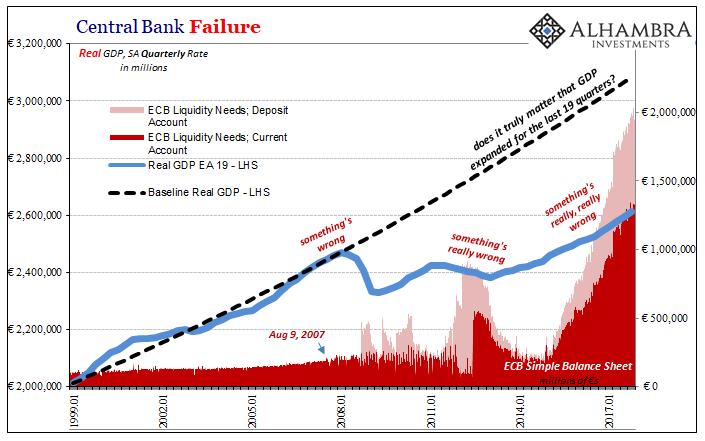

Effective June 10, 2014, the European Central Bank cut the interest rate it paid on its deposit account to less than zero. That instrument in forming the floor for what is a money market corridor in European policy, it was the world’s first major NIRP experiment. Europe’s economy had by GDP been growing again for three straight quarters by then after a re-recession in 2012 extending into the first quarter of 2013 completely upset the delicate post-2008 recovery balance.

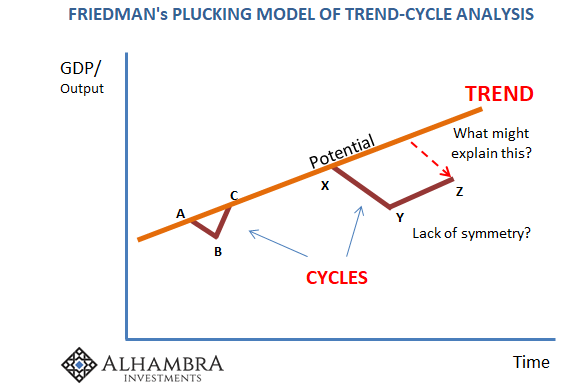

The purpose of NIRP was to ensure this re-recovery would remain on track. Already there was a problem just in that reasoning. After nearly a year of recovery, “re” or not, there really shouldn’t be much involvement of policy or any kind of “stimulus.” Symmetry rules of any business cycle dictate that once an economy starts back upward, it goes upward without assistance.

In fact, that had been the defining mandate for monetary policy throughout the previous few years. Its intended role was to get the economy to switch signs, to end the negatives so that the economy would naturally progress as it always had in business cycles where positives would on their own proliferate.

Even the ECB in 2014 knew that low level positives after both the massive Great “Recession” and then this 2012 re-recession weren’t right. Europe’s economy was growing, but it wasn’t growth; symmetry was conspicuously absent. Thus, what policymakers attempted in 2014 was to create it by experiment.

It has been a universal, worldly problem not limited by any means to that particular geography or its idiosyncratic imbalances (of which are substantial). Ten years later, the entire globe is still talking about “stimulus” for lack of symmetry.

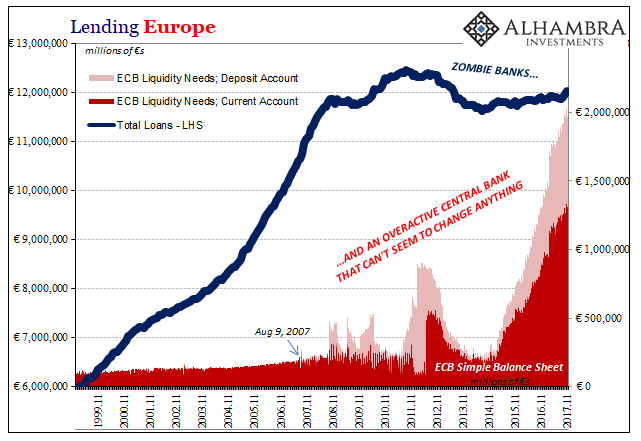

The switch to NIRP was by no means the only emphasis. Just three months after setting the deposit account at -10bps, the ECB in September 2014 reset it to -20bps.

