You find lots of tortured arguments about the state of the economy, largely because the premise starts with the boom and then seeks to find it. If it isn’t currently visible in the data, there is unusual and unearned confidence that the data will have to change in the near future (rather than the past three times we’ve been through this where the narrative is what ends up differently).

It’s a curious development, though understood plainly for the reasons I detailed earlier. The economy in narrative is booming now, so the economy in data, which isn’t, will be booming later.

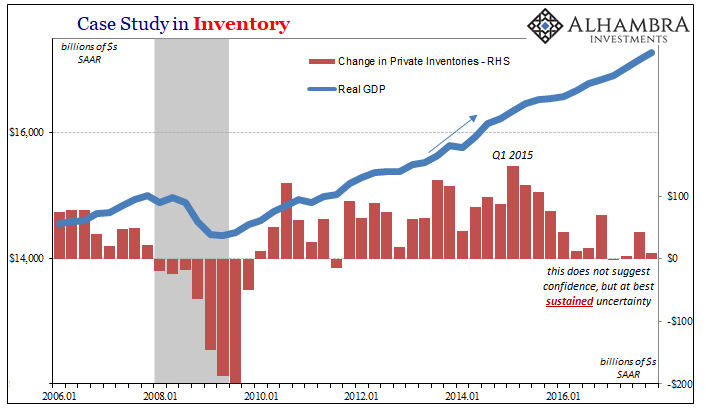

One data-based measure of this discrepancy is inventory, a subject we’ve covered before. Inventory accumulation in 2017 was low. Compared to 2014, it was practically nil. Some take that to mean inventory will lead US expansion in 2018 to great things.

From Bloomberg last month:

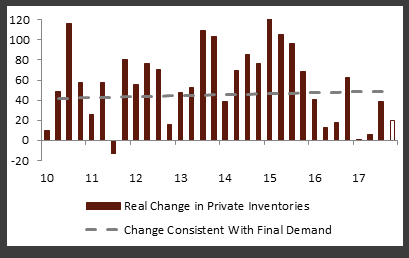

First, U.S. inventory investment is simply too low. Although the contribution of inventories to growth can be volatile from quarter to quarter, inventories tend to grow in line with final sales over longer periods of time. Today, that simply is not happening; inventories have been trailing the growth in domestic demand. If the economy expands at 2.2 percent, the rough trend since the end of the recession, inventories would need to grow by about $50 billion per year to keep pace with demand. Inventories ran below that level in 2017. That means factories are likely to go into overdrive to boost inventories in coming quarters.

The chart accompanying the article is reproduced above. The author completely ignores everything before, about how inventory rose so far above the rate consistent with final sales particularly 2014-15. The reason for lower inventory growth in 2016-17 is therefore obvious. Unless sales pick up substantially above the moribund 2% pace, there is no reason for businesses to order up the anticipated “factory overdrive.” They did that four years ago to negative effect.

This inventory weakness is, as noted on those prior occasions, one pretty clear measure of business confidence, or specifically the lack of it. Manufacturers may claim in whichever PMI to be happy to the point of euphoria, but the firms doing all the ordering don’t appear as optimistic in action if not in words.

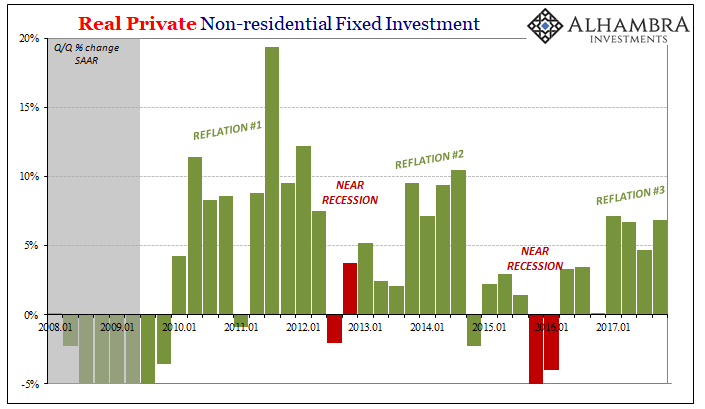

There are and have been other corroborative indications across a broad spectrum of activities. Starting with the labor market slowdown, a big one, general business in the US has also foregone capital expenditures at an increasing rate over the last ten years (lower peaks).

