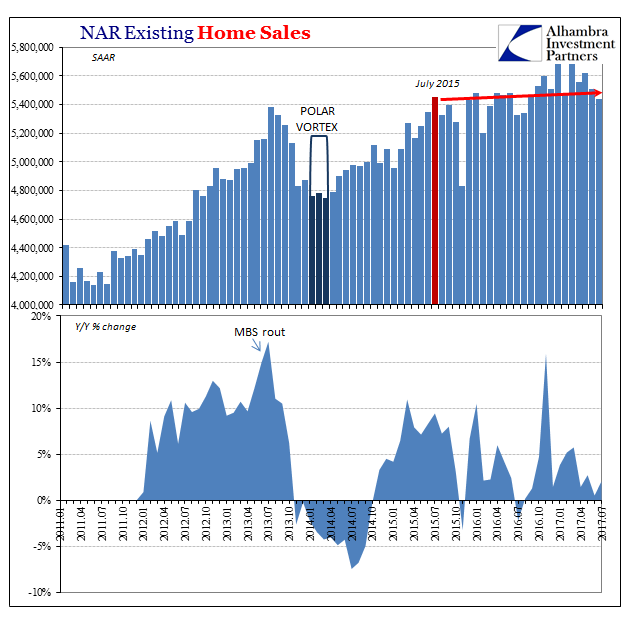

The most recent housing data continues to suggest weakness. The National Association of Realtors (NAR) reports that sales of existing homes were down slightly last month from June. It continues a lower trend dating back to March. Overall, the level of resales is largely flat going back to the summer of 2015.

At a 5.44 million seasonally-adjusted annual rate for July 2017, that is actually slightly less than the 5.45 million (SAAR) estimated for the same month two years earlier. The housing market is not crashing, nor does it appear to be in danger of doing so. But it is also not expanding, either, the latter condition relevant to broader macro analysis beyond real estate.

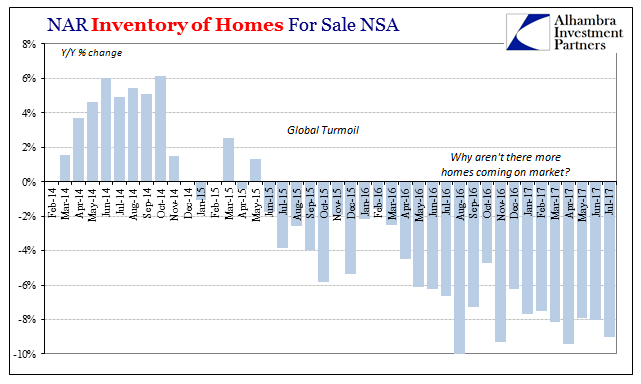

The primary reason seems to be widespread consumer caution. American homeowners do not appear willing to put up their homes for sale despite rising prices. It is practically the antithesis of the housing mania period from just over a decade ago. That may be in part due to a paradigm shift in expectations and behavior (a lot of people learned something from the bust).

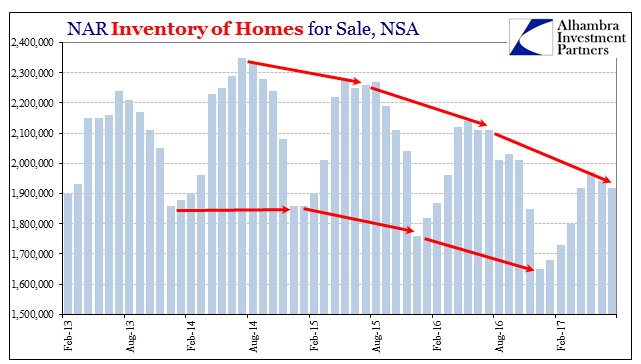

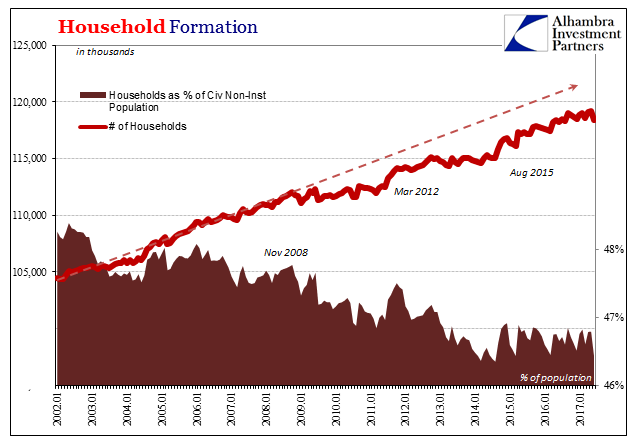

But the shift in inventories is a more recent change. The number of houses available for sale, according to the NAR, began falling in the summer of 2014 – coincident to the appearance of the “rising dollar.”

The peak for inventory in this whole real estate reflation cycle was July 2014. It wasn’t so much the exchange value of the dollar that seems to have influenced prospective property sellers. Rather, it was likely the common interpretation of growing economic uncertainty surrounding it; especially the oil price crash that only economists attempted to treat as a positive.

