Suddenly central banks are mesmerized by yield curves. One of the jokes around this place is that economists just don’t get the bond market. If it was only a joke. Alan Greenspan’s “conundrum” more than a decade ago wasn’t the end of the matter but merely the beginning. After spending almost the entire time in between then and now on monetary “stimulus” of the traditional variety, only now are authorities paying close attention.

Last September the Bank of Japan initiated QQE with YCC (yield curve control). The ECB in December altered its QE parameters to allow for what looks suspiciously like a yield curve steepening bias. And the Fed in its last policy statement declared its upcoming intent to think about balance sheet runoff that, as my colleague Joe Calhoun likes to point out, is almost surely going to be favored in the same way.

Central bankers spent years saying low interest rates were stimulus. They have yet to explicitly correct their interpretation, preferring the more subtle approach of instead altering their operations as noted above. As I wrote back in December:

In the realm of “How Do We Get Ourselves Out Of This Mess We Created?”, it doesn’t seem as if they yet have any actual answers. In the department of the smallest silver linings, at least central bankers have finally been introduced to curves. For the global economy, it remains a highly negative signal that central bankers used the last seven years of global depression just to arrive at Finance 101.

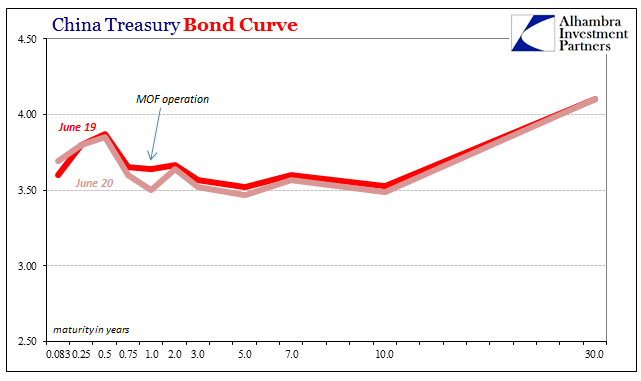

Flat curves mean a whole lot when combined with low nominal interest rates – and it isn’t what “stimulus” is supposed to be about. Given the sensitivity to flatness of late, it should not be surprising that yet another government authority has tested the waters of steepening. China’s Ministry of Finance today used for the first time its new authority to “boost liquidity” in that country’s treasury bond market. The MOF bought 1.2 billion yuan of 1-year notes that it said were not attracting enough demand.

The amount is small, about $175 mm within a multi-trillion overall market, but symbolism counts especially in a prospective policy of reassurance. While the government was bidding on shorter bonds, the central bank was upping its OMO’s for the month. Short rates throughout China have begun to exceed longer rates and officials are starting to realize the negative implications of the curves produced in this fashion.

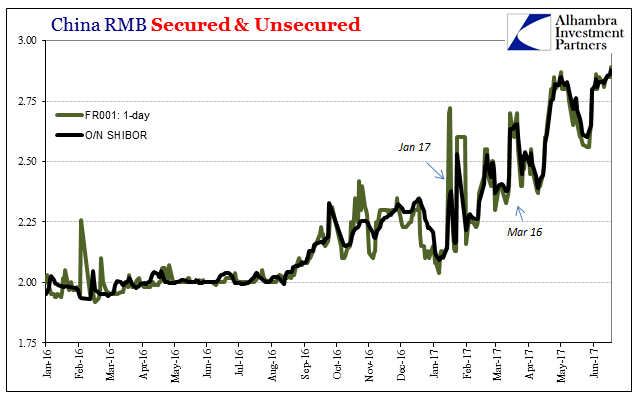

As you can see above, there was some limited effect for the 1-year issue, but overall Chinese money conditions remain a total mess. June is a tense month in RMB terms anyway, with mid-year cash checks coming up, but liquidity conditions have been deteriorating somewhat violently since January.

