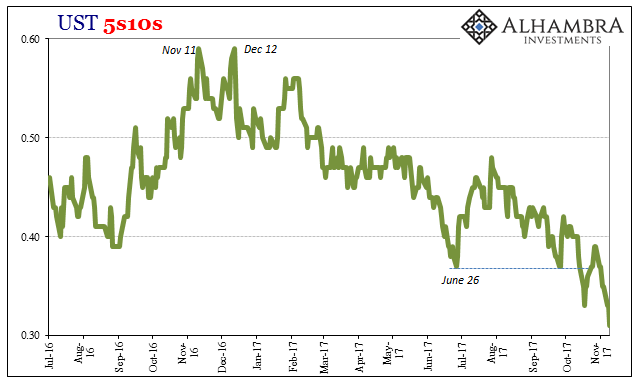

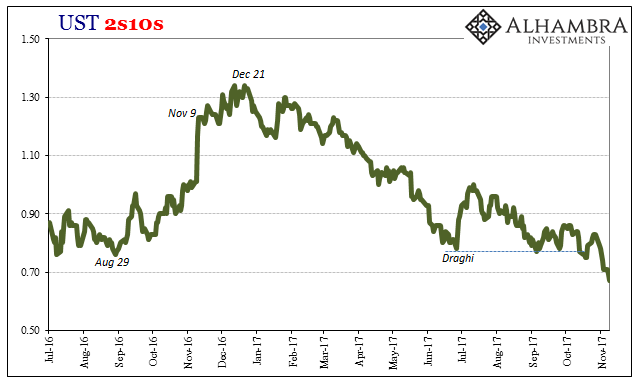

While I commend the mainstream media for refraining the past few months from their orthodox tendencies to shout BOND ROUT!!! every time long Treasury yields rise for more than a few days at a time, that doesn’t mean the total absence of the ridiculous. With the long end once again trending lower in nominal yields, the curve has utterly collapsed well past last summer’s low point(s), a condition that leaves most commentary stunned.

After all, the Fed undertaking “rate hikes” is supposed to signal their concerns about rising inflation and economic potential. Though neither of those is currently indicated anywhere, though they should have been a long time ago, the media continues to take Economists’ projections at face value. Editorial standards are as constant as the “conundrums” they have produced.

This has led to an overabundance of articles and stories all declaring how the bond market is surely wrong (without noting how right it has been for a very long time, directly in the face of Economists) and will live to really regret fighting the Fed. These are often created by logical fallacies (appeal to authority, in the form of either Bond Kings or Fed Kings), or, as in the case here, the preposterous.

What propelled the glut was demographic patterns in big economies that saw a surge in the share of people aged 35 to 64, which tend to be years of high savings, Will Denyer, an economist at Hong Kong-based Gavekal, wrote in a report this month. When those demographic patterns reverse, the implication will be potentially “big rate rises” and the risk of a “major fall” in global equity valuations, he wrote.

