Confirming that they inhabit the same planet but live in a very different world, Mario Draghi, the head of the European Central Bank, who is front and center for global monetary politics this week spoke in Germany ahead of his Jackson Hole main event. What he said was astounding in the same sort of way a drunken man spouts nonsense his stupor has him believing is genius. If ten years ago you were told that the major central banks around the world were going to “print” tens of trillions in “money” and that the result of all that was ten years later their research emphasis trying with the thinnest evidence to show that they were not, in fact, powerless, you would have thought the very idea pure insanity.

But here we are. And in trying to explain how we could have come to such a reductive state, Mario Draghi actually said that the ECB or any central bank must be,

…unencumbered by the defense of previously held paradigms that have lost any explanatory power.

OK.

If it doesn’t work, stop doing it. That’s a good way of thinking, but that’s not what Draghi is saying. He is talking about “unconventional” monetary policies like QE as if they were good and effective programs. The “previously held paradigms” to which he is referring are the old conventions that state you don’t create money out of thin air (people should not lose sight of the setting of his speech, which was Germany, after all). Banks do it for economic reasons (theoretically) but central banks don’t.

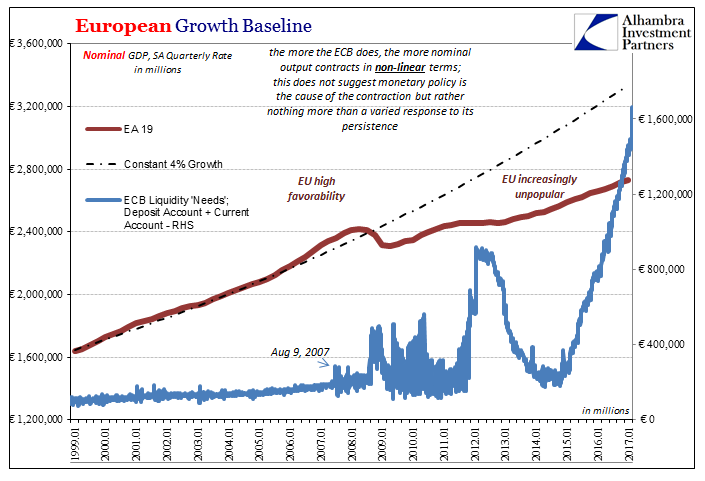

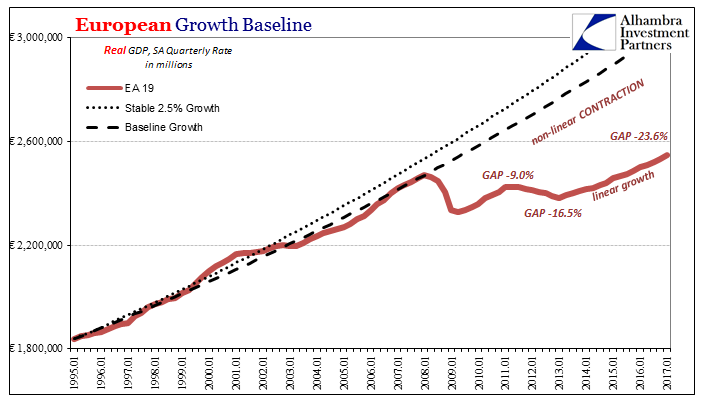

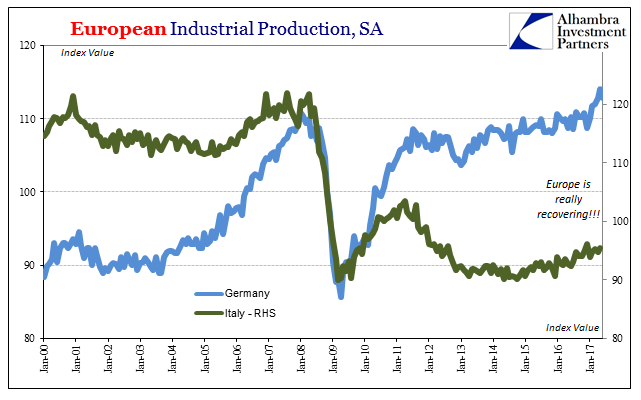

Mario Draghi doesn’t realize, because he can’t, that QE isn’t any different than those “previously held paradigms”; it was but an extension of ineffective central planning. He or other central bankers like him didn’t actually change the game, at all. Look at each economy and how they have effectively shrunk. To claim that QE worked is to revert to the “jobs saved” standard, which is exactly what he is doing now.

…a large body of empirical research has substantiated the success of these policies in supporting the economy and inflation, both in the euro area and in the United States.

