If the essence of modern eurodollar money is bank balance sheet capacity, then we need not wonder what has gone wrong or why. The very heart of this global currency system no longer beats so healthy and strong. Global banks shrink rather than expand at a breakneck pace, their desire to do the latter restrained by the incapacity of the system to manage what’s left.

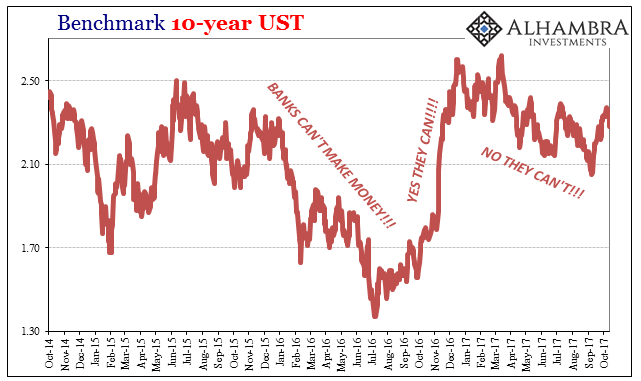

In very general terms, it is really simple; banks that can’t make money in this money aren’t going to make their balance sheet capacity available to others. Since the system is incestuous in this crucial respect, it becomes merely self-reinforcing.

Contraction here means non-linear contraction, though quite a few firms have shrunk on an absolute basis, too. In other words, the rate of growth matters the most in testing the difference between eurodollars abundantly available on a global basis, or eurodollars increasingly tight and at odds with economic growth.

QE has been entirely absent in this regime, apart from a few temporary outliers. As I wrote in December 2015 in claiming why this “tightness” will continue:

QE was supposed to create a recovery and thus great profit opportunity, but the absence of QE leaves banks to only leave, meaning no profit and thus truly no recovery. This financialism becomes the economic misimpression that “unexpectedly” showed up this year to spoil the self-congratulatory party as the FOMC tries over and over for a lift off.

As this point is pressed home over and over, as each bank cuts back and restructures against FICC, the “dollar” only cuts deeper and deeper into the financialized global economy and makes it only less opportune for what balance sheet resources remain; and round and round we go.

Almost two years later, the banks in their Q3 2017 earnings report still can’t make money in this money. They have shifted conveniently in their excuses, this time talking about the lack of volatility depressing FICC, or the colloquial “bond trading.” They can’t make money when volatility is high, and they can’t make it when volatility is low, suggesting (again) volatility in the conventional sense isn’t really the problem.

JP Morgan, for example, reported last week that in its Corporate & Investment Bank segment Markets revenue was down 21% year-over-year. The vast majority of that being “bond trading”, the bank’s fixed income revenue summed to $3.2 billion in Q3 2017 compared to $4.3 billion in Q3 2016 (during the “reflation” selloff where interest rates had nowhere to go but up). That’s -27% where it really counts.

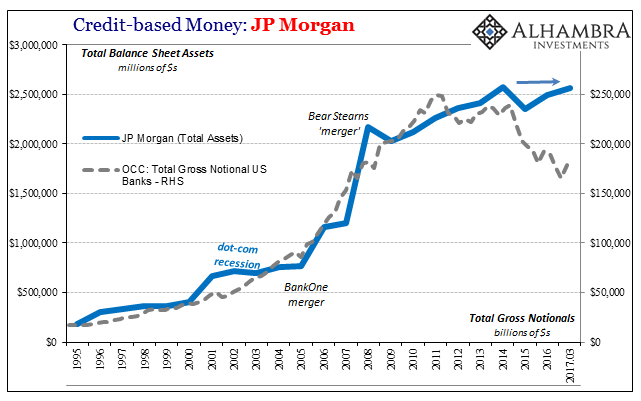

Such a slump in fixed income revenue, which includes JPM’s derivatives book, is not something the system can just ignore. JPM’s lack of profit-making in FICC is passed around as diminished balance sheet capacity, or the equivalent of monetary tightness.

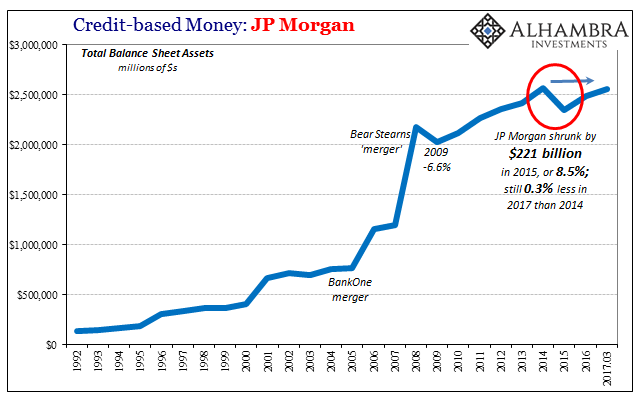

JP Morgan’s entire balance sheet (total assets) is at the end of Q3 smaller than it was in 2014. During those three years we found globally the equivalent of what appeared to be a “dollar shortage”, otherwise known as the “rising dollar.”

