I wouldn’t put it in the category of LBJ “losing Cronkite”, but it is at least a measure of amplified pressure (or just any pressure). This week has been utterly embarrassing for the Federal Reserve, a central bank that refuses to define clearly what it is attempting to do. It leaves questions even for who used to be highly sympathetic.

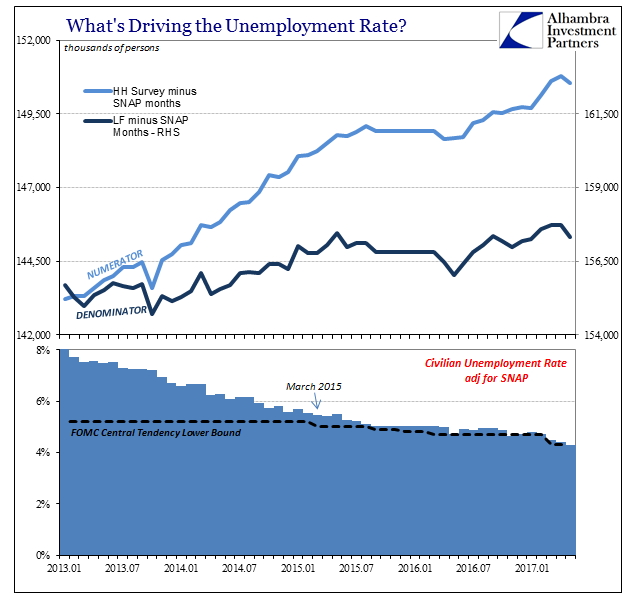

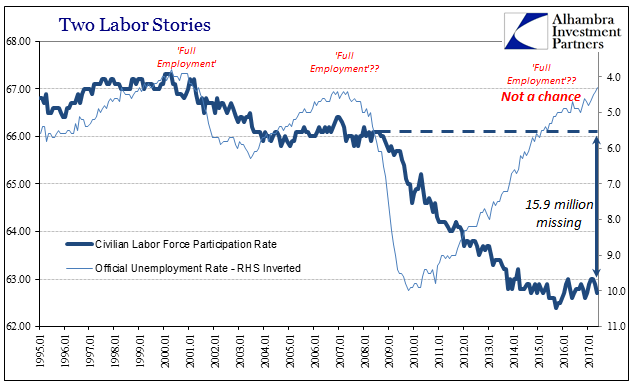

Their aim is simple enough as a matter of pure economics. The economy didn’t recover and is never going to (so long as monetary matters remain truly unexamined). Having resisted this possibility for nearly a decade, officials who have now come around wish to avoid having to admit it. So they let the media define the economy by the unemployment rate which projects an image of conditions that simply don’t exist.

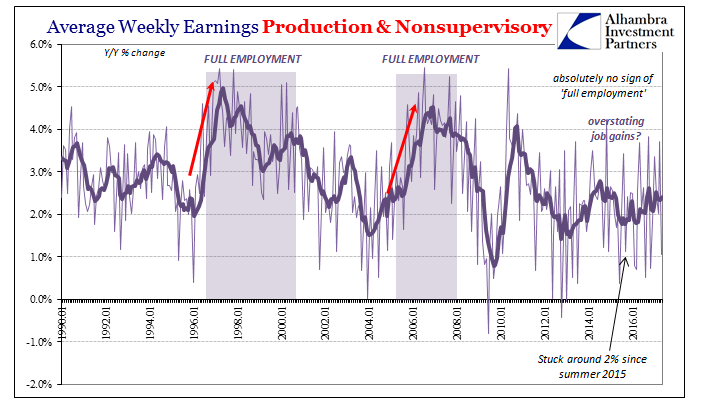

The New York Times has typically been friendlier to the official stance on these matters. Credentials go a long way there, and who has better pedigree than Federal Reserve policymakers? But even they may have to call foul because it’s not like the unemployment rate just yesterday dropped so low. It’s been flirting with official levels of “full employment” for three years, forcing the FOMC’s suspect models to redefine down their calculated central tendency (the theorized range where low unemployment is believed to spark serious wage acceleration and then consumer price inflation) time and again.

At 4.3%, the unemployment rate doesn’t any longer leave much room for interpretation. It’s go time, now or never.

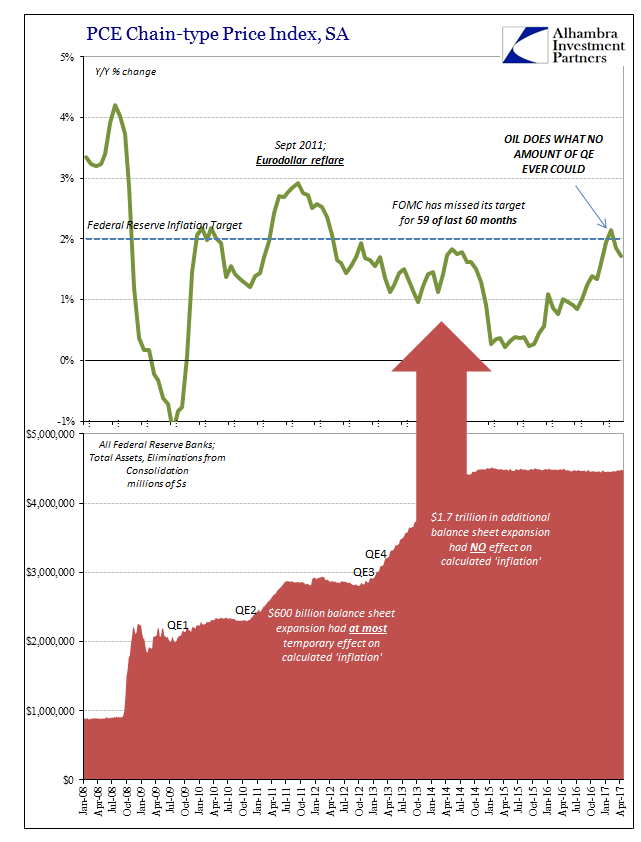

Inflation has stubbornly stayed lower than the Federal Reserve has desired for the past eight years, and it has been falling in the last few months. In a move that could well define her chairmanship of the central bank, Janet Yellen is betting that falling prices are a temporary blip that will soon be forgotten.

