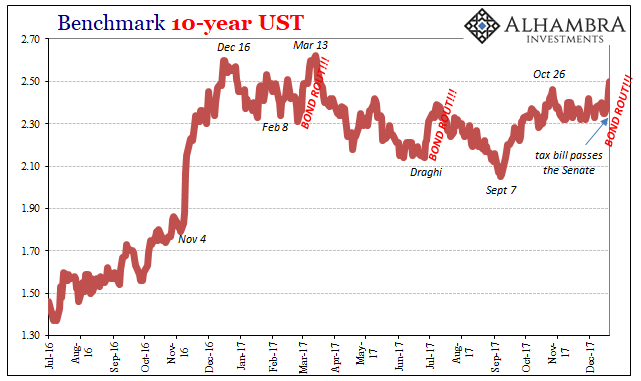

One final note for 2017 with regard to the long end of the Treasury curve. It may seem as if the interest rate fallacy would combine with specific bouts of illiquidity to create falling yields during them. That is not always the case, and, in fact, a lot of times the opposite does occur.

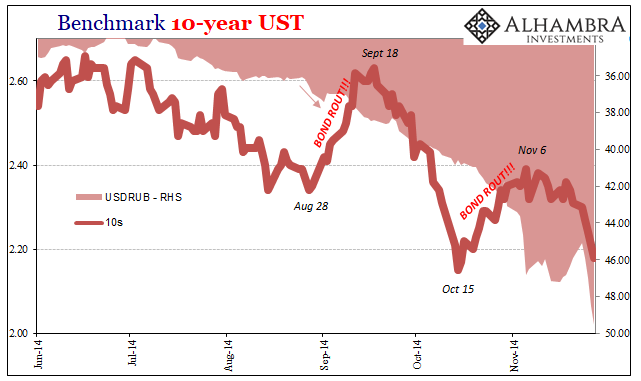

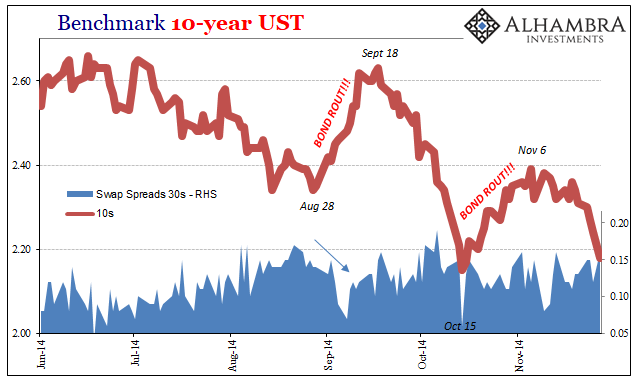

Take October 15, 2014, for example. There was a bonafide BOND ROUT!!! both before and after it, two breaks in the trend of persistently lower interest rates following the breakdown of Reflation #2. The so-called buying panic in the Treasury market that day perhaps represented the final end of Reflation #2, at the very least a clear warning to that effect, though one that was overlooked and dismissed (often intentionally).

The bond selloff of mid-December 2017 was nowhere near the intensity of either of those, but is at least consistent with the what’s been observed in the past. Yields falling again and the curve collapsing into the final days of this year perhaps a fitting end to what has been a thoroughly disappointing calendar.

Happy New Year to everyone, and hopefully a more awakened and enlightened 2018. One of these years it will happen, why not 2018?

Stay In Touch