The pattern is merely repeated at different scales. The lack of offered balance sheet capacity makes it more difficult (and expensive) for other banks to manager their own balance sheets. Therefore, the rate of expansion in the aggregate private bank balance sheet slows to a crawl, if not on occasion the outright shrinking indicated in far too many places.

Without the derivatives, a balance sheet becomes far more inefficient and cumbersome, awkward to a fault. The math just doesn’t work the same, exposing whatever particular bank to greater (modeled as well as realized) risk. In that environment the only possible operating solution is to be far more fastidious and reluctant in balance sheet growth.

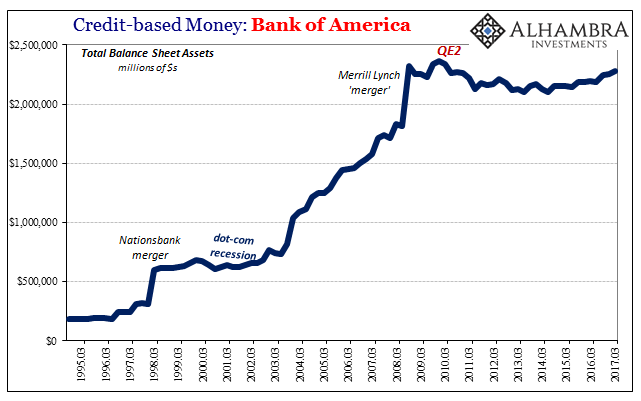

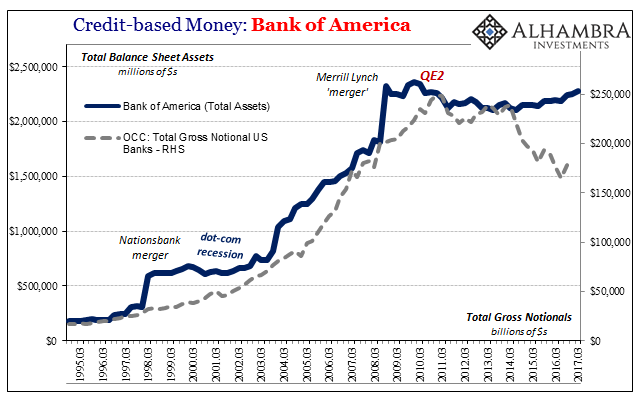

Bank of America also reported earnings last week, and unsurprisingly its results particularly in FICC were similarly atrocious. Repeating the pattern set by JPM, the bank blamed low volatility for a 22% contraction in “bond trading” revenue. BofA’s balance sheet is still smaller today than it was in Q2 2010.

Again, without the ability to easily and fluidly manage balance sheet risk (assets), no bank is going to expand at a pace necessary to shift from the system from monetary tightness to sufficient or better. After four QE’s in the US, and numerous others around the world, it is perfectly clear monetary policy plays no role here other than perhaps having proven to these banks that the Fed really is irrelevant.

While these are but anecdotes, the pattern is repeated everywhere if not uniformly so. There was tremendous growth up until 2007-08, and a clear change in behavior thereafter. It has nothing (or very little) to do with regulations, and everything to do with risk and more so how it is managed in these practical eurodollar settings.

In that sense the eurodollar system is, or was, a contradiction of sorts; it grew rapidly because it grew rapidly. So long as balance sheet capacity was exploding higher, it threw off the necessary monetary resources (both liquidity in things like repo, as well as capacity in things like CDS and interest rate swaps) to keep balance sheet capacity growing exponentially. All return with no risk. The interruption of that circular logic caused an irreparable rift in operation.

The monetary tightness of the last decade is the reverse; all risk with no return. Part of the increased appreciation for risk is the lack of fluid ability to trade liabilities (liquidity and math-as-money derivatives) to manage balance sheets. The profit part of the equation is easy enough to see and to appreciate why it will continue as I stated a few years ago. The effects of that are a bit harder to appreciate and understand, particularly given the almost paradoxical nature of its operation.

In visual form, however, what else needs to be said?

Stay In Touch