Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as Bernanke tried to claim.

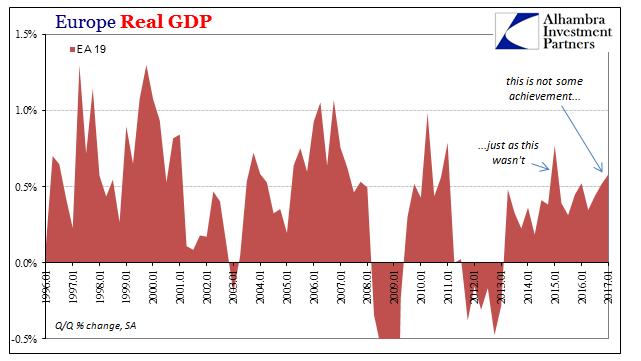

In Q1 2017, at least, the Europeans are trying to celebrate, as contrary to this longer-term arrangement their economy outperformed ours by some distance. Real GDP growth was revised upward to +0.6% quarter over quarter, the highest growth rate in two years. And it is that framing which becomes highlighted in all mainstream commentary, so as to emphasize what sounds like a positive distinction.

Europe’s economy is, however, like its US counterpart still contracting. The estimates all have plus signs and in linear terms it appears as if growth has occurred, but by what truly matters both only trail further and further behind not each other but where the world needs these economies to be to get out of the trap.

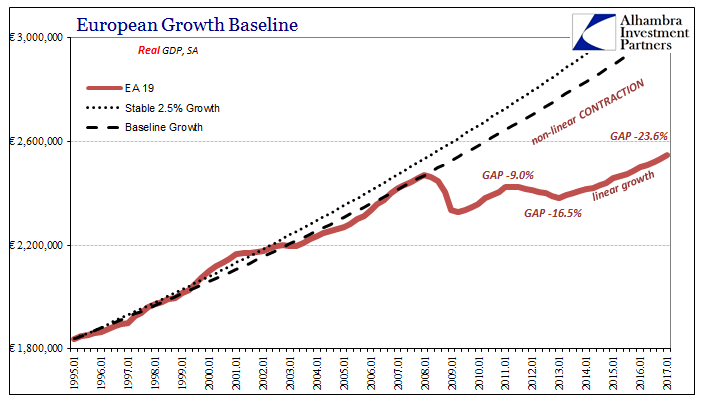

European GDP has been positive in real terms for each of the past sixteen quarters through Q1 2017. And in those four years of “growth”, the level of estimated output has only fallen further behind than it already was when it exited re-recession after 2012. At the start of that renewed contraction, Real GDP was 9% behind the pre-crisis baseline; at its end in the first quarter of 2013, -16.5%. As of the latest “encouraging” GDP report and upward revision, real GDP is 23.6% below trend. This is continuing non-linear contraction.

The prior trend-line is not some mathematical trick, it is an estimate of what is needed in terms of economic output and performance to get back to normal and out of dangerous stagnation and depression. It is not a precise estimate by any means, nor does it need to be when the level of GDP misses by such a wide mark. We don’t need to know exactly how far behind Europe’s economy is, as the US’s is, in order to safely conclude that it is by a huge margin. Output increases, but never makes up for what it too often loses.

Monetary policy in particular was supposed to correct this problem, or at least increase dramatically the chances of that happening. “Stimulus” is delivered for precisely these reasons, to address any shortfall in “aggregate demand” by boosting output even in various other sectors. Economic theory posits that output even for the sake of output leads to alleviation of this “output gap” through “pump priming.”

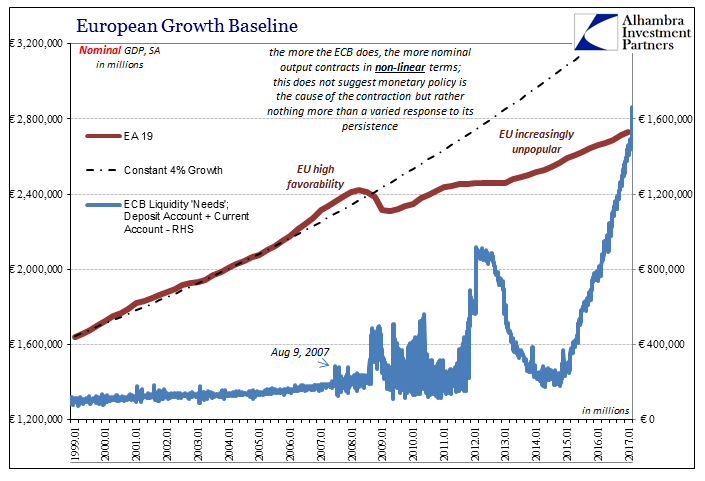

It does not, however, contemplate what might happen if “stimulus” does nothing at all. There is again in Nominal as Real GDP and inflation no detectable effect from whatever the ECB has done. This is not a minor discrepancy, as what has been attempted has been considerable to the point of insanity; at least on paper. In terms of just the ECB’s simplified balance sheet addressing the system’s “liquidity needs”, there is now approaching €2 trillion in “liquidity” where on August 8, 2007, there was just €191 billion. If you had stated in early 2007 that the ECB was going to take such extreme measures, people would have objected on very safe historical grounds; if you further stated it would do absolutely nothing, they would have thought you hopelessly mad.

