Many if not most people were looking at Janet Yellen’s Jackson Hole speech hoping for some hint or clue as to her “hawkishness” or “dovishness.” As I’ve written before, that’s the wrong to look at the Federal Reserve and its policy. They want to raise rates simply because it’s been one hundred and nineteen months since they started lowering them.

Without further excuses provided by a rampaging “rising dollar”, as it did in 2015 and 2016, they just have to get on with it. The real message in her speech was more subtle, maybe too much. We can find it more easily in contrast to her predecessor’s prior appearances at Jackson Hole.

This year’s gathering is nothing compared to the one seven years ago in August 2010. Though the Great “Recession” had officially ended more than a year before, the economy wasn’t progressing as much or as quickly (sounds familiar) as it perhaps should have been given the size of the downturn and devastation. Then problems in Europe appeared that really had little to do with Europe.

Essentially markets and the media wanted Ben Bernanke to bail out the system again. QE1 had been terminated at the end of March 2010, and in between was a flash crash in US stocks and a whole lot of negativity in other markets – the same kind as became common in 2008.

Bernanke didn’t disappoint, of course, practically signaling that a second QE was coming (as it did). First, however, he had to get around the need for a second.

On the whole, when the eruption of the Panic of 2008 threatened the very foundations of the global economy, the world rose to the challenge, with a remarkable degree of international cooperation, despite very difficult conditions and compressed time frames. And when last we gathered here, there were strong indications that the sharp contraction of the global economy of late 2008 and early 2009 had ended. Most economies were growing again, and international trade was once again expanding.

Notwithstanding some important steps forward, however, as we return once again to Jackson Hole I think we would all agree that, for much of the world, the task of economic recovery and repair remains far from complete.

Bernanke may have been an economist but that wasn’t who he really was (or is). The man is a sophist through and through. Read that statement again and you are provided the sense that the “crash” was some externality unrelated to the Federal Reserve. In other words, the worst monetary panic in generations had nothing to do with the monetary agency assigning itself dominion over money.

In many ways that was actually true, except that the Fed did not stand idly by while it all happened. Bernanke makes it sound as if there was some rogue wave that all at once crashed onboard the USS Economy and nearly sank it, if not for the fearless crew.

It was rewriting history that wasn’t all that old. He had to do it else people might start to get suspicious about a second QE, and then start wondering not just how ineffective the first one might have been but also what was really going on that required, in Bernanke’s view, a second (and then third, and then fourth).

Contrast Bernanke’s seven year old sophistry with Janet Yellen’s version given today in the same setting.

The U.S. and global financial system was in a dangerous place 10 years ago. U.S. house prices had peaked in 2006, and strains in the subprime mortgage market grew acute over the first half of 2007. By August, liquidity in money markets had deteriorated enough to require the Federal Reserve to take steps to support it. And yet the discussion here at Jackson Hole in August 2007, with a few notable exceptions, was fairly optimistic about the possible economic fallout from the stresses apparent in the financial system. [emphasis added]

They were nearly as much a year later in August 2008, too. The reason for it was all the “powerful” responses that were offered, liquidity and otherwise, that at the time they were started economists uniformly believed would be effective; but already by August 2010 they were being officially forgotten.

Back to Yellen today:

Despite the forceful policy responses by the Treasury, the Congress, the FDIC, and the Federal Reserve as well as authorities abroad, the crisis continued to intensify: The vulnerabilities in the U.S. and global economies had grown too large, and the subsequent damage was enormous. From the beginning of 2008 to early 2010, nearly 9 million jobs, on net, were lost in the United States. Millions of Americans lost their homes. And distress was not limited to the U.S. economy: Global trade and economic activity contracted to a degree that had not been seen since the 1930s. The economic recovery that followed, despite extraordinary policy actions, was painfully slow. [emphasis added]

She doesn’t come out and state what those “vulnerabilities” actually were, but she no longer needs to. It was a monetary panic whose end result was the economic damage which she further (partially) lists. All the King’s horses and All the King’s men in 2008.

But not just 2008. They still have yet to put the economy back together again. The focus of Yellen’s speech was regulation, primarily those put in place after the panic because officials (like Bernanke and Yellen) had no idea what was really going on. The very fact of the crisis demonstrated that much.

The idea behind reform and re-regulation (Dodd-Frank and other rules) was to make the financial system “resilient” in order to foster growth. If banks and institutions were confident about this new system arising from the ashes of the old, then recovery would happen; at least that was the assumption.

Now–a decade from the onset of the crisis and nearly seven years since the passage of the Dodd-Frank Act and international agreement on the key banking reforms–a new question is being asked: Have reforms gone too far, resulting in a financial system that is too burdened to support prudent risk-taking and economic growth?

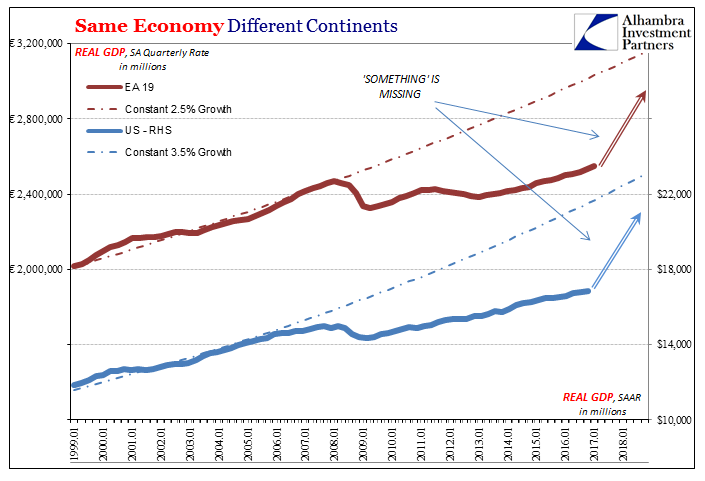

People are only asking the question because there is every reason to suspect that “something” just ain’t right. Ten years is more than enough time (and five years of “transitory” doesn’t really convince anyone anymore). I don’t mean regulation specifically, but instead the monetary system. Yellen and her comrades are being pushed closer to the truth. It won’t surprise you that she believes the answer to her question is “no”, but the mere fact that she feels compelled to address the matter shows (as always) that she is worried that maybe there is something holding it all back, and that this something is within her area of bureaucracy.

Why is the Fed seeking to “raise rates?” Because what else are they going to do? They surely suspect by now that in the end it doesn’t matter either way. Things happen whether they do or they don’t; the “rising dollar” amply proving that point for the third time since 2007. When you don’t know what to do or why, you do what comes naturally or what you were trained to do.

Monetary policy has no answers. It hasn’t for a very, very long time. There are neither doves nor hawks at the FOMC. There are only more questions than answers, especially after Bernanke and ten years.

Now let’s hear what Mario Draghi has to say on the topic. One thing I doubt he will address is why despite often opposite monetary policy stances the US and Europe have ended up in the same predicament.

Stay In Touch