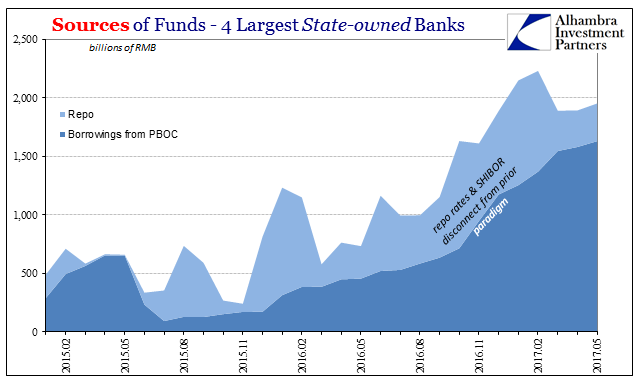

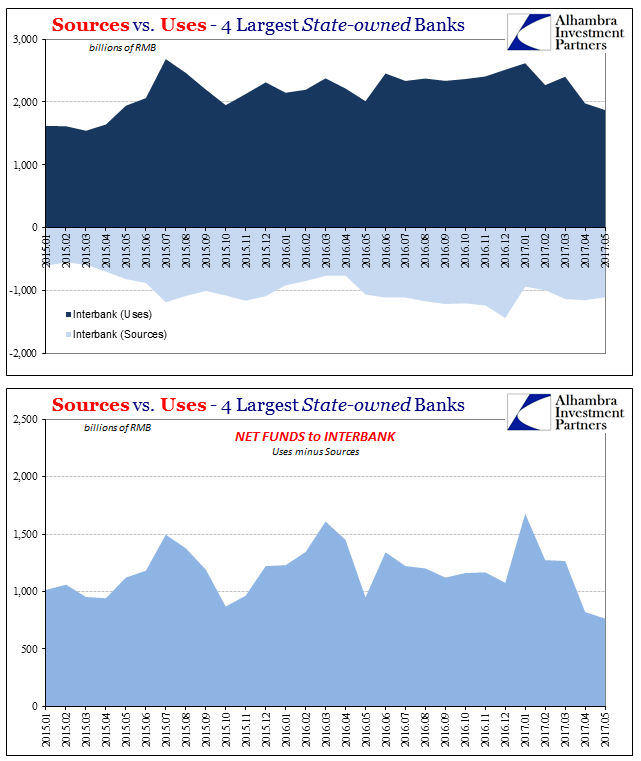

The reason is very straightforward, too, as there is little spare liquidity capacity from China’s largest banks. They have been borrowing heavily from the PBOC, and the PBOC directly obliging every time, to no avail. The Big 4 banks are left to redistribute on net far less RMB than they used to.

