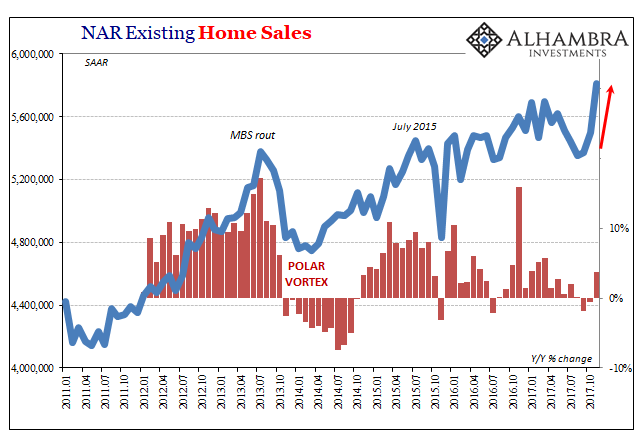

Sales of existing homes soared in November 2017, according to the National Association of Realtors (NAR). Up 5.6% in just the one month, at 5.81mm (SAAR) homes sold that’s the highest pace for resales since December 2006. After several months of glaring weakness, either a delayed rebound from hurricane disrupted activity or a burst of renewed optimism has gripped the real estate market (I’d bet the former given the timing).

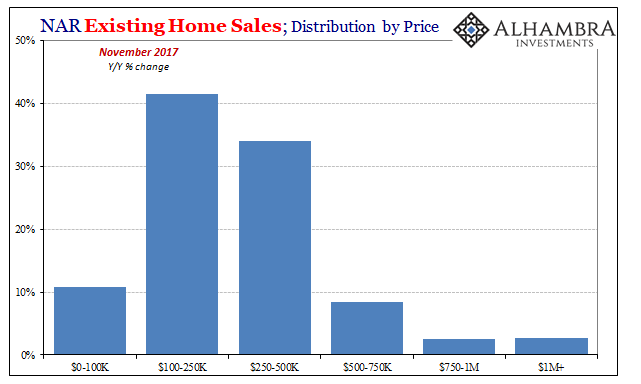

The breakdown of home sales by price last month shows a dramatic reversal from 2017’s persistent skew toward activity only at the upper ends. The NAR reports that sales in the all-important mid-range absolutely spiked. In the $100k to $250k tier, activity was up 42% year-over-year; in the next higher stage, houses priced $250k to $500k, there were 34% more completed transactions this November than last.

These results actually raise more questions than provide answers. They’re the kind of distortions typically reserved for anomalous conditions, or statistical problems in the data series. For almost all November’s big jump to be channeled only into the middle leaves too much to suspicion, particularly given how the upper ends of the housing market have been where the vast majority of growth has been derived for several years running.

Despite these numbers, overall that was still the case last month at least on the inventory side. First-time buyers continue to be absent from the market, in one part because there isn’t nearly enough available-for-sale inventory on offer. Even the NAR has been forced to acknowledge the glaring discrepancy:

As evidenced by a subdued level of first-time buyers and increased share of cash buyers, move-up buyers with considerable down payments and those with cash made up a bulk of the sales activity last month. The odds of closing on a home are much better at the upper end of the market, where inventory conditions continue to be markedly better.

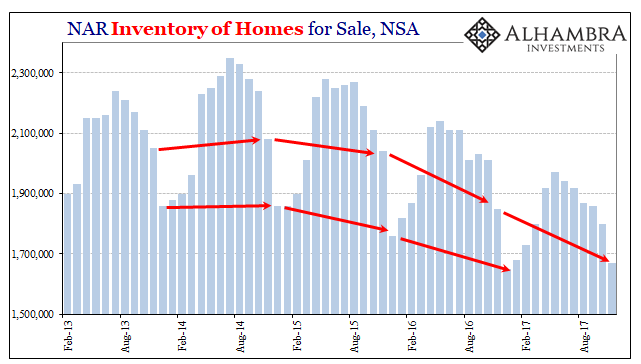

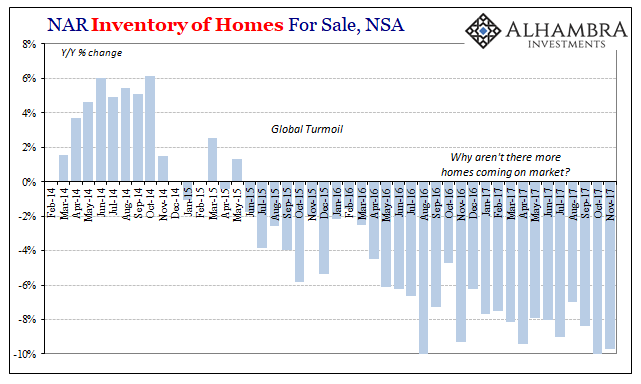

Inventory levels continue to drop overall at significant rates. The estimated number of units for sale yet to be contracted is down to 1.67 million, 20% fewer than were on offer in November 2014.

