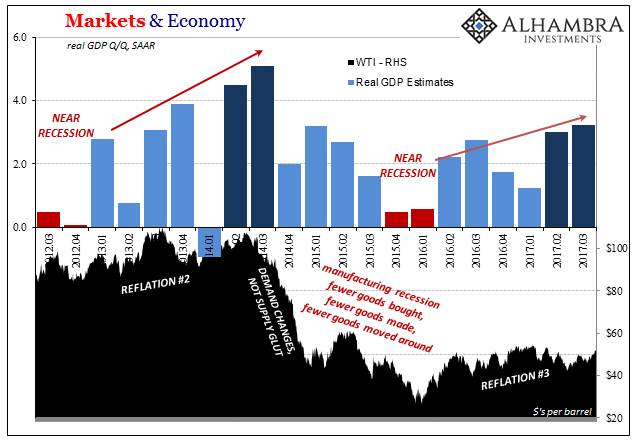

Gross Domestic Product (GDP) was revised upward from a seasonally-adjusted annual growth rate of 2.945% to 3.243%. For the first time since the middle of 2014, GDP appears to have advanced (subject to further revisions) at a better than 3% rate for two consecutive quarters. That level of growth used to be commonplace, even something of an economic floor, but now is celebrated as an achievement given the rarity of its occurrence.

And even when compared to prior intermittent upswings, GDP still registers more trouble than positives. Comparing the middle quarters of 2017 with the middle quarters of 2014 shows just how little growth is actually taking place. What makes up actual economic growth is not the occasional decent quarter or two, but sustaining them for a prolonged period.

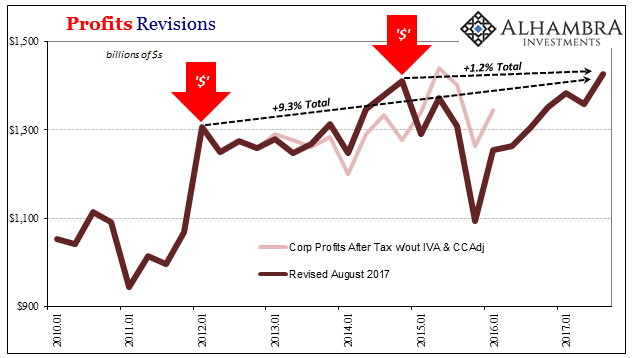

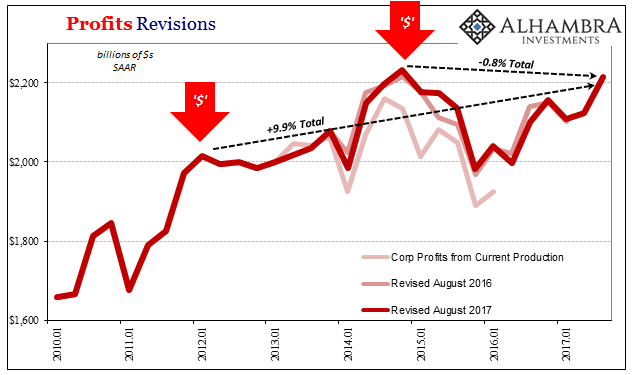

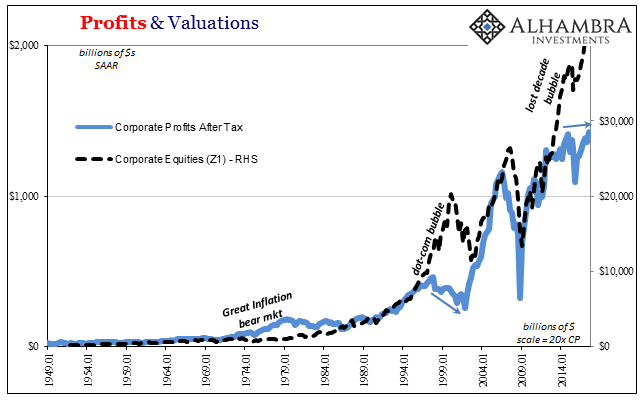

Like inflation, these numbers mean something in the real world. We can observe those effects through something like corporate profits. Accompanying the first GDP revision to Q3 estimates are the BEA’s versions of profit estimates. During the quarter, corporate bottom lines improved like the overall economy captured by headline GDP.