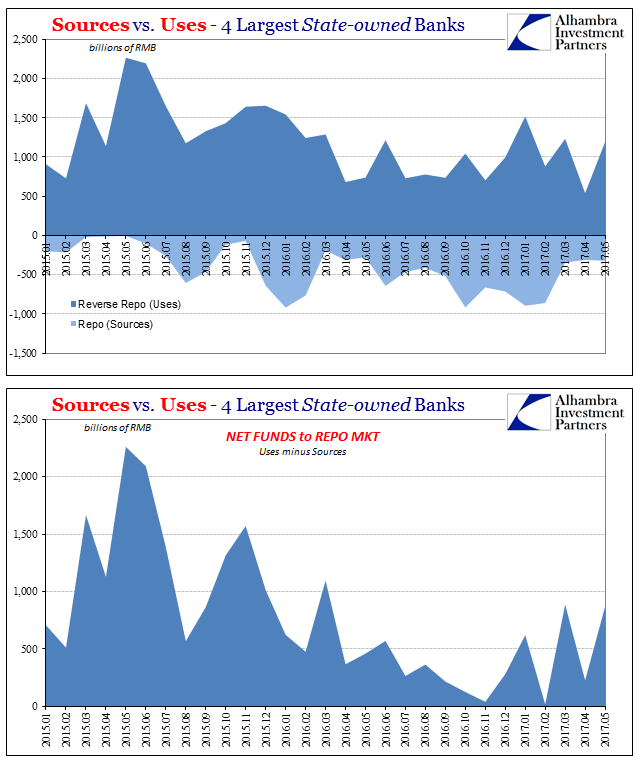

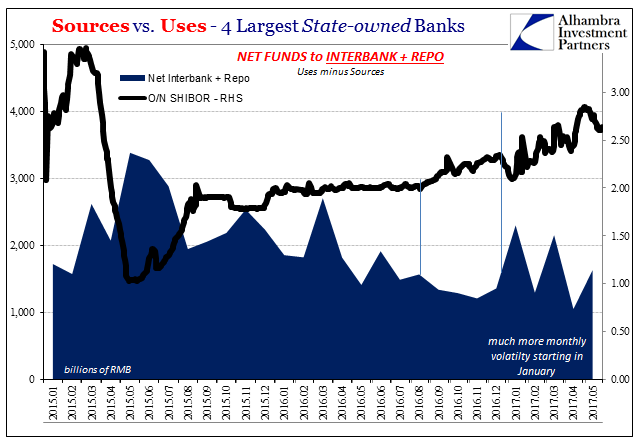

In May, the banks increased the amount of RMB sent out into repo (uses of funds) via reverse repurchase agreements. That, however, merely continued a pattern of uneven and volatile monthly balances that aren’t conducive to systemic good function in liquidity terms.

As these banks were last month adding funds in that one part, they were also withdrawing them from other interbank channels. In terms of the latter, China’s Big 4 banks forwarded the smallest amount of RMB liquidity since the PBOC began reporting interbank balances separately at the start of 2015.

Since repo and unsecured RMB capacities are still quite linked in China unlike in dollar markets, volatility in redistribution capacity as well as target market becomes volatility in money market rates as well as their escalation toward greater uncertainty. From this view, the nervousness apparent in the PBOC’s CNY policy as well as the MOF’s entry into the treasury market are quite understandable. Policymakers in China are becoming very concerned and therefore intervening for good reason.

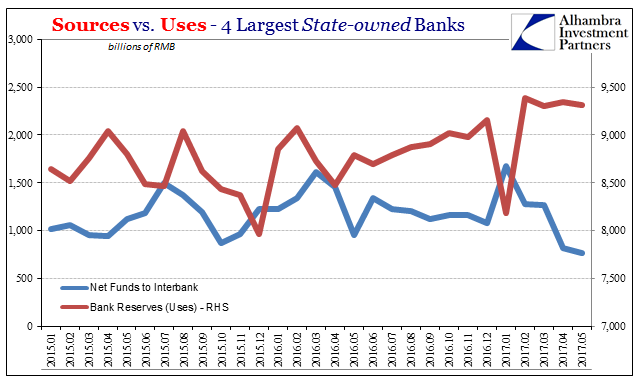

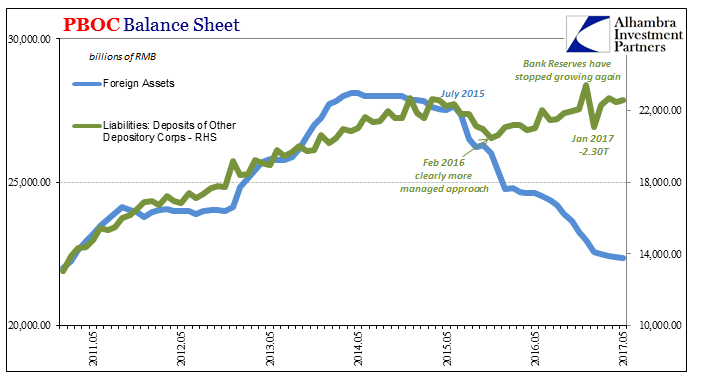

The problem stems from lack of growth in bank reserves. Without asset side (forex “dollars”) expansion, and with the PBOC functionally limited in how it might offset that lack of increase, there has been little overall growth in bank reserves in 2017 which has affected the big banks the most.

There has been no increase in reserves since February and the New Year seasonal flows, which is very likely why the level of interbank redistribution has tumbled to its lowest point in the series.

The consequences of this illiquidity are what we find in longer-term government paper – liquidity preferences that are economically negative. It usually leaves a flat, non-conforming curve, or in China’s current case an inverted one. It’s such a simple thing made complicated by the mainstream’s orthodox perspective. For economists, and therefore the media, there can be no reason for liquidity preferences because central banks have been “printing money” for years on end.

The narrative is a little different as it pertains to the Chinese, for this “tightening” is instead given an official approval that in reality doesn’t exist. The Chinese treasury bond curve that suddenly holds authorities’ attention is a product of the same global affliction. The official world stopped paying attention to money decades ago, and their monetary illiteracy is showing as central banks and finance ministries now try their hand at curves.

Stay In Touch