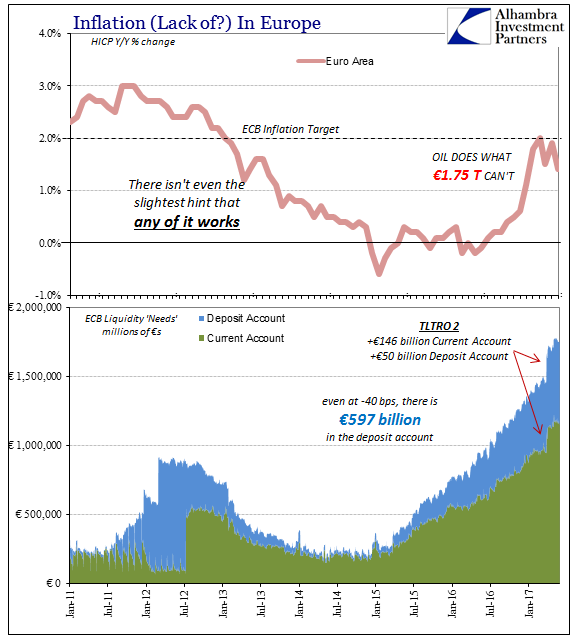

At the end of March, the European Central Bank (ECB) offered a second round of bank financing. Dubbed TLTRO’s, T for “targeted”, the program offered banks a chance to obtain direct funding for up to four years at an incredibly low rate. European banks in TLTRO2 were allowed up to as much as 30% of their outstanding eligible loan books as of January 31, 2017 (netted against any previously drawn TLTRO1 balances).

The rate for the original TLTRO’s had been set as the MRO rate on the day of the tender. For this second run, banks were given an added incentive where the cost of funding can be as low as the deposit rate. The ECB recognized these liquidity preferences for once, where it did not want to penalize banks for borrowing the funds (at 0% as the MRO rate) and then holding at least some of them idle in the deposit account (at -0.4%). It was a direct acknowledgement that the intended penalty of NIRP in the first place was a misguided academically-driven endeavor.

To qualify for the reduced funding, banks are to meet certain lending benchmarks up to January 31, 2018. However, the real goal may not be loans at all, especially if banks are merely betting that between now and the 4-year maturity the rate on the deposit account is moved higher as the ECB is tempted to normalize. Why lend and take risk when you can pay a little for none and patiently do nothing as the central bank gives you euros as it once again fools itself?

The take-up for TLTRO2 was much higher than was anticipated. Various surveys of economists were expecting about €110 billion to be sought when in fact more than €230 billion actually was. It is another instructive example about the state of economics, where economists spend all their time trying to guess what the next major statistic will be when it would be far better spent instead understanding the true underlying mechanics leading to why it won’t be anything like the guesses.

