Of all the moving parts contradicting the narrative of the growing economic boom, it’s incomes that will do it the most disservice. After all, there can be no such thing without them. Until our future robot AI overlords finally descend to either free humanity from labor, or eliminate us altogether, the economy still runs on the basic capitalist premise of labor utility.

We need to work such that we don’t have to make our own clothes and grow our own food, that way we can be freed to produce our own YouTube videos. The successful exchange of labor (videos) and capital (internet infrastructure and distribution franchise) is obviously income paid at profit. If the economy is truly working well, that’s when we are all working and incomes grow robustly.

Thus forms the virtuous circle all economists and policymakers actively seek out. The more incomes rise, the more we tend to spend, the more businesses will hire to keep up with expanding revenue. On and on it goes in what we call a boom.

Almost all major economic problems can be distilled as the reverse. Consumers stop spending, business stop hiring, leading to less spending. The grand idea behind an exploitable rational expectations theory is to use primarily monetary policy to get both consumers and businesses feeling good about the future so that they act today in belief of a much brighter tomorrow.

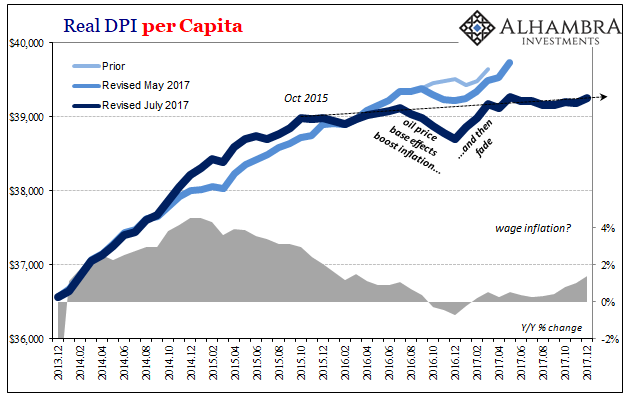

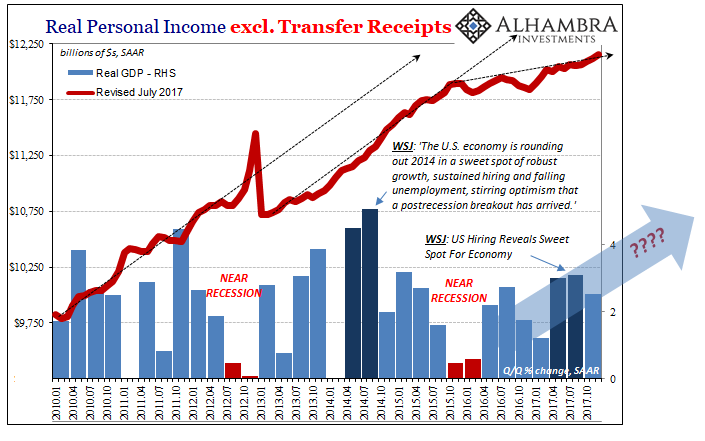

The “rising dollar” of 2014-16 produced just those sorts of negative pressures. The downturn initially hit business income, meaning profit. They responded by cutting back on the growth of inputs, managing costs to a more serious degree than they already had been doing. The labor market slowed (as did capex spending) by a considerable margin.