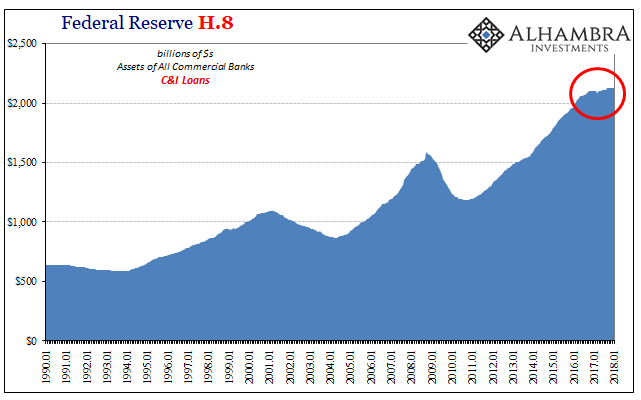

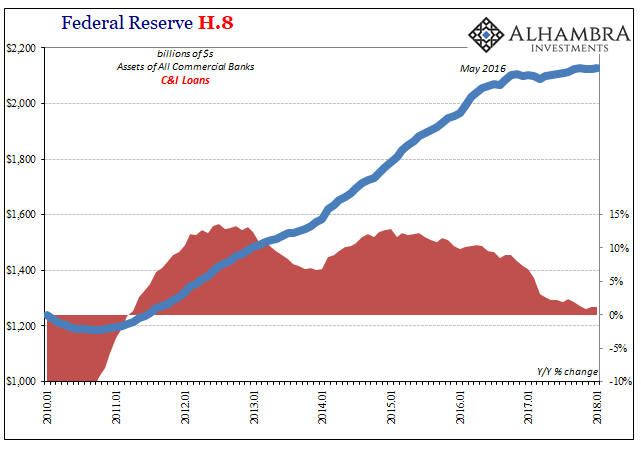

It is consistent with a couple separate data points, though related, both prepared by the Federal Reserve. The first is its H.8 release covering the assets and liabilities of commercial banks in the US. One important cyclical indicator on the asset side of the ledger is the volume or level of Commercial and Industrial (C&I) loans. Just as inventory and labor market growth tailed off considerably in 2016, so, too, did C&I lending.

Commercial lending didn’t contract as it had in prior recessions, but it did grind to a halt. That’s unusual for several reasons starting with its prolonged lack of growth and the fact that this lengthy stagnation has persisted following the end of a downturn (rather than take place during it, and the recovering sharply after it was over).

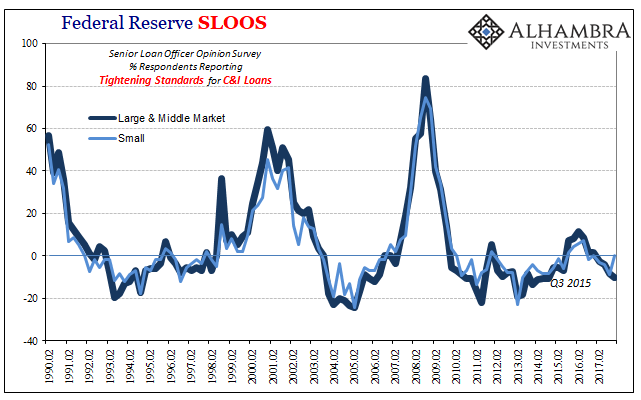

The second Federal Reserve data series helps clarify what’s going on here. The Senior Loan Officer Opinion Survey (SLOOS) is a quarterly examination querying bank lending practices and views. The two main focuses of SLOOS are lending standards and bank officer perceptions about demand for lending.

Of the first, lending standards, the SLOOS estimates show a small tightening in later 2015 coincident to “global turmoil” and the economic downturn produced by the “rising dollar.” That has, for survey respondents in general, abated such that lending standards are likely loosening again (though for small firms at the end of 2017 that trend may have abruptly ended).

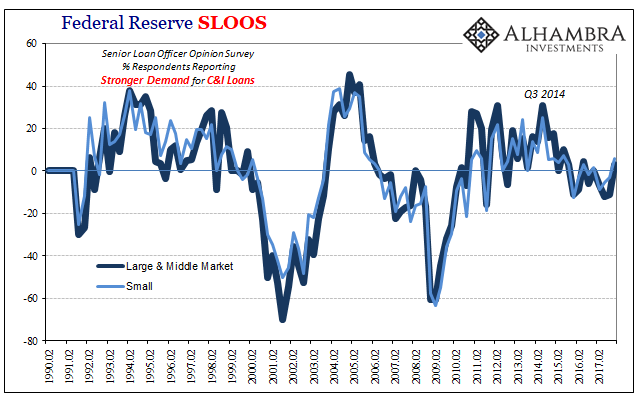

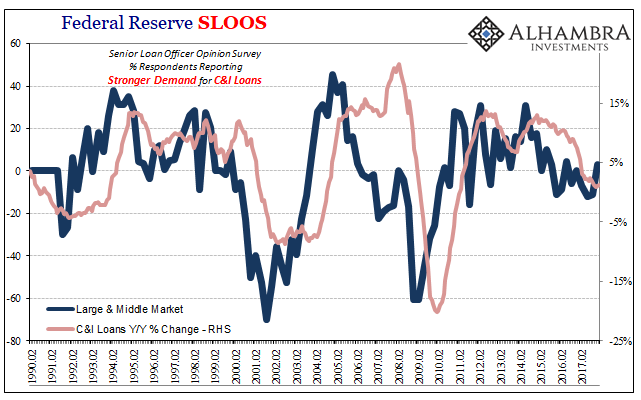

It is the other part where we find our answers. According to SLOOS, starting with the first appearance of the “rising dollar”, commercial customers began to scale back or foresee lower borrowing. Since that did happen as stated in H.8, all that remains is settling the different in timing.

The issue there is almost certainly structural frictions – the time it takes for completing financing versus when and where commercial and industrial firms predict demand. In other words, these companies told their lending partners in late 2014 and early 2015 they weren’t nearly as optimistic in their requirements for loans so that by 2016 they followed through on fewer additional lending commitments.

The SLOOS data has for January 2018 ticked up slightly from October 2017, but it doesn’t yet represent much or any change from nearly zero growth indicated over the past few years. That would suggest C&I firms still don’t see much need for additional C&I loans, certainly nowhere near a rapid or even rapacious pace, which like the labor market and inventories is just not consistent with the forthcoming boom in anything other than hysteria.

As I’ve written before, “The economy is what actually happens, not what people think other people think Economists say is happening.” Everyone supposedly “feels” like there is an inflationary boom, yet no one outside of media commentary is acting like it; not even preparing for one.

Stay In Touch