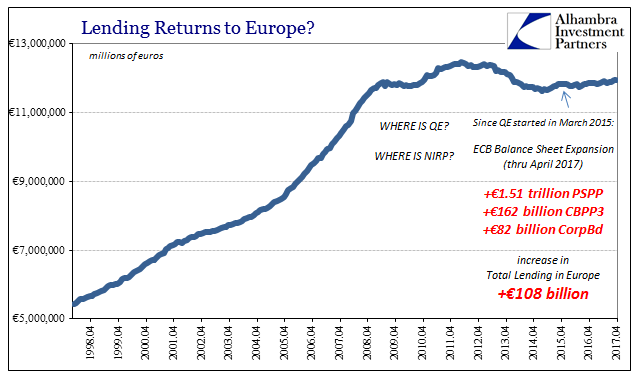

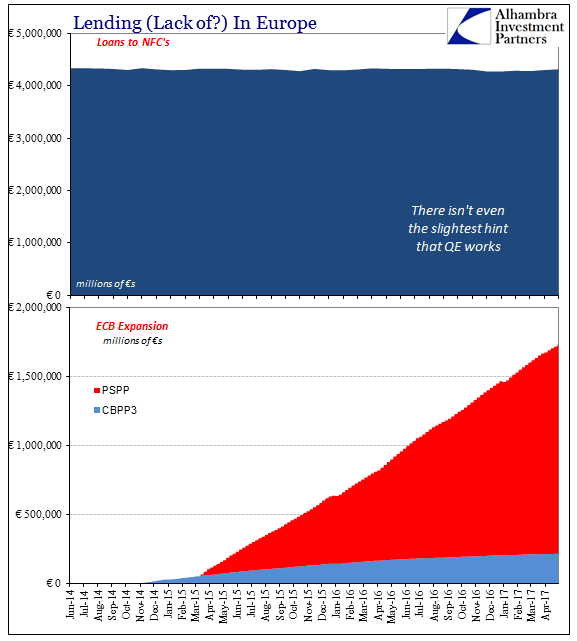

In the two months since that happened, inflation in Europe has subsided rather than spiked. To be fair, if there are to be any inflationary effects it is too soon to expect them. But still, this is, of course, nothing new. Full QE was initially begun in March 2015 over two years ago, and the Continent’s HICP rate barely notices if at all. Despite bond purchases through PSPP of €1.5 trillion, additional covered bond purchases of €162 billion under the third such program, and now €82 billion of corporate bonds added to the various NCB balance sheets (totaling €1.8 trillion altogether), total lending in Europe has in those twenty-six months increased by a paltry €108 billion.

Given that total lending remains more than a half a trillion euros still below the September 2011 peak, these are embarrassingly unimpressive results in just linear terms. In non-linear terms, the cost of almost six years in this state has added up, which is why the EU itself has been threatened politically in a way that ten years ago was thought impossible. Monetary policy simply contains no actual money, because, as TLTRO2 demonstrates, it’s not what the ECB does with inert and idle bank reserves that matter but rather how banks construct their balance sheets which remain full of liquidity preferences this far down the road.

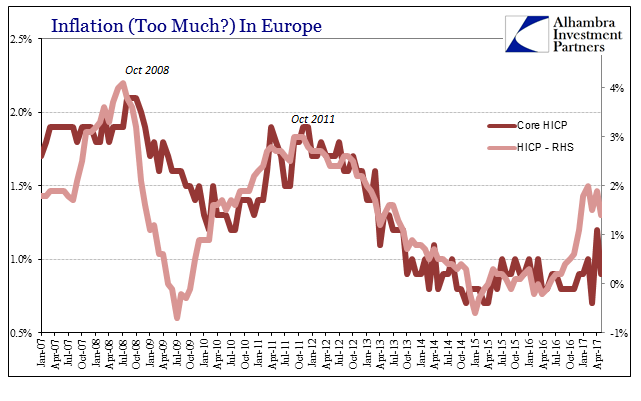

As the policymaking body gathers again to discuss the future course of “monetary” policy for the central bank, they do so with inflation rates falling back down once more. The headline HICP, like the Fed’s PCE Deflator, touched their 2% target exactly once in almost five years; and that had everything to do with the base effects of oil prices rather than even minimal potency from the two years of QE.

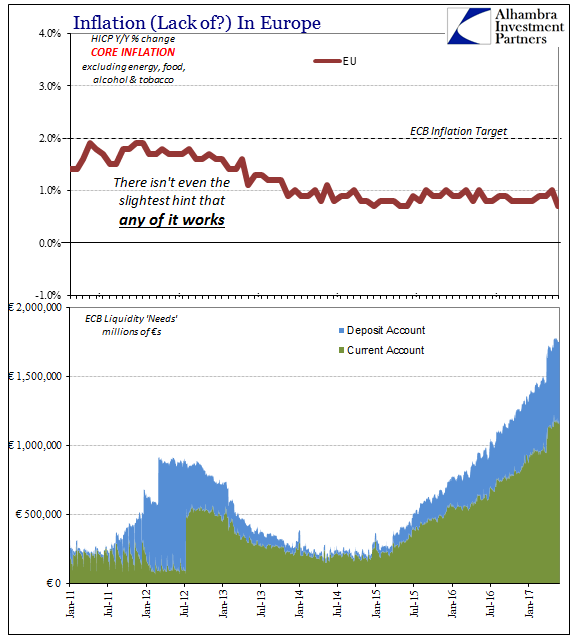

Europe’s so-called core inflation rate perhaps describes the situation better, stripped of those energy price consequences. In April, it had accelerated to 1.2%, the highest in years, but as usual these incidences on the high side are what prove to be transitory. For May, the core HICP rate is once more less than 1%, just 0.9% as it has been rather consistently for several years of this global downturn related instead to the “rising dollar” (where these liquidity preferences all trace back to).

Without banks lending, there will (can) be no increase in inflation. The ECB for all its rhetoric and posturing is helpless to achieve anything. It has proven in another jurisdiction that central banks don’t know what they are doing. No matter the size or nature of these activities, they produce nothing. To be so thoroughly outdone (and now undone) by the annual comparison of Brent Sea Crude is the definitive statement about monetary conditions. The latest TLTRO’s may be relatively new, but the lackluster depression conditions are not.

Stay In Touch