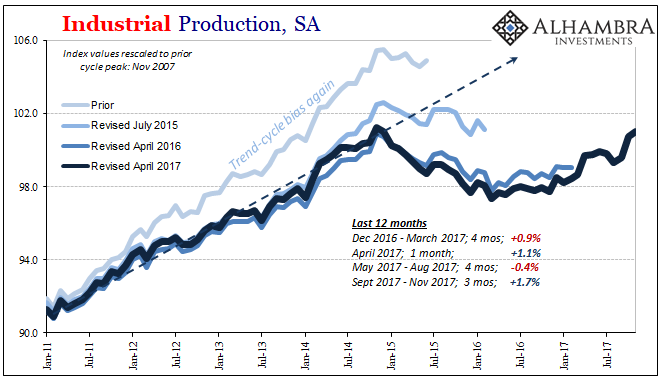

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017.

For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months. Combining April 2017 with October, IP advanced by 2.2% leaving the other 10 to contribute slightly more than 1%. That’s not a positive sign of sustained economic advance. The latter of those two big gains was the sharp pickup following the hurricane disruptions.

Industrial production has been far more volatile like that since the upturn began in mid-2016. A maintainable advance is one that is far more uniform and steady, one less susceptible to fits and starts for that leave industry unable to gather necessary momentum.

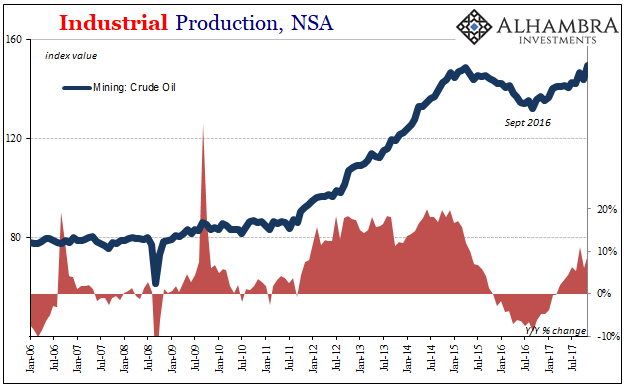

Some of this difference can be explained by where there is strength, and where there isn’t. On the plus side, mining production is back on track particularly in the oil patch. IP for crude was up just about 10% year-over-year in November, following a big boost in September and back closer to 2014 levels of expansion.

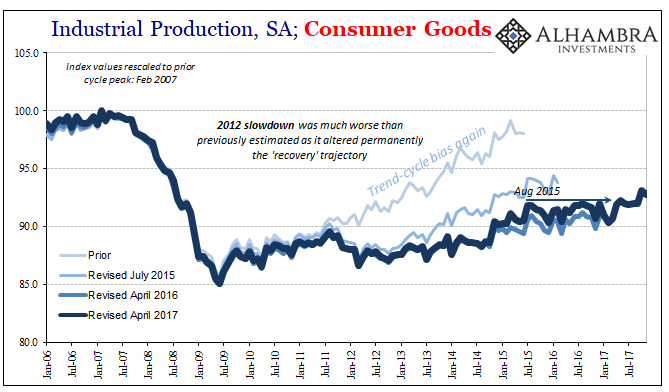

On the other side of the ledger, IP for consumer goods remains pretty much stagnant going on for more than two years now. Outside of the one good month in October, the production of consumer goods (which fell back in November) is flat for the 26 other months going back to August 2015.

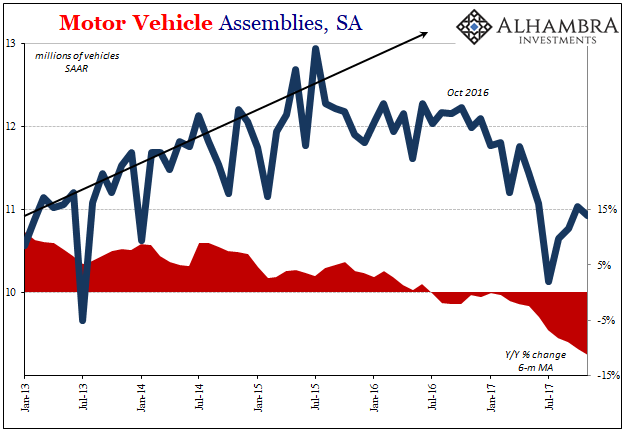

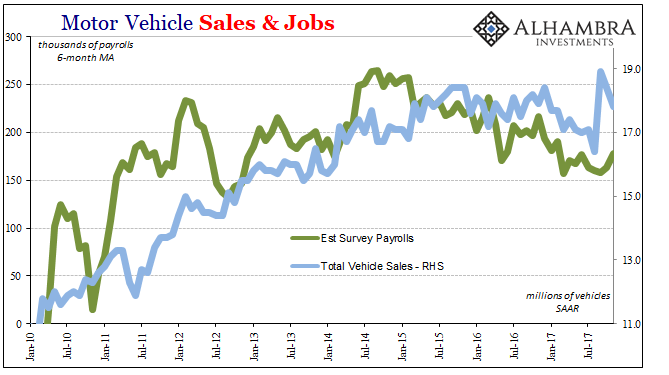

A good part of that weakness at least over the last year is attributable to the auto sector. Car production didn’t quite plummet in the first half of 2017 as it would in a recession, but it was something close to that. Slowing sales and huge levels of inventory drove the adjustment through this July.

Auto sales because of the summer storms in Texas and Florida aided the imbalance for a short while. Already, however, sales are dropping back closer to where they were before them, leaving carmakers still very sensitive to economic considerations more than those temporary impositions.

Motor Vehicle Assemblies declined slightly in November after barely rebounding back up to 11 million (SAAR) in October. These are very low levels, particularly given that the uptrend is now more than two years in the past. The widening gulf between sales and production is still inventory at all levels. The sector is now seeing to the other side of the hurricane effect and is clearly reluctant to embrace the better economy narrative.

That’s not really surprising given that auto sales (and finance) are pretty closely tied to fundamentals like incomes and jobs; in a very real sense, anyway, rather than the narrative about the 4.1% unemployment rate.

It’s pretty clear, as well as intuitive, that labor market health and growth leads, vehicle sales follow, and then auto production after everything else. Despite constantly positive rhetoric, the labor market in 2017 was not good – significantly short of decent. That doesn’t appear to be about to change, and at least according to MVA’s carmakers seem to agree.

Like the boost in retail sales, it’s not the kind of background fundamentals that would indicate lasting positive impacts from the one-time push. And like 2014, it also seems unlikely that the oil sector will be able to do much for broad pump priming or second order effects beyond shale production. In that sense, the growth rate for November in IP was deceiving, or at most consistent with what we have observed for the past almost six years.

Decent months are far too infrequent, more like anomalies than healthy economic results. That has meant more often uneven economic “growth”, an atypical pattern that Industrial Production demonstrates pretty well of late as well as why. Like a car engine performing at maximum efficiency, a real economic advance is one where all cylinders are firing perfectly. That just hasn’t happened since 2009 because of so many grave monetary interruptions, and despite optimism about 2017 heading into it, it didn’t this year, either.

Stay In Touch