But it still doesn’t mean very much. In context, profits are lagging severely still even though the downturn, an actual contraction in net income terms, ended seven quarters ago (the trough for profits was Q4 2015). Depending on the specific measure, corporate net income is in Q3 2017 at best barely more than Q4 2014, or, in the more important economic measures like profits from current income and corporate net cash flow, still below that period.

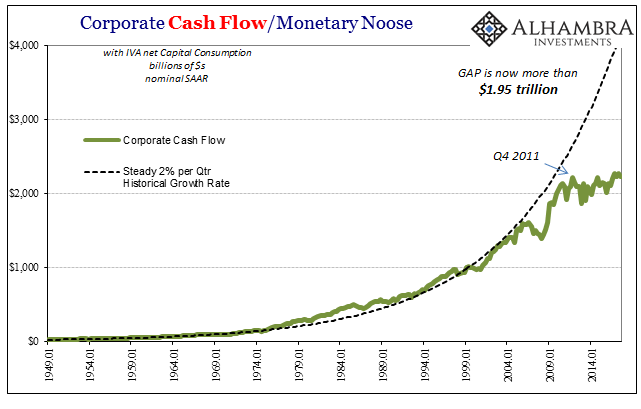

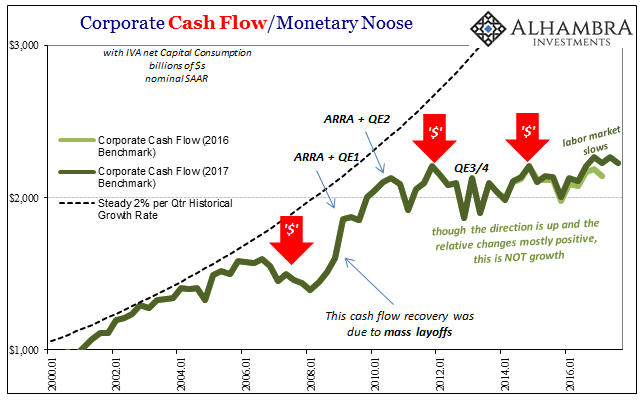

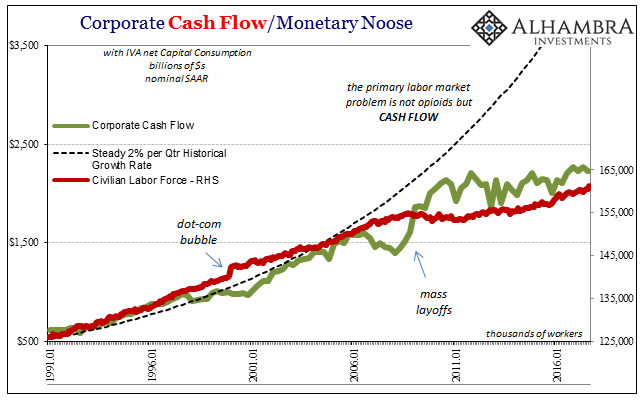

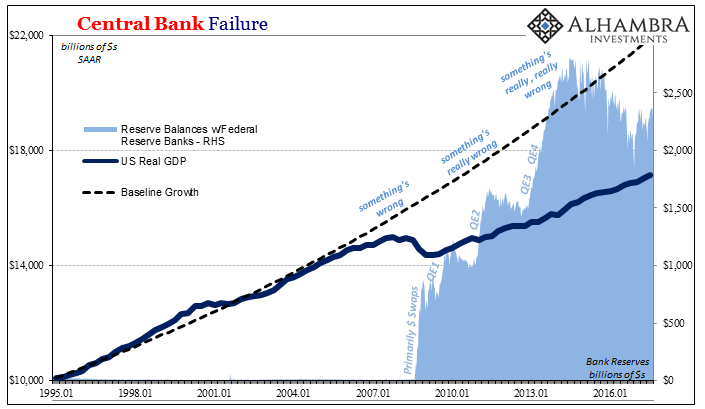

This lack of growth goes back almost six years, a deviation in growth rates (and much more volatility) registering in early 2012 following the monetary fireworks in 2011. Economists and central bankers after finally admitting their might be an economic problem have tried to turn it into an exogenous one, blaming the medical profession so as to avoid scrutiny of the monetary profession.

