Deutsche Bank’s CEO John Cryan warned that the bank’s quarterly results for Q3 would be no better than those produced in the two disappointing quarters prior. He has been proved by the bank’s reported results to have been optimistic. Trading revenue fell an alarming 30% year-over-year, with DB joining the rest of Wall Street in blaming the absence of “volatility” for it.

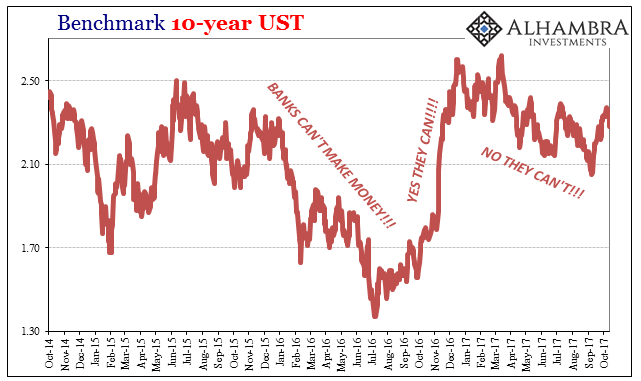

The press release for the latest quarterly earnings cited “an interest rate environment which remained challenging.” It can only be interpreted the same as for the rest, meaning all these banks really have bought into the idea that interest rates have nowhere to go but up.

Aside from the trading segment, DB’s Corporate & Investment Bank segment reported truly awful results. Revenues were down 23% Y/Y to just €3.5 billion. By way of comparison, in Q3 2010 the same bank division reported net revenues of just over €5 billion.

Within the Corporate & Investment Bank, the all-important FICC category, or FIC as it is characterized at DB, produced 36% less revenue in Q3 2017 than in Q3 2016 (though the bank notes that on a comparable reporting basis, having reclassified certain desks, apparently, the comp for FIC was instead -24%). Deutsche Bank still can’t make money in “bond trading.”

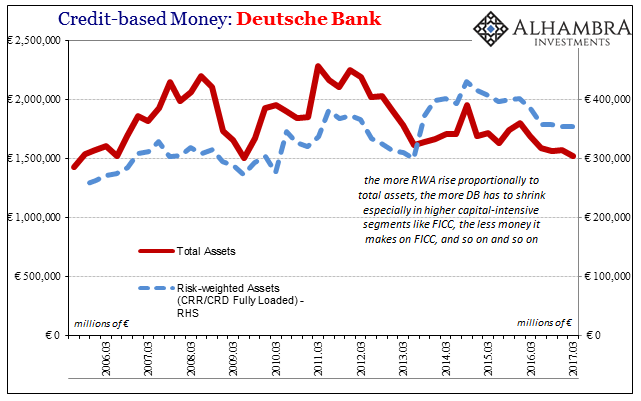

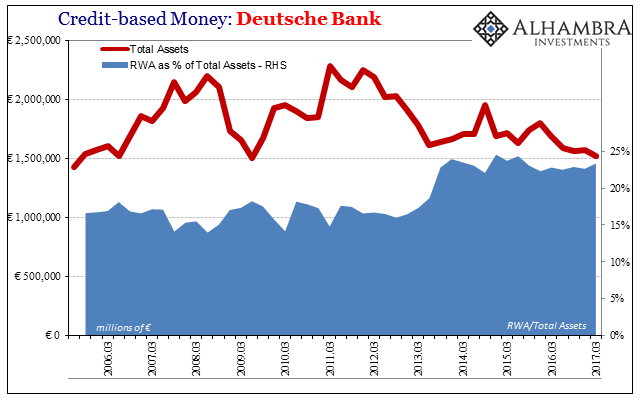

As a result, the bank is essentially locked into a struggle with itself, a self-cycling reduction that regulations have played a larger role in fostering, far more so than anywhere else. The firm was always highly aggressive with its math, but has been made to recalculate by among other things Basel 3.

Without revenue growth in bond trading as both a euphemism and an accurate depiction of other activities, the bank can’t afford the higher capital costs associated with those activities. Had the recovery actually happened, though, they would have easily been able to. Risk-Weighted Assets (RWA) have risen especially as a proportion of Total Assets despite in 2012-13 several publicized tricks of accounting (altered math), leaving the bank few options because profit growth hasn’t come close to living up to what was expected of a recovery.

Without enough return in FIC and CIB, the higher level of RWA can only be managed by shrinking Total Assets, particularly those related to the more capital intensive desks like what operate in “bond trading.” It is literally more risk for less return, where less return leads to even more risk, more shrinking and the self-reinforcing positive feedback loop that none of the previous four or five restructuring plans have been able to break out of.

It’s why now John Cryan having been in his position only for a short time is already edging closer to an exit following whispers of a serious shareholder revolt. The bank, which isn’t truly a bank, may, in fact, be broken beyond repair. It is therefore a very good representation of the eurodollar system it once easily and necessarily dominated.

Because of that, DB’s struggles are not shouldered by DB’s management and shareholders alone. The bank is, or was, one of the largest in the world particularly when it came to the more esoteric parts of “bond trading.” Deutsche Bank’s withdrawal from it has been noticed and felt, to be sure, even if it doesn’t show up anywhere other than the footnotes of its own, as well as all the others’, bank reports.

Stay In Touch