The NAR believes there is pent up demand at these lower ends particularly with young adults waiting patiently for the right opportunity. But if that was actually the case, given the clear reluctance of existing home owners in that space to sell, then it would only make sense that builders would be cashing in on what should otherwise be tremendous opportunity. Again, the NAR is obliged to acknowledge this basic economics without providing any explanation for its violation:

Price appreciation is too fast in a lot of markets right now. The increase in homebuilder optimism must translate to significantly more new construction in 2018 to help ease these acute inventory shortages.

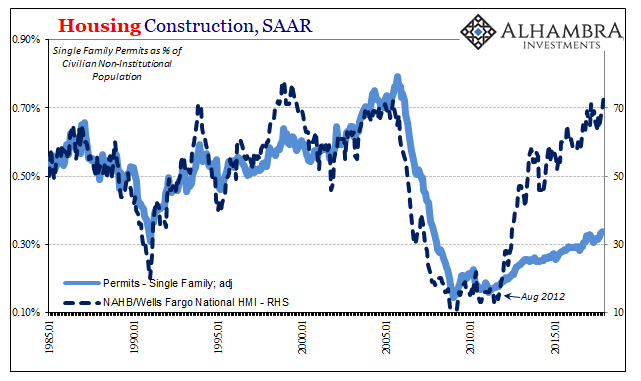

As noted yesterday, homebuilder optimism is sky high right now, but activity is not. Construction of single-family units continues to move at a historically subdued rate. Perhaps demand isn’t as forthright as suggested especially in the lower levels despite November’s near-record jump in those tiers.

This is not a recent development, either. The NAR has for some time been complaining about the dichotomy between lack of inventory (which should be pushing construction) and lack of builder commitments no matter how much enthusiasm they claim on various surveys. Three years ago, in December 2014, at the apex of the “best jobs market in decades”, NAR’s Chief Economist Larry Yun lamented of November 2014’s resale estimates in pretty much the same way he does today:

Lagging homebuilding activity continues to hamstring overall housing supply and is still too low in relation to this year’s promising job growth,” says Yun. “Much faster price and rent appreciation – easily exceeding wage growth – will occur next year unless new construction picks up measurably.

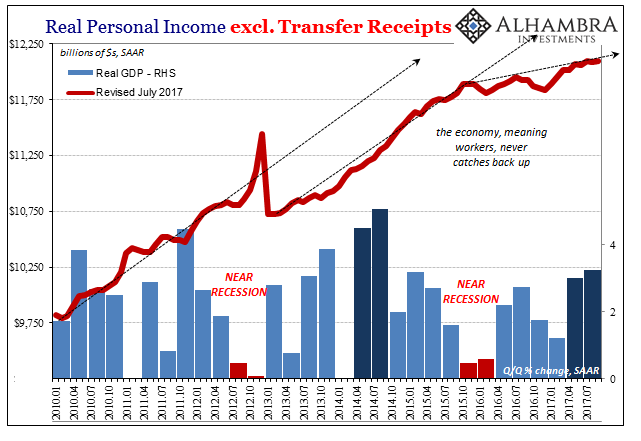

Construction activity never did pick up, it actually decelerated a bit from that point, and still the lower ends of the real estate market remain in much the same imbalance anyway pricing too many outside of either option (new or existing). Or rather that part of the market has actually been in balance all along, and it was instead this idea of “promising job growth”, as Yun put it three years ago, or “the healthy labor market and higher wage gains” that Yun writes about today that just doesn’t exist and hasn’t this whole time.

Maybe builders aren’t building because there really isn’t that much demand down there.

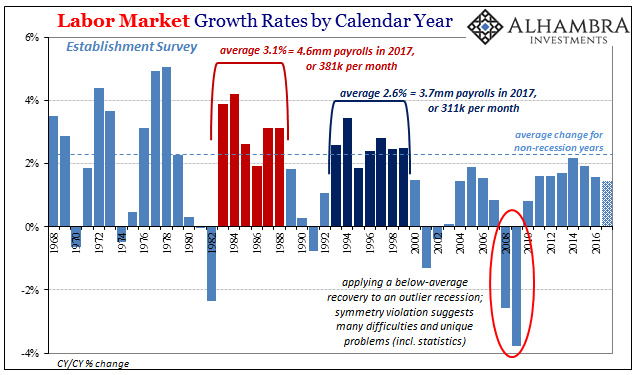

The labor market wasn’t all that great in 2014 to begin with, not even reaching average in percentage terms before ever getting to questions about the Establishment Survey’s upward biases. It hasn’t gotten any better since that time; in fact, all of the BLS figures save the unemployment rate show a clear slowing in the labor market (and still no significant wage acceleration) persisting even now.

It seems very likely that homebuilders as buyers in the upper ends of the market are motivated and excited more for prices than anything else. That is clearly the case as to the former, and the NAR estimates though statistically questionable for November had consistently demonstrated that bias for the latter, too.

Stay In Touch