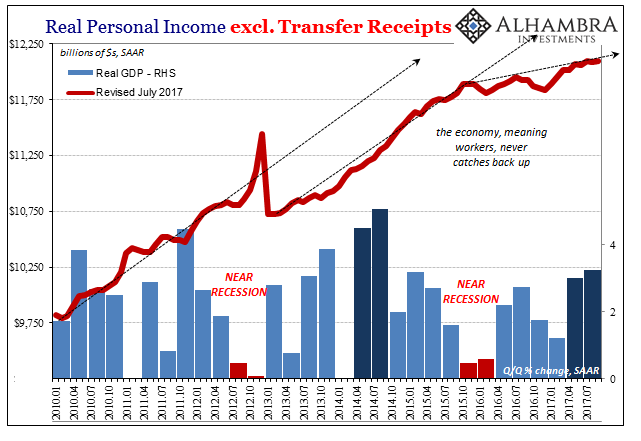

The opioid crisis is all-too-real, of course, but the labor market doesn’t have a drug problem so much as businesses have a cash flow problem. Corporate cash flow is clearly and substantially restrained. Absent sustained cash flow growth, which goes along with profit growth, businesses in the aggregate can only be cautious about their cost structures. Labor is their single largest input.

Given this situation, one that has been thoroughly proved as more than temporary, from inside the corporate board room the repurchase of shares actually makes some (perverse) sense. With limited internal resources, it appears far less of a risk to borrow funds from the bond market to buyback stock rather than build more and better productive capacity.

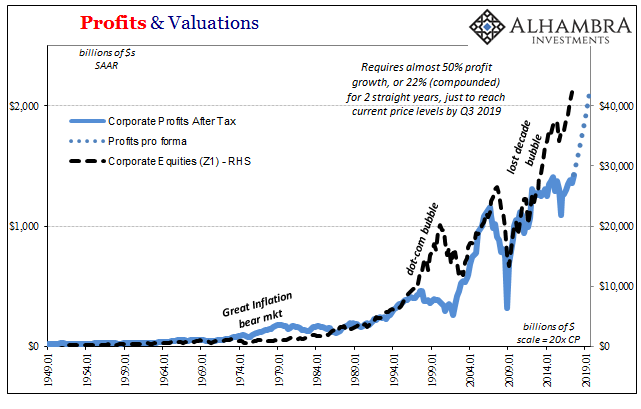

That underlying flow into stocks has led to a growing imbalance therefore between prices and profits; i.e., valuations. Along with stock investors who have rationalized this difference as something like the mainstream inflation story (the 4.1% unemployment rate really does mean full employment, which can only lead to really, really robust economic conditions), valuations have struck levels last seen, only seen, in the late nineties during the dot-com bubble.

This difference can only make sense if you believe that economic growth is picking up here and around the world to such a degree that profits and earnings are about to explode upward. At the current level of stock values (and the Z1 estimates shown above and below are only updated through Q2 2017), corporate profits would have to rise 50% just to equal them. For that to happen by Q3 2019, two years from now, would require sustained 22% growth.

Such profit growth is rare, and even when it has occurred it happens in the immediate aftermath of a recession (such as Q4 2008 to Q4 2010, or in 2003/04) from a deep trough. What GDP’s headline growth suggests, quite strongly, is that the probability of that happening is exceedingly small unless something drastic is about to change.

That is the essence, really, of the current stock bubble. Investors keep telling themselves that the economy is, in fact, right around the corner from truly happy days. But like the related inflation story, it never happens and there is less indicated today that it’s even remotely possible. That’s not the way 2017 was supposed to have unfolded, and that’s why the bond market, eurodollar futures, inflation expectations, etc., are all vital to understanding why and why it is continuing on this way rather than the Hollywood ending stocks are price for.

It’s bad probability math for stocks, and worse news for the labor market that continues to struggle also two years after the 2015-16 downturn. It really is like a ratchet effect, where the longer revenue (headline growth suggested by GDP) continues to be lackluster at best the more pessimistic businesses have to be about cash flow and profit projections, leaving them that much more cautious about using, and how they use, their financial resources (less new labor, more retired shares).

When the stretching of valuations really got started in 2013, there was at least some rationale to it. Though QE3 (and 4) wasn’t what everyone thought it was, it was still a reason to believe as to how things might change from bad to good so that earnings would come up behind to support prices. Four years later, the expectation still stands only now there is nothing behind it; no additional QE’s to push the global economy since central banks have essentially thrown in the towel, replaced with but a vague sense that things just have to get better because it’s been long enough that they haven’t.

It is, quite simply, Japanification denial, reduced to a meaningless tautology. It can’t happen here, really everywhere, because it just can’t.

Stay In Touch