That almost tenfold increase in reserves does tell us something very important about monetary policy as well as the state of Europe’s economy. On the surface, it would appear that as Europe’s economic gap (the non-linear contraction) only grows as the ECB’s efforts do, we might be tempted to wonder if the ECB’s policies were actually causing the contraction. We know, however, this is a false arrangement of causation, for what the ECB does is in response to what is happening in the economy. In short, monetary policy isn’t any more than an official signal that “something” is very wrong, and the more whatever central bank does the greater the deficiency very likely is.

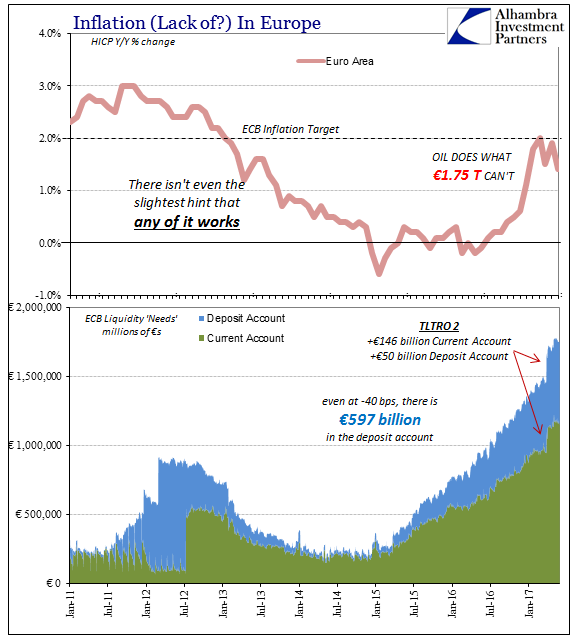

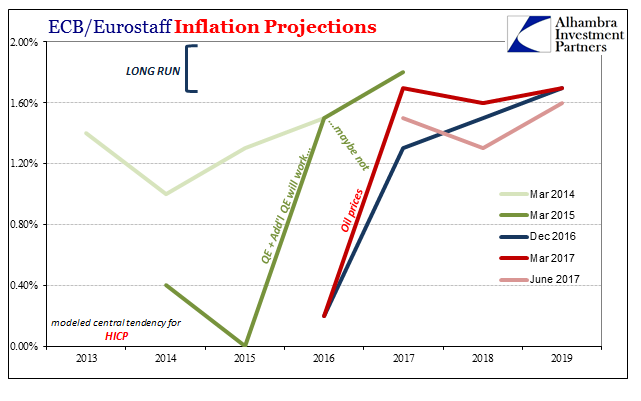

There is no case to be made that these are “money printing” operations, because such huge interventions had they actually been that would have created some clear imprint in both output as well as consumer prices. But, as noted yesterday, consumer prices have instead responded only to oil, an embarrassing outcome that proves even more so with updated official projections released today concurrent with both GDP revisions and the latest ECB policy meeting.

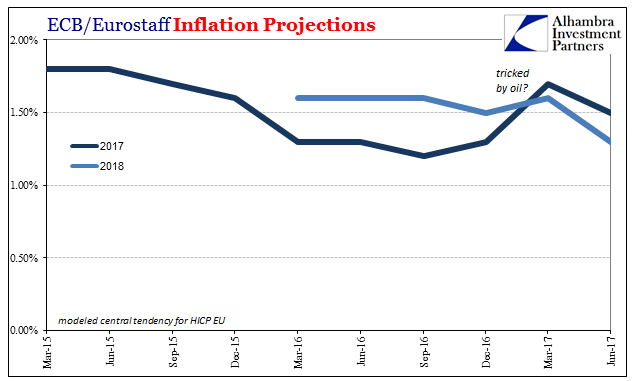

The Eurosystem’s Staff (the ECB staff trades off with Eurosystem’s to alternate suites of projections) appears to have been to some degree “tricked” by the base effects of Brent Sea crude priced in euros (based on its dollar price). The ECB’s staff had in March figured this increase in HICP inflation in early 2017 due to oil would combined with QE somehow have a more lasting effect on Europe’s consumer prices, raising the outlook to 1.7% for 2017. As actual HICP rates have instead only briefly been affected, Eurosystem’s staff in its June update has cut that forecast, as well as the one for 2018.

At just 1.3% for the mean level for next year, you have to wonder what possible positive consumer price momentum the ECB’s massive QE and covered bond purchases are modeled to accomplish. Outside of 2017 oil, the official forecasts don’t expect inflation to hit the 2% target before 2020, much the same lack of indicated economic (really monetary) momentum as now is predicted for also the US economy.

They have all done massive QE’s and after so much of it for so long there isn’t anything to show for them – other than perhaps the sentiment effects on stock prices. It is, in non-linear terms, the world best described instead by the global bond markets. Interest rates will rise, and stock investors fulfilled by earnings, only when growth returns in non-linear fashion; when this shrunken economy starts to crawl out and plausibly work its way back to unshrunk. But after so much effort and time lost, what chance is there for that possibility? By what catalyst?

Officials clearly don’t understand the nature of the problem, let alone its cause (which is in their own backyard). So instead they craft the narrative that it is a small problem that is always getting better (linear growth), if for no other reason than to circumvent the public’s questioning of officials. If the world economy in reality gets only worse and no one in Europe, America, or wherever else can really say why, they can at least keep their jobs.

Stay In Touch