What doesn’t substantiate the presumed successes of these policies is everything that actually matters:

The empirical evidence which he and those like him have taken as their last resort are statistical studies purporting to show that without QE (or the like) bond yields might have been higher. That’s it. From there it is inferred that higher effective interest rates would have made the situation in Europe (or wherever else) worse. Therefore, QE was a success in that it “saved jobs.”

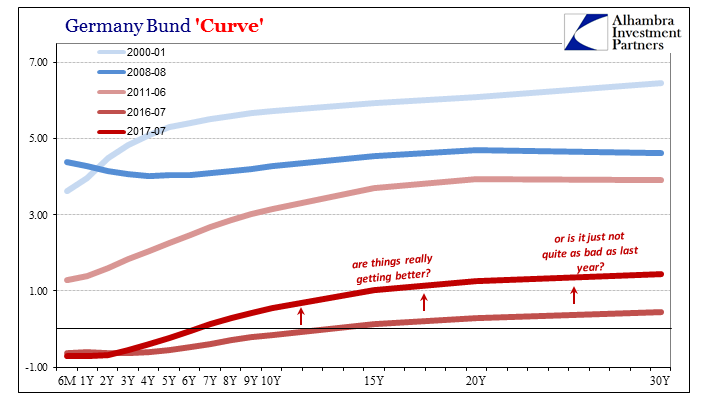

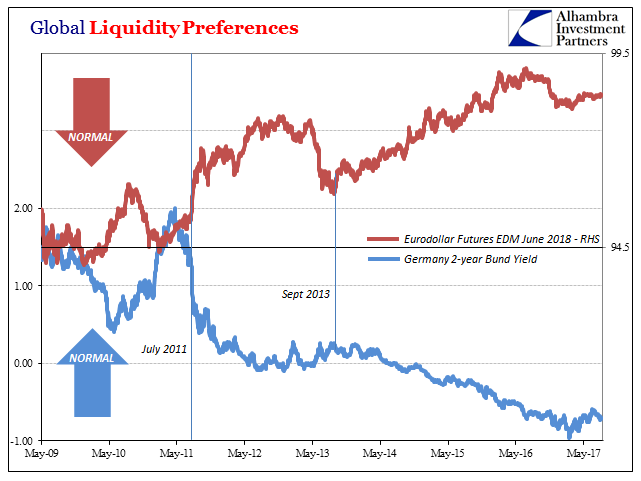

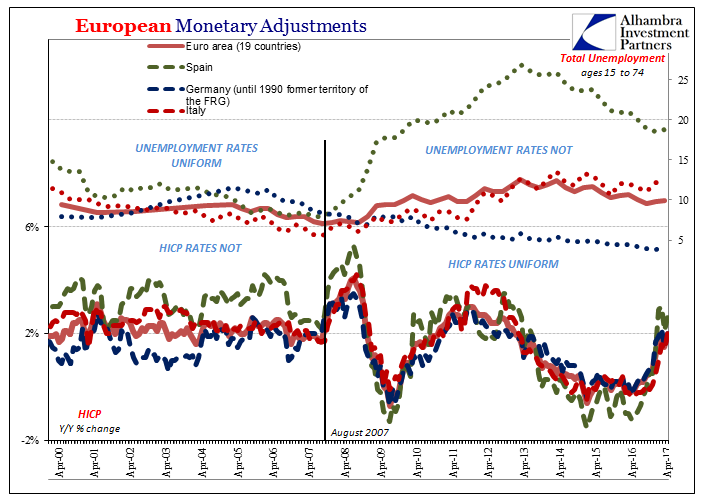

It’s difficult even to make that argument along geographical lines in Europe. Did buying Italian sovereign bonds under SMP reduce Italian bond yields? Very likely. Did that make any difference? Perhaps, but not nearly as much as is as claimed. The most likely chain of cause and effect reverses Draghi’s theory. He bought more Italian and Greek bonds simply because those were the places hardest hit by what is at the core of all these troubles, and what the ECB has yet to come to terms with (the eurodollar system of global money).

The European economy is more fragmented today than it was in May 2010 when the ECB bought its first Greek bond. All that has changed in the years since is that the central bank no longer sterilizes those or the myriad other purchases that have followed. He doesn’t see it because he is ideologically incapable, but Europe is farther along on the road to Japanification than anywhere else in the world (except, obviously, Japan).

His own words in this warm-up speech are actually the way in which Japanification happens; it’s not zombie banks or a rigid business culture. It is being encumbered by the defense of previously held paradigms. That is exactly what he did today, and what he will do (in all likelihood) in Wyoming. They really don’t know what they are doing.

Stay In Touch