People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

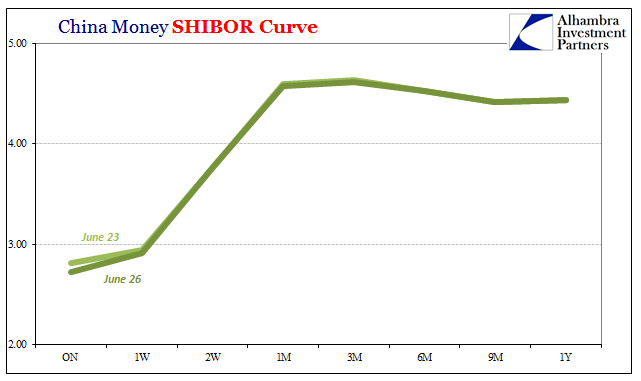

But it goes much deeper than that. I have described my own fixation with RMB money markets as weirdly obsessive. It is “weird” only in the sense that it isn’t immediately clear to someone on the outside why anyone who isn’t Chinese should care. After all, the 3-month interest rate swap on overnight SHIBOR is about as far away from a Federal Reserve blaming opioid use for the failure of QE’s to create a recovery as you might get. The second part we in the US have to deal with every day, so the first doesn’t seem to rate any notice.

In reality, however, those two are linked. There is everything in China that we might want to know about the failure of the US economy to recover – as well as a great deal about how it all came to be this way in the first place. China is in many ways a mirror onto the eurodollar, a window into its existence that remains far from our everyday view. It matters because it is what ails the world.

The shadow system continues to be hidden because economists long, long ago declared none of this mattered. For them, they instead focused on “money demand” leaving the evolution in money supply to happen far out of sight (as well as far from oversight). The result was the collision in 2007 between how money actually works and the Keystone Cops, these policymakers under Ben Bernanke who couldn’t even implement IOER properly.

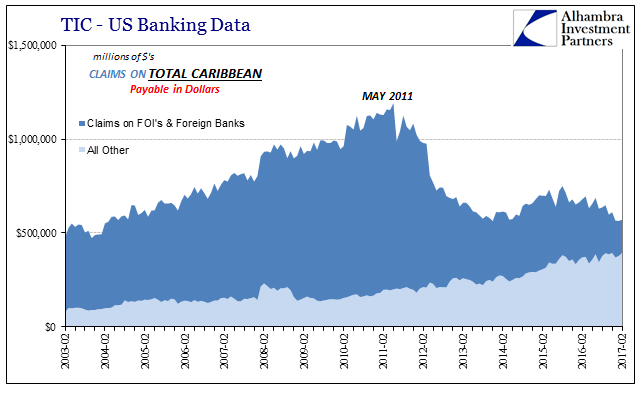

The history of the crisis aftermath is one of only further such collisions. There was another big one in 2011, and then still another beginning in 2013 that crested more so in 2014. The timing could not have been more inconvenient for the Fed, as that was when officials were most optimistic about the global future and our place in it.

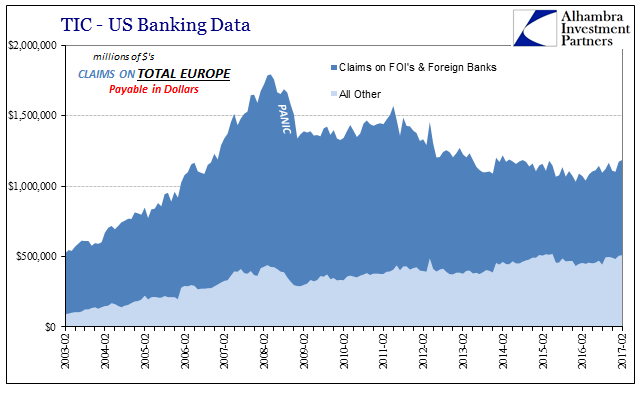

Yet, if they had been paying attention to the “dollar” instead (or had been forced to), they might have understood better the dangers to the global economy that were imminent at that very same moment. The term eurodollar is in many ways misleading, including the root “euro” that historically referred to these dollar markets in Europe. In many respects, the eurodollar after 2008 came to be more of an Asian “dollar.”

I wrote in October 2014, just two days after a serious warning played out in a UST “buying panic”:

I think that is a second unappreciated change that is taking place, and in some respects has already taken place. The dollar short was very European-centric in the 2000’s, owing to their ready participation in the housing bubble in the US (and I would even argue that the bubble itself was largely based on that European short). Since August 2007, Europe has withdrawn somewhat, if only in terms of marginal participation. That, however, does not mean that the dollar short goes away with Europe’s retrenching.