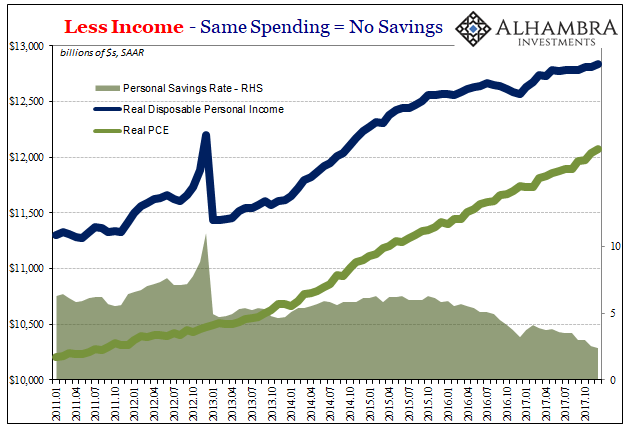

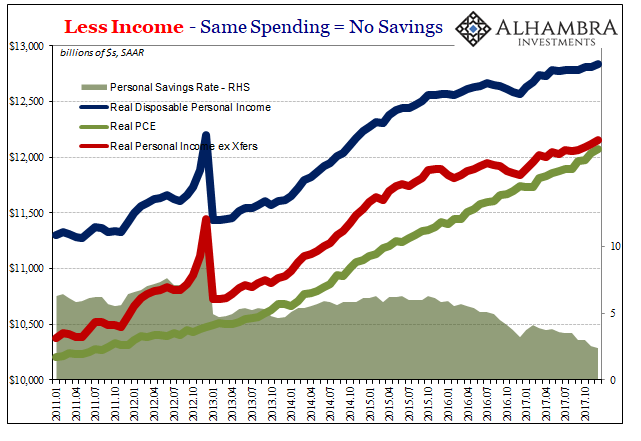

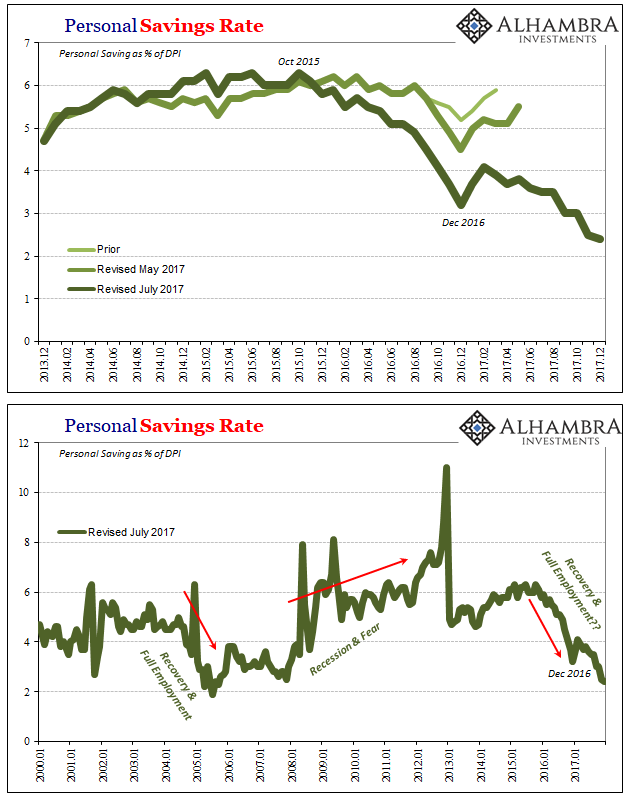

As a result, national (labor) income did, too. Consumer spending decelerated only by a little. The difference between those two is, of course, savings.

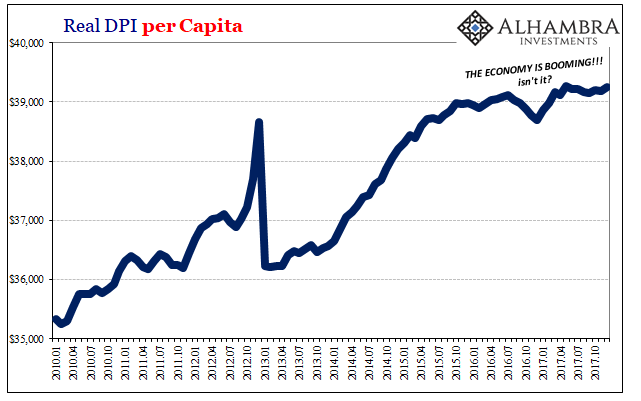

But what really confounds this idea of a boom is that both of those trends continued through both 2016 and 2017. Given the 2015-16 downturn, it seemed reasonable to give up on 2016. The following year, however, was widely figured to be the beginning of the upturn, the real upturn that would produce widespread recovery more consistent with past versions. It was in many ways (China the other major part) the basis for “globally synchronized growth.”

That’s not what happened. Instead, the labor market remained moribund, one of the worst years for American labor in some time, constrained by businesses clearly reluctant to act on whatever positive sentiment. We know there is a lot of positivity remaining on both sides, particularly for consumers who are never shy about saying so in any of the consumer sentiment surveys.

In other words, consumers clearly want to spend (and want to believe everyone else does, too). The problem for the economy is that they can’t. Basic demand is always two parts, willingness and ability. No matter how willing anyone might be, if they can’t all the positive sentiment in the world matters for too little.

That leaves the whole of this economic boom in the hands of reluctant businesses. What are they afraid of? To me, the answer is pretty simple. It’s the same message as is being played out in curves all over the world. What if Janet Yellen is wrong AGAIN?

They were burned by the mainstream consensus particularly in 2014 and early 2015 (after being burned to a lesser extent in 2011). There was no downturn in the official narrative, just a combination of “transitory” factors economists told everyone to ignore. After a while, they couldn’t be merely set aside because these negative pressures were both serious and clearly more than temporary.

While consumers continue to spend at a slightly lower rate than before, their income in the aggregate has decelerated almost to zero growth. It seems they are still figuring on this boom everyone keeps talking about, and for the past few years there hasn’t really been any consequences for living the fairy tale. The point where that is no longer true may be rapidly approaching.

Without any margin of savings, the slightest shock could send consumer spending and the economy into a much greater downturn than 2015-16. It’s probably a good thing the “rising dollar’s” economic damage was largely focused overseas given that trends weren’t really that robust at that time. What if the next one comes back home?

Not only might we find consumer spending softening as a matter of a turn in sentiment, that inflection would be amplified by the usual cyclical emotion of a shock in consumer behavior. To go from 2.4% savings, as is estimated for December 2017, back to just 5% let alone 6% would be a serious and full-blown recession.

That means this boom really has to boom, and I mean BOOM, at some point in the near future. Incomes will have to shift toward incredibly robust just to make up for 2017 and its past consumer spending at minimal growth. To rebuild the margin of savings in addition to rapidly climbing current spending would require tremendous, sustained income acceleration.

Where is that indicated? There isn’t even the slightest hint those kinds of hasty positive pressures are building up right now (UST 10s yields would be already passing 3.5% in a straight line on their way to 4%, with the yield curve blowing out first steeper, rather than 2.5% to maybe get up to 3% and flattening to nearly nothing). Economists keep pointing to the unemployment rate, but the unemployment rate’s extreme low level has coincided with the slowdown, not acceleration, in national (labor) income. It’s been totally disproven, particularly last year.

Instead, this all points toward 2017 being what it was – another phony recovery year predicated on dubious positive expectations for tomorrow. It was a year when that idea was given its full chance. The income data doesn’t suggest a lot of the same wiggle room for 2018. This is the year the boom has to boom, and do so starting with almost nothing going for it. These are the outer limits of sentiment. They can’t keep only talking about tomorrow’s economy; it has to show up today.

Stay In Touch