The global turmoil that followed in 2015 would have confirmed caution, as well as the actual downturn and near-recession related to it.

The end of it almost a year and a half ago has not precipitated renewed enthusiasm, however. As in other economic indications (autos), this restraint/uncertainty/weakness continues well into this year. There is now a growing body of statistical evidence that consumer behavior has turned even more negative.

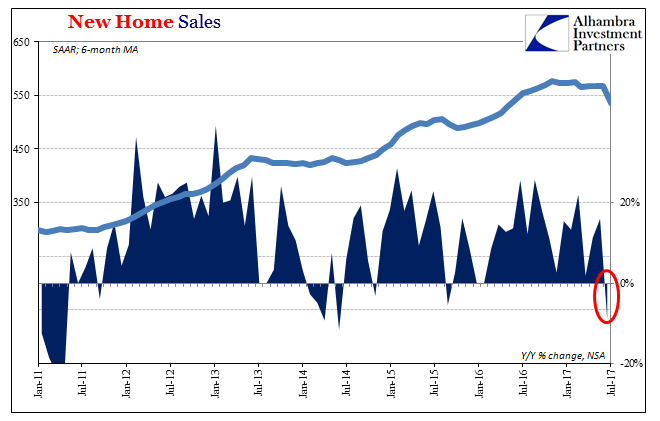

Released yesterday, the Commerce Department reported sharply lower new home sales also for July. At 571k (SAAR), that is significantly less than the 630k in June. Though that might be statistical variation (month to month can be volatile), unadjusted new home sales were down almost 10% year-over-year.

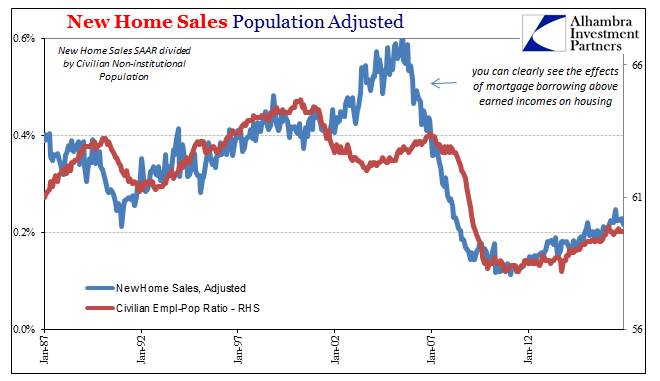

Using a 6-month moving average, the trend in sales is clearly lower dating back to around November last year. That is contradictory, of course, to “reflation” sentiment that around the same time exploded in optimism. It’s another piece of evidence refuting the idea of sentiment (in survey form, at least) as a driving factor in aggregate economic decisions.

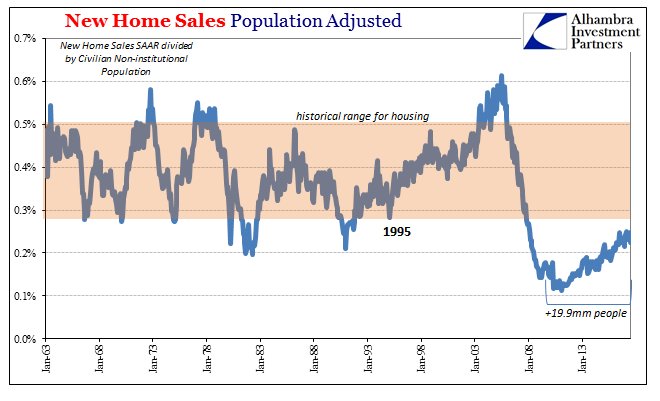

It’s not as if new home sales are or have been robust, either. Adjusted for population growth, the sale of new single family housing units remains around historical lows. There isn’t a huge amount of demand for new construction despite more than a decade’s distance since the (last) bubble burst. There is clearly more than a shift in behavior.

It’s not likely to be demographics, either. Baby Boomer retirement might in theory reduce the need as well as desire for home construction. Enough time has passed, however, where especially in resales with rising prices some kind of supply should be offered (whether other existing houses, which just isn’t happening, or building new ones, which doesn’t appear to be taking place, either) given economic appearances. At some point, the housing stock has to be replenished and turned over.

If it isn’t being done, that is almost surely a demand issue relating to both recent as well as trend macro factors (meaning not the “recovery” talked about in the mainstream).

The unemployment rate may be really low and still falling, but it isn’t an accurate view of the labor market. The recovery, so to speak, from the Great “Recession” has been stunted and under the “rising dollar” became more fragile still. Restraint/uncertainty/weakness well into 2017 makes perfect sense from this view.

As noted last week, household formation which had rebounded in 2014 has been falling off once again since around August 2015 – right around the same time as falling inventory. It is complementary data that suggests growing reluctance on the part of consumers to take a major risk with a major life change. That’s not indicative of a healthy economy, or even the right marginal direction towards one.

Looking for economic improvement in 2017 continues to get harder not easier.

Stay In Touch