The Communist Chinese government views banking as a core industry, the securities business a core concept of banking. Their domestic sector has therefore been given preference and protection despite market reforms adopted elsewhere in China’s economy. Foreign bank presence has been ostensibly nothing, a fact that the government I believe wanted as a measure of symbolic openness rather than head toward manifest recharacterization.

The first to attempt the China allure was Morgan Stanley. The rules compelled any foreign bank presence take the form of a Joint Venture (JV) with a local Chinese firm (among other often draconian requirements), with that local bank or broker retaining the majority stake. Morgan Stanley’s adventure with China Fortune Securities began on December 7, 2007, not exactly fortuitous timing for its conception.

It was actually the second time the Wall Street firm had tried in China. Back in 1995 when the Asian tiger first opened itself to any kind of overseas influence, it made a sizable investment in China International Corp, or CICC. It was never anything more than a passive venture over which Morgan Stanley exercised no control, not even the opportunity to sell its products under CICC banners.

Morgan Stanley eventually sold its shares in 2010 (Morgan also had its own problems).

The lack of significant progress remained an impediment for greater penetration. JP Morgan had established JP Morgan First Capital as a minority JV in 2010, but late last year decided it just wasn’t progressing the way the American bank had hoped (JPM also has its own problems). It generated minimal profits but for who really knows what risks. It was sold last October.

With President Trump in China this week, Chinese officials announcing relaxed restrictions on foreign securities practices. Rumors had been leaked some time ago, so the timing of the announcement as well as some of the details was all that remained to clear up. Still, this was a big step.

Over the next three to five years, restrictions will be altered such that foreign firms will be allowed majority stakes in their JV’s, including those in the securities business (FICC). They will be allowed a 51% controlling interest, a cap that will be removed after 3 years. For life insurance companies, the cap will be 51% in three years, removed after five.

The obvious question is, “what changed?” Why are the Chinese suddenly rolling out the figurative red carpet for foreign presence in businesses that are held as state security?

For real answers, I think we need only go back to last week and PBOC Governor Zhou’s blunt assessment of Chinese conditions. He stated quite clearly that China has a debt problem. He didn’t go further into the details, for what he left out explicitly, implying only, was that China really has a bad debt problem. Its banks and securities firms are on the hook for what the government hasn’t absorbed. These are not likely to be small, trivial balances.

The grand debt swap scheme envisioned as one likely solution to this imbalance hasn’t gone nearly as far was hoped. The Big 4 banks, all state-owned, are very well-capitalized at least according to Basel rules and measures (for whatever that’s ultimately worth), but many of China’s midsized firms are not. They could use some fresh “capital” even if it is from abroad.

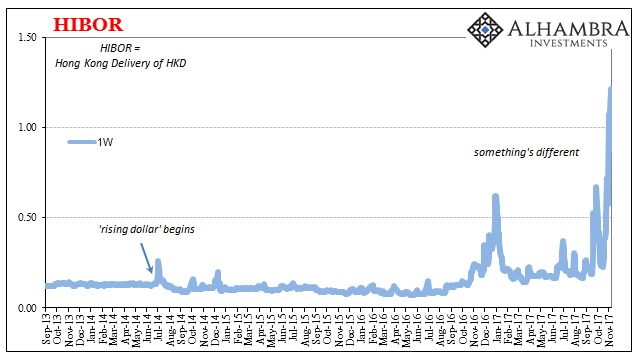

China could also use some more “dollars”, the external root problem Zhou also discussed in his missive. The Chinese have tried quite a few different things to stabilize their currency situation, to no avail. As noted earlier this week, their Hong Kong “dollar” adventure has gone off the rails, having become another great external risk to add to the PBOC’s concerns.

Last month, the Chinese government floated a minimal dollar bond issue for the first time in more than a decade. The purpose was to establish an extremely workable price benchmark for any Chinese firms (read: banks) who might want to explore Eurobonds (bonds issued in dollars offshore, meaning bonds in eurodollars, thus Eurobonds).

The global eurodollar banking sector isn’t cooperating with China’s demands for “dollar” funding, especially since 2013, so alternate approaches are being actively sought. In that vein, it makes sense that the Chinese government would try to give especially investment banks (FICC) what they clearly want (or at least wanted at one time) to try to up the reward for “dollars” in China.

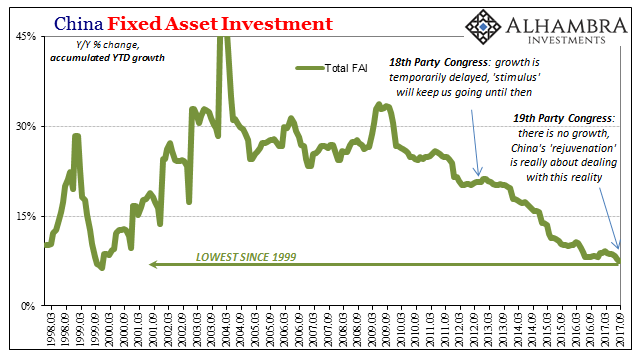

The timing of this announcement, again as it was being worked on for a month at least, puts it in the realm of the bond sale as well as the Hong Kong blowup. Are the Chinese in a hurry, or is it desperation? I have been writing for years that a lot of China’s debt expansion took place under very different assumptions; before 2013 it was uniformly expected that China’s economy was merely delayed in returning to pre-crisis growth paradigm.

A no-growth paradigm is not just a problem for China’s economy but more so for a financial system giving out loans and securities predicated on (very) wrong assumptions.

That’s a debt problem but also a monetary one in the modern world of credit-based currencies, where funding channels are, as Zhou pointed out, “hidden, complex, sudden, contagious and hazardous.” Give global eurodollar banks, especially in the FICC business, a full skin in China’s “dollar” game and maybe it gets less sudden and hazardous (though it could also amplify contagious). Hidden and complex won’t change, not anytime soon, so increasing the infrastructure and global reach of China’s part in hidden and complex is at least a rational if still risky approach.

I don’t think we are done seeing new Chinese “dollar” strategies, either. That counts on the supply side, such as foreign-based FICC, Hong Kong, and Eurobonds, as well as the demand side in reducing China’s needs for “dollars” (oil in CNY, bilateral trade agreements wherever possible). As such, I believe China’s new strategy is coming into focus – survive the next period however long it may be as best as possible until whatever time China is either strong or desperate enough to do something else.

That all is, in my view, what Zhou was referring to when he wrote:

However, at present and for a period in the future, China’s financial sector is still in a period of high risk-prone period [sic]. [emphasis added]

The government’s actions once more demonstrate that these aren’t just hollow words.

Stay In Touch