If I was forced to use only one word to describe most that is wrong in the world today it would be “economists.” The global economy is stuck in a depression that has already lasted ten years. Because of it, the world’s social and political order has frayed around the edges and threatens to do much more than that (in some places already in progress). Meanwhile, economists who are no experts in anything other than statistics and regressions have all this time stuck with their statistics and regressions.

ZeroHedge reports this morning on some (more) interior confusion by economists at one of the big banks. The Fed has “raised rates” and yet according to their calculations, all their calculations, financial conditions are for them paradoxically easier.

The supportive trend in financial conditions evident in our FCI is not dependent on the methodology we use to construct our index. Indeed, the signals from various alternative FCIs – including from Bloomberg and the Chicago, Kansas City and St. Louis Federal Reserve Banks – are similar: financial conditions have eased materially in recent months even as the Fed has raised rates.

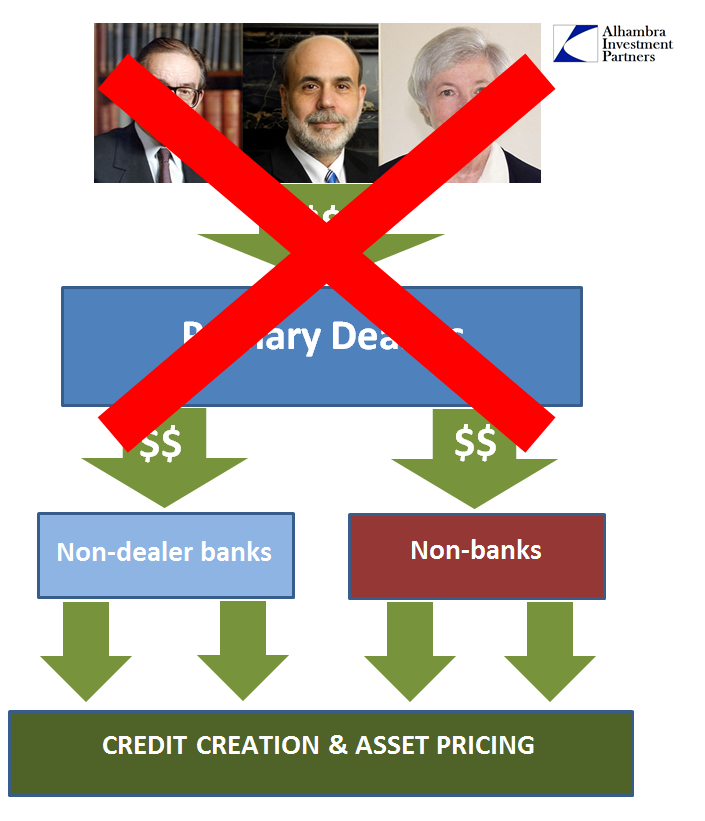

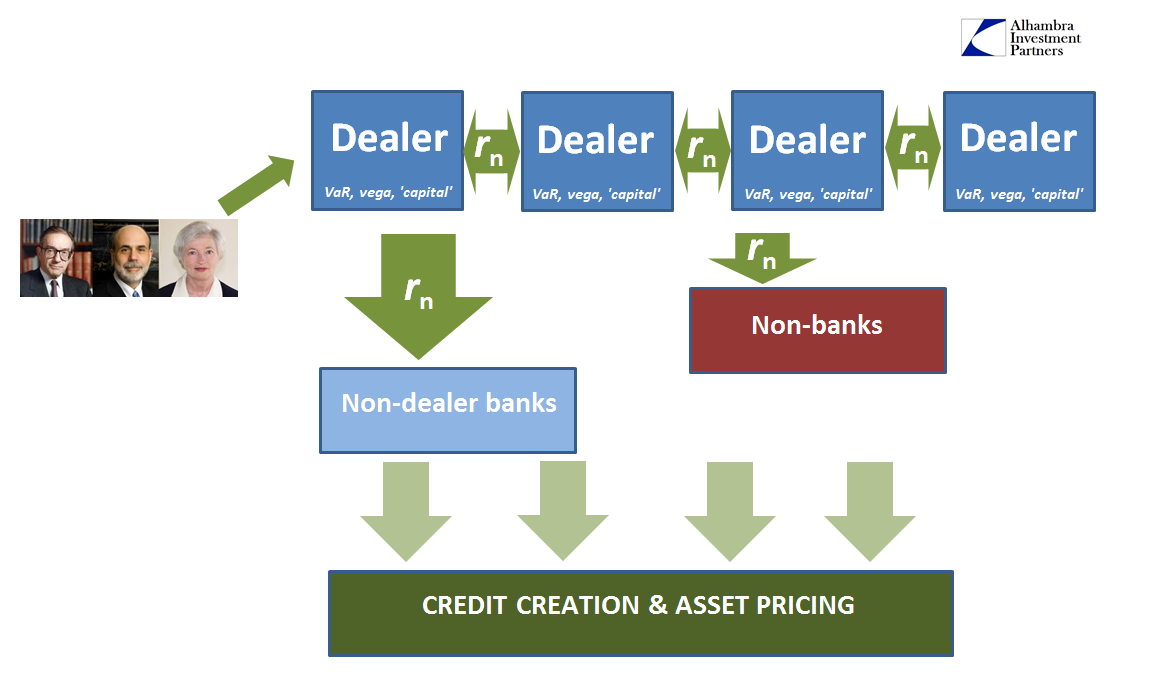

It’s almost as if the Fed doesn’t really matter, which for economists at this one bank as well as everywhere else just cannot be. Therefore, these same people will spend hours upon hours upon hours trying to unravel what for them is a mystery. The system is supposed to work how the system is supposed to work, where the central bank is the center point of everything.

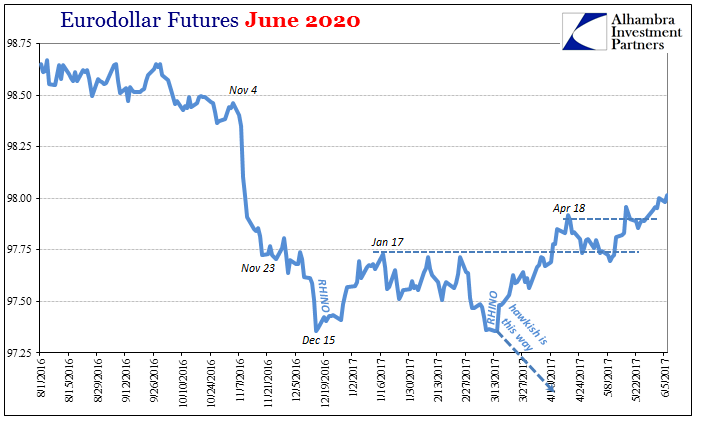

This is not, of course, the first time this has happened. It has been a fairly regular occurrence going back a very long time. When discrepancies like this arose before, meaning pre-crisis, practically no one noticed because the front side of asset bubbles are the fun side and it (seems to) pays not to notice. In early 2007, for example, the FOMC itself held much the same debate if in the other direction. Markets like eurodollar futures were projecting lower interest rates very early on which confounded and aroused harsh reactions from policymakers.

MR. DUDLEY. Well, another explanation is that the economists who make the dealer forecasts are not the traders who execute the Eurodollar futures positions. So that’s a possible alternative explanation… A number of people that I’ve talked to in the markets have said that this is what they thought was going on, and they advised me not to take what was going on in the Eurodollar futures markets literally because they felt that some of them were putting on these positions in case of a bad scenario that led to significant reductions in short-term interest rates.

Fed officials like Bill Dudley, who was at that time head of the Open Market Desk at FRBNY, confirmed with economists at the Primary Dealer banks and found them largely in agreement with the Fed’s position. Imagine that, economists agreeing with other economists, both taking the position that markets must be wrong and econometric models unassailable.

It didn’t matter that it was actual traders at these very same banks who were doing all the buying in eurodollar futures, meaning that the traders were ignoring their own economists and projecting a very different near- and intermediate-term outlook. As we know but too well today, those traders were actually still way too optimistic but at least were moving in the right direction. Policymakers and economists never caught up, and are still lagging far behind because for them nothing changed. The events of 2008 were some random “tail risk” that once ended (by the “courage” of one of their own, Bernanke, no less) was a matter for historians alone. They took nothing from it, not even to be more cautious about simply dismissing inconvenient market evidence in favor of the echo chamber.

