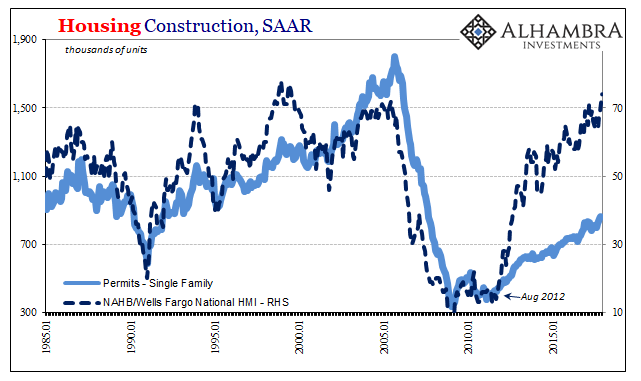

US homebuilders haven’t been this happy since the dot-com era. Not even the housing mania of the mid-2000’s had builders feeling this good about things. According to the National Association of Homebuilders (NAHB), the trade group that represents firms in the industry, their sentiment index registered a blistering 74 in December 2017.

Predictably, that’s got a lot of people excited about everything from housing to general economic prospects. Confidence is a big part of mainstream economics, and for good reason.

Developers, though, aren’t even sure why they are so enthusiastic right now. According to the NAHB, they were dead against the Republican tax reform plan working through Congress but apparently have flipped so as to use it as an excuse to be nakedly optimistic.

Homebuilders had been vehemently opposed to the Republican tax plan, which is set for a final vote in Congress this week. Changes to both the mortgage interest deduction and property tax deductions were seen as removing some of the benefits of homeownership. Apparently, builders now see the business incentives in the plan as outweighing those other negatives.

There are, of course, other possibilities. It may just be that like consumer confidence, or manufacturing sentiment, emotions no longer correlate so strongly with actual, realized activity.

The NAHB’s survey of member firms isn’t exactly a robust gathering of data. Splicing together series drawn from three different parts of the single-family segment, it asks participants to break down their views into essentially three buckets (Good, Fair and Poor in the first two, with the last rated on a scale of High/Very High, Average, and Low/Very Low).

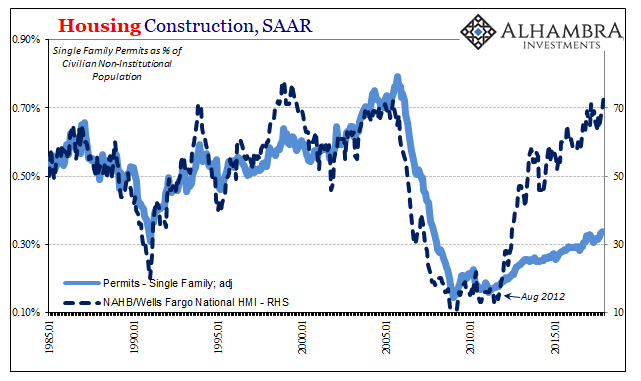

Homebuilders feel like its 1999 but are building at a pace more like 1992. That’s a world of difference without accounting for the changes brought on by time. Actually, its worse than that, adjusting for population growth the single-family stock of homes is way, way behind no matter that it’s been growing for years.

What’s happening here is pretty clear, illuminated very well by the two charts above. That sharp upturn in the NAHB’s index happened in August 2012 amidst an economic downturn that nearly reached recession proportions. No matter, the Fed by that point was widely expected to undertake a third QE, to be all MBS (QE4 added more UST’s), which they did only one month later.

So long as the housing market hasn’t relapsed into outright contraction, optimism prevails and in fact strengthens as builders along with the rest of the economy recalibrate all their expectations to something far less than normal. It is the typical reduction of standards we find everywhere else, where simple positive numbers now excite, often tremendously, where in the past it took actual, sustained growth to produce equivalent levels of positive emotions.

In other words, the construction sector isn’t telling us that the economy is about to take off, rather it is telling us that its perfectly happy, ecstatic even, that it isn’t as bad as 2009.

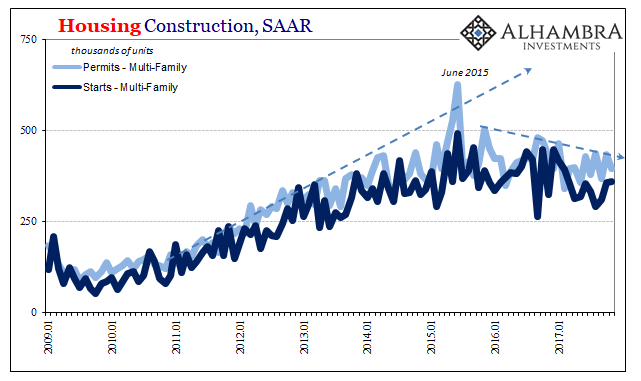

That emotional verdict, however, is derived solely from the single-family sector. The NAHB does not attempt to include the multi-family segment within its viewpoint data. It’s a pretty glaring omission in normal times given that apartment construction is no trivial proportion of construction activity. What makes it even more difficult to reconcile is that for the past few years multi-family construction is in outright contraction.

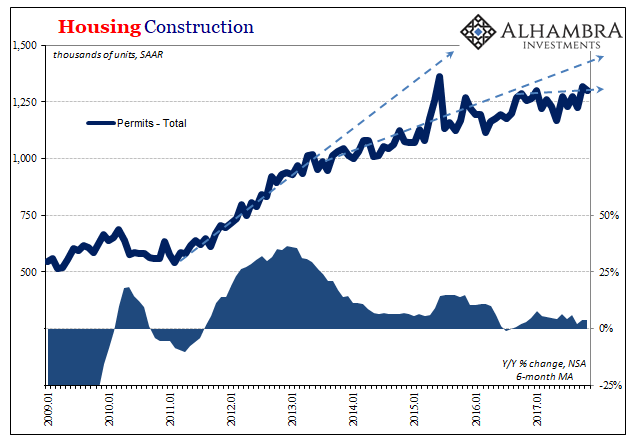

The latest data from the Census Bureau for November 2017 shows that in this part of the real estate market there has been no hurricane effect, no boost or bump to provide some cover for what is really an alarming trend (more so that it has persisted for two and half years and counting). It’s not as if the single-family part is so robust that it more than offsets this drag; overall construction is positive this year but barely.

So homebuilders report feeling downright giddy for reasons they can’t really explain and for a level of activity that actually is barely more than past busts. And that sentiment, of course, excludes one very important part of housing construction that is totally in the tank and has been for years. Sounds like the perfect representation of the last ten years, the recovery in name only (RINO). It’s a close cousin to rate hikes in name only(RHINO), both derived from the same misguided interpretation of wholly devalued “confidence.”

Stay In Touch