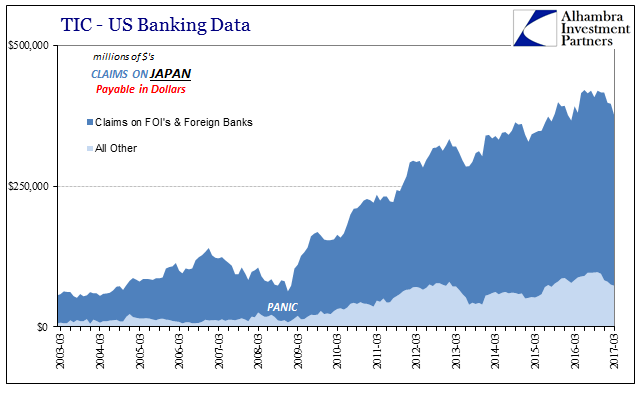

I called it then the Tangled Web of the Asian Dollar. It may not seem like much of a difference, but geography does matter. A eurodollar bank like UBS or Barclays operating from Europe have the same global reach as Eastern eurodollar banks like Mitsubishi UFJ, but there are very real differences in between them that matter. The global redistribution of “dollars” became more and more, at the margins, a Japanese affair.

And that brings us back to the basic analysis of the dollar short – nobody really knows much about it. It exists independent of any statistical measure and in far too many cases, including and especially policymakers, independent of knowledge and experience (closed system? The dollar short is the empirical refutation of all closed system approaches in economics). As it is in 2014 we are still finding out it is probably bigger (IMF) and more widespread than even thought now after seven years of close involvement with it.

However big it may have been in 2014, it seems for the global “dollar” experience in 2015 and 2016 perhaps somewhat smaller again. The BIS, however, in its latest annual report suggests that for Japan by the end of last year it might not have been.

Assets denominated in dollars on the balance sheets of Japanese banks surged to about $3.5 trillion by the end of 2016, the coordinating body for the world’s central banks said Sunday in its annual report about the global economy. Those exceed liabilities in dollars by about $1 trillion, creating a massive so-called long position in the currency. The report also cited Canadian lenders for following a similar trend, almost doubling their dollar exposure since the crisis. Their net long positions reached almost $200 billion, the BIS said.

On the one hand, it is a positive sign to find the BIS interested in Japanese redistribution of “dollars”, while on the other it is hugely frustrating asking yourself what these people have been doing the last few decades and why it took so long and so much economic damage for them to just now come around to it. The issue in eurodollars is largely opportunity, meaning why Japanese banks were exploiting the retreat of European (and Caribbean) banks in the money dealing “dollar” business. After all, Japan’s eurodollar history is as long as Europe’s, and in 2008 it was BoJ that was hitting dollar swaps second after the ECB.

The answer appears to be China. The Chinese were supposed to be the engine of strength throughout, but even more so in the post-crisis era of “new normal” low levels of growth in the developed world. Up until really 2015, many seemed to think China’s economy and financial system was immune to eurodollar decay. Thus, it was likely for Japanese banks irresistible to use their aggregate familiarity with the intricacies of funding to increasingly supply China with its eurodollar “hot money” sourced from all the various hidden corners of the global market.

Having created this leading dealer position for themselves, Japanese banks have also recreated the imbalances European banks exhibited by 2007. They are hugely susceptible to “dollar” funding strains, a fact made quite apparent particularly in the first half of 2016 with the yen’s sudden reverse. As Japanese banks go, so goes China’s and the world’s economy. Or, there is massive systemic and criminally unappreciated risk to this Asian “dollar.”

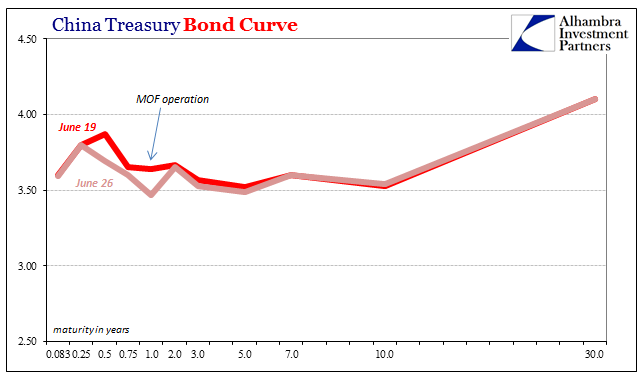

You might therefore conclude that the latest (screwed up) SHIBOR or treasury curve does actually require serious investigation, even though ten years later we still live with the consequences of how these kinds of things mostly remain weird obsessions.

Stay In Touch