If her forecast is right, the Fed policy meeting on Wednesday will turn out to be a nonevent in a gradual return to normal policy. If she’s wrong, the June 2017 meeting will look like a giant unforced error that unnecessarily prolonged an era in which the Fed proved impotent to get inflation up to the 2 percent level it aims for and lost credibility needed to fight the next downturn.

I repeat it often and will continue to so long as is necessary. The PCE Deflator has been at 2% just once in the last sixty months, and it had absolutely nothing to do with the Federal Reserve. Janet Yellen, however, refuses to bend. She has attached herself steadfast to the word “transitory”, even though by any reasonable definition the word lost meaning two years ago in the summer of 2015 when it failed to properly characterize the situation just the first time.

At her latest press conference this week, the Fed Chairman in her prepared remarks exclaimed:

CHAIRMAN YELLEN. The recent lower readings on inflation have been driven significantly by what appear to be oneoff reductions in certain categories of prices, such as wireless telephone services and prescription drugs.

She didn’t actually say the word, so the media who have been conditioned by it reported it in their various summations anyway. The assembled members at her press conference just weren’t buying it like they used to. She was asked repeatedly about inflation, particularly given the CPI released that very day. Whereas in the past the questions were typically of the soft ball variety prejudged to believe in whatever she claimed, skepticism was evident throughout the affair.

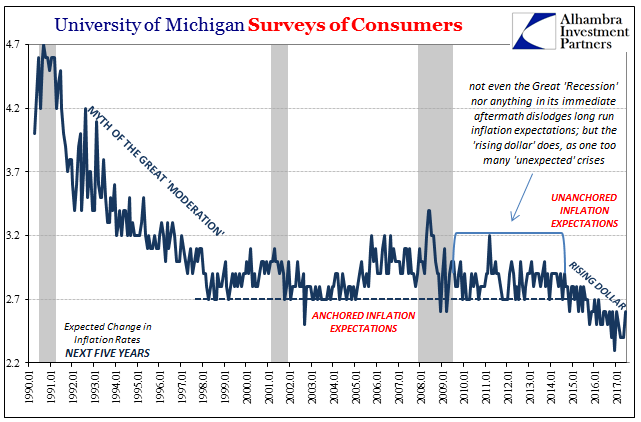

CHAIRMAN YELLEN. So, I don’t think central bank credibility at least the Feds’ credibility has been impaired. We look at a whole variety of indicators of inflation, expectations, professional forecasters, whether it’s in the blue-chip or the survey of professional forecasters, those expectations have remained quite steady and in close alignment with our 2 percent inflation target. TIPS based measures of inflation compensation do not provide straight reads on market participants’ estimates and expectations about inflation. They embody other elements, risk premia and liquidity premia as well. They had moved down and now have moved– they remain at low levels. But they have moved back up again. It is true that some household surveys of inflation expectations have moved down, but overall I wouldn’t say that we’ve seen a broad undermining of inflation expectations.

Reread that quote. It’s a rambling dissembling in words that amounts to claiming that though all the evidence is against her, we should just ignore it because those professional forecasters who are similar academic economists still believe in her and the Fed.

At least one FOMC official is publicly stating his doubts, and in doing so merely restating what is by now so obvious that even the media has started to get it. Minneapolis Fed President Neel Kashkari was the lone dissenter against the latest “rate hike.” His disapproval was grounded in what used to be called “dovishness”, as he explains in a blog post published today (h/t ZeroHedge).

For me, deciding whether to raise rates or hold steady came down to a tension between faith and data.

On one hand, intuitively, I am inclined to believe in the logic of the Phillips curve: A tight labor market should lead to competition for workers, which should lead to higher wages. Eventually, firms will have to pass some of those costs on to their customers, which should lead to higher inflation. That makes intuitive sense. That’s the faith part.

On the other hand, unfortunately, the data aren’t supporting this story, with the FOMC coming up short on its inflation target for many years in a row, and now with core inflation actually falling even as the labor market is tightening. If we base our outlook for inflation on these actual data, we shouldn’t have raised rates this week.

There is absolutely no evidence whatsoever that the 4.3% unemployment rate means anything substantial; at least not in true economic terms. What it instead tells us is that only 4.3% of adults who can look for work can’t find it. The “missing” almost 16 million Americans cut loose by the shrinking economy don’t factor into 4.3%. The U-6 isn’t even an accurate measure of what is more fairly classified as enormous “slack.” There isn’t any inflation because the Great “Recession” wasn’t a recession. Treating it like one will lead to Janet Yellen’s faithful deer-in-headlights response to increasingly incredulous questions from a once criminally uncritical media.

As I wrote earlier this month, the extreme nature of the unemployment rate has finally forced Yellen’s hand. It really is a binary option at this point: admit the unemployment rate is faulty and open the can of worms about the last ten years, or keep the faith as she has done all along and bet it all on an imminent surge in something. Markets have already deserted the Fed, and the media is a hair’s width from joining them. One dissenter is a start, but how many more are willing to gamble as Yellen has? Everything is at stake here, at long last.

This is a hugely positive development, one that was probably inevitable given that nothing has worked out but nonetheless long overdue. Transitory may finally be haunting Janet Yellen.

Stay In Touch