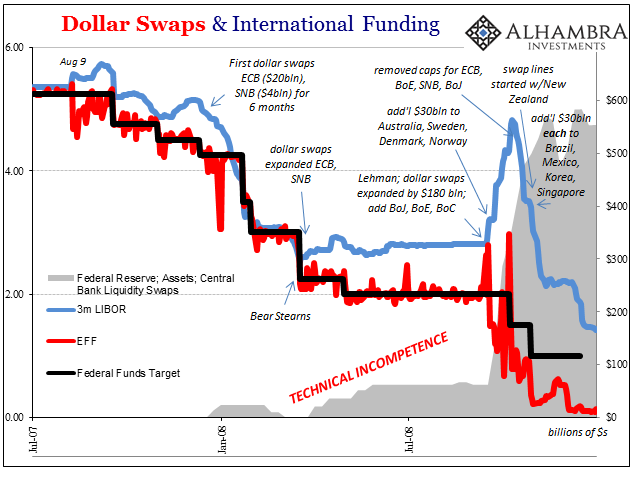

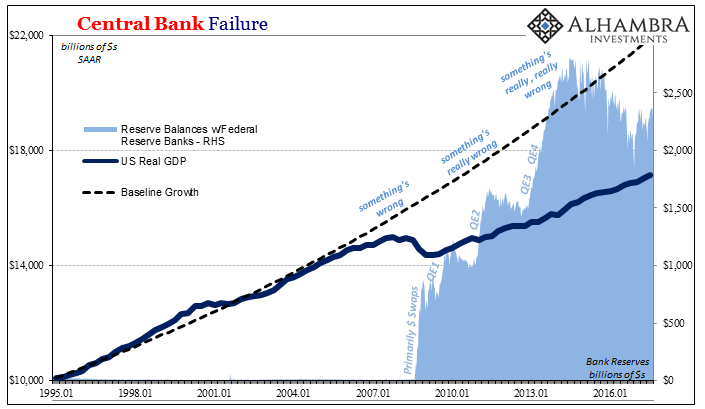

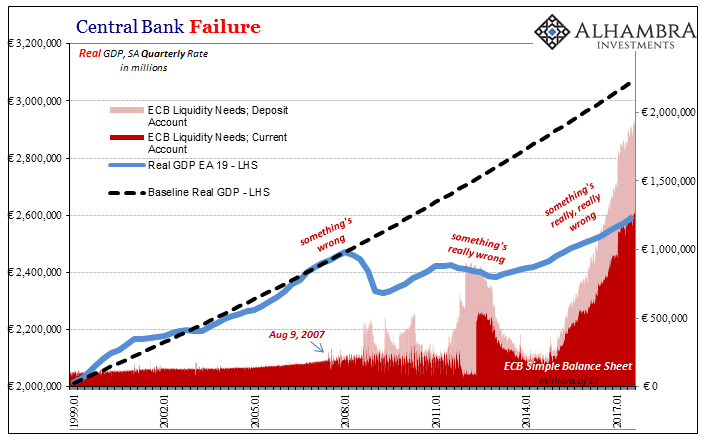

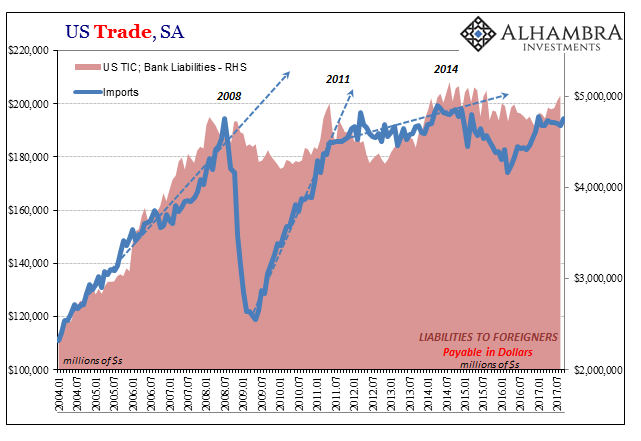

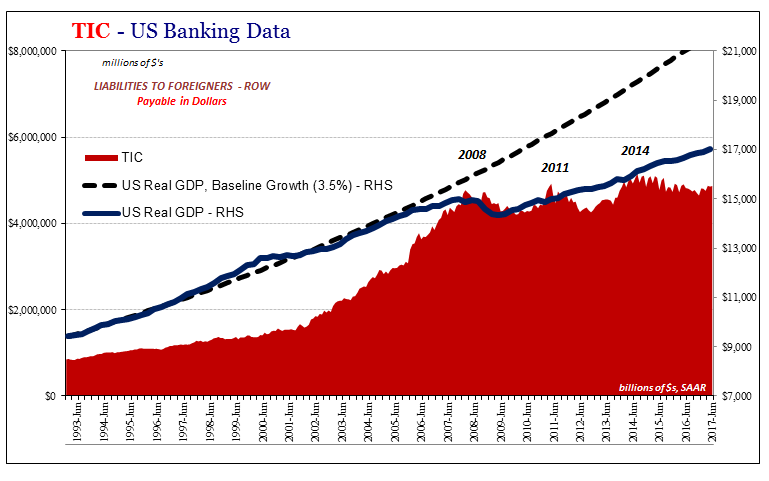

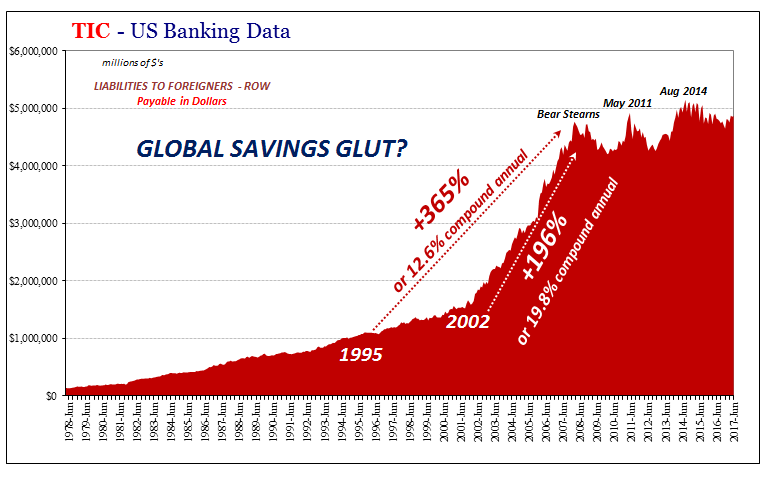

The “glut” discussed here is Ben Bernanke’s “global savings glut”, a figment he imagined a decade ago to explain why monetary growth outside the United States even in dollars just had to be someone else’s doing (and therefore responsibility). As I told my audience in the Cayman Islands last month, this idea was the only way that Economists like Bernanke could make sense of what was actually happening.