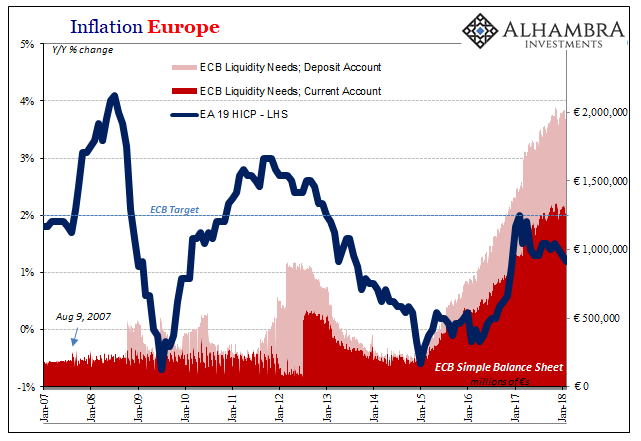

Outside the money market floor, the central bank began buying up all manner of financial assets. On October 2014, they initiated their third round of covered bond purchases (a security somewhat unique to European banking). A month later, it was ABS. By March 2015, it was the big one everyone had been waiting for – the Public Sector Purchase Program, or PSPP, which is commonly known as QE. That was eventually expanded and then by the middle of 2016 they were buying corporate bonds, too. The deposit account had by then been set at -40bps.

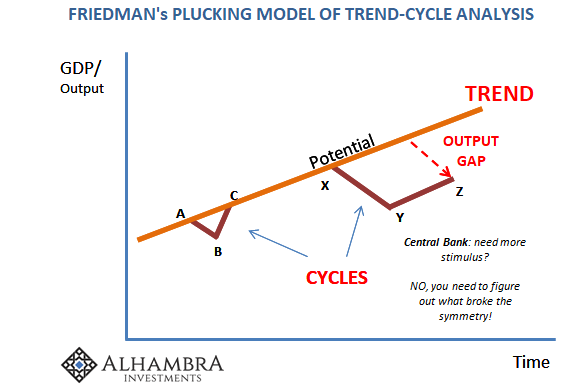

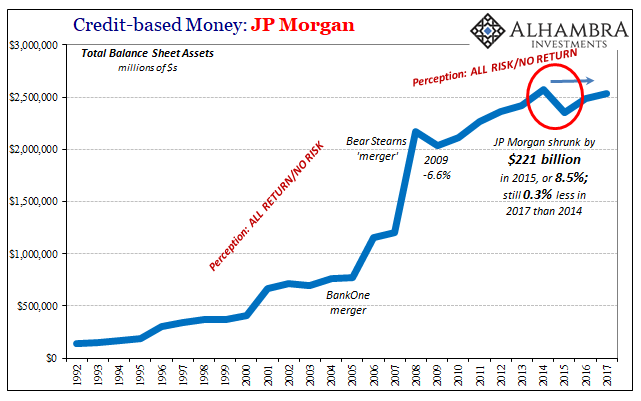

The theory behind so much “stimulus” is relatively simple, which is usually an indication of a problem. Simplicity doesn’t usually do very well in the face of stunning complexity. To expect a straight line in between is to invite confusion and ultimately ineffectiveness.

There are two channels by which all this is meant to work out into the real economy. The first is expectations. You see the ECB doing more and more and you are meant to think immediately “money printing.” History shows conclusively that money printing leads to inflation. Therefore, expecting a burst of inflation, you act today on what will undoubtedly occur tomorrow.

The second channel are those infamous “portfolio effects.” This is more direct, where in buying so many assets, meaning taking them out of the hands of the banking system (at a premium and therefore profit, no less), the banking system is left to do something else. In other words, as a bank the ECB buys up what you already have giving you an incentive to sell it to them and forcing you to go do something else in response. That “something else” is believed to be substantially more lending.

The combination of expectations as well as portfolio effects was supposed to be acceleration. Those low-level positives in GDP as a proxy for broken symmetry should have vanished. With all that was being done, how could it not?

