains chronically unstable due to the absolute rather than relative state of the true global reserve.

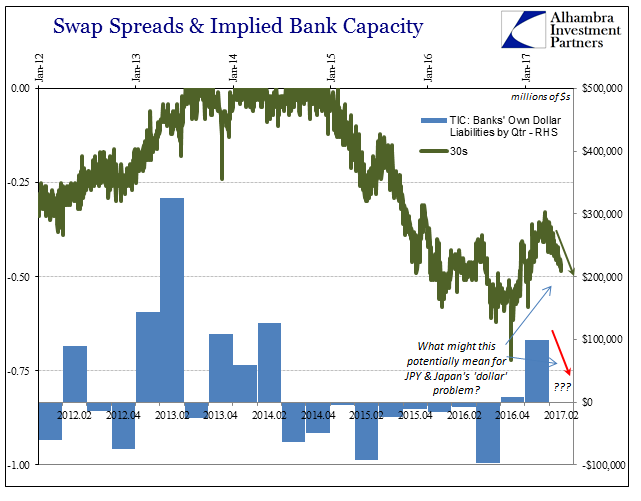

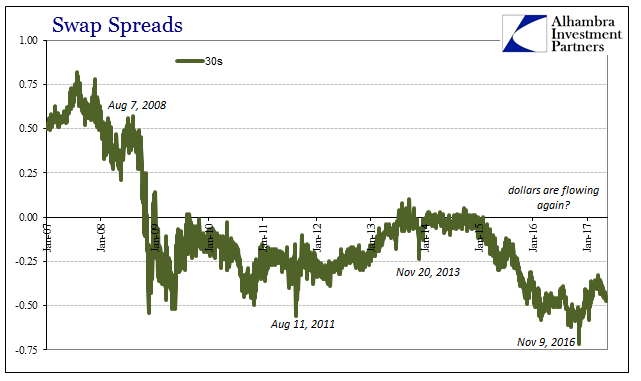

The multi-trillion dollar (and tens of trillion RMB) question is how long the PBOC can hold this position? They have staked out CNY around 6.89 no matter the cost, leveling off official forex reserves at $3 trillion and dollarization at 1 for 1. These round numbers, again, aren’t likely by accident. However, China’s internal contradictions will demand that something change and not all that far down the road. Chinese officials clearly hope that is the “dollar”, meaning that eurodollar conditions become favorable again and “capital inflows” return if either on their own or through the contributions of this artificial window of what seems like at least CNY stability.

Under that scenario, bank reserves could rise with them and Chinese banks would be freed, or a condition more like it, from this monetary ceiling. The problem with betting on such a conditional situation is when it doesn’t pay off. Long shot or not, absent a real as opposed to faked (as in the current case; PBOC forward transactions either direct or through Chinese banks are obscuring the position of forex reserves in the present) “dollar” circumstance the costs will only continue to pile up month after month.

Those would include a further choice in the near future; either let bank reserves contract all over again like in 2015, or continue to inject RMB and surpass 1 for 1 in de-dollarizing Chinese money. The former would likely lead to conditions in China’s as well as the world’s economy behaving also like 2015, while the latter might end up the same way, too, if for only further undermining CNY and leading to the same self-reinforcing cycles as during those times (CNY down = BAD).

The issue for the PBOC is not, therefore, “tightening”, but what do you do caught between a rock (“dollar”) and a hard place (de-dollar)? In other words, there may not be any right answer, rather just a series of ad hoc bypasses and emergency-type measures that leave the Chinese economy dealing with illiquidity and volatility anyway, and still facing at best uncertain monetary prospects.

Stay In Touch