Therefore, over the decades that followed, these blobs of offshore “proliferation of products” gained and gained until economists weren’t able to ignore them any longer. Stock and Watson saw it as “good luck” while Ben Bernanke looked upon it as a “global savings glut.” To a closed-system economist like Bernanke in 2005, that’s what it appeared to be; a mass of credit and money from outside the United States.

To try to justify this interpretation, the former Fed chief even dreamed of foreign Baby Boomers increasing their retirement allocations up to and past that time, therefore the glut of savings.

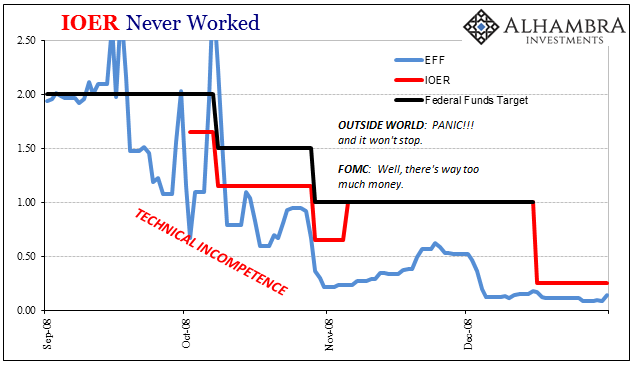

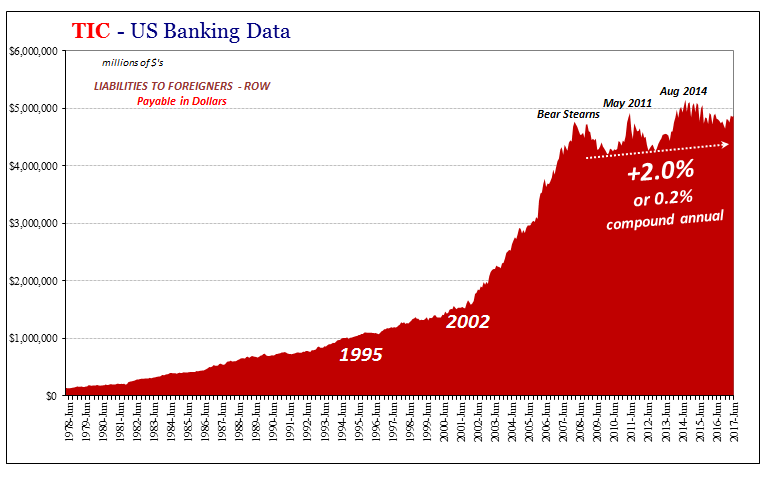

In a way it’s not surprising that Economists would still refer to the “global savings glut” even in 2017 as if they have been asleep the past ten years or so. I only bring it up (repeatedly) to demonstrate just how clueless and incompetent Fed and other central bank officials were and still are. After what really happened in 2007 and 2008, eurodollar panic, not dollar panic, and then further official “discoveries” of things like the trillions of footnote dollars, there really isn’t any rationale for thinking offshore funding is anything like a global savings glut.

The ongoing tightness of that credit-based monetary ecosystem more than explains, as Milton Friedman proved again and again referring to the interest rate fallacy, the behavior of the bond market without ever requiring more and more desperate attempts to explain reality in a way that preserves what has been wrong for a very long time.

It’s that kind of institutional inertia that really prevents the fomenting of actual and active solutions; because Economists have always thought this way, the mere fact that they have for so long becomes an argument or evidence unto itself – as if no counterfactual evidence has been presented even though it has.

Someday long into the future, interest rates will have to rise and by more than a little at every part of the yield curve. I still believe that when the time comes the economic growth unleashed that causes it will be breathtaking to the point of disbelief – emerging market kinds of growth rates here in the US and maybe even Europe. That day, however, won’t ever be possible until the “global savings glut” is relegated to the shameful past history of most if not all central bank thinking.

That, more than anything, is what the yield curve is saying especially at these nominal rates. The global savings glut and all the related monetary beliefs in the mainstream just don’t jive with reality.

Stay In Touch