Evaluating NIRP is more intangible (though no less conclusive), but the large scale asset purchases (LSAP) are more easily defined. Of the three largest of them, covered bonds, corporate bonds, and the PSPP buying government bonds, from October 2014 through to the end of February 2018 the ECB has absorbed an astounding €2.32 trillion. To give you a further sense of scale, in October 2014 European M1 totaled €5.72 trillion.

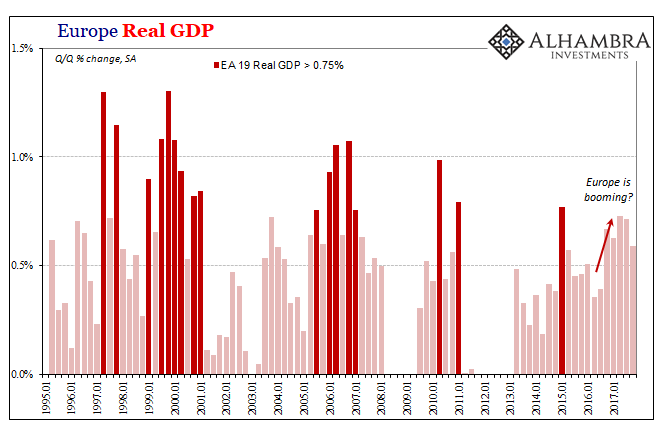

Europe’s economy has over this period continued to grow uninterrupted; accelerated even. However, there is no evidence that was anything more than the continuation of broken symmetry. If all that “money printing” had been effective, real growth would have followed an actual burst of inflation.

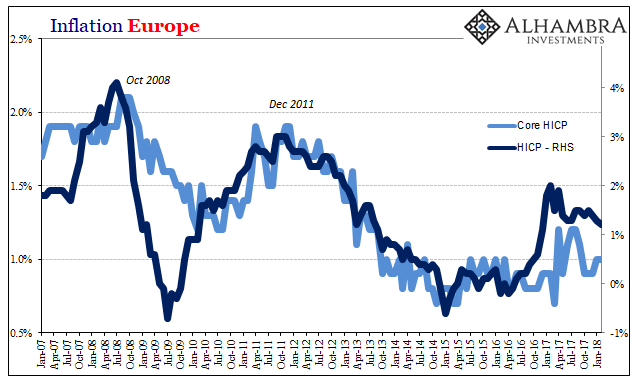

Not only is GDP still stuck in low-level positives, there isn’t the slightest hint of consumer price reaction, let alone overreaction. Time is obviously a factor given that real economic processes take time from inception to detection, but its been four years now. Two months into 2018, the latest initial estimates for February 2018, show that inflation is not just undershooting the target but still moving in the wrong direction.

Europe’s HICP for February was up 1.2% year-over-year, down from 1.3% in January and the oil price high of merely 2.0% in February 2017. Core inflation rates, which in Europe strip out both energy and food as well as tobacco and alcohol, suggest nothing has changed despite the substantial monetary intervention by Europe’s policymakers.

Time is no longer a factor in any evaluation, though Economists like those at these central banks keep trying to make it one. In the US, there’s this ridiculous idea of “transitory” factors, that a continual string of temporary interference has improbably added up to a constant miss for inflation.

In Europe, central bankers aren’t as devious, but no less undeterred. Doesn’t matter four years, they claim, inflation is coming even if there is no current basis to believe it.

Mario Draghi last month:

The strong cyclical momentum, the ongoing reduction of economic slack and increasing capacity utilisation strengthen further our confidence that inflation will converge towards our inflation aim of below, but close to, 2%. At the same time, domestic price pressures remain muted overall and have yet to show convincing signs of a sustained upward trend.

For all the current inflation hysteria, there sure is an absence of inflation. More concerning to those who believe so much in it, there is an even more shocking lack of explanation for this. Instead, they always and in every case devolve into some form of “just wait.”

Again, time is no longer a factor; it can’t be. Central bankers had a theory, they acted on it and the evidence empirically discredited it. What that leaves us is not some unknown or random burst of inflation always just over the horizon, it leaves all of us with so far unbreakable broken symmetry. That’s the one constant here no matter what is done in any one place, and the only thing that should wholly preoccupy every Economist and central banker in the world.

Stay In Touch