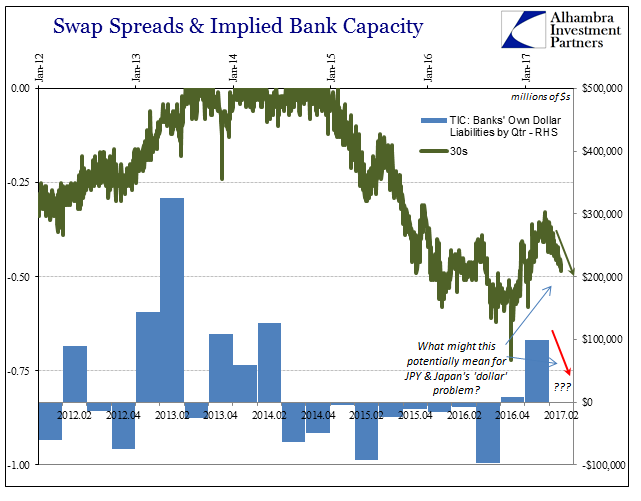

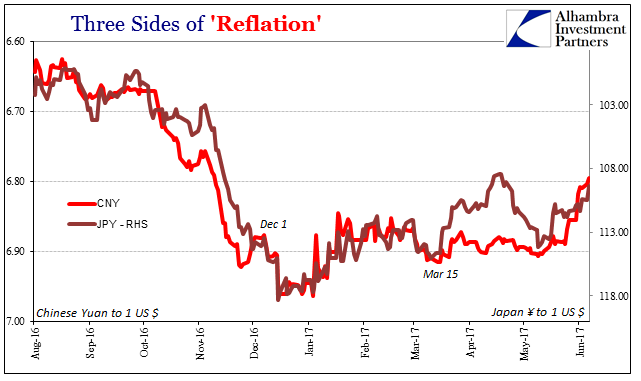

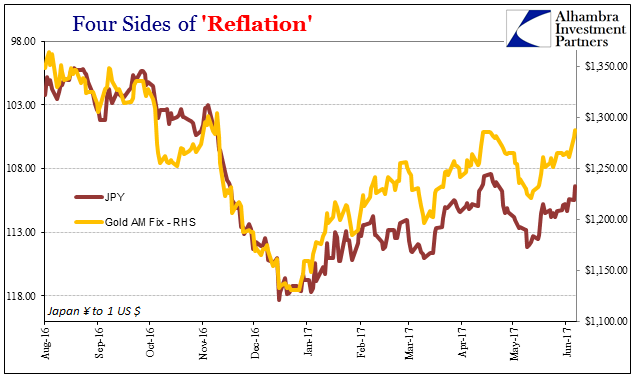

Through no action or direction of the Fed, the global “dollar” conditions after February 11, 2016, have been relatively better. The confusion more recently stems from the same set of flawed premises; it was widely believed that the tighter “dollar” conditions of the “rising dollar” period, though “unexpected”, were due to the end of QE and then the first “rate hike.” They weren’t; the global “dollar” pays little or no mind to monetary policy.

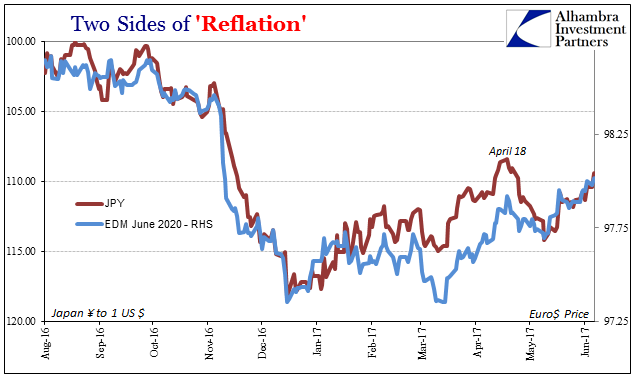

When we survey markets today, there is an unmistakable connection between “dollars” and none with “rate hikes.” In fact, eurodollar futures are once more confounding economists, dating back, almost as if taunting economists again, to the last one. And we know it is traders at the same banks as these bewildered economists who are again bidding them back up (as well as UST’s despite that “interest rates have nowhere to go but up”) against “reflation”; meaning for these specific purposes now against this “easing” trend.

That’s not related to any further “rate hikes”, expected or otherwise, but instead a growing uneasiness that “dollar” capacity globally hasn’t actually changed over the past year plus. Eurodollar futures tell us about the expected state of the world over the visible horizon, and at lower anticipated rates (higher prices) it doesn’t suggest monetary policy but functionally tight money unrelated to official gestures. The Fed doesn’t matter; the “dollar” does. Once you realize the true state of things there are no more mysteries.

The problem, then, is economists who don’t appear capable of figuring out what really isn’t that hard. They are apparently devoted to the way things are supposed to work as described in the academic textbooks written by still other economists; without ever having questioned, even after 2008, if that was really ever the case. It isn’t surprising that policymakers would find sympathy with other economists despite all evidence against them, for they are one in the same (witness Janet Yellen’s constant references, for example, to “professional forecasters” who unlike market indications of inflation expectations or now even consumer surveys of the same are steadfast in their belief in Janet Yellen no matter how wrong she is proven to be; professional forecasters are economists, too).

The world doesn’t run on a small cadre of statisticians every six weeks or so fiddling with small changes to a money market rate that no one uses. You can appreciate why economists believe this, because they are those people. So long as they are, and so long as they keep tinkering with only the immaterial, the “dollar” is left to its own devices which has for a decade now meant only trouble. The past year or so hasn’t even been “easing” so much as the space between the last eruption and the next one that markets are starting to sense as more than a sketchy possibility – just like 2014 and the last time conditions